XRP Whale Goes On Shopping Spree: 27 Million Coins Snapped Up As Price Dips

15 Giugno 2024 - 5:00PM

NEWSBTC

A recent buying spree by a deep-pocketed XRP investor has sent

ripples (pun intended) through the cryptocurrency community. This

whale, with a seemingly bottomless appetite for XRP, has scooped up

nearly 27 million coins, sparking speculation of a potential price

surge. However, the broader market sentiment remains murky, leaving

investors to navigate a sea of conflicting signals. Related

Reading: NEAR Protocol: From Recent Dip To Google Search Darling –

Is $16 Next? XRP Whales Bet Big On Coin’s Future The on-chain

transaction tracker, Whale Alert, reported a significant purchase

by a known XRP whale. This investor, identified by a cryptic wallet

address, gobbled up 27.74 million XRP from cryptocurrency exchange

Binance. This hefty purchase, valued at roughly $13 million, adds

to a growing collection by the same whale, who has been

accumulating XRP throughout recent price dips. This aggressive

buying behavior is often interpreted as a bullish sign. Whales,

with their vast resources, are seen as having a keen understanding

of the market and a long-term view. Their willingness to invest

heavily in XRP, even during a bearish period, suggests confidence

in the asset’s potential for future growth. Technical Indicators

Paint A Sunny Picture Adding fuel to the optimistic fire is a

recent technical analysis predicting a 20% price increase for XRP

by July 15th. This forecast, while not a guarantee, provides a

glimmer of hope for investors seeking a return on their XRP

holdings. Additionally, XRP has displayed relative stability

compared to other cryptocurrencies, experiencing a low price

volatility and a high percentage of positive days over the past

month. However, a closer look reveals some storm clouds on the

horizon. The Fear & Greed Index, a measure of investor

sentiment, currently sits at a concerning “extreme greed.” This

suggests the market might be overbought, potentially leading to a

correction as investors cash out their profits. XRP: On Legal

Battles And Conflicting Market Signals Furthermore, the ongoing

lawsuit between Ripple and the SEC continues to cast a long shadow

over XRP. The outcome of this legal battle could have a significant

impact on the price, making any predictions inherently uncertain.

XRP’s recent price action presents a confusing picture for

technical analysts. On the bullish side, we see a significant

increase in Futures Open Interest (OI) and derivatives volume,

suggesting growing investor engagement. This could be interpreted

as a sign of accumulating positions in anticipation of a price

rise. Related Reading: Ethereum Longs Crushed! Who Got Burned In

The $62 Million Fire Sale? However, the bullish narrative is

challenged by the oversold RSI reading currently hovering near 35.

In traditional technical analysis, this suggests the asset might be

due for a correction, potentially contradicting the predicted price

increase. The current situation surrounding XRP is a classic case

of conflicting signals. The whale’s buying spree and the technical

analysis offer a bullish narrative, while the Fear & Greed

Index and the SEC lawsuit paint a more cautious picture. Featured

image from Human Services-UC Davis, chart from TradingView

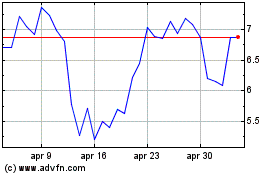

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Gen 2025 a Feb 2025

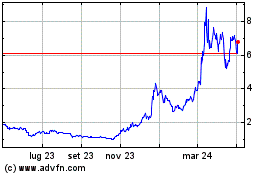

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Feb 2024 a Feb 2025