Bitcoin Officially In Overheated MVRV Zone, Rally End Near?

22 Novembre 2024 - 2:30PM

NEWSBTC

On-chain data shows Bitcoin has recently surpassed a level of the

Market Value to Realized Value (MVRV) Ratio that has historically

signaled overheated conditions. Bitcoin Has Surpassed Highest MVRV

Deviation Pricing Band In its latest weekly report, the on-chain

analytics firm Glassnode has discussed about how Bitcoin is looking

right now from the perspective of a pricing model based on the MVRV

Ratio. The MVRV Ratio is a popular BTC indicator that keeps track

of the ratio between the market cap of the asset and its realized

cap. The latter here is an on-chain capitalization model that, in

short, tells us about the amount of capital that the investors as a

whole have used to purchase their tokens. Related Reading: Shiba

Inu Could See A 53% Surge If This Resistance Breaks, Analyst

Explains Since the MVRV Ratio compares this initial investment

against the value that the investors are currently holding (that

is, the market cap), it essentially provides information about the

profitability of the addresses on the BTC network. Now, the pricing

model that Glassnode has created doesn’t directly make use of the

MVRV Ratio itself, but rather some standard deviations (SDs) from

its mean. Below is the chart for this model shared by the analytics

firm in the report. In this model, pricing levels correspond to BTC

prices at which the MVRV Ratio would attain a value equal to a

certain SD above or below its mean. At the +0.5 SD level, for

instance, the MVRV Ratio is 0.5 SD greater than its mean value.

From the graph, it’s apparent that the Bitcoin price has broken

past the highest of the pricing bands part of this model with its

latest run. The level in question is the +1.0 SD, equivalent to

$90,200 at the moment. Historically, BTC has tended to form tops

when its price has exceeded this pricing band. The reason behind

this is the fact that at such high levels of the MVRV Ratio, the

investors carry a significant amount of profits, so a mass selloff

with the motive of profit-taking can become a real possibility.

Related Reading: XRP Binance Inflows Spike: What It Means For Price

The last time that the cryptocurrency broke past this barrier was

in the first quarter of this year. As is visible in the chart, it

didn’t take the price long to top out back then. In full-blown bull

markets in the past, however, Bitcoin has generally sustained

inside this overheated territory for notable periods of time before

finding a peak. An example of this trend is also highlighted in the

chart; the first half 2021 bull run saw the coin stay in the zone

for a few months thanks to high capital inflows. As such, it’s not

necessary that BTC would immediately reach a cyclical top now that

it has become overheated on this model. BTC Price Bitcoin had risen

beyond the $98,000 level earlier in the past day, but it seems the

coin has suffered a minor setback as it’s now back at $97,500.

Featured image from Dall-E, Glassnode.com, chart from

TradingView.com

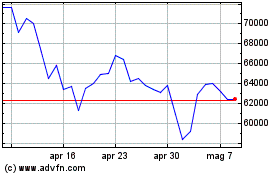

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Nov 2023 a Nov 2024