Lido (LDO) Takes The Lead With 13% Surge Post Ethereum ETF Approval – Key Levels To Watch

25 Maggio 2024 - 4:30AM

NEWSBTC

Lido (LDO), the liquid staking protocol for the Ethereum (ETH) and

Polygon (MATIC) blockchains, has seen a significant price spike in

the last 24 hours following the long-awaited approval of spot

Ethereum ETF applications by the US Securities and Exchange

Commission (SEC) on Thursday. The protocol’s native token, LDO, has

successfully regained the $2.30 level and is looking to break out

of its one-month downtrend structure that has been in place since

the market correction in April. LSD Sector Set To Soar With

Ethereum ETF Approval? As reported by our sister website,

Bitcoinist, the SEC’s approval of the Ethereum ETFs was detailed in

an official filing, highlighting that the proposals meet the

provisions of the Exchange Act and relevant regulations governing

national securities exchanges. The Commission has determined

that proposals from notable entities such as BlackRock, Grayscale,

Bitwise, VanEck, Ark Invest/21Shares, Invesco Galaxy, Fidelity, and

Franklin Templeton fulfill the requirements to prevent fraud and

manipulation, protect investors, and safeguard the public interest.

Related Reading: Analyst Says Ethereum Spot ETFs Approval Will See

“Animal Spirits” Reignite Crypto – What This Means Crypto analyst

Daan Crypto Trades, commenting on the Ethereum ETF approval on X

(formerly Twitter), pointed out that the new index funds approval

has led to two sectors emerging as clear winners. One of

these sectors is Liquid Staking Derivatives (LSD) coins, with Lido

at the forefront. Lido provides staking support for the Ethereum

blockchain without the need to lock tokens or maintain

infrastructure, allowing participants to engage in on-chain

activities such as lending and farming. Key Levels To Watch For

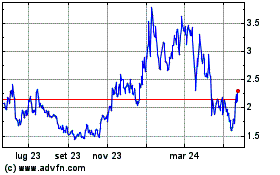

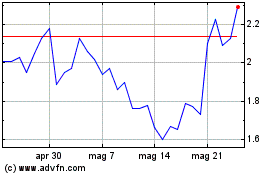

Lido During the early hours of Friday, LDO reached a peak of $2.49

but has since retraced to its current trading price of $2.35. Large

investors are interested in the token, as Spot On Chain data

reveals that six fresh wallets/whales withdrew 4.3 million LDO

($9.59 million) from crypto exchange Binance over the past 24

hours. This indicates a growing interest in holding the

token, as sentiment suggests a potential increase in price parallel

to Ethereum once the newly approved index funds for the

second-largest cryptocurrency enter the market in the coming

months. Moreover, CoinGecko data shows that Lido has experienced a

trading volume of $350 million within the last 24 hours, marking a

78.60% increase compared to Thursday’s. However, the token remains

68% below its all-time high (ATH) of $7.30, achieved during the

2021 bull market. Related Reading: Ethereum Eyes $4,000 Comeback

Fueled By Bullish Buying Spree Looking ahead, bullish investors

should closely observe the next resistance level on the LDO/USD

daily chart, situated at $2.55. Breaking this level is crucial for

breaking the downtrend structure that has persisted over the past

month, potentially leading to retests at $2.70 and $2.90.

Conversely, the $2.21 zone serves as a significant support level,

as it acted as a strong barrier for Lido in the past week and a

half before the breakout. Featured image from Shutterstock, chart

from TradingView.com

Grafico Azioni Lido DAO Token (COIN:LDOUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Lido DAO Token (COIN:LDOUSD)

Storico

Da Nov 2023 a Nov 2024