‘Uptober’ Is Just Around The Corner: Here’s Where Bitcoin Price Is Headed

22 Settembre 2024 - 6:00PM

NEWSBTC

As October approaches, investors are looking ahead to what the

month will bring this time around for Bitcoin and the entire crypto

industry. Historically, October (often referred to as “Uptober”)

has been a month of significant upward momentum for Bitcoin since

the crypto’s creation. Related Reading: Avalanche (AVAX) Rallies On

Fed Rate Cut, DeFi Growth Boosts Long-Term Outlook With the

previous year’s October seeing impressive gains and kickstarting a

strong bull run, many investors are keenly analyzing market trends

to predict where Bitcoin might be headed this time around.

Historical Context Of Uptober And What It Means For Bitcoin Bitcoin

might have a smaller history when compared to traditional asset

classes, but it has had a strong history of notable patterns and

repetitions. One of these is the concept of a bullish October among

other months of the year. Over the past several years, October has

consistently delivered positive returns for BTC. This pattern has

fostered a strong belief among investors that the coming October

may hold favorable conditions for price growth, especially as

market sentiment shifts towards optimism after the recent Fed

interest rate cut. According to data from CoinGlass, Bitcoin has

had green monthly closes in October for the past five years.

Furthermore, out of the eleven years since Bitcoin’s inception, it

has recorded positive monthly closes in October on nine occasions.

As expected, this consistent performance has solidified October’s

reputation as a month of promise for the crypto. For instance,

Bitcoin surged by 28.52% in October 2023. This significant uptick

not only marked a successful month but also paved the way for a

sustained multi-month rally that ultimately saw Bitcoin reaching an

all-time high of $73,780 in March 2024. Looking ahead to October

2024, if Bitcoin were to replicate a similar 28% increase, we could

witness it surpassing its previous all-time high, potentially

peaking above $81,000. Current Market Sentiment Bitcoin is

currently navigating a wave of bullish sentiment, although its

price growth is hampered by resistance around $63,000. To reach

this price point, Bitcoin increased by about 21% last week from a

low of $52,827 on September 6. With a week remaining in

September, Bitcoin’s stabilization around $63,000 indicates a

possible support base for an upcoming rally. Bitcoin is also

largely in a phase of accumulation, which may see smart large

investors loading up throughout next week before the foreseen rally

in October. Related Reading: Solana Jumps 10% As Fed Eases Rates,

Analysts Eye Even Higher Gains With the clock ticking down to

October, all eyes are on Bitcoin. At the time of writing, Bitcoin

is trading at $63,010. This price point could soon become a thing

of the past with the projections of a bull run in October. However,

caution is advised, as the price performance in the last week of

September could make or break a bullish sentiment leading into

October. Featured image from Pexels, chart from TradingView

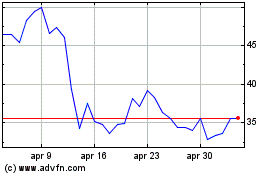

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Gen 2024 a Gen 2025