Crypto Analyst Reveals 6 Must-Buy Altcoins With The Most Potential

06 Maggio 2024 - 1:30PM

NEWSBTC

As the crypto market exhibits signs of a burgeoning altseason,

crypto analyst Alex Wacy has shared a strategic forecast with his

175,000 followers on X. Wacy predicts a selective yet explosive

growth phase for altcoins, emphasizing the critical nature of asset

selection and market timing. Crypto Market Outlook And Asset

Selection Strategy Wacy’s recent thread underscores the

anticipation of a massive altseason: “Only ~15% of altcoins will

bring 10-100x in this hyper growth. Asset selection matters more

than ever. One slip-up, and you’re out.” His analysis highlights

the potentially selective nature of the upcoming market phase,

suggesting significant disparities in performance among altcoins.

Wacy believes the market is currently undervalued and primed for a

significant uptick. He suggests that the consolidation of the total

altcoin market cap above $700 billion would confirm the bull trend,

signaling the onset of altseason. This perspective is rooted in

current market behaviors where sentiment remains largely bearish,

presenting a contrarian opportunity for growth. He categorizes the

current sentiment into three types of capitulation—price, time, and

growth—indicating varied investor behaviors that often precede

market recoveries. The prevailing fear of further drops, according

to Wacy, will likely clear out weak hands, setting the stage for a

supercycle driven by Fear of Missing Out (FOMO) and subsequent

strong buying activities. Related Reading: Buy Crypto In May, Go

Away: Arthur Hayes Shares His Top Altcoin Picks Top 6 Altcoins With

The Most Potential #1 And #2: WIF as well as PEPE are the memecoins

highlighted by Wacy as potential early movers in the anticipated

altseason. “Look at WIF and PEPE, structurally similar to DOGE

during its meteoric rise. These coins have cultivated a community

and meme appeal that could very well parallel SHIB’s market cap in

the previous cycle,” Wacy asserts. He notes that PEPE appears

particularly poised for a breakout, whereas WIF, though currently

weaker, has the potential for quick shifts in market sentiment. #3

Ondo Finance (ONDO): This Real World Asset (RWA) focused coin is

characterized by its robust buy support during price dips. Wacy

sees ONDO as an undervalued asset with a significant upside. “ONDO

has a resilient buy floor; even slight retractions to around $0.64

could offer lucrative entry points ahead of substantial upward

trajectories,” he advises. His first target is the $1.62 price

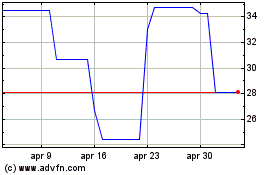

zone. #4 Arweave (AR): Known for its decentralized data storage

solutions, Arweave is praised by Wacy for its strong market

structure and resilience during downturns. Moreover, Arweave is

building AO, a decentralized computer network which can be run from

anywhere. “Arweave isn’t just storage; it’s a foundational

technology in a decentralized future. A consolidation above $49

would likely be the catalyst for an explosive growth phase,” he

predicts. Related Reading: Why This Crypto Bull Run Might Not Live

Up To The Past: Analyst #5 Echelon (PRIME): Wacy discusses PRIME’s

multifaceted ecosystem, which encompasses a trading card game and

an AI-powered game, both of which are gaining traction. “Echelon

stands at the confluence of gaming and blockchain technology,

attracting a broad audience with its innovative gameplay and

decentralized features,” he remarks. From a technical analysis

perspective, the PRIME price is near a favorable buying zone from

$14.97 to $17.5. “Hoping that altcoins are already entering the

altseason, would like to see a V-shaped reversal,” Wacy states. #6

Ethena (ENA): This synthetic dollar protocol offers an alternative

to traditional banking and is poised for growth. “Ethena’s pattern

on the weekly charts typically precedes major price movements. With

the next major unlock event slated for April 2025, the buildup

could be substantial,” Wacy explains. He likens ENA’s current price

trajectory with the one of SEI. Strategic Profit-Taking Wacy also

provides strategic advice on profit-taking, anticipating that the

altcoin market index, TOTAL3, could ascend to between $2 trillion

and $2.3 trillion during the altseason. He suggests considering

partial profit-taking once the market reaches approximately $1.6

trillion. His rationale is based on historical patterns where many

investors fall prey to greed, resulting in substantial losses. The

analyst further advises preparing a profit-taking strategy in

advance, advocating for the reservation of 10-15% of positions for

potential further growth beyond initial targets. He warns that the

last surge in a growth phase often triggers excessive greed,

suggesting that recognizing such signals could be crucial for

timely exits before the onset of bear market conditions. At press

time, WIF traded at $3.58. Featured image from iStock, chart from

TradingView.com

Grafico Azioni Arweave (COIN:ARUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Arweave (COIN:ARUSD)

Storico

Da Gen 2024 a Gen 2025