SUI Eyes Potential Pullback As RSI Flashes Warning: $1.4 Retest In Sight

23 Settembre 2024 - 1:00PM

NEWSBTC

SUI impressive bullish momentum appears to be losing steam as

technical indicators point toward a potential cooldown, with the

Relative Strength Index (RSI) signaling overbought conditions,

raising concerns about the sustainability of the recent

rally. The $1.4 level is now in focus, as this cooling

strength suggests that a pullback could be on the cards, offering a

critical moment for SUI as it navigates through growing market

pressure. Will the bulls hold their ground, or is a correction set

to unfold? This article aims to analyze SUI’s recent price action

in light of technical indicators, particularly the RSI, which

suggests a potential cooling of momentum. By examining the

implications of overbought conditions and the likelihood of a

retest at the $1.4 level, this analysis seeks to provide insight

into whether SUI’s bullish trend will continue or if a correction

is on the horizon. Technical Indicators Point To Cooling Momentum:

A Turning Point For SUI? Despite SUI’s price trading above the

100-day Simple Moving Average (SMA) on the 4-hour chart, the

cryptocurrency is undergoing a noticeable pullback, aiming to

retest the $1.4 level. This suggests that the recent bullish

pressure may be slowing as traders reassess key support and

resistance zones. An analysis of the 4-hour Relative Strength Index

suggests a potential price drop toward $1.4 as the RSI line is

dropping from the overbought zone toward the 50% threshold,

indicating that SUI’s bullish momentum may be losing strength.

Related Reading: SUI Climbs 36% Amid Bullish Breakout – Is $1.50

The Next Target? Also, on the daily chart, SUI is showing bearish

sentiment as it attempts to retest the $1.4 mark. Since breaking

above the 100-day SMA, the price has experienced a consistent

upward trend without any significant pullbacks, indicating that a

noticeable correction may be on the horizon. Finally, on the 1-day

chart, a detailed analysis of the RSI signal line indicates that it

has surpassed the 50% threshold and is currently at an impressive

82%. This high reading raises concerns about potential overbought

conditions, which could trigger a market correction or pullback.

$1.4 Retest Looms: What Traders Should Watch For Next As SUI

approaches the critical $1.4 level, traders should be vigilant, as

a breach below this point could indicate a potential move toward

the $1.16 support level. If the price breaks below $1.16, it may

signal a further decline toward the $0.8690 level and beyond.

Related Reading: SUI Bulls Gear Up, Can They Push Through The $1.16

Ceiling? However, if SUI experiences a strong rebound at the $1.4

level, the price may start to rise again toward its all-time high

of $2.18. A breakout above this level could indicate a continuation

of the upward trend, possibly paving the way for a new all-time

high. At the time of writing, SUI was trading at approximately

$1.55, marking a 5.99% increase over the past 24 hours. The

cryptocurrency’s market capitalization was around $4.1 billion,

with trading volume exceeding $964 million, reflecting increases of

5.64% and 151.91%, respectively. Featured image from Shutterstock,

chart from Tradingview.com

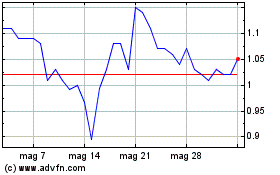

Grafico Azioni SUI Network (COIN:SUIUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni SUI Network (COIN:SUIUSD)

Storico

Da Gen 2024 a Gen 2025