Crypto Analyst Unveils Top 10 BTCfi Altcoins Post-Halving

17 Aprile 2024 - 5:00PM

NEWSBTC

As the community prepares for the much-anticipated fourth halving

set for April 19, 2024, the buzz around Bitcoin-based projects is

reaching a fever pitch. Crypto influencer Leshka.eth, with a

following of over 128,500 on X (formerly Twitter), has identified a

set of altcoins under the Bitcoin financial ecosystem (BTCfi) that

could see significant gains post-halving. Crypto Analyst Shares His

Top-10 BTCfi Altcoins Leshka.eth told his 128,500 followers on X

(formerly Twitter) about the potential of various projects in the

BTCfi landscape. He remarked, “The countdown to BTC halving ends in

2 days. If you missed 1,000x on BRC20 and Ordinals, if you missed

800x on STAMP, check out my watchlist of BTCfi altcoins poised to

surge because of the halving.” Here’s a breakdown of the top

altcoins Leshka.eth believes could benefit from the upcoming

Bitcoin halving: 1. Hulvin (HULVIN): This project is touted as the

first halving-themed memecoin with the slogan “Make Halving Great

Again.” Initially mentioned by Leshka.eth when it was valued at a

$9 million market cap, Hulvin has seen an impressive ascent,

crossing a $30 million market cap. “I first mentioned it when it

was at $9M market cap. Today it surpassed $30M MC and outperforming

all other tokens on the market. Still much space for a price

discovery,” Leshka.eth highlighted. The coin currently trades at

$0.01298 with a daily volume of $5.8 million. 2. Map Protocol

(MAP): Designed to simplify cross-blockchain transactions using

light clients and zero-knowledge (ZK) proofs, MAP Protocol operates

without relying on trusted third parties. It facilitates secure

peer-to-peer connections and emphasizes compatibility across

different blockchains. Currently, MAP is trading at $0.0248 with a

$107 million market cap and a 24-hour trading volume of $3.2

million. Leshka.eth views it as a crucial infrastructure component

for the evolving blockchain ecosystem. 3. Stacks (STX): As a layer

built on top of the Bitcoin blockchain, Stacks introduces

functionalities such as smart contracts, decentralized finance

(DeFi), non-fungible tokens (NFTs), and decentralized applications

(dApps). It is often compared to the Lightning Network due to its

extension of Bitcoin’s capabilities. Related Reading: Crypto Expert

Predicts Bitcoin Will Reach $650,000 Due To This Reason With a

substantial market cap of $4.04 billion and a price of $2.29,

Stacks represents a significant part of the BTCfi landscape.

“Stacks transforms Bitcoin from a digital gold into a more

expansive ecosystem capable of supporting a wide array of

applications,” Leshka.eth noted. 4. Mintlayer (ML): This layer 2

solution enhances Bitcoin’s functionality by enabling DeFi, smart

contracts, atomic swaps, NFTs, and dApps directly on the Bitcoin

network. Trading at $0.38 with a market cap of $24 million and a

daily volume of $2.5 million, Mintlayer stands out for its

integrative approach to extending Bitcoin’s utility without the

need for an entirely separate blockchain. 5. SatoshiSync (SSNC):

Collaborating with LayerZero and Chainlink, SatoshiSync offers a

toolkit for easing transactions on Bitcoin’s L1 and L2 layers. Even

before its token launch, the platform had attracted over 50,000

users, underscoring its practical value. SSNC is priced at $0.1275,

with a market cap of $124.7 million and modest daily transactions

amounting to $0.45 million. 6. Bitcoin Virtual Machine (BVM): BVM

is a rapidly growing Layer 2 solution for Bitcoin that allows users

to create their own L2 networks, thereby enhancing the value of BVM

tokens. The BVM team is also planning to introduce airdrops for BVM

stakers, which Leshka.eth believes could “drive up demand for the

tokens significantly.” BVM is currently trading at $5.35, with a

market cap of $133.6 million and a 24-hour volume of $2.74 million.

Related Reading: Arkham Releases Top 5 Crypto Rich List – You Won’t

Believe How Much Is Inaccessible 7. Naka Chain (NAKA): Positioned

as a cost-effective, high-speed Bitcoin L2 blockchain tailored for

DeFi applications that utilize Bitcoin for gas fees, Naka Chain

enables developers to port decentralized apps from Ethereum to

Bitcoin with minimal changes. It functions similarly to the

Ethereum Virtual Machine (EVM), enhancing its appeal. NAKA is

trading at $0.026, with a market cap of $56.32 million and a daily

volume of $128,000. 8. Elastos (ELA): Elastos aims to construct a

blockchain-driven version of the internet, addressing scalability

and flexibility issues found in Ethereum and other DApp platforms.

With a market cap of $81 million and trading at $3.69, ELA focuses

on building a robust infrastructure for a decentralized internet.

9. MVC (SPACE): This public blockchain integrates multiple

technologies, including the UTXO model and Proof of Work (PoW), to

deliver exceptional performance, minimal fees, and high

decentralization. SPACE trades at $17.59 with a market cap of $52.3

million and a 24-hour volume of $1.31 million. 10. Photon: Touted

as a superior traditional Layer 2 solution, Photon leverages the

security of Bitcoin’s Layer 1 to support scalable decentralized

applications, providing efficiency and flexibility comparable to

Ethereum’s ecosystem. This project is one to watch, with its

upcoming launch expected to attract significant attention. “Keep an

eye out for its upcoming launch!,” Leshka.eth stated. 11.

Additional Mention – BounceBit: BounceBit is a Bitcoin staking

chain that allows users to earn yields on their dormant Bitcoin.

With a focus on early access, the platform encourages active

participation and utilization of Bitcoin for staking purposes. The

imminent launch of BounceBit is highly anticipated by the

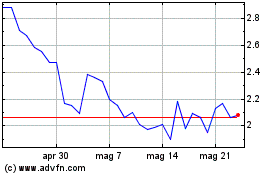

community. At press time, Stacks (STX) was trading at $2.29, down

40% from its all-time high reached on April 1. Featured image

created with DALL·E, chart from TradingView.com

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Gen 2024 a Gen 2025