Litecoin Is A Hub Of Whales: Over $2.85 Billion Of $100,000 Transactions Processed

12 Luglio 2024 - 4:30PM

NEWSBTC

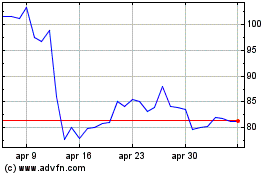

Litecoin has been under intense selling pressure in the past few

months. After peaking in April, the coin has been trending lower,

looking at the arrangement in the daily chart. There is strength at

spot rates. So far, LTC is up 20% from July lows and continues to

peel back losses. The expansion in price also comes amid other

positive developments, at least from on-chain developments. Is

Litecoin A Whale Haven? According to IntoTheBlock, there has been a

significant uptick in on-chain transfers on the proof-of-work

network. As of July 12, the network has processed $2.85 billion

worth of transactions, each averaging at least $100,000. Related

Reading: Spot Ethereum ETFs FOMO: Tron Founder Justin Sun Drops $5

Million On ETH This level translates to over half of the network’s

market cap. Most importantly, Litecoin is doing far better than top

altcoins. IntoTheBlock data shows that though Dogecoin has roughly

3X the market cap of Litecoin, it only sees $590 million in large

transfers daily. The huge difference means Litecoin attracts more

whales, most likely drawn to the network’s security and low fees.

Litecoin has not changed, and its original mandate of complementing

Bitcoin remains. It operates as a proof-of-work network powered by

miners who must commit to buying new gear and updating it regularly

to be competitive. As of July 13, Litecoin had a hash rate of 1.01

PH/s, according to Coinwarz. Despite Litecoin’s Halving in 2023,

more miners are unfazed by falling rewards and continue to secure

the network. MWEB Private Transactions Rising, LTC Unfazed By

Short-Term Price Fluctuations The spike in Litecoin

transactions also comes amid the increasing adoption of Mimble

Wimble (MWEB). According to MWEBexplorer data, MWEB transactions

have doubled in the past few days. This surge points to a

rising preference for private transactions among Litecoin users.

Through MWEB, users can send private transactions. Though MWEB

transactions are more expensive, coming in at $0.00267 versus

$0.0008 for ordinary transactions, it is relatively cheaper than

transacting on Bitcoin. According to YCharts, the average Bitcoin

transaction fee now stands at $1.487, up from 1.163 recorded

yesterday. Related Reading: Analyst Upbeat On USTC, Sees Price

Soaring Over 300% With more transactions posted on Litecoin, LTC

holders are equally unfazed by dropping prices; a whopping 71% are

in the red. As of July 12, IntoTheBlock data reveals that 77% of

LTC holders have held their coins for over a year. Only 6% bought

LTC within the last month. Feature image from DALLE, chart from

TradingView

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Dic 2023 a Dic 2024