Chainlink Price Could Start ‘New Bull Rally’ – Here’s The Level To Watch

08 Febbraio 2025 - 10:30PM

NEWSBTC

The Chainlink price was one of the several victims of the bearish

pressure that swept the entire crypto market at the start of last

week. The altcoin’s value fell to $17 — for the first time since

late November 2024 — in almost a single move on Monday morning.

Chainlink Price Overview The price of Bitcoin dropped to $92,000

after news of US President Donald Trump’s trade tariffs sparked

fears of retaliatory actions and a potential trade war.

Interestingly, Bitcoin’s price plunge was relatively less

significant than that of the altcoin market, with large-cap assets

like Ethereum falling by nearly 30% in one swoop. Specifically, the

Chainlink price kicked off the week with a 32% slump, succumbing to

the bearish pressure triggered by the US trade tariffs. As of this

writing, the LINK token has recovered above the $18 mark despite a

1.4% price decline in the past 24 hours. Related Reading: Ethereum

Outflows On Derivative Exchanges Hit Record Lows: What It Means for

ETH Although the LINK price looks set for a bullish recovery, there

seems to be a lull in its movement over the past few days. This

sluggishness may be somehow connected to a crucial resistance

level, which could prove pivotal to the start of a fresh bull run.

Here’s Why $23.76 Is Crucial Prominent crypto trader Ali Martinez

took to the X platform to share a significant level that could be

crucial to the long-term health of the Chainlink price. This

analysis is based on the average cost basis of several LINK

investors. In cost-basis analysis, the ability of a level to

act as support or resistance depends on the total amount of coins

last acquired by investors in the region. In the chart below, the

size of the dot represents and directly corresponds to the number

of LINK tokens purchased within a price bracket. Recent data from

IntoTheBlock shows that around 96,760 investors bought

approximately 110.43 million Chainlink tokens within the $20.96 –

$26.25 price range — at an average price of $23.78. The high

purchasing activity has led to the formation of a supply barrier

within this price region. The $23.78 region acts as a resistance

zone because of the elevated number of investors with their cost

basis in and around it. This level has the potential to witness

significant selling pressure from investors wanting to sell their

tokens after returning to a breakeven point, thereby hindering

further price increases. This implies the potential supply of LINK

tokens could overwhelm the buying demand within the $20.96 – $26.25

bracket. According to Martinez, a successful breach above the

$23.78 level could set the stage for a new bull rally for the

Chainlink price. Related Reading: Bitcoin Price Attempts a

Comeback: Can the Recovery Hold? Featured image from Unsplash,

chart from TradingView

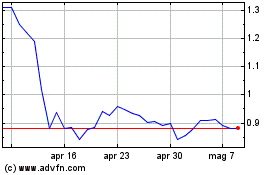

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Flow (COIN:FLOWUSD)

Storico

Da Feb 2024 a Feb 2025