Massive Sell-Off: Mt. Gox Bitcoin Payout Fears Wipes Out $170 Billion From Crypto Market

06 Luglio 2024 - 2:30AM

NEWSBTC

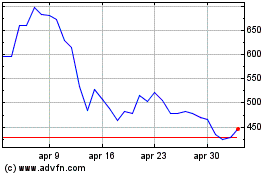

The cryptocurrency market experienced a substantial downturn on

Friday, compounding the selling pressure witnessed over the past

two weeks. The leading cryptocurrency, Bitcoin (BTC), retraced over

20% from its highs in June and May, dropping as low as

$53,500. The market decline was largely attributed to the

long-awaited trustee overseeing the Mt. Gox bankruptcy, who

announced the commencement of Bitcoin and Bitcoin Cash repayments

to creditors affected by the infamous hack that resulted in

billions in losses. As a result, the entire cryptocurrency

market shed over $170 billion in combined market capitalization in

just 24 hours. Bitcoin Repayments And German Government Sell-Off

The trustee responsible for the Mt. Gox bankruptcy estate, Nobuaki

Kobayashi, stated that Bitcoin and Bitcoin Cash repayments had

begun through designated crypto exchanges. While the amount

transferred to these exchanges was not specified, data from market

intelligence platform Arkham revealed that 47,229 BTC, valued at

$2.71 billion, had been transferred to an unknown address. Related

Reading: Polkadot Under Fire: 20% Price Drop Follows $87 Million

Spending Outrage Kobayashi emphasized that the remaining funds

would be returned to creditors once “specific conditions” were met,

including verifying registered accounts and finalizing discussions

with the designated exchanges. The decline in crypto prices

led to substantial liquidations in the derivatives markets, with

over 229,755 traders experiencing combined liquidations worth

$639.58 million in the past 24 hours. Of this amount, $540.46

million represented long trades, indicating positions taken by

investors expecting long-term asset appreciation.

Additionally, the German government contributed to the market

pressure by selling approximately 3,000 BTC, equivalent to around

$175 million, from a seized stash of 50,000 BTC associated with the

movie piracy operation Movie2k. Despite the sell-off, the

government still holds over 40,000 BTC, valued at over $2 billion.

What Historical Price Cycles Suggest Despite the ongoing bloodbath

witnessed in crypto prices over the past month, industry insiders

and analysts remain optimistic about Bitcoin’s future

performance. Despite the short-term selling pressure

resulting from Mt. Gox repayments, experts anticipate a rebound

towards the end of the year. Crypto data and research firm CCData

suggested that Bitcoin’s current appreciation cycle has not yet

peaked and will likely achieve a new all-time high.

Historical market cycles indicate that Bitcoin’s Halving event,

which reduces the supply of new BTC, typically precedes a period of

price expansion between 12 and 18 months. The most recent Halving

occurred in April, suggesting potential further growth into

2025. Related Reading: Dogecoin Decimated: $5 Million

Liquidation Sparks 14% Price Plunge Tom Lee, co-founder and head of

research at Fundstrat Global Advisors, told CNBC that he predicts

that Bitcoin will hit $150,000 despite the Mt. Gox overhang. The

launch of an Ethereum exchange-traded fund (ETF) in the US and the

approval of the first US spot Bitcoin ETF earlier this year

contribute to the overall positive sentiment in the market,

indicating potential growth and further mainstream adoption of

cryptocurrencies. At the time of writing, BTC is trading at

$55,680, reflecting a significant 21% drop in price over the past

month. Bulls in the market are closely monitoring the $54,480 price

level, representing substantial support for BTC. This level holds

critical importance as it could prevent further price declines and

the risk of breaking below the crucial $50,000 level. Featured

image from DALL-E, chart from TradingView.com

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Feb 2024 a Feb 2025