2025 Crypto Forecast: Four-Year Cycle Points To Peak In Q2/Q4, Expert Advises Caution

28 Dicembre 2024 - 1:30PM

NEWSBTC

As the market approaches the end of 2024, the crypto landscape is

teeming with speculation and anticipation. A recent report from the

data aggregator CoinGecko has provided a comprehensive analysis of

what investors can expect in 2025. With the market

experiencing a significant correction, many industry participants

are left questioning their next steps. However, CoinGecko’s

insights suggest a promising trajectory ahead. Broader Crypto

Market Signs Point To Significant Growth One of the standout

predictions centers around Bitcoin (BTC), the flagship

cryptocurrency. The report indicates that Bitcoin is positioned

favorably within a logarithmic analysis of its monthly chart,

revealing a consistent upward movement within an ascending

channel. Related Reading: Ethereum On The Cusp Of Major

Breakout In Q1 2025, Altcoins Expected To Follow Suit Currently,

Bitcoin is nearing a pivotal axis point within this channel,

echoing patterns observed during previous bullish cycles.

Optimistically, the analysis forecasts that Bitcoin could soar to

$250,000, reflecting a staggering 154% increase. This

projection aligns closely with historical trends observed following

Bitcoin’s Halving events, where supply constraints often lead to

price surges. Such a milestone would not only reinforce Bitcoin’s

dominance in the crypto market but also attract a wave of new

investors. The broader cryptocurrency market is also showcasing

signs of significant growth. The total market capitalization is

currently navigating a rising wedge pattern, which historically has

served as a precursor to substantial bullish rallies. Altcoin

Season On The Horizon? In a more granular look at the market, the

report highlights the total market capitalization of

cryptocurrencies outside the top 10. This segment has

reportedly formed a classic “cup and handle” pattern on its monthly

chart. Currently, it is testing a crucial resistance level of $370

billion. A breakout above this threshold could trigger a

remarkable 317% rally, potentially pushing the total cap to $1.6

trillion. Such a move would signify the onset of what many are

calling a “robust altcoin season,” where lesser-known

cryptocurrencies could see substantial gains. Several key

milestones from 2024 are expected to drive this anticipated growth.

Bitcoin’s Halving event, which historically leads to supply

constraints, is poised to play a critical role. Additionally,

anticipated approvals for exchange-traded funds (ETFs) for coins

such as XRP, Litecoin or Solana could further legitimize Bitcoin

and other cryptocurrencies in the eyes of mainstream investors,

according to the report. Related Reading: Historical Data Shows

What To Expect From Ethereum Price In Q1 2025 – It’s Very Bullish

CoinGecko further points to political factors, such as pro-digital

asset policies from influential figures like President-elect Donald

Trump, may also create a conducive environment for growth. As

cryptocurrencies begin to integrate more deeply into economic

frameworks, their adoption is likely to rise. At the time of

writing, the total crypto market capitalization stands at $3.22

trillion. Bitcoin, trading at $94,456, recorded losses of 1.8% and

3% on the 24 and seven day time frames, respectively.

Featured image from DALL-E, chart from TradingView.com

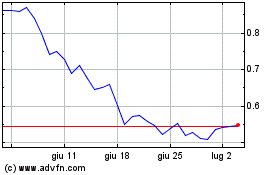

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Dic 2023 a Dic 2024