Leapmotor Shares Fall After Stellantis Takes Stake in EV Maker for $1.58 Billion

26 Ottobre 2023 - 8:05AM

Dow Jones News

By Jiahui Huang

Zhejiang Leapmotor Technology's shares were lower at the mid-day

break after initially rising on news of a 1.5 billion euro ($1.58

billion) investment by Stellantis in the Chinese electric-vehicle

maker.

Leapmotor shares ended the morning session down 9.4% at 33.40

Hong Kong dollars, reversing course from early gains of as much as

11.5%.

Some of the whipsawing into negative territory arose from early

investors in the company seeking an exit point, said Ke Qu, an

analyst at CCB International Securities.

"The stock price is under pressure due to selling pressure from

pre-IPO investors," Qu said in an email. "Most may think this

partnership announcement creates [a] better exit window for their

three-year or even longer investment."

Qu added that Leapmotor is relatively short on cash compared

with other listed startups in China, and can benefit from a partner

to leverage its exposure and competitiveness in European or U.S.

markets.

"Greater access to [the] EU means better profitability than

elsewhere in the world," she said.

Netherlands-based Stellantis said early Thursday that it is

taking a roughly 20% stake in Leapmotor, with the companies

planning to create a joint venture to sell Leapmotor products

outside of China, starting with Europe.

Leapmotor debuted in Hong Kong in September 2022 after raising

about HK$6.06 billion (US$774.8 million) in its initial public

offering.

The Chinese company delivered 44,325 vehicles in the third

quarter, up almost 25% from a year earlier. Revenue in the quarter

rose 32% on the year to CNY5.66 billion.

Write to Jiahui Huang at jiahui.huang@wsj.com

(END) Dow Jones Newswires

October 26, 2023 01:50 ET (05:50 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

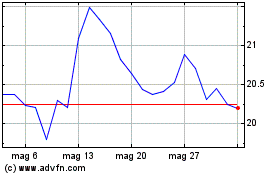

Grafico Azioni Stellantis NV (BIT:STLAM)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Stellantis NV (BIT:STLAM)

Storico

Da Mag 2023 a Mag 2024