Societe Generale: A rock-solid and sustainable top tier european

bank

A ROCK-SOLID AND SUSTAINABLE

TOP TIER EUROPEAN BANK

PRESS RELEASE

Paris, 18 September 2023, 7am

A FOCUSED STRATEGY FOR A SUSTAINABLE FUTURE

- Be a rock-solid bank: streamline

business portfolio, enhance stewardship of capital, improve

operational efficiency, maintain best-in-class risk management

- Foster high performance sustainable

businesses: excel at what we do, lead in ESG, foster a culture of

performance and accountability

2026 FINANCIAL TARGETS: SUSTAINABLE VALUE

CREATION

-

CET 1 ratio at 13% in 2026, under Basel IV

-

Average annual revenue growth between 0% and 2% over 2022-2026

-

Cost-to-income ratio below 60% in 2026

- Return on tangible equity (ROTE)

between 9% and 10% in 2026

-

Payout ratio range between 40% and 50% of reported net income1,

from 2023

REINFORCED ESG ACTIONS

- A 80% reduction

in upstream Oil & Gas exposure by 2030 vs. 2019; -50% reduction

by 2025 (vs. previous commitment of -20%)

-

EUR 1bn transition investment fund with a focus on energy

transition solutions and nature-based and impact-based projects

supporting UN’s Sustainable Development Goals

Slawomir Krupa, Chief Executive Officer

of Societe Generale

Group, commented:

“I am pleased to share our strategic vision,

financial targets and our aspirations for the future of Societe

Generale. Our 2026 Strategic Plan will deliver our ambition to be a

rock-solid, top tier European bank, built on our strong

foundations: trusted long-standing client relationships, talented

and committed teams, innovative and distinctive value-added

businesses and pioneering ESG leadership.

We will strengthen the Group by shaping a

simplified business portfolio, while taking the right actions to

build-up capital and increase flexibility, structurally improve our

operating leverage and maintain our best-in-class risk

management.

Our client-centered business platform and

pioneering ESG franchise will bolster the performance of our

business in a world of change and opportunities. We will accelerate

the decarbonisation of our businesses and work closely with our

clients and partners to maximize our positive impact at the

forefront of the energy, environmental and social transition.

We will foster a culture of performance and

accountability across the Group, powered by our talented and

committed people, to ensure we deliver consistent performance and

long-term value creation for all our stakeholders.”

Societe Generale’s Board of Directors, under the

chairmanship of Lorenzo Bini Smaghi, met on 15 September 2023

and approved the Group’s strategic plan and financial targets for

2026.

The plan is a focused strategy for a sustainable

future built circa a clear roadmap with two areas of focus: be a

rock-solid bank and foster high performance, sustainable

businesses.

BE A

ROCK-SOLID BANK

The first objective of the Group’s strategy is

to further strengthen the financial profile of the bank. Capital

build-up will be a priority to increase the Group’s flexibility and

long-term competitiveness.

1. Enhance

stewardship of capital

Societe

Generale will

build capital to a

target CET 1 level

of 13% in 2026

under Basel IV2, with a minimum

level based on a buffer of 200 basis points above

requirements.

In addition to a disciplined business portfolio

management, Societe Generale will use the following levers to

achieve this target:

-

Limited organic Risk Weighted Assets (RWA) growth below 1% per

annum on average from 2024 to 2026 based on stricter capital

allocation, Boursorama and ALD being the only beneficiaries;

-

Proactive risk transfer of capital and development of capital

partnerships;

-

Increased capital generation through improved operational

efficiency;

-

A distribution policy with a payout ratio between 40% and 50% of

reported net income3 from 2023, with a balanced distribution mix

between cash dividend and share buybacks from 2024. A distribution

of excess capital will be considered once the CET 1 target is

reached.

On top of the organic capital generation, the

capital trajectory includes regulatory impacts (of which

Basel IV for circa 85 basis points2 and remaining regulatory

impact in 2023 for circa 50 basis points), the impact of organic

RWA growth and other impacts based on prudent assumptions on

various items4.

The Group phased-in CET1 ratio is expected above

12% in Q1 2025, around 13% at end 2025 and 13% at end 2026. The

Group RWA should be above EUR 420bn at end 2026.

With this strict capital discipline, businesses

will grow differently mainly through increased advisory and

self-financed RWA growth within an expected annual

revenue growth

of between 0%

and 2%

(CAGR

2022-2026).

2. Streamline

business portfolio

Societe

Generale will shape a consistent,

simplified and integrated business model,

anchored in the Group’s core

franchises.

This will be achieved by deploying strict

portfolio management criteria: consistency with the ESG imperative,

accretive to Group profitability, material Group synergies, limited

exposure to tail-risks, and leading franchises in attractive

markets.

3. Improve

operational efficiency

In 2026,

Societe Generale targets

a cost-to-income ratio below

60% with linear

improvement from

2024.

Driven by tangible levers already identified,

the Group aims to reach gross savings of circa EUR 1.7bn by 2026

(vs. 2022), of which circa 40% will be of new gross savings. This

includes the delivery of ongoing plans (in particular the merger of

the French networks and the savings synergies from the integration

of LeasePlan), as well as an improvement in IT efficiency and a

leaner organisation.

Leveraging on a platform-based strategy, the

improvement in IT efficiency will represent circa EUR 0.6bn of

the total gross savings while ensuring an improved business

impact.

The decrease in cost-to-income between 2022 and

2026 will be driven by total expected gross savings for -600 basis

points, the end of Single Resolution Funds (circa -300 basis

point), the reduction of transformation charges (between -200 and

-250 basis points), compensating the impact of inflation and other

impacts (between +450 and +500 basis points).

These various projects will lead to circa EUR

1bn of transformation charges over 2024-2026, which will be borne

by the businesses.

4. Maintain

best-in-class risk

management

On the back of a sound

risk profile, Societe

Generale expects a

net cost of risk between 25 and

30 basis points over the

2024-2026

period, within a stable risk

appetite.

The Group will maintain a clear and consistent

credit risk management: prudent origination policy, diversification

and low concentration risk, stable market risk appetite, and

comprehensive tail-risk monitoring. The risk framework encompasses

a holistic approach to risk management including environmental,

social and non-financial risks.

FOSTER

HIGH-PERFORMANCE,

SUSTAINABLE

BUSINESSES

The Group’s strategy aims to foster

high-performance, sustainable businesses in order to ensure a

sustainable performance over time.

5. Excel

at what we do

In a world of change, Societe Generale will

capture client value thanks to a client-centered model.

The Group will benefit from the strong

positioning of its franchises on megatrends to pursue long-term

growth through solution-driven expert advisory and financing.

With clients at the center of the value creation

process, the Group intends to shape a

simplified, integrated

and synergetic business model,

bringing businesses closer together and boosting cross-selling.

The Group will scale up its value

proposition by combining in-house expertise and

external partnerships, providing cutting edge

solution-driven expert advisory. Digital capabilities will be

further developed supporting an increasing contribution of digital

sales to the Group revenues, a lower cost-to-serve, and expected

run-rate value creation from data and artificial intelligence of

circa EUR 500m by 20265.

6. Lead in

ESG

Societe

Generale is

accelerating its ESG

ambitions to

reinforce its leadership

in the environmental transition and its

contribution to the UN’s Sustainable Development

Goals.

Accelerate the

decarbonisation

of its businesses with new

targets

The Group is committed to a process of aligning

its financing with trajectories compatible with the objectives of

carbon neutrality in 2050, starting with the most CO2-emitting

activities, as defined by the Net Zero Banking Alliance (NZBA).

Having largely completed its withdrawal from the

thermal coal sector while achieving in advance its 2025 target to

reduce by 20% its exposure to the upstream Oil & Gas sector,

the Group sets new targets:

-

Accelerate the reduction of upstream Oil & Gas exposure,

reaching -80% by 2030 vs. 2019, with an intermediary 2025 step of

-50% (vs. previous commitment of -20%);

-

Stop providing financial products and services dedicated to

upstream Oil & Gas greenfield projects6;

-

Phase-out exposure7 on upstream Oil & Gas private pure players

and reinforce engagement with energy sector clients, particularly

on their climate strategy;

-

New target on Oil & Gas financed GHG emissions of -70% by 2030

vs. 20198;

-

New Cement sector target of -20% carbon emission intensity by 2030

vs. 2022;

-

New Automotive sector9 target of -51% carbon emission intensity by

2030 vs. 2021;

-

Power target of -43% carbon emission intensity by 2030 vs. 2019 is

confirmed, as well as the target for thermal coal to reduce

exposure to zero by 2030 in EU and OECD countries, and by 2040

elsewhere;

-

Confirmation of the Group’s own account carbon footprint reduction

of 50% from 2019 to 2030.

Investing in innovation

Societe

Generale

also announced

the launch of

a new EUR 1bn

transition

investment

fund, including

an equity component of EUR 0.7bn, to support the emergence of new

actors and new technologies. The initiative will focus on energy

transition, nature-based solutions and impact-driven opportunities

which support the UN’s Sustainable Development Goals.

Developing

partnerships and launching new

initiatives to generate more impact

- Create an independent scientific

advisory board composed of experts covering climate, nature, social

issues and sustainable development that will enrich the Group’s ESG

reflections, bringing long-term perspectives and scientific

views;

- Explore new areas of cooperation

with the International Finance Corporation (IFC), a member of the

World Bank Group, in sustainable finance projects in emerging

markets, building on our joint expertise, track-record as partners,

and commitments toward the Sustainable Development Goals;

- Accelerate its philanthropic

actions, notably through material increase of the Societe Generale

Foundation’s budget, to further support culture and education and

professional integration. In addition, a new partnership is

envisaged to contribute to biodiversity and ocean

preservation.

7. Foster

a culture of performance and

accountability

Societe

Generale is committed to being a

responsible employer of choice and embedding a

performance and accountability focused culture.

In addition to increasing its employee

engagement score, the Group will also further strengthen its

commitment to gender diversity,

allocating EUR 100m to

reduce the pay gap and targeting

more than 35% of

women in senior leadership

roles by 2026.

To foster an ownership mindset, the Group will

also launch a yearly

employee share program aligning employee and

shareholder interests10.

The Group will have simplified and clear

reporting principles:

- A focus on reported income as a

fair representation of performance for both reporting and

distribution;

- Normative return based on a 12%

capital allocation;

- Increased allocation of Corporate

Centre costs to businesses (incl. transformation costs);

- Data-based

incentives with higher weight of cost and profitability

targets.

As a consequence of the new strategy and, in

particular, the increase from 11% to 12% of the normative capital

allocated to businesses, two adjustments will be accounted: the

impairment of the remaining part of the African, Mediterranean and

Overseas activities, and the goodwill on Equipment Finance

activities for a total amount circa EUR 340m11 in Q3 23, and a

provision of Deferred Tax Assets of circa EUR 270m11 in 2023.

BUSINESS FOCUS

French Retail Banking aims to increase its

client base to 17 million clients, while targeting a cost-to-income

ratio below 60% with more revenues and lower cost base. This will

be driven by the combination of higher efficiency of the French

retail network and a higher contribution from Boursorama.

Long-term strategic goals:

-

Be the #1 partner for corporates, wealthy & affluent clients

and digital customers and a responsible provider for mass-market

clients;

-

Further strengthen the value proposition for clients with a

best-in-class quality of service;

-

Have the most efficient banking model;

-

Develop a full range of ESG solutions (savings, financing and

advisory).

The SG network will leverage on further

integration with Insurance and Private Banking activities to

maximize commercial synergies.

Boursorama, the leading digital bank in France,

will accelerate further client acquisition to reach more than 8

million clients in 2026 in order to boost long term value. This

strategic decision will incur a negative cumulated impact of circa

-EUR 150m of gross operating income between 2023 and 2025. The

Group sees substantial earnings potential with a positive net

income above EUR 300m in 2026.

Global Banking and Investor Solutions (GBIS)

will further reinforce the sustainability and profitability of its

model. Societe Generale targets a cost-to-income ratio below 65% in

2026 based on a range of 1% to 2% annual average revenue growth for

Financing & Advisory (2022 to 2026) and a revenue range between

EUR 4.9bn and EUR 5.5bn for Global Markets.

Long-term strategic goals:

-

Keep improving operating leverage;

-

Decrease RWA intensity by developing an asset-light and

advisory-driven model;

-

Extract further value from integrated leading franchises;

-

Remain the most innovative provider of ESG solutions;

-

Be at the forefront of digital innovation (Digital Assets,

AI).

While building on our positioning as a Tier 1

European wholesale player and trusted partner for clients, our

recent partnerships with AllianceBernstein and Brookfield

illustrate our capability to develop innovative pathways to further

expand our client offering and grow our revenues differently.

International Retail, Mobility &

Leasing Services

International Retail Banking

will focus on the sustainability of returns with a return on equity

above its cost of equity on a run-rate. For 2026, the Group targets

a cost-to-income below 55%.

Long-term strategic goals:

-

Build a more compact and efficient set-up;

-

Maintain a best-in-class client experience thanks to the

combination of expertise and digital capabilities;

-

Be an ESG leader across Group’s geographies;

-

Ensure strict compliance and risk management.

Mobility & Leasing

Services will leverage the full

integration of LeasePlan by ALD to be a world leader within the

mobility ecosystem. The Group aims to deliver a cost-to-income

below 55% in 2026.

Long-term strategic goals:

-

Provide an integrated offer from car finance to insurance;

-

Be a key player in the decarbonisation in financing and leasing

solutions;

-

Be a ground-breaking tech leader in mobility services;

-

Increase and maintain a sustainable high profitability.

ALD targets a +6% earning assets annual average growth from 2023

to 2026 with 50% Electric Vehicles in new contracts in 2026.

Overall, International Retail, Mobility

& Leasing Services targets a

cost-to-income below 55%.

OVERALL GROUP FINANCIAL TARGETS

The Group’s strategic roadmap translates into

the following financial targets:

-

A rock-solid CET 1 Ratio at 13% in 2026 post Basel IV

implementation;

-

An average annual revenue growth between 0% and 2%

(2022-2026);

-

An increased operational efficiency with a cost to income ratio

below 60% in 2026;

-

A net cost of risk expected to be in a range between 25 and 30

basis points from 2024 to 2026;

-

A Return On Tangible Equity between 9% and 10% in 2026;

-

An LCR target above or equal 130% and a NSFR target above or equal

112% through the cycle;

-

A target NPL ratio between 2.5% and 3% in 2026;

-

A leverage ratio comprised between a range of 4% to 4.5% through

the cycle;

-

A MREL ratio above or equal to 30% of RWA through the cycle;

-

Apply a sustainable distribution policy based on a payout ratio

range between 40% and 50% of reported net income12, with a balanced

distribution mix between cash dividend and buybacks from 2024

onwards.

Appendice: Breakdown of 2022 financial statement by pillars

restated from new organisation13

|

(In EURm) |

2022 |

|

Group |

|

|

|

Net Banking Income |

27,155 |

|

|

Operating expenses |

-17,994 |

|

|

Gross operating income |

9,161 |

|

|

Net cost of risk |

-1,647 |

|

|

Operating income |

7,514 |

|

|

Net income from companies accounted for by the equity method |

15 |

|

|

Net income from other assets |

-3,290 |

|

|

Income tax |

-1,483 |

|

|

Net income |

2,756 |

|

|

Of which non-controlling interests |

931 |

|

|

Group net income |

1,825 |

|

|

Average allocated capital |

55,282 |

|

|

Group ROE (after tax) |

2.2% |

|

|

|

|

|

|

(In EURm) |

|

French Retail Banking (including Insurance) |

|

|

|

Net Banking Income |

9,194 |

|

|

Of which private banking |

1,414 |

|

|

Operating expenses |

-6,482 |

|

|

Gross operating income |

2,712 |

|

|

Net cost of risk |

-483 |

|

|

Operating income |

2,229 |

|

|

Net income from companies accounted for by the equity method |

8 |

|

|

Net income from other assets |

57 |

|

|

Income tax |

-593 |

|

|

Net income |

1,701 |

|

|

Of which non-controlling interests |

1 |

|

|

Group net income |

1,700 |

|

|

Average allocated capital |

15,698 |

|

|

|

|

|

|

(In EURm) |

|

Global Banking & Investor

Solutions |

|

|

|

Net Banking Income |

10,082 |

|

|

Operating expenses |

-6,634 |

|

|

Gross operating income |

3,448 |

|

|

Net cost of risk |

-421 |

|

|

Operating income |

3,027 |

|

|

Net income from companies accounted for by the equity method |

6 |

|

|

Net income from other assets |

6 |

|

|

Income tax |

-576 |

|

|

Net income |

2,463 |

|

|

Of which non-controlling interests |

36 |

|

|

Group net income |

2,427 |

|

|

Average allocated capital |

16,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In EURm) |

|

International Retail, Mobility & Leasing

Services |

|

|

|

Net Banking Income |

8,107 |

|

|

Operating expenses |

-3,930 |

|

|

Gross operating income |

4,177 |

|

|

Net cost of risk |

-705 |

|

|

Operating income |

3,472 |

|

|

Net income from companies accounted for by the equity method |

1 |

|

|

Net income from other assets |

11 |

|

|

Income tax |

-836 |

|

|

Net income |

2,648 |

|

|

Of which non-controlling interests |

723 |

|

|

Group net income |

1,925 |

|

|

Average allocated capital |

9,314 |

|

|

|

|

|

of which International Retail

Banking |

|

|

|

Net Banking Income |

4,166 |

|

|

Operating expenses |

-2,357 |

|

|

Gross operating income |

1,809 |

|

|

Net cost of risk |

-464 |

|

|

Operating income |

1,345 |

|

|

Net income from companies accounted for by the equity method |

0 |

|

|

Net income from other assets |

11 |

|

|

Income tax |

-357 |

|

|

Net income |

999 |

|

|

Of which non-controlling interests |

437 |

|

|

Group net income |

562 |

|

|

Average allocated capital |

4,432 |

|

|

|

|

|

of which Mobility & Leasing

Services |

|

|

|

Net Banking Income |

3,941 |

|

|

Operating expenses |

-1,573 |

|

|

Gross operating income |

2,368 |

|

|

Net cost of risk |

-241 |

|

|

Operating income |

2,127 |

|

|

Net income from companies accounted for by the equity method |

1 |

|

|

Net income from other assets |

0 |

|

|

Income tax |

-479 |

|

|

Net income |

1,649 |

|

|

Of which non-controlling interests |

286 |

|

|

Group net income |

1,363 |

|

|

Average allocated capital |

4,883 |

|

|

|

|

|

|

(In EURm) |

|

Corporate Centre |

|

|

|

Net Banking Income |

-228 |

|

|

Operating expenses |

-948 |

|

|

Gross operating income |

-1,176 |

|

|

Net cost of risk |

-38 |

|

|

Operating income |

-1,214 |

|

|

Net income from companies accounted for by the equity method |

0 |

|

|

Net income from other assets |

-3,364 |

|

|

Income tax |

522 |

|

|

Net income |

-4,056 |

|

|

Of which non-controlling interests |

171 |

|

|

Group net income |

-4,227 |

|

|

|

|

|

|

|

|

|

|

Press contacts:Jean-Baptiste Froville_+33 1 58 98 68 00_

jean-baptiste.froville@socgen.com Fanny Rouby_+33 1 57 29 11 12_

fanny.rouby@socgen.com

Societe

Generale

Societe Generale is a top tier European Bank

with 117,000 employees serving 25 million clients in more than 60

countries across the world. We have been supporting the development

of our economies for nearly 160 years, providing our corporate,

institutional, and individual clients with a wide array of

value-added advisory and financial solutions. Our long-lasting and

trusted relationships with the clients, our cutting-edge expertise,

our unique innovation, our ESG capabilities and leading franchises

are part of our DNA and serve our most essential objective - to

deliver sustainable value creation for all our stakeholders.

The Group runs three complementary sets of

businesses, embedding ESG offerings for all its clients:

- French

Retail Banking, with leading retail bank SG and insurance

franchise, premium private banking services, and the leading

digital Bank Boursorama.

- Global

Banking and Investor Solutions, a top tier wholesale bank

offering tailored-made solutions with distinctive global leadership

in Equity Derivatives, Structured Finance and ESG.

-

International Retail, Mobility & Leasing

Services, comprising

well-established universal banks (in Czech Republic, Romania and

several African countries), and ALD / LeasePlan, a global player in

sustainable mobility.

Committed to building together with its clients

a better and sustainable future, Societe Generale aims to be a

leading partner in the environmental transition and sustainability

overall. The Group is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe).

In case of doubt regarding the authenticity of

this press release, please go to the end of Societe Generale’s

newsroom page where official Press Releases sent by Societe

Generale can be certified using blockchain technology. A link will

allow you to check the document’s legitimacy directly on the web

page. For more information, you can follow us on Twitter

@societegenerale or visit our website societegenerale.com.

1 After deduction of interest on deeply subordinated notes and

undated subordinated notes, restated from non-cash items that have

no impact on the CET 1 ratio2 Basel IV impact estimated at circa

85bps from 01/01/2025 to 31/12/2026.3 After deduction of interest

on deeply subordinated notes and undated subordinated notes,

restated from non-cash exceptional items that have no impact on the

CET 1 ratio.4 Including NPL backstop, rating migrations, other

regulatory adjustments, M&A,…5 Expected run rate value creation

from Data/AI use cases.6 Effective as of 1st January 2024. The new

sectoral policy detailing the modalities is available on Societe

Generale’s web page.7 Effective as of 1st January 2024.8 Oil and

Gas absolute financed GHG Emissions on scope 1, 2 and 3 end use

covering the broad value chain from upstream, midstream to

downstream.9 Concerning the credit exposure to car manufacturers.10

Subject to general meeting of shareholders’ approval.11 No impact

on the 2023 distribution. Non audited figures.12 After deduction of

interest on deeply subordinated notes and undated subordinated

notes, restated from non-cash items that have no impact on the CET

1 ratio.13 NB : 2022 figures have been restated in compliance with

IFRS 17 and IFRS 9 for insurance entities. Average allocated

capital based on an allocation rate of 12% of risk weighted assets.

These restatements are not audited.

- Societe-Generale-Capital-Markets-Day-2023-EN

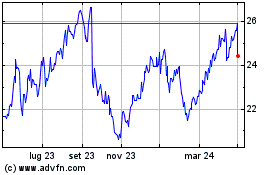

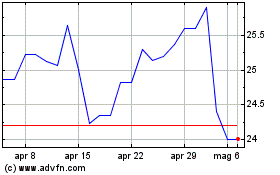

Grafico Azioni Societe Generale (BIT:1GLE)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Societe Generale (BIT:1GLE)

Storico

Da Mag 2023 a Mag 2024