Will Fantom Network Activity Give FTM Price A Shot In The Arm?

09 Gennaio 2024 - 11:00AM

NEWSBTC

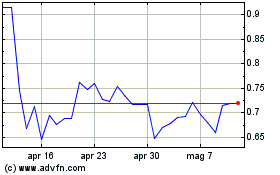

Fantom (FTM) investors have endured a brutal week, witnessing their

holdings shrink by over 20% in just seven days. The latest blow

came within the past 24 hours, with a nearly 10% plunge leaving the

token hovering around $0.37. This stark price decline stands in

stark contrast to the encouraging surge in Fantom’s network

activity, raising questions about what’s driving the disconnect.

While increased transactions and user engagement are typically seen

as positive indicators for a blockchain project, Fantom’s price

remains stubbornly bearish. Related Reading: Polygon NFTs Explode:

6-Month High Volume Ignites Market – Details Will Fantom Network

Volume Lift FTM Price? This suggests that external factors,

potentially broader market sentiment or negative news surrounding

the project, are playing a more significant role in shaping the

token’s value. Investors are now left grappling with the

uncertainty of whether Fantom’s robust network activity will be

enough to overcome these headwinds and paint its chart green again.

FTMUSD trading at $0.39 on the daily chart: TradingView.com FTM

Price Analysis The path forward for Fantom remains shrouded in some

degree of mystery. A close examination of technical indicators and

further analysis of the broader market and project-specific news

will be crucial for deciphering the token’s next move. Fantom (FTM)

has faced a recent price slump, prompting closer investigation into

investor behavior. Analysis reveals a contradictory picture. While

FTM tokens held by whales and large transactions exceeding $100k

have both seen a decline, suggesting potential long-term support, a

different story unfolds regarding exchange activity. Source:

Santiment Supply on exchanges has steadily risen since December

23rd, indicating increased selling pressure and a likely

contributor to the current price dip. Meanwhile, FTM held outside

of exchanges has dwindled, hinting at potential accumulation by

long-term investors. This divergent picture suggests a temporary

imbalance between selling and buying forces, pushing FTM lower in

the short term. However, the underlying support from stable top

holdings and reduced whale activity might offer a glimmer of hope

for a potential rebound in the longer term. Despite the bad market

condition in 2023, @FantomFDN has been growing and shining like a

phoenix from the ashes 📈 👻 #Fantom has had 128M+ new unique

addresses in 2023 and is ranked in 3rd place compared to other top

EVM blockchains 🎉 😍 With the mainnet launch of…

pic.twitter.com/oA27loqrtf — Fantom Insider (@fantom_insider)

January 7, 2024 Related Reading: Injective Poised For Breakout?

Unlock Event Sparks $60 INJ Price Surge Forecasts As the token

faced a decline in value, Fantom Insider took to Twitter to unveil

a notable accomplishment for Fantom in 2023. The tweet highlighted

that, despite the token’s temporary downturn, FTM had secured an

impressive position, ranking third in terms of unique addresses

among Ethereum Virtual Machine (EVM) blockchains for the year. This

disclosure positioned Fantom closely behind established entities

like Polygon and Binance Chain, signaling a noteworthy achievement

for the platform in expanding its user base and ecosystem

engagement throughout the course of 2023. (Featured image from

Zipmex)

Grafico Azioni Fantom Token (COIN:FTMUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Fantom Token (COIN:FTMUSD)

Storico

Da Dic 2023 a Dic 2024