BNP PARIBAS Group: Confirmation of the Net Income trajectory

13 Marzo 2024 - 7:00AM

BNP PARIBAS Group: Confirmation of the Net Income trajectory

Confirmation of

the Net Income trajectoryPress releaseParis, 13 March

2024

The BNP Paribas Group confirms a steady growth

trajectory in Net Income, Group Share through the cycle. As such,

2024 Net Income will be higher than 2023 Distributable Net

Income.

BNP Paribas also confirms its 2025 ROTE1 target

in a range of 11.5% to 12%, as well as its ROTE target of 12% in

2026.

This trajectory, combined with a 60% pay-out

ratio2, should enable the Group to return a total of about 20

billion euros3 to its shareholders from 2024 to 2026.

Leveraging its diversified and customer-focused

model, BNP Paribas should continue to grow faster than its

underlying economy and to gain market share.

The trajectory will also be driven by the return

on capital deployed since 2022, following the sale of Bank of the

West, with a 2025 return on invested capital of more than 16%.

In addition, the Group announces an acceleration

and widening of operating efficiency measures amounting to a

recurring figure of about 400 million euros, thus raising the

target of the 2022-2025 plan to 2.7 billion euros. The Group also

confirms a jaws effect of an average of at least 2 points4 from

2022 to 2025.

Lastly, the Group maintains a conservative

origination policy and strict risk control. It reiterates its cost

of risk target of below 40 basis points each year over the duration

of the plan.

About BNP ParibasBNP Paribas is

the European Union’s leading bank and key player in international

banking. It operates in 63 countries and has nearly 183,000

employees, including more than 145,000 in Europe. The Group has key

positions in its three main fields of activity: Commercial,

Personal Banking & Services for the Group’s commercial &

personal banking and several specialised businesses including BNP

Paribas Personal Finance and Arval; Investment & Protection

Services for savings, investment and protection solutions; and

Corporate & Institutional Banking, focused on corporate and

institutional clients. Based on its strong diversified and

integrated model, the Group helps all its clients (individuals,

community associations, entrepreneurs, SMEs, corporate and

institutional clients) to realise their projects through solutions

spanning financing, investment, savings and protection insurance.

In Europe, BNP Paribas has four domestic markets: Belgium, France,

Italy and Luxembourg. The Group is rolling out its integrated

commercial & personal banking model across several

Mediterranean countries, Turkey, and Eastern Europe. As a key

player in international banking, the Group has leading platforms

and business lines in Europe, a strong presence in the Americas as

well as a solid and fast-growing business in Asia-Pacific. BNP

Paribas has implemented a Corporate Social Responsibility approach

in all its activities, enabling it to contribute to the

construction of a sustainable future, while ensuring the Group's

performance and stability.

Press contactSandrine Romano –

sandrine.romano@bnpparibas.com – +33 6 71 18 23 05Hacina Habchi –

hacina.habchi@bnpparibas.com - +33 7 61 97 65 20

1 Return on non-revaluated tangible equity 2

Applied to distributable Net Income after taking into account the

remuneration of Undated Super Subordinated Notes (“TSSDI”)3 Subject

to the approval of the General Meeting and to ECB authorization

(for the share buyback program), cumulated amount with respect to

financial years 2023, 2024 and 20254 CAGR 2022-2025 of Group

revenues minus CAGR 2022-2025 of Group operating expenses excluding

Bank of the West

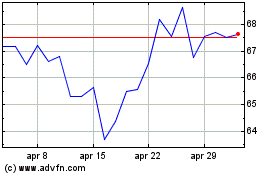

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Gen 2025 a Feb 2025

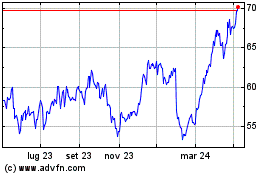

Grafico Azioni BNP Paribas (BIT:1BNP)

Storico

Da Feb 2024 a Feb 2025