Cosmos (ATOM) Elliott Wave Summary (2019 – 2023)

21 Dicembre 2023 - 11:46PM

NEWSBTC

Cosmos ($ATOM) is the coin that powers the entire Cosmos ecosystem.

It consists of a variety of projects from different spheres such as

finance, decentralized exchanges (DEX), and cloud computing. The

earliest price data I can find for $ATOM is from Kraken, starting

in April 2019. Using this price data, the remainder of the article

represents my best efforts to apply Elliott Wave Theory (EWT) to

isolate its placement in market structures. I will assume that you

have some knowledge of EWT to understand the terms, but I have also

included a small glossary at the bottom for reference. EWT Summary

Cosmos Price Data from Kraken | Source: ATOMUSD on tradingview.com.

A link to the raw image since it might be hard to see all the

details: https://www.tradingview.com/x/jIKwljmV. Cycle Wave 0 – Mar

2020 – $1.1151 Primary Wave 1 – $2.4794 Primary Wave 2 – $1.8482

(38.2% LFR) Primary Wave 3 – $32.2433 (3.618 LFE) Primary Wave 4 –

$7.872 (50% LFR) Primary Wave 5 – $44.7383 (1.236 LFE) Cycle Wave 1

– Sep 2021 – $44.7383 Primary Wave A – $20.2221 (Contracting,

Leading Diagonal) Primary Wave B – $33.2641 (Contracting Triangle)

Primary Wave C – $5.5409 (Impulse) Cycle Wave 2 – Jun 2022 –

$5.5409 (50% LFR) Primary Wave 1 – ONGOING Primary Wave 2 – TBA

Primary Wave 3 – TBA Primary Wave 4 – TBA Primary Wave 5 – TBA

Cycle Wave 3 – ONGOING Related Reading: Crypto Analyst Who

Predicted Bitcoin 2023 Bull Run Releases New Target Exploring

Further EWT uses ratios to create price targets. The main target

being the 1.618 LFE, however there are the minimum, lower, and much

higher LFE’s to watch out for. For $ATOM we first need to find the

beta multiple to scale the targets off of. This is accomplished by

taking Wave 1 and dividing it by Wave 0. In this case for the Cycle

Wave Degree it’s approximately 40.12. Then we raise this multiple

to various numbers defined by EWT to create a table of targets. In

order below are the LFE Price Targets: 0.618 – $54.26 1 – $222.3

1.236 – $531.3 1.618 – $2,176.84 Therefore, if we expect $ATOM to

be a Diagonal then $54.26 – $222.3 is the preferred price box. If

we are looking for the typical price box then it’s: $531.3 –

$2,176.84. However, due to the nature of the next estimated bull

run only the Intermediate Degree Wave 3 of the Cycle Wave 3 should

play out. The next bull run is estimated by many traders and

institutions to peak around late 2024 to early 2026. Benner Cycle

Theory also puts a market peak around 2026. You can see the full

layout for Benner’s Cycle Theory here. As such, the Intermediate

Wave 1 and 2 are: $17.2656 and $6.17. The beta multiple for the

Intermediate Degree is approximately 3.116. Then as we did for the

Cycle Wave Degree the relevant typical price box is: $25.14 –

$38.81. The higher price boxes are all above the ATH for $ATOM. The

current price action for $ATOM is overwhelmingly bullish, so the

higher price boxes are definitely a possibility. Cosmos Price Data

from MEXC | Source: ATOMUSD on tradingview.com. A link to the raw

image since it might be hard to see all the details:

https://www.tradingview.com/x/FQhUSWST. Related Reading: When Is

The Next Crypto Bull Run? Conclusion Given the next bull run peak

for crypto is likely late 2024 to early 2026 the relevant LFEs to

use for $ATOM are at the Intermediate Wave Degree . The typical

price targets for the Intermediate Degree Wave 3 are $25.14 –

$38.81. The price as I write is $11.3 so the next peak is a rough 2

to 3.5x from here. If the Wave 3 is heavily extended and possibly

goes to the 2.618 or 3.618 LFE then a new ATH is possible. That

would mean a minimum of a 4x from here to the next peak. The

Primary Wave 1 of Cycle Wave 3 is likely due in late 2026 to 2030

using Fibonacci Time Ratios. Related Reading: Smart Buyers Are

Focusing on 3 Cryptocurrencies Glossary Elliott Wave Theory (EWT)

“A theory in technical analysis that attributes wave-like price

patterns, identified at various scales, to trader psychology and

investor sentiment.” Source: “Elliott Wave Theory: What It Is and

How to Use It” by James Chen (2023) Logarithmic Fibonacci

Retracement (LFR) A measured correction at certain Fibonacci ratios

on a semi-log scale. Logarithmic Fibonacci Extensions (LFE) A

measured rally at certain Fibonacci ratios on a semi-log scale.

Supplemental Reading “Elliott Wave Principle – Key To Market

Behavior” by Frost & Prechter (2022) “Visual Guide to Elliott

Wave Trading” by Gorman & Kennedy (2013) “How to Calculate

Logarithmic Retracements and Extensions” by C. D. Chester (2023)

Featured image from learn.swyftx.com. Charts from tradingview.com.

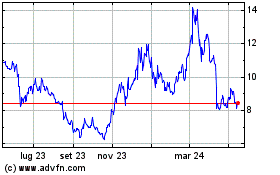

Grafico Azioni Cosmos Atom (COIN:ATOMUSD)

Storico

Da Ott 2024 a Nov 2024

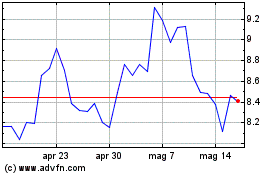

Grafico Azioni Cosmos Atom (COIN:ATOMUSD)

Storico

Da Nov 2023 a Nov 2024