Mt. Gox Creditors Begin Withdrawing Owed Bitcoin And BCH Funds Via Kraken

23 Luglio 2024 - 11:30PM

NEWSBTC

After a decade-long wait, creditors of the now-defunct Mt. Gox

Bitcoin exchange have finally begun receiving their owed Bitcoin

(BTC) and Bitcoin cash (BCH) via the Kraken and Bitstamp crypto

exchanges. However, this had a notable impact on the

cryptocurrency market, contributing to a nearly 4% drop in the

price of Bitcoin after users confirmed the deposits to their

wallets from the exchanges. Mt. Gox Distributes Millions To

Bitstamp And Kraken On an early Tuesday morning, wallet addresses

linked to Mt. Gox initiated the transfer of $2.85 billion worth of

BTC. According to on-chain data from blockchain analytics

platform Arkham, Mt. Gox executed the movement of $2.85 billion in

BTC to new wallets with the primary purpose of distributing 5,110

BTC, equivalent to $340.1 million, to four distinct Bitstamp

addresses. Related Reading: Ethereum ETFs Witness Stellar

Start As Trading Soars; Analyst Sees ETH’s Price Reaching $8,000 In

Q4 Bitstamp is one of the five exchanges that collaborate with the

Mt. Gox Trustee to facilitate the return of funds to the exchange’s

creditors, including Kraken and Japanese exchanges Bitbank and SBI

VC Trade. Notably, Mt. Gox still retains possession of 85,234 BTC,

valued at approximately $5.70 billion. While some users within the

Reddit community have confirmed the receipt of Bitcoin returned by

Mt. Gox through Kraken, Bitstamp users have reported not yet

receiving their allocations. Kraken had previously announced

the successful reception of creditor funds from the Mt. Gox trustee

amounting to over $3 billion or 48,641BTC, estimating a timeframe

of 7-14 days for the complete deposit of funds into user accounts.

Critical Support Zones For Bitcoin In the aftermath of the

Mt. Gox payouts, market data analysis platform CryptoQuant has

spotted the price correction that BTC has experienced over the past

few hours, with the company noting that it has impacted the line of

1-3 month BTC holders. CryptoQuant emphasizes the importance

of monitoring support levels, specifically highlighting the $63,600

area, representing the average purchase price of 3-6 month bitcoin

holders. Crypto analyst Caleb Franzen, on the other hand, has

observed Bitcoin returning to a familiar support zone, which has

proven effective. Despite the temporary setback, Franzen contends

that Bitcoin has displayed a pattern of higher highs and higher

lows in the short term, indicating resilience amidst the current

price volatility. Related Reading: Ethereum Price Stays Flat

Despite Today’s ETF Debut: QCP Explains Why Further insights

provided by analyst Ali Martinez point to a potential double-bottom

pattern with bullish relative strength index (RSI) divergence on

lower time frames for Bitcoin. If confirmed, Bitcoin could see a

rebound to $67,600, contingent upon the critical support level at

$66,000 holding firm. Delving into on-chain data, Martinez

underscores a crucial support zone for Bitcoin between $63,440 and

$65,470. Within this range, approximately 1.89 million addresses

collectively purchased 1.23 million BTC, highlighting the

significance of this zone as a key area to monitor in the coming

days. Featured image from DALL-E, chart from TradingView.com

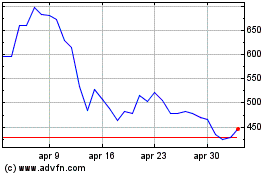

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Feb 2024 a Feb 2025