Bitcoin Consolidates Near ATH – Volume Suggests A Big Move Ahead

31 Ottobre 2024 - 11:30AM

NEWSBTC

Bitcoin has been trading in a tight 4-hour range between $71,300

and $73,300 since Tuesday, setting the stage for a significant move

in the coming days. Analysts and investors closely watch this range

as BTC inches closer to its all-time high (ATH). Top analyst

Axel Adler recently shared key data from CryptoQuant, noting that

trading volume has steadily decreased as Bitcoin remains within

these levels. Typically, this volume decline signals consolidation,

a phase often preceding a major price swing. Related Reading:

Dogecoin Metrics Reveal Increasing Network Activity – Is DOGE Ready

To Break Yearly Highs? Anticipation is building with the U.S.

election just around the corner on November 5. Market sentiment is

optimistic, and many expect Bitcoin to break out of this range

soon, either pushing into new highs or experiencing a healthy

retrace to fuel further growth. The coming days will be

pivotal for Bitcoin’s trajectory as traders assess whether the

consolidation period will lead to a breakthrough into uncharted

territory. As BTC flirts with its ATH, the stage is set for a

decisive move that could shape the market’s direction through the

end of the year. Bitcoin Price About To Move Bitcoin is at a

defining point in this cycle, nearing the end of a 7-month

accumulation period and poised to test new all-time highs.

CryptoQuant analyst Axel Adler has noted in a recent analysis on X

that BTC is currently range-bound, trading between $72,900

resistance and $71,400 support, with trading volumes showing a

gradual decline. According to Adler, this reduced volume in

Bitcoin’s confined range hints at an impending breakout. However, a

new catalyst appears necessary to drive this shift and launch BTC

past its previous highs. The upcoming U.S. election may be that

catalyst, with potential market impacts depending on the outcome.

Market sentiment suggests that a Trump victory could stimulate

bullish sentiment in the financial markets, possibly positively

influencing Bitcoin’s price trajectory. Investors are eyeing this

pivotal event as a possible trigger to push BTC beyond the $73,794

mark, its all-time high, into uncharted price territory. Related

Reading: Ethereum Holds Key Support To Set A $6,000 Target –

Analyst A successful breakout from the current range could usher

Bitcoin into price discovery mode, where FOMO (fear of missing out)

could drive buying pressure, amplifying the surge. On the other

hand, if BTC fails to secure a new high, it may dip back toward

lower support levels, potentially consolidating further until the

necessary momentum builds. BTC Flirting With ATH Bitcoin is

holding strong above $72,000, inching closer to breaking its

all-time high (ATH) and entering a price discovery phase. Price

discovery typically ushers in significant gains, as fresh highs

fuel market optimism and buying pressure. However, BTC has

yet to decisively break past its previous ATH of $73,794, and a

temporary decline below $70,000 remains a possibility if demand

doesn’t strengthen soon. The $71,000 support level now serves as a

critical base for BTC. If the price holds above this mark in the

coming days, momentum will likely build for a solid attempt to

break the ATH, potentially triggering a new wave of bullish

sentiment. Traders and investors closely watch BTC’s

performance at these levels, knowing that any sustained movement

above $73,794 could signal the start of a powerful uptrend as

Bitcoin pushes into uncharted territory. Related Reading: Cardano

Might See A Massive Pump Around November 18 – Analyst Exposes 2020

Similarities Meanwhile, a short retrace to lower support levels

might provide the liquidity needed to propel BTC beyond its current

resistance. Whether through a direct push or a minor pullback,

Bitcoin’s resilience above $72,000 sets the stage for an imminent

test of ATH, with price discovery and new highs on the horizon.

Featured image from Dall-E, chart from TradingView

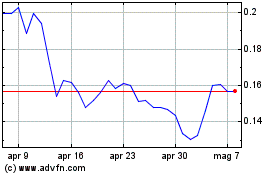

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Nov 2023 a Nov 2024