Iveco Group 2024 First Quarter Results

10 Maggio 2024 - 7:30AM

The following is an extract from the “Iveco Group 2024 First

Quarter Results” press release(*). The complete press release can

be accessed by visiting the media section of the Iveco Group

corporate website:

https://www.ivecogroup.com/media/corporate_press_releases or

consulting the accompanying PDF:

Iveco Group consolidated revenues of €3.4

billion (in line with Q1 2023).Adjusted EBIT of

€233 million (up €59 million compared to Q1

2023)and adjusted net income of €153 million

(up €77 million compared to Q1 2023). Negative

free cash flow of Industrial Activities of €436 million (€110

million better compared to Q1 2023).

(*) 2024 financial data shown refers to

Continuing Operations only, unless otherwise stated. Continuing

Operations exclude the Fire Fighting business which, following the

already announced signing of a definitive agreement for the

transfer of its ownership, has been classified as Discontinued

Operations. 2023 comparative figures have been recast

consistently.

Consolidated revenues of

€3,367 million, in line with Q1 2023. Net

revenues of Industrial Activities of €3,283

million, flat vs Q1 2023, with positive price realisation

offsetting lower volumes mainly in South America, a negative mix,

and an adverse foreign exchange impact.

Adjusted EBIT of

€233 million (€59 million

increase compared to Q1 2023) with a

6.9% margin (up

170 bps compared to Q1 2023). Adjusted EBIT of Industrial

Activities of

€201 million

(€55 million increase vs Q1 2023) and margin

at 6.1% (up 170 bps compared to

Q1 2023), mainly thanks to lower product costs and a continuously

positive price realisation in the quarter.

Adjusted net income of

€153 million (€77 million increase compared

to Q1 2023), after deducting the pre- and after-tax loss of

€115 million from signing the definitive agreement to transfer

the Fire Fighting business. Adjusted diluted earnings per

share of €0.57 (up €0.32 compared to Q1

2023).

Financial expenses of

€21 million (vs €72 million in Q1 2023),

decreasing year over year mainly thanks to a more contained foreign

exchange rate and cost of hedge impact in Argentina, as a result of

the implemented hedging strategy, as well as to an improvement in

the Argentinian hyperinflation accounting impact.

Reported income tax expense of €53 million, with

adjusted effective tax rate (adjusted ETR) of

28% reflecting different tax

rates applied in the jurisdictions where the Group operates and

some other discrete items.

Free cash flow of Industrial

Activities negative at

€436 million (vs negative

€546 million in Q1 2023) in line with our seasonal working

capital absorption.

Available liquidity at

€4,685 million as of 31st March 2024, down

€63 million from 31st December 2023, including €2,000 million

of undrawn committed facilities.

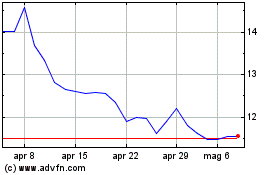

Grafico Azioni Iveco Group NV (BIT:IVG)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Iveco Group NV (BIT:IVG)

Storico

Da Dic 2023 a Dic 2024