Is Bitcoin Ending 2024 On A High Note? Analysts Say This Level Is Key

28 Dicembre 2024 - 11:30AM

NEWSBTC

As Bitcoin (BTC) continues to move sideways, investors wonder

whether the flagship crypto will end the year positively or on a

sour note. Some analysts suggest a close above recently lost levels

could propel BTC’s price to new highs. Related Reading: Analyst

Forecast ‘Highly Bullish’ 2025 For Ethereum: Is The Bleeding Over?

Bitcoin’s Red Week, Green Year Since breaking past the long-awaited

$100,000 barrier in early December, Bitcoin has seen two

significant corrections to the lower zone of its one-month range.

Throughout the month, the flagship crypto’s price has traded

between $90,000 and $108,000, hovering between $96,000 and $102,000

for most of December. However, since reaching its latest all-time

high (ATH) of $108,353 ten days ago, Bitcoin has lost the $100,000

support zone, falling to its lowest price in weeks. Over the past

week, BTC has struggled to reclaim the $98,000 support zone, losing

its Christmas retest above this level on Thursday. Now, the largest

crypto by market capitalization moves within the mid-zone of its

monthly range, displaying a candle that “doesn’t look great but

also not the worst. Neutral, and still a few more days to go,” as

Altcoin Sherpa stated. The analyst suggested that Bitcoin could see

“some weird price action over the next few weeks with despair

followed by an absolute moon mission and killer alt season.”

Meanwhile, Daan Crypto Trades called BTC’s current price action the

“end of the year chop.” He noted that as Bitcoin moves sideways,

liquidity is “building on both sides,” with an area of interest

below $94,000 and a key level above the $100,000 mark. Some

investors asked the community to zoom out on BTC’s chart,

highlighting that the cryptocurrency remains within a historical

range despite the horizontal trajectory. If Bitcoin were to end the

year at its current price, it would still record a 48.15% return in

Q4 and a 122% increase in the yearly timeframe. Bitcoin Risks Fall

To One-Month Lows Analyst Carl Runefelt considers that investors

should watch the $92,500 support zone, as breaking below that

horizontal level could send BTC’s price to $86,000. Similarly, Ali

Martinez warned investors about a key level for BTC. Martinez

asserted that investors “don’t want Bitcoin to dip below $92,730,”

explaining that it is “essentially free fall territory” if the

flagship crypto loses that level. According to the analyst, the

flagship crypto could fall as low as $70,000 if it loses the key

support zone based on the UTXO Realized Price Distribution (URPD)

chart. In a previous post, he explored a bearish outlook where BTC

could fall as low as $60,000, noting that several experts

forecasted a correction anywhere from 23% to 36% for BTC. Martinez

considers a 25% crash to the $70,000 mark possible, as the URPD

chart shows minimal support below the $93,806 and $92,730 zones.

“If this critical demand area doesn’t hold, we could see a sharp

drop to $70,085,” he warned. Related Reading: New Solana Memecoin

Leader? PENGU Flips BONK Amid Whale Accumulation He also pointed

out that Bitcoin broke below one of its “most significant support

zones at $97,300,” which suggests a bearish outlook while it isn’t

reclaimed. However, the analyst asserted that this outlook would be

invalidated if BTC has “a sustained close above $97,300 and, more

critically, a daily close above $100,000.” Martinez added that

reclaiming these levels could start the next leg toward the

$168,000 target. As of this writing, Bitcoin is trading at $94,587,

a 1.24% decrease in the daily timeframe. Featured Image from

Unsplash.com, Chart from TradingView.com

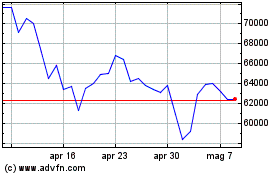

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin (COIN:BTCUSD)

Storico

Da Dic 2023 a Dic 2024