Ethereum Could Reclaim $2,700 As Key Data Signals Reduced Selling Pressure

08 Ottobre 2024 - 1:00AM

NEWSBTC

Ethereum (ETH) currently trades approximately 11% below its local

highs of around $2,730. Investors are optimistic about a potential

price surge in the coming days, driven by encouraging on-chain

data. Key metrics from Glassnode indicate a decline in ETH inflows

into exchanges, suggesting that investors are holding onto their

assets rather than selling. This trend typically points to

increased accumulation and could foreshadow a bullish breakout.

Related Reading: Chainlink (LINK) Bullish Pattern Could Ignite A

Breakout: Analyst Sets $15 Target As the broader crypto market

evolves, Ethereum investors remain vigilant, anticipating a bullish

reclaim that could propel prices higher. The decrease in exchange

inflows could signify that traders are positioning themselves for a

potential upward movement, as they seem more inclined to retain

their holdings during this crucial phase. Should Ethereum

successfully break above critical resistance levels, it could

reignite bullish momentum and attract further investment. The next

few days will be pivotal for ETH, as traders closely monitor price

action and on-chain metrics for signs of a resurgence. With the

right conditions, Ethereum may set its sights on new highs,

reinforcing the overall positive sentiment in the market. Ethereum

Exchanges’ Net Position Change Decreases Ethereum (ETH) is

currently at a crucial price level following a 15% dip from its

local highs. The broader crypto industry is brimming with

anticipation for a massive rally after the Federal Reserve’s

decision to cut interest rates a couple of weeks ago. However,

despite the optimistic outlook, prices have struggled to climb

higher, leaving many investors on edge. Fortunately, on-chain data

from Glassnode suggests a reduction in selling pressure, which

could improve market sentiment and pave the way for a potential ETH

rebound. One key metric to consider is the Ethereum Exchanges’ Net

Position Change indicator, which has been downward since

mid-September. This indicator tracks the flow of ETH into and out

of exchanges, and its recent decline signifies that inflows have

dropped significantly. Lower inflows typically indicate reduced

selling pressure, as fewer investors are moving their assets onto

exchanges to sell. This shift in momentum reflects a positive

change in market sentiment, suggesting that investors may be less

inclined to liquidate their positions at current price

levels. As selling activity decreases, Ethereum could gain

some much-needed breathing room to recover from its recent decline.

Related Reading: Solana (SOL) Holds Above $140 As Funding Rate

Signals Bullish Momentum Moreover, increased confidence among

investors might lead to upward price movement in the coming days.

Ethereum may be positioned for a resurgence if this trend

continues, potentially setting the stage for a bullish breakout as

market dynamics shift in its favor. As traders remain vigilant, all

eyes will be on ETH to see if it can capitalize on this improved

sentiment and regain upward momentum. ETH Testing Crucial Supply

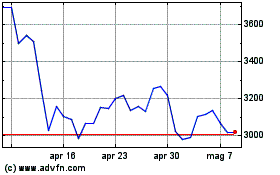

Levels Ethereum (ETH) is trading at $2,448 after facing

rejection at the 4-hour 200 exponential moving average (EMA) at

$2,516. The price also struggled to maintain momentum above the

4-hour 200 moving average (MA) at $2,458, indicating a critical

moment for ETH. If Ethereum fails to reclaim both of these key

levels in the coming days, it may be at serious risk of dropping

towards the $2,200 area, potentially triggering a deeper

correction. Conversely, if ETH manages to break above and hold

these crucial indicators, it could signal a bullish trend reversal,

opening the door for a surge toward the $2,700 resistance area. The

outcome in the next few days will be vital for determining

Ethereum’s trajectory. Related Reading: Dogecoin Could Target $0.20

Soon, Analyst Predicts – Is DOGE Primed For A Rally? Traders and

investors will closely monitor these levels, as the ability to

reclaim them could provide the momentum needed for ETH to regain

strength and attempt to test higher price levels. The current price

action reflects the uncertainty in the market, making it imperative

for ETH to assert itself decisively to inspire confidence and drive

a rally. Featured image from Dall-E, chart from TradingView

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Dic 2023 a Dic 2024