Bitcoin Selloff: German Gov’t Offloads Another $67 Million As Price Wobbles

26 Giugno 2024 - 6:00PM

NEWSBTC

In a continued effort to liquidate its substantial Bitcoin

holdings, the German government has once again engaged in

significant transactions involving BTC, according to data from

blockchain analytics platforms Arkham Intel. This morning, the

Federal Criminal Police Office (BKA) executed nine transactions

involving a total of roughly 2,786 BTC. German Gov’t Continues Its

Bitcoin Sell-Off Arkham Intel’s data shows that four of them are

internal transfers while five transactions were direct transfers to

crypto exchanges and market makers, suggesting an intent to sell.

The five potential sales amount to 1,095.339 BTC worth

approximately $67 million. Specifically, the BKA made two 125 BTC

transfers, each worth approximately $7.7 million, to well-known

crypt exchanges Bitstamp and Kraken. An additional transaction

involved a minute test transfer of 0.001 BTC to Flow Traders, a

leading market maker. This small transaction was soon followed by a

much larger transfer of 345.338 BTC to the same entity, strongly

suggesting preparation for a substantial sell order. Related

Reading: Here’s Why The Bitcoin Bottom Is In, New Highs Imminent:

Crypto Expert Another noteworthy transfer of 500 BTC was directed

to an enigmatic address tagged as “139Po.” This address has seen

previous activity linked to the German government but remains

shrouded in mystery, speculated to be another sale point. These

transactions form part of a broader trend observed since last week.

Just a day prior, on June 25, the government had disposed of 400

Bitcoin worth $24 million on Kraken and Coinbase, as well as 500

BTC to address “139Po.” This is in addition to significant

movements earlier last week: $130 million worth of BTC were

transferred to exchanges on June 19 and $65 million on June 20.

Counterbalancing these outflows, the government received $20.1

million back from Kraken and $5.5 million from wallets associated

with Robinhood, Bitstamp, and Coinbase. Related Reading: Will

Bitcoin Have A ‘Red Monday, Green Week’? Analyst Sets $63,500

Target Currently, the German government’s holdings amount to 45,264

BTC, valued at around $2.8 billion. This makes Germany one of the

top nation-state holders of Bitcoin, trailing only behind the

United States, China, and the United Kingdom, which hold 213,246

BTC, 190,000 BTC, and 61,000 BTC respectively, according to data

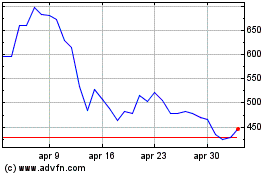

from Bitcoin Treasuries. BTC Price Hangs Above Critical Level The

pattern of large-scale disposals by the German government has

contributed to fluctuations in Bitcoin’s market price, which has

experienced a decline of approximately 6% since the onset of these

transactions. Bitcoin’s value briefly fell below the $60,000

threshold following the announcement from Mt. Gox about

disbursing approximately $9 billion worth of Bitcoin and Bitcoin

Cash starting in July. Market analysts and investors are also

keenly observing these governmental actions as the sell-off seems

to continue at a slow pace. This strategic liquidation by the

German government arrives at a pivotal juncture for market

sentiment, with Bitcoin prices teetering just above critical

support levels. Should the daily trading price close below the

$60,000 threshold, it could potentially trigger a more pronounced

downturn in Bitcoin’s price, exacerbating market volatility and

uncertainty. At press time, BTC traded at $61,451. Featured image

created with DALL·E, chart from TradingView.com

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Dic 2023 a Dic 2024