3 Reasons Why Bitcoin ETFs Will See Explosive Growth In 2025, According To Bitwise

12 Dicembre 2024 - 10:30AM

NEWSBTC

The Bitcoin (BTC) market has undergone a remarkable recovery this

year, largely due to the increased popularity of Bitcoin ETFs. BTC

reached an all-time high of $73,000 in the first quarter of the

year, sparking a bullish trend that continues today, with a recent

high of $104,000. The presidential election of Donald Trump has had

a huge impact on this rise especially over the past month, as he

has positioned himself as the first pro-crypto President, picturing

America as the “crypto capital of the world.” Trump’s favorable

position toward digital assets has infused increased optimism among

investors, resulting in increased buying pressure from Bitcoin ETF

providers such as BlackRock and Fidelity. Notably, the top 12

Bitcoin ETFs have emerged as the biggest BTC holders, with a

combined asset value of over $100 billion. This figure

represents one of the most successful ETF launches in financial

history, with the 12 spot Bitcoin ETFs now collectively owning

approximately 1.1 million BTC—equivalent to about 5% of all Bitcoin

in circulation. Bitcoin ETFs Expected To Surpass 2024 Inflows

In a recent report, crypto asset manager Bitwise outlined three key

factors that suggest Bitcoin ETFs will continue to see explosive

growth in 2025. Initially, it’s important to note that the first

year of ETF operations is typically the slowest. Related

Reading: Bitwise Forecast: Bitcoin, Ethereum, And Solana Poised For

Record Highs In 2025 Historical comparisons with gold ETFs launched

in 2004 show a significant increase in inflows over subsequent

years. For instance, gold ETFs began with $2.6 billion in their

first year, followed by $5.5 billion in the second year, and

progressively higher amounts in the following years. The firm

suggests that if the 12 spot Bitcoin ETFs in the United States

follow a similar trajectory, 2025 could see inflows that far exceed

those of 2024. Another factor contributing to potential growth is

the anticipated participation of major financial wirehouses. Firms

such as Morgan Stanley, Merrill Lynch, Bank of America, and Wells

Fargo have yet to fully deploy their wealth management teams to

promote Bitcoin ETFs. As regulatory environments become more

favorable under Trump, these institutions are expected to unlock

access to Bitcoin ETFs for their clients, potentially directing

trillions of dollars into the crypto market. Investors ‘Laddering

Up’ Finally, Bitwise has identified a clear trend among investors

known as “laddering up.” This pattern indicates that initial small

contributions to Bitcoin frequently lead to increasing investments

over time. The asset manager believes that many investors who

entered the Bitcoin ETF market in 2024 will double down on their

investments in 2025. Related Reading: XRP Price Prediction: Last

Phase Of ABC Wave Points To A Bounce To New ATH At $5.85 The firm’s

assertion that “3% is the new 1%” indicates increasing acceptance

of Bitcoin as a genuine asset class, which they believe will lead

investors to dedicate a larger amount of their portfolios to

cryptocurrencies. At the time of writing, BTC had consolidated

above $100,900 following a 7% dip to $91,000 at the start of the

month. Over the previous 24 hours, the market’s biggest

cryptocurrency has seen an almost 4% price increase. Featured image

from DALL-E, chart from TradingView.com

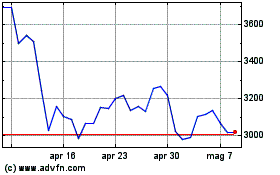

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Feb 2024 a Feb 2025