This Hedera Network Service Is Under Attack, TVL Drops by 65%

09 Marzo 2023 - 7:00PM

NEWSBTC

The Hedera Network services are experiencing a critical moment with

an ongoing exploit that compromises the network’s tokens after

discovering irregularities affecting various Hedera dApps,

Liquidity Pool (LP) tokens, wrapped tokens, and their users. The

Hedera Foundation (HBAR) tweeted: We’ve noticed network

irregularities that are impacting various Hedera dApps and their

users.The Foundation is in communication with impacted partners.

We’re monitoring and working to help resolve the issue. Please

standby for more information. Related Reading: Bitcoin Dealt

Another Round Of Blows, Is The Bear Market Back? How The Exploit

Impacted The Hedera Network? Hedera is a fully open-source and

publicly distributed ledger that uses fast and secures hash graph

consensus. Hedera’s services include smart contracts based on

Solidity, an object-oriented programming language developed by the

Ethereum Network team specifically for constructing and designing

smart contracts on blockchain platforms. According to the

Decentralized Finance (DeFi) researcher, who goes by the pseudonym

DeFiIgnas, the ongoing exploit has targeted the decompilation

process in the Hedera network. In addition, bridged tokens have

been frozen by Hashport, the enterprise-grade public utility that

facilitates the movement of digital assets between distributed

networks. To ensure the safety and security of users, the

Hashport bridge has been temporarily paused so that users won’t be

able to access multi-chain transactions. As of this writing, the

exploit continues to affect the Hedera network. In addition, the

Hedera Foundation reported that it has been in contact with and

continues to communicate with affected partners as it monitors and

works to resolve the network security breach. dApps Total Value

Locked Dropping Fast The decentralized digital asset exchange

(DEX) Pangolin has reported that users are experiencing problems

withdrawing their funds from hashpart-related pools, as the various

tokens on the network are “paused,” as are all smart contracts, due

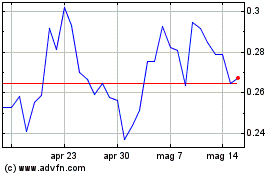

to the “outage” that the Hedera network is experiencing. As seen in

the chart above, the total value locked (TVL), which measures the

value of deposits and stakes in the dApps and the blockchain, is

falling rapidly for Hedera dApps. The TVL includes all coins

deposited in the features provided by the DeFi protocols, including

stakes, loans, and liquidity pools. Stader labs, which

supports six separate networks that allow users to deposit tokens

into liquid staking protocols, is the most affected by the current

exploit, suffering a 65.46% drop with a TVL of $32 million.

Related Reading: Altcoins At Underbought Levels Not Seen Since

Early January: Santiment The exploit has significantly impacted the

Hedera hashgraph token, highlighting the downtrend the hashgraph

has been experiencing since February, from a high of $0.0914 to the

$0.0589 level. Investigations by the network’s core team are

underway to identify the security breach of the smart contract

network and the cause and further impact on the tokens. The Hedera

Foundation concluded: The Hedera core team is actively

investigating the smart contract irregularity that has been

discovered. They are working directly with teams across the

DeFi ecosystem to determine the cause and potential impact. Updates

will be provided as they become available. Featured image from

Unsplash, chart from TradigView.com

Grafico Azioni Graph Token (COIN:GRTUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Graph Token (COIN:GRTUSD)

Storico

Da Dic 2023 a Dic 2024