Bitcoin Teeters On The Edge Of Glory: Will It Smash The $70,000 Resistance?

02 Aprile 2024 - 4:00AM

NEWSBTC

Bitcoin (BTC) has been making waves with its steady climb towards

setting a new all-time high (ATH), currently finding a foothold at

the $68,000 zone. This level of performance represents a

culmination of investor confidence, market dynamics, and underlying

economic factors that paint a broader picture of the digital

currency’s “resilience and appeal.” Crypto analyst Ali has recently

shed light on a critical juncture in Bitcoin’s journey, identifying

a significant resistance level that could influence its short-term

price movements. Related Reading: Get Ready For A Bitcoin Cash

Revolution: Analyst Forecasts Historic Breakout Key Resistance

Awaits Ali’s analysis brings to the forefront a specific resistance

barrier that Bitcoin faces on its path to achieving a new ATH.

According to Ali, a resistance level at $70,320, characterized by a

total volume of 599,260 BTC held by 736,380 addresses, stands as

the gatekeeper to further bullish momentum. Surpassing this

threshold could potentially catalyze Bitcoin’s ascent, further

solidifying its status as the pinnacle of the cryptocurrency

market. This resistance particularly represents the collective

anticipation and strategic positioning of hundreds of thousands of

investors who have staked their claims in Bitcoin’s digital gold.

#Bitcoin finds solid ground at $68,300, yet a break below could

lead to a downswing to the next support range at $65,250-$63,150,

where 760,000 wallets hold 520,000 $BTC. On the brighter side,

securing $70,320 as support is vital for #BTC next leg up!

pic.twitter.com/EMPBRRADzT — Ali (@ali_charts) April 1, 2024

Meanwhile, the crypto market’s sentiment has been a rollercoaster,

with Bitcoin experiencing a slight retreat, marking a 1.4% decrease

over the past week and a 2.4% dip in the last 24 hours, landing at

a market price of $68,448, at the time of writing. Caution Amid

Bitcoin Record Streak Amidst this backdrop, author and former hedge

fund manager Jim Cramer has voiced his observations, suggesting

that the market is “the most overbought” it has been in a while.

The observations come just as Bitcoin marks its seventh month of

positive performance, a milestone last achieved in 2012. This

period of growth is highlighted by a monthly candlestick chart

closing higher than the peak of its last cycle. Adding to this

“overbought” sentiment by Jim Cramer is a transaction of the

seventh wealthiest Bitcoin address withdrawing 8,889 BTC from

Bitfinex, valued at roughly $627 million, recorded by Peckshield.

Related Reading: Bitcoin Flash Crash Washes Out 81,000 Crypto

Traders For Over $220 Million However, despite this, Cramer’s

statements have sparked debates and skepticism among the crypto

community, with some questioning the timing of his comments as an

April Fool’s jest. April Fools + Cramer Signal = Massive rip

incoming — TB – JDUN (@Jduntrades) April 1, 2024 Featured image

from Unsplash, Chart from TradingView

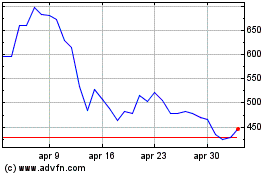

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Feb 2024 a Feb 2025