Dogecoin Whales Bought 210 million DOGE During Recent Correction – Bullish Signal?

12 Dicembre 2024 - 5:00PM

NEWSBTC

Dogecoin has seen choppy price action over the past few weeks,

reflecting the broader market’s indecision. After reaching a new

yearly high of $0.484, the price retraced sharply, losing over 25%

of its value. This pullback has left Dogecoin struggling to regain

strength and find clear direction, creating uncertainty among

retail investors. Related Reading: Bitcoin Finds Support At $94.5K

As STH Realized Prize Signals Strength Despite the retrace,

on-chain data provides a promising signal for Dogecoin’s potential

recovery. Metrics from Santiment reveal that Dogecoin whales took

advantage of the recent dip, accumulating a staggering 210 million

DOGE during the correction. This accumulation suggests that large

holders position themselves for higher prices, signaling confidence

in Dogecoin’s long-term outlook. The market is watching closely to

see if this whale activity can reignite momentum and push Dogecoin

back toward its highs. With whales accumulating during the

correction, recovery might be on the horizon, but the price still

needs to reclaim key resistance levels to confirm a bullish

continuation. Investors and analysts are awaiting the next move,

which could determine whether Dogecoin remains in a consolidation

phase or resumes its upward trend. Finding Fuel To Rally Dogecoin

has been a standout performer recently, experiencing a massive

surge since November 5. The meme coin gained over 220% during this

period, capturing the attention of retail and institutional

investors alike. However, after this impressive rally, Dogecoin is

now in a consolidation phase, as the market takes a pause before

the next significant move. Top analyst Ali Martinez shared insights

on X, highlighting on-chain data from Santiment that offers a

bullish perspective. According to Martinez, Dogecoin whales took

advantage of the recent price correction, accumulating an

impressive 210 million DOGE. This activity underscores the

growing interest in ‘smart money’, as large holders often

accumulate during dips in anticipation of future price increases.

Such whale activity is a positive long-term signal for Dogecoin and

meme coins, suggesting confidence in its potential for further

growth. Related Reading: Solana Will ‘Step Back Into The Spotlight’

Once It Reclaims $222 – Details Despite the bullish signals,

Dogecoin must overcome current consolidation to maintain its upward

trajectory. A breakout above the current pattern would likely

trigger another surge, continuing its rally. However, failure to

break out could lead to a deeper correction as investors reassess

short-term market conditions. The next move will likely set the

tone for Dogecoin’s direction in the coming weeks, making it a

critical moment for the popular meme coin. Dogecoin Testing Crucial

Demand Dogecoin (DOGE) is currently trading at $0.41 after

successfully testing support at the $0.36 level, a critical area

that has held firm during recent market volatility. Over the past

few days, DOGE has been ranging sideways, confined between

resistance at $0.48 and support at $0.36. This range-bound activity

suggests the market is in a consolidation phase, with both bulls

and bears waiting for the next decisive move. If Dogecoin can break

above the key resistance level at $0.48, it would signal renewed

bullish momentum and likely trigger a push higher. Such a breakout

could attract more buyers and set the stage for DOGE to challenge

its previous highs. On the other hand, failure to hold the $0.36

support level would likely lead to a deeper correction, with the

potential to test lower demand zones as investors lose confidence

in the short-term outlook. Related Reading: Cardano Follows 2020

Bullish Pattern – Top Analyst Plans To Take Profits Between $4 And

$6 As Dogecoin remains within this range, traders and investors

closely monitor the price action for signs of a breakout or

breakdown. The next few sessions will be pivotal in determining

whether DOGE resumes its upward trajectory or faces a more extended

correction period. The meme coin sits at a crossroads, poised for

its next big move. Featured image from Dall-E, chart from

TradingView

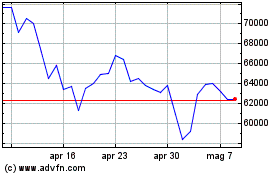

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Dic 2023 a Dic 2024