Liquidation Alert As High-Risk Loans On Aave Reach $1 Billion – Details

09 Giugno 2024 - 9:14AM

NEWSBTC

According to a report by data analytics company IntoTheBlock, the

volume of high-risk loans on the prominent Aave Protocol is

reaching high levels as general loan volume in the DeFi space

records multi-year highs. This development is believed to stem from

investors exploring various investment strategies in a bid to

maximize profits in a highly anticipated crypto bull run. Related

Reading: Aave Joins Binance’s BNB Chain Ecosystem – Here’s How

Users Benefit Aave’s High-Risk Loans 5% Short Of Liquidation

Threshold In its weekly newsletter on June 8, IntoTheBlock

highlights that DeFi loans are currently estimated at $11

billion representing the peak value seen in the last two years. As

the largest lending protocol, Aave accounts for over 50% of these

figures with its users having borrowed about $6 billion.

Notably, $1 billion of this debt is categorized as high-risk loans

which are placed against volatile collateral. Currently, these

loans present substantial risk, with the values of their collateral

asset within 5% of their set liquidation threshold. For context,

the margin call level or liquidation threshold is a predetermined

point at which an asset’s value falls to a level where the lender

or broker requires the borrower to add more collateral to maintain

the loan or position. Failure to meet this requirement may result

in the automatic liquidation of such collateral. When

collateral assets hover around this critical threshold as with the

high-risk loans on Aave, any minor dip may lead to widespread

liquidations. This normally results in the loss of such assets for

the borrower. However, in certain conditions where a rapid price

decline occurs, the borrower may incur additional losses which may

be transferred to their account balance on the lending

platform. Furthermore, liquidations from these high-risk

loans may exacerbate market volatility, which may result in more

price loss, leading to more liquidations in a downward spiral. In

addition, many assets getting liquidated at once can create

liquidity crunches which can prevent the Aave protocol from

operating smoothly. Related Reading: Curve Founder Michael Egorov

Clears Aave Loan, Reduces Total Debt To $42.7 Million AAVE Price

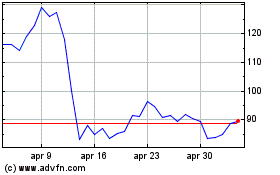

Overview Meanwhile, AAVE has declined by 5.30% in the last day

after facing serious resistance at the $98.20 price zone. The DeFi

token is currently valued at $92.30 after an overall negative

performance in the past week resulting in an 11.53% price loss.

However, according to price prediction site Coincodex, the general

sentiment around AAVE remains positive. The team at Coincodex backs

AAVE to make a remarkable comeback hitting a price point of $303.87

in the next one month. Featured image from LinkedIn, chart from

Tradingview

Grafico Azioni Aave Token (COIN:AAVEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Aave Token (COIN:AAVEUSD)

Storico

Da Nov 2023 a Nov 2024