Trump Floats Bitcoin Payments As Solution To $35 Trillion US Debt Crisis

03 Agosto 2024 - 11:30AM

NEWSBTC

In a recent interview with Fox News, former President Donald Trump

voiced support for using Bitcoin as a tool to help pay down the

United States’ $35 trillion national debt as he positions himself

for a potential 2024 presidential re-election, while also signaling

a notable shift in the Republican party’s stance on digital assets.

Trump’s Strategy To Tackle $35 Trillion Debt With Bitcoin “Crypto

is a very interesting thing, very high level in certain ways,

intellectually very high level,” Trump said. The former president

acknowledged the rapid growth and adoption of cryptocurrencies

globally, warning that if the US does not embrace the technology,

countries like China will move ahead and seize the initiative.

Related Reading: Research Firm Predicts Bullish Bitcoin Breakout

For Q4: 4 Key Reasons Trump’s recent comments echo proposals from

Republican figures such as Wyoming Senator Cynthia Lummis and

former House Speaker Paul Ryan, who have floated the idea of the US

government investing in Bitcoin holdings to help pay down the

national debt. While Trump didn’t offer any new specifics, he

did hint at the possibility of the government simply “handing out a

little crypto check” or “handing them a little Bitcoin” as a way to

pay down the $35 trillion debt. Genesis Triggers $1.6 Billion In

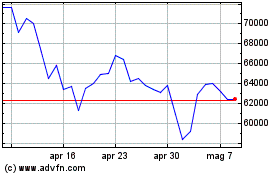

BTC And ETH Transfers Bitcoin, the largest cryptocurrency by market

capitalization, briefly dipped below the $63,000 level, reaching a

weekly low of $62,440 as news of the Genesis distributions hit the

market. According to the announcement made by Genesis on

August 2, the firm has commenced making distributions to creditors

pursuant to its Chapter 11 bankruptcy plan. As part of the

initial distribution, BTC creditors will receive 51.28% of their

holdings in-kind, while ETH creditors will receive 65.87% of their

ETH holdings. On the other hand, creditors of other altcoins,

excluding Solana (SOL), will receive an average of 87.65% of their

holdings, while Solana creditors will receive 29.58% of their

holdings. Related Reading: Cardano Goes Toe-To-Toe With Ethereum As

Whales Scoop Up 120 Million ADA The distributions have already

begun, with wallets linked to Genesis Trading moving 16.6K BTC

($1.1 billion) and 166.3K ETH ($521.1 million) in the past hour,

according to market intelligence platform Arkham. Interestingly,

billionaire investor and crypto supporter Mark Cuban has reportedly

received $19.9 million in ETH from the Genesis Bankruptcy, further

highlighting the implications of the firm’s downfall. The firm also

disclosed that creditors have established a $70 million litigation

fund to pursue claims against various third parties, including

Digital Currency Group (DCG), Genesis’ parent company. At the

time of writing, the largest cryptocurrency on the market has

managed to regain the $63,100 level after falling towards the

$62,000 zone on Friday. BTC is currently down 0.8% in the 24-hour

time frame. Featured image from DALL-E, chart from TradingView.com

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Nov 2023 a Nov 2024