At its Capital Markets Day, Iveco Group updated its guidance for 2024 and presented the financial targets for the duration of the Plan

15 Marzo 2024 - 7:30AM

At its Capital Markets Day, Iveco Group

updated its guidance for 2024 and presented the financial targets

for the duration of the Plan

Turin, 15th March 2024. At its Capital Markets

Day held yesterday in Turin, Italy, Iveco Group (EXM: IVG)

presented its revised guidance for 2024 and, within its new

Strategic Business Plan (SBP), financial targets at 2026 and

2028.

Both the updated guidance and the future targets

take into account the exclusion of the Fire Fighting Business Unit

since, as announced on Wednesday, March 13, Iveco Group signed a

definitive agreement for the transfer of its ownership.

Based on conservative assumptions on the

evolution of the macro-economic scenario, with the interest base

rate flat versus 2023 levels, and considering market evolution in

line with industry’s expectations and a price policy in line with

the markets, Iveco Group’s year-end guidance and future financial

targets, in comparison to the previous ones, are as follows:

|

|

|

2024 Previous Guidance1 |

2024 Updated Guidance2 |

|

Industrial Activities |

Net Revenues3 |

~(5)% |

~(4)% |

|

Adjusted EBIT |

€770-820mn |

€790-840mn |

|

Free Cash Flow |

€350-400mn |

€350-400mn |

|

Investments |

~€1bn |

~€1bn |

|

Group |

Adjusted EBIT |

€900-950mn |

€920-970mn |

| |

|

2022-26 SBP1 |

2024-28 SBP2 |

|

|

|

2026 targets |

2026 targets |

2028 targets |

|

Industrial Activities |

Net Revenues3 |

€16.5-17.5bn |

~€17bn |

~€19bn |

|

Adjusted EBIT margin |

5.0-6.0% |

6-7% |

7-8% |

|

Investments4 |

~5% |

6-7% across the Plan |

|

Free Cash Flow |

~€0.5bn |

~€0.6bn |

~€0.9bn |

|

Group |

Adjusted Net Income |

€0.6-0.8bn |

~€0.7bn |

~€0.9bn |

|

Adjusted diluted EPS |

N/A |

~€2.4 per share |

>€3 per share |

Notes:1 Including the Fire

Fighting Business Unit.2 Excluding the Fire

Fighting Business Unit since, as mentioned above, Iveco Group

signed a definitive agreement for the transfer of its

ownership.3 Including translation

effects.4 Property, plant and equipment and

intangible assets (incl. capitalised R&D); as a percentage of

Net Revenues.

Non-EU-IFRS Financial

Information Iveco Group monitors its operations through

the use of several non-EU-IFRS financial measures. Iveco Group’s

management believes that these non-EU-IFRS financial measures

provide useful and relevant information regarding its operating

results and targets and enhance the readers’ ability to assess

Iveco Group’s financial performance and financial position.

Management uses these non-EU-IFRS measures to identify operational

trends, as well as make decisions regarding future spending,

resource allocations and other operational decisions as they

provide additional transparency with respect to our core

operations. These non-EU-IFRS financial measures have no

standardized meaning under EU-IFRS and are unlikely to be

comparable to other similarly titled measures used by other

companies and are not intended to be substitutes for measures of

financial performance and financial position as prepared in

accordance with EU-IFRS. Iveco Group’s non-EU-IFRS financial

measures are defined as follows:

- Adjusted EBIT: is defined as EBIT

before restructuring costs and non-recurring items. In particular,

non-recurring items are specifically disclosed items that

management considers rare or discrete events that are infrequent in

nature and not reflective of on-going operational activities.

- Adjusted Net Income/(Loss): is

defined as profit/(loss) for the period, less restructuring costs

and non-recurring items, after tax.

- Adjusted Diluted EPS: is computed

by dividing Adjusted Net Income/(Loss) attributable to Iveco Group

N.V. by a weighted-average number of Common Shares outstanding

during the period that takes into consideration potential Common

Shares outstanding deriving from the Iveco Group share-based

payment awards, when inclusion is not anti-dilutive. When Iveco

Group provides guidance for adjusted diluted EPS, the Group does

not provide guidance on an earnings per share basis because the

EU-IFRS measure will include potentially significant items that

have not yet occurred and are difficult to predict with reasonable

certainty prior to year end.

- Adjusted Income Taxes: is defined

as income taxes less the tax effect of restructuring expenses and

non-recurring items, and non-recurring tax charges or

benefits.

- Adjusted Effective Tax Rate

(Adjusted ETR): is computed by dividing a) adjusted income taxes by

b) profit (loss) before income taxes, less restructuring expenses

and non-recurring items.

- Net Cash (Debt) and Net Cash (Debt)

of Industrial Activities: Net Cash (Debt) is defined as total Debt

plus Derivative liabilities, net of Cash and cash equivalents,

Derivative assets and other current financial assets (primarily

current securities, short-term deposits and investments towards

high-credit rating counterparties) and financial receivables from

CNH Industrial deriving from financing activities and sale of trade

receivables. Iveco Group provides the reconciliation of Net Cash

(Debt) to Total (Debt), which is the most directly comparable

EU-IFRS financial measure included in the Group’s consolidated

statement of financial position. Due to different sources of cash

flows used for the repayment of the debt between Industrial

Activities and Financial Services (by cash from operations for

Industrial Activities and by collection of financing receivables

for Financial Services), management separately evaluates the cash

flow performance of Industrial Activities using Net Cash (Debt) of

Industrial Activities.

- Free Cash Flow of Industrial

Activities (or Industrial Free Cash Flow): refers to Industrial

Activities, only, and is computed as consolidated cash flow from

operating activities less: cash flow from operating activities of

Financial Services; investments of Industrial Activities in

property, plant and equipment and intangible assets; as well as

other changes and intersegment eliminations.

- Available Liquidity: is defined as

cash and cash equivalents, including restricted cash, undrawn

medium-term unsecured committed facilities, other current financial

assets (primarily current securities, short-term deposits and

investments towards high-credit rating counterparties), and

financial receivables from CNH Industrial deriving from financing

activities and sale of trade receivables.

Cautionary StatementStatements

other than statements of historical fact contained in this press

release, including competitive strengths; business strategy; future

financial position or operating results; budgets; projections with

respect to revenue, income, earnings (or loss) per share, capital

expenditures, dividends, liquidity, capital structure or other

financial items; costs; and plans and objectives of management

regarding operations and products, are forward-looking statements.

Forward-looking statements are not guarantees of future

performance. Rather, they are based on current views and

assumptions and involve known and unknown risks, uncertainties and

other factors, many of which are difficult to predict and/or are

outside the Company’s control. If any of these risks and

uncertainties materialise (or they occur with a degree of severity

beyond the Company’s predictions and/or expectations) or other

assumptions underlying any of the forward-looking statements prove

to be incorrect, the actual results or developments may differ

materially from any future results or developments expressed or

implied by the forward-looking statements, which are sometimes

based upon estimates and data received from third parties (such

estimates and data being often revised). Except as otherwise

required by applicable rules, Iveco Group expressly disclaims any

intention to provide, update or revise any forward-looking

statements in this press release to reflect any change in

expectations or any change in events, conditions or circumstances

on which these forward-looking statements are based. All

forward-looking statements by Iveco Group or persons acting on its

behalf are expressly qualified in their entirety by the cautionary

statements contained herein. Information in this press release

cannot be relied upon as a guide to future performance. To the

fullest extent permitted by applicable law, no representation or

warranty of the Company, express or implied, is made as to, and no

reliance should be placed upon, the fairness, accuracy,

completeness or correctness of the information or opinions

contained in this press release. None of the Company, its

affiliates, directors, advisors, employees and representatives, or

anyone acting on their behalf shall bear any responsibility (in

negligence or otherwise) for any loss arising from any use of this

press release or its contents or otherwise arising in connection

with these materials. This press release does not represent

investment advice or a solicitation, recommendation, invitation, or

offer for the purchase or sale of financial products and/or of any

kind of financial services as contemplated by the laws in any

country or state. Further information concerning Iveco Group,

including factors that potentially could materially affect Iveco

Group’s financial results, is included in Iveco Group’s reports and

public filings under applicable regulations.

Iveco Group N.V. (EXM: IVG) is

the home of unique people and brands that power your business and

mission to advance a more sustainable society. The eight brands are

each a major force in its specific business: IVECO, a pioneering

commercial vehicles brand that designs, manufactures, and markets

heavy, medium, and light-duty trucks; FPT Industrial, a global

leader in a vast array of advanced powertrain technologies in the

agriculture, construction, marine, power generation, and commercial

vehicles sectors; IVECO BUS and HEULIEZ, mass-transit and premium

bus and coach brands; IDV, for highly specialised defence and civil

protection equipment; ASTRA, a leader in large-scale heavy-duty

quarry and construction vehicles; MAGIRUS, the industry-reputed

firefighting vehicle and equipment manufacturer; and IVECO CAPITAL,

the financing arm which supports them all. Iveco Group employs more

than 36,000 people around the world and has 20 industrial sites and

29 R&D centres. Further information is available on the

Company’s website www.ivecogroup.com

Media Contacts:Francesco Polsinelli, Tel: +39

335 1776091Fabio Lepore, Tel: +39 335 7469007E-mail:

mediarelations@ivecogroup.com

Investor Relations:Federico Donati, Tel: +39

011 0073539 E-mail: investor.relations@ivecogroup.com

- 20240315_PR_Iveco_Group_Updated_Guidance_and_SBP_Targets

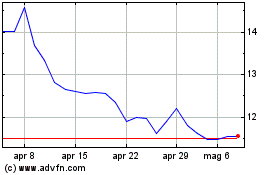

Grafico Azioni Iveco Group NV (BIT:IVG)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Iveco Group NV (BIT:IVG)

Storico

Da Nov 2023 a Nov 2024