Dogecoin & Co. Take Over Social Media: Why Memecoin Frenzy Is Bad For Bitcoin

15 Novembre 2024 - 10:00AM

NEWSBTC

Data shows Dogecoin and other meme coins are receiving a

significant amount of attention on social media, a sign that may

not be ideal for Bitcoin. Top 6 Memecoins Have Seen Their Social

Dominance Rocket Up Recently In a new post on X, the analytics firm

Santiment has discussed about the trend in the Social Dominance for

a few different subsections of the cryptocurrency sector. The

“Social Dominance” here refers to an indicator that basically tells

us about the mindshare that a particular asset or a group of coins

has on the major social media platforms right now. Related Reading:

Bitcoin Sets Record $93,000 High As Extreme Greed Level Hits 84

More formally, the metric’s value is calculated as a percentage of

the discussions related to the top 100 cryptocurrencies by market

cap that the given asset is making up for. To determine this, the

indicator collects posts/threads/messages available on five

platforms: X, Reddit, Telegram, 4Chan, and BitcoinTalk. It then

filters them for the keyword in question. Note that for measuring

the “discussion,” the metric simply counts up these posts

containing at least one mention of the asset, rather than counting

up the mentions themselves. The advantage of this methodology is

that outlier posts containing hundreds of mentions don’t skew the

data. Now, here is the chart shared by the analytics firm that

shows how the Social Dominance related to three subsections of the

market has changed over the last few months: The three segments in

question are the layer 1 top six, the layer 2 top six, and the

memecoin top 6. “Layer 1” networks refer to the primary blockchains

that handle their own security, like Bitcoin and Ethereum. Networks

like Polygon that are built on top of these chains are known as

“layer 2.” Naturally, the meme coins refer to the popular

meme-based tokens, like Dogecoin and Shiba Inu. From the graph,

it’s apparent that the Social Dominance of the layer 1 top 6 had

rocketed up a couple of days back as a result of Bitcoin setting

multiple new all-time highs (ATHs). BTC has continued to explore

new highs since then, but it appears that the focus of social media

users has shifted elsewhere, with the Social Dominance of the layer

1 giants witnessing a cooldown. The indicator has stayed relatively

low for the layer 2 coins throughout this, implying the traders

haven’t been caring much about them recently. The assets that have

hogged all the attention have been the memecoins, who have just

seen their discussion hit a new record. The reason behind this high

interest in these tokens is the impressive rally that Dogecoin has

seen over the past week, leaving the rest of the sector in the dust

after amassing profits of more than 104%. If the past is anything

to go by, though, this outperformance may not be such a good thing.

“Historically high speculative asset social dominance typically

indicates greed and emotional trading,” notes Santiment. Assets in

the cryptocurrency sector tend to move opposite to the crowd’s

beliefs, so greed is something that has generally led to tops for

the market. Related Reading: XRP NVT Ratio Has Been High Recently:

What It Means As such, it’s possible that a shift in focus away

from Dogecoin may have to happen, if Bitcoin and others have to

continue their bull run. Dogecoin Price At the time of writing,

Dogecoin is trading around $0.398, up over 2% in the last 24 hours.

Featured image from Dall-E, Santiment.net, chart from

TradingView.com

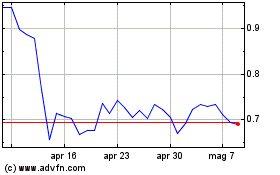

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Dic 2023 a Dic 2024