Bullish Return: Institutional Investors Pour $1.44 Billion Into Crypto In One Week

16 Luglio 2024 - 6:30PM

NEWSBTC

Crypto investment products have experienced another week of inflows

to build upon inflows witnessed in the prior week. According to

data from CoinShares, digital asset investment products recorded

$1.44 billion worth of inflows last week, which is a further

indication of the return of bullish momentum into the crypto

industry. This brings the total inflow to $1.881 billion over a

two-week period after three consecutive weeks of outflows. With

last week’s numbers, the total value of inflows into crypto

investment funds this year now stands at a record $17.8 billion.

Bullish Return Among Institutional Crypto Investors The latest data

shows that crypto investment products are starting to reflect the

overall change in market sentiment. As noted by CoinShares’ latest

weekly report, this change into bullish sentiment has allowed

digital investment products to further surpass the $10.6 billion

inflow received during the 2021 bull market. Related Reading:

JPMorgan Says Crypto Liquidations Will End And Bitcoin Bull Market

Will Begin, Here’s When Last week’s inflows amounted to $1.44

billion, which is the 5th largest weekly inflow on record.

Unsurprisingly, Bitcoin received the lion’s share of the

investments. As the world’s first and largest crypto asset, Bitcoin

has always been the centre of attraction among other

cryptocurrencies. The cryptocurrency has also been in the spotlight

for the past few months since the launch of Spot Bitcoin ETFs. A

return of bullish momentum allowed Bitcoin to receive $1.35 billion

last week, which is also the fifth-largest weekly inflow on record

for Bitcoin. Notably, this inflow came amidst concerns about

selling pressure sparked by a selloff of over 45,000 BTC by the

German State of Saxony. On the other hand, short-Bitcoin

products witnessed $8.6 million worth of outflows. Short-Bitcoin

products are for investors who anticipate a decline in the price of

Bitcoin. With this in mind, it can be deduced that the withdrawal

of short positions is a manifestation of a diminishing bearish

outlook among institutional investors. Ethereum led the

altcoin market with a net inflow of $72 million, allowing it to

reverse its total net inflow this year from a negative $15 million

at the beginning of the week to $57 million at the end of the week.

Solana exchange-traded products followed suit with a $4.4 million

net inflow, a 270% reduction from $16.3 million in the prior week.

At the time of writing, Solana’s total inflow this year stands at

$62 million. Litecoin, XRP, and Cardano witnessed inflows of

$1.2 million, $1.0 million, and $1.2 million, respectively.

Multi-asset investment products also recorded $17.2 million in

inflows. Related Reading: Crypto Analyst Says Ethereum Price Is

Headed To $4,000, Here’s Why ETPs are still one of the best ways

for institutional investors to get exposure to cryptocurrencies

like Bitcoin and Ethereum. Their use has been on the rise since the

beginning of the year, especially in North America. In terms of

geographical location, the United States had the most inflows with

$1.274 billion, Switzerland with $57.5 million, Hong Kong with

$54.6 million, and Canada with $23.2 million, among others.

According to CoinShares, the total assets under management (AuM)

are now at $84.713 billion. Featured image created with Dall.E,

chart from Tradingview.com

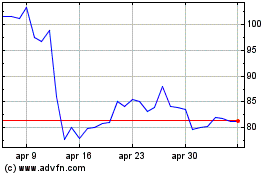

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Dic 2024 a Dic 2024

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Dic 2023 a Dic 2024