Singapore, Singapore, October 10th, 2024,

Chainwire

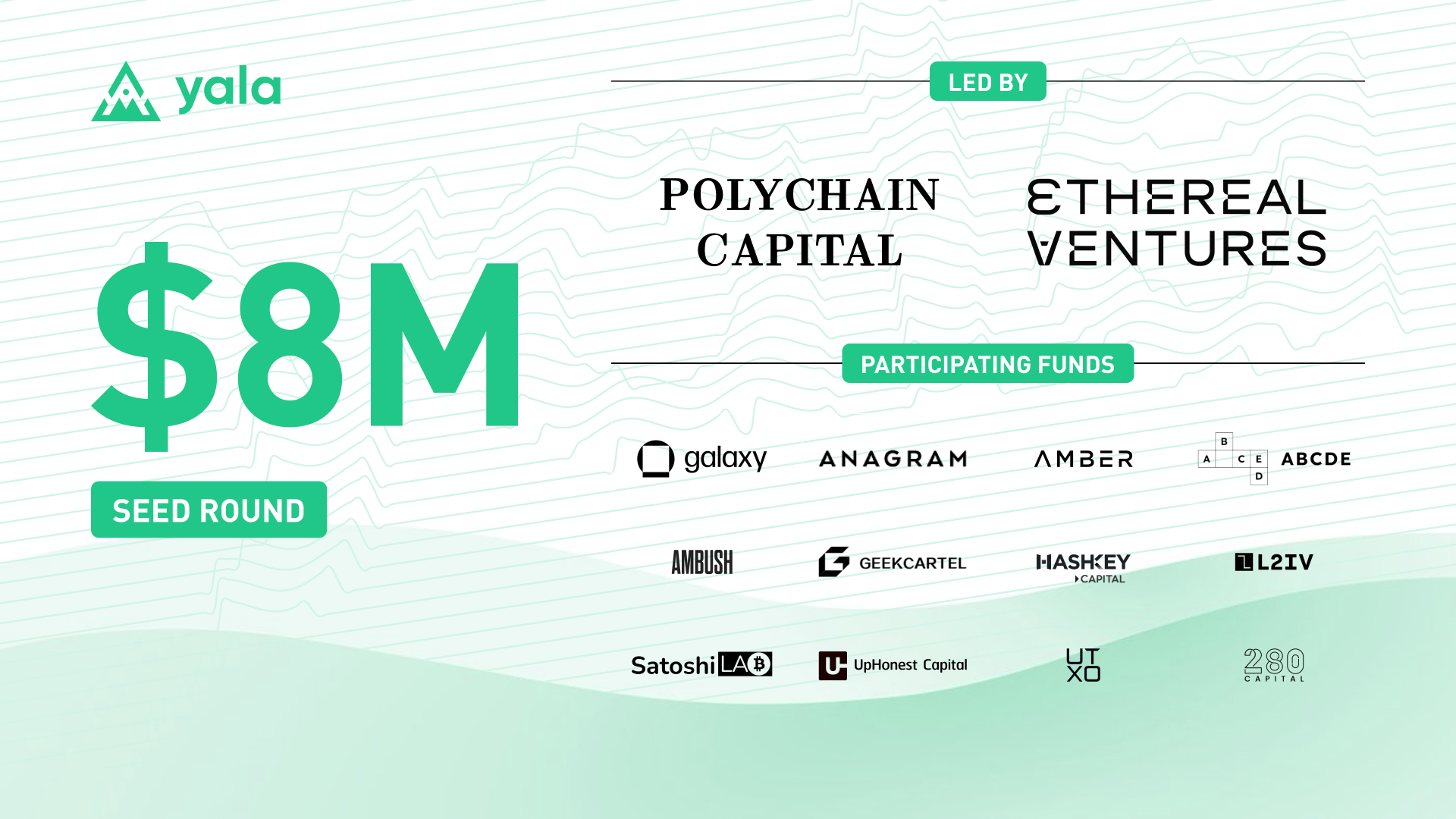

Leading industry investors join forces

to support Yala's vision of a connected multi-chain ecosystem with

Bitcoin.

Yala, a liquidity protocol

and stablecoin issuer for Bitcoin, has announced the successful

completion of its 3x oversubscribed seed funding round. The round

was co-led by Polychain Capital and Ethereal Ventures, with

participation from prominent investors, including Galaxy Vision

Hill, Anagram, Amber Group, ABCDE, Ambush Capital, GeekCartel,

HashKey Capital, L2 Iterative Ventures (L2IV), SatoshiLab, UpHonest

Capital, UTXO Management, and 280 Capital.

Yala’s team raised an $8 million seed

round at an undisclosed valuation, funding the expansion of its

engineering, growth, and security teams ahead of its mainnet

launch. This follows over 2,000 BTC in committed deposits from

investors.

Yala’s mission is to unlock Bitcoin

liquidity through a protocol that combines stablecoin issuance with

multi-chain ecosystems. Its modular architecture supports

cross-chain deployments across EVM-compatible platforms like

Ethereum and non-EVM systems like Solana, enhancing Bitcoin

composability and driving a connected Bitcoin DeFi ecosystem.

Key Investors Highlight Support

“Our strategy is to invest in and support founders in

building an ecosystem driven by strong synergies. Through its

stablecoin, Yala will bridge the gaps, enabling our Bitcoin

ecosystem to thrive with robust liquidity”, said the

Polychain Capital Team.

"Yala's approach addresses the current liquidity gap in

the Bitcoin ecosystem. Their first-mover advantage, paired with the

excellent execution speed of the team, will unlock new

opportunities in BTC-related DeFi innovation. EV is thrilled to be

supporting their journey," added Min Teo, Managing Partner

& Co-founder at Ethereal Ventures.

Yala’s Vision

Yala is building a modular

infrastructure to deploy cross-chain modules, enhancing Bitcoin

composability across ecosystems. The key components of the Yala

protocol are:

- Overcollateralized Stablecoin Protocol: A

Bitcoin-backed stablecoin ensuring security and stability.

- MetaMint: Enables minting stablecoins directly

from the Bitcoin mainnet on the destination chain.

- Insurance Derivatives Service: Provides

comprehensive insurance solutions within the DeFi ecosystem.

Yala's multi-token system aims to boost

Bitcoin cross-chain liquidity, featuring $YU (Bitcoin-backed

stablecoin) and $YALA (the governance token of the Yala ecosystem).

$YU allows Bitcoin holders to potentially earn yields across

various cross-chain DeFi protocols while preserving the security

and stability of the Bitcoin network.

"Yala is revolutionizing Bitcoin's role in

decentralized finance," said Vicky

Fu, Yala Co-founder and CTO. "By

issuing Bitcoin-backed stablecoins and creating programmable

cross-chain modules, we're not just enhancing liquidity, but we're

building a bridge that connects Bitcoin to the wider DeFi

ecosystem, unlocking unprecedented opportunities for innovation and

growth."

The Road to Mainnet

Yala is set to release its testnet next

week, with several key developments planned:

- Testnet V0: $YU stablecoin issuance and Pro

Mode.

- Testnet V1: $YU stablecoin Lite Mode with meta

yield.

- V1 Release: Insurance module and security

upgrades.

- V2 Launch: Governance framework

initiation.

Yala's roadmap focuses on building a

robust liquidity layer that connects Bitcoin to major Layer 1 and

Layer 2 ecosystems. As the team builds momentum toward the mainnet

launch, they encourage the community to participate in the upcoming

testnet.

For more information and to stay

updated on Yala's progress, users can visit yala.org.

About Yala

Yala is building a Bitcoin

liquidity layer to unlock the full potential of Bitcoin liquidity

by connecting it to multi-chain ecosystems. Its modular approach

supports deployments on both EVM-compatible platforms and non-EVM

systems, aiming to foster a robust and interconnected Bitcoin DeFi

ecosystem. Key features of the Yala protocol include an

overcollateralized stablecoin protocol, an insurance derivatives

service, and a MetaMint functionality, enabling seamless liquidity

between Bitcoin and other ecosystems.

Website | YouTube | LinkedIn | X

Contact

Co-founder,

COO

Kaitai

Chang

Yala

media@yala.org