Ageas announces exclusive negotiations to strengthen its partnership with UK over 50s specialist Saga

11 Ottobre 2024 - 8:00AM

UK Regulatory

Ageas announces exclusive negotiations to strengthen its

partnership with UK over 50s specialist Saga

Ageas announces that it has entered into

exclusive negotiations with Saga plc, the UK specialist provider of

products and services to people aged over 50, to establish a

20-year partnership with Saga Services Limited (SSL) for the

distribution of personal lines Motor and Home insurance products to

Saga's customers. Alongside this, Ageas would also acquire Saga's

Insurance Underwriting business, AICL (Acromas Insurance Company

Limited), which together form the Proposed Transaction.

The Proposed Transaction aligns perfectly with

Ageas’s recently unveiled Elevate27 strategy, to capitalise on its

robust Non-Life presence across Europe, while accelerating

solutions targeted at an ageing population, a rapidly expanding

customer segment where the Group and Ageas UK already has real

strength and expertise. Furthermore, it presents Ageas with the

opportunity to enhance its position as a leading personal lines

insurer in the UK, adding scale to a core European market of the

Group. By combining Saga's insights with Ageas UK's personal lines

insurance expertise particularly in this customer segment, the

partnership offers a unique competitive advantage in the expanding

over 50s market.

Under the Proposed Transaction, Ageas UK, a

subsidiary of Ageas, would enter into a 20-year Affinity

Partnership with SSL, Saga’s Insurance Broking business, which

distributed in excess of GBP 479 million in Gross Written Premiums

(GWP) in the 12-month period ended 31 July 2024 across

its motor and home insurance products. The Proposed Transaction

represents a total cash payment of GBP 147.5 million,

subject to customary completion adjustments, with a potential

additional contingent consideration of up to GBP 60 million,

subject to meeting agreed policy volumes and profitability targets.

Completion of the AICL transaction remains conditional on the

signing of definitive transaction documentation and regulatory

approvals. As of January 2024, AICL’s Own Funds (Unrestricted

Tier1) and Solvency Capital Requirement stand at GBP 83 million and

GBP 54 million, respectively.

Based on the initial consideration and including

capital synergies, the estimated impact on the Ageas Group Solvency

is - 5%.

The Proposed Transaction will not affect the

Group’s current share buyback programme.

Background on Saga

Saga, created over 70 years ago, is a specialist

in the provision of products and services for people over 50. The

Saga brand is one of the most recognised and trusted in the UK.

Saga is known for its high level of customer service and its

high-quality, award-winning products and services including cruises

and travel, insurance, personal finance and media.

(www.saga.co.uk)

Hans De Cuyper, CEO of Ageas

said: "We eagerly anticipate further

strengthening our partnership with Saga, a well-known brand in the

UK. This proposed deal aligns seamlessly with the Ageas Group

recently launched Elevate27 strategy, which aims to leverage our

strong European presence in Non-Life, add scale to our business,

and benefit from material capital diversification. This transaction

allows us to grow in a market where we already have real strength

and expertise. Ageas has a longstanding tradition of successful

partnerships, and we are confident that this collaboration with

Saga will open new avenues for creating and accelerating profitable

growth."

Ant Middle, CEO of Ageas UK

said: “This proposed deal with Saga aligns perfectly

with our strategy to profitably grow in UK personal lines and in

creating powerful partnerships to the benefit of our customers.

Deepening our relationship with Saga unlocks even more opportunity

to increase our competitiveness in a rapidly expanding over 50s

customer segment; an area where we already have real strength and

expertise. It also draws on our strengths of technical and

operational excellence, and customer care, providing more potential

for us to leverage the significant investments made in our business

over the last three years and offer our expertise in meeting the

unique needs of Saga’s customers.”

Mike Hazell, CEO of Saga plc

said: “We are hugely excited at the opportunity to

grow our home and motor Insurance business through this proposed

partnership with Ageas. The coming together of Saga’s fantastic

brand and Ageas’s unrivalled expertise in operating successful

affinity insurance partnerships, would create a winning

combination. Our joint reputation for delivering exceptional

products and services to people over 50 means this partnership

would allow us to serve even more customers with great products at

excellent value. Saga is a unique business with a long heritage,

great people and loyal customers. We have been clear for some time

that developing a partnership approach is the right strategy,

providing us with a capital-light route to growth and the ability

to reduce debt, leading to the creation of long-term sustainable

value for all our stakeholders.”

Whilst Ageas and Saga are in exclusive

negotiations, the Proposed Transaction remains subject to the

parties agreeing binding documentation as well as regulatory

approvals, and therefore there is currently no certainty that it

will occur. A further announcement will be made in due course, as

appropriate.

Proposed terms

Affinity Partnership

- The Affinity

Partnership would be for a 20-year term, with the ambition to ‘go

live’ by the end of 2025.

- Ageas UK would

pay Saga an upfront consideration of GBP 80 million payable at or

around the ‘go live’ date.

- Additionally,

Saga may receive contingent consideration of up to GBP 30 million

in 2026 and up to GBP 30 million in 2032, subject to certain policy

volume and profitability targets being met.

- SSL would

receive commission on the GWP generated over the term of the

Affinity Partnership representing the value that SSL will continue

to provide through the Partnership.

Ageas acquisition of AICL

- Ageas UK would

acquire AICL for a total consideration of GBP 67.5 million, subject

to customary completion adjustments.

- Completion of

the AICL transaction is targeted in Q2 2025 and is conditional on

the signing of definitive transaction documentation and certain

regulatory approvals.

Ageas is a listed international

insurance Group with a heritage spanning almost 200 years. It

offers Retail and Business customers Life and Non-Life insurance

products designed to suit their specific needs, today and tomorrow,

and is also engaged in reinsurance activities. As one of Europe's

larger insurance companies, Ageas concentrates its activities in

Europe and Asia, which together make up the major part of the

global insurance market. It operates successful insurance

businesses in Belgium, the UK, Portugal, Türkiye, China, Malaysia,

India, Thailand, Vietnam, Laos, Cambodia, Singapore, and the

Philippines through a combination of wholly owned subsidiaries and

long-term partnerships with strong financial institutions and key

distributors. Ageas ranks among the market leaders in the countries

in which it operates. It represents a staff force of about 44,000

people and reported annual inflows of more than EUR 17 billion in

2023.

- Pdf version press release

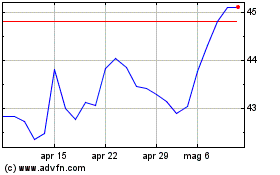

Grafico Azioni Ageas SA NV (EU:AGS)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ageas SA NV (EU:AGS)

Storico

Da Dic 2023 a Dic 2024