Bear Market Bites: Chainlink Loses 10%, Further Downturn To $6.80 Feared

06 Luglio 2024 - 3:15PM

NEWSBTC

The cryptocurrency market continues its summer swoon, with major

coins like Bitcoin tumbling to four-month lows. Chainlink (LINK), a

key player in the decentralized oracle network space, has been

especially hard-hit, dropping 25% since the beginning of June. But

is this a buying opportunity, or the precipice of a steeper

decline? Related Reading: Polkadot Under Fire: 20% Price Drop

Follows $87 Million Spending Outrage This Chart Pattern Looms Large

Technical analysts are scrutinizing Chainlink’s chart, with a

particular focus on the dreaded “Head and Shoulders” pattern. This

formation, characterized by a central peak flanked by two smaller

ones, often signals a trend reversal from bullish to bearish.

Analyst Ali Martinez believes a breach of the neckline, the support

level currently hovering around $12.70, could trigger a significant

downturn. #Chainlink $LINK faces a potential 45% price correction

if it falls below $12.70! pic.twitter.com/8NGwMzEIhR — Ali

(@ali_charts) July 4, 2024 If LINK falls below $12.70, we could see

a cascading sell-off, warns Martinez. This could push the price

down to $6.80, a staggering 45% drop. Fibonacci retracement levels,

a technical tool used to identify potential support and resistance

zones, further bolster this bearish outlook. The 0.786 Fibonacci

level aligns perfectly with Martinez’s target of $6.80, lending

credence to his prediction. Bearish Sentiment Grips The Market

Adding fuel to the fire is the overall bearish sentiment gripping

the crypto market. The Fear and Greed Index, a measure of investor

sentiment, currently sits at a chilling 26, firmly in “Fear”

territory. This fear is reflected in LINK’s trading activity. The

price is struggling to stay above the critical $12.70 mark, and any

decisive break below could accelerate the sell-off. A Glimmer Of

Hope: Oversold Territory And Price Prediction However, a glimmer of

hope remains. The Relative Strength Index (RSI), another technical

indicator, suggests LINK might be oversold. The RSI is currently at

28, dipping into “oversold” territory. This could signal a

potential short-term bounce, as oversold assets often experience

temporary price corrections. Interestingly, some analysts

contradict the prevailing bearish sentiment. Price for LINK is seen

increasing 52.73% by August 5th, pushing the price to a healthy

$18.97. While technical analysis paints a bleak picture, this

prediction offers a counterpoint, highlighting the inherent

uncertainty within the crypto market. Related Reading: Buy The Dip?

XRP Whales Doing Exactly That – Is A Price Rally Next? The Road

Ahead For LINK Ultimately, the future of Chainlink remains shrouded

in uncertainty. Technical indicators scream caution, while some

analysts maintain a bullish outlook. The coming weeks will be

crucial for Chainlink. Will it defy the bearish whispers and stage

a comeback, or succumb to the gravitational pull of a deeper

correction? Featured image from Coldkeepers, chart from TradingView

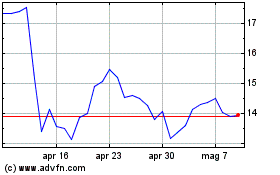

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Gen 2024 a Gen 2025