ARGAN: S&P strengthened ARGAN’s “Investment Grade” status with a “Stable” outlook for its “BBB-” rating

13 Maggio 2024 - 5:45PM

ARGAN: S&P strengthened ARGAN’s “Investment Grade” status with

a “Stable” outlook for its “BBB-” rating

Press release – Neuilly-sur-Seine, Monday, May 13, 2024

– 5.45 pm

S&P strengthened ARGAN’s “Investment

Grade” status with a “Stable” outlook for its “BBB-”

rating

ARGAN, the only French real estate

company specializing in the DEVELOPMENT & RENTAL OF PREMIUM

WAREHOUSES listed on EURONEXT and leading player of its market,

announced that the outlook on its “BBB-” long-term issuer credit

rating was raised to “Stable” by S&P Global

Ratings.

S&P Global Ratings raised the outlook on

ARGAN’s “BBB-” from “Negative” to “Stable”. This credit rating

update comes after ARGAN successfully led a capital increase in the

amount of €150 million1, which was launched and finalized on April

23, as part a move to strengthen our development and debt reduction

plan.

In its report, S&P Global Ratings stressed

more particularly:

- the faster than previously

anticipated improvement in debt ratios by the end of 2024, which

ARGAN targets to bring to 44 % regarding its LTV2 ratio and to

9.5x for its net debt to EBITDA;

- an adequate liquidity position,

with no refinancing needs for the years 2024 and 2025; and

- a portfolio of premium assets that

generate stable and predictable cash flows, in a supportive French

logistics real estate sector.

More generally, this upgrade testifies

to the adequacy of the Group’s strategy for mastered growth and

strong debt reduction as well as increased trust from financial

markets in ARGAN’s name, reinforced by steady and transparent

financial communication.

The rating is available on the website of

S&P Global Ratings (www.standardandpoors.com).

2024 financial calendar (Publication of the

press release after closing of the stock exchange)

- July 1: Net sales of 2nd quarter 2024

- July 24: Half-year results 2024

- October 1: Net sales of 3rd quarter 2024

2025 financial calendar (Publication of the

press release after closing of the stock exchange)

- January 3: Net sales of 4th quarter 2024

- January 16: Annual results 2024

- March 20: General Assembly 2025

About ARGAN

ARGAN is the only French real

estate company specializing in the DEVELOPMENT & RENTAL OF

PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of

its market. Building on a unique client-tenant-centric approach,

ARGAN builds pre-let PREMIUM warehouses for blue-chip clients and

supports them throughout all project phases from the development

milestones to the rental management.Profitability, tight control

over our debt and sustainability are at the heart of

ARGAN’s DNA. Its strongly proactive ESG policy has

very concrete results with our Aut0nom® concept, the “in-use” Net

Zero warehouse. As of today, our portfolio represents 3.6 million

sq.m, across about a hundred warehouses, exclusively located in the

continental part of France. This portfolio is valued €3.7 billion

as at December 31, 2023 for a yearly rental income of about €200

million in

2024. ARGAN

is a listed real estate investment company (French SIIC), on

Compartment A of Euronext Paris (ISIN FR0010481960 - ARG) and is

included in the Euronext SBF 120, CAC All-Share, EPRA Europe and

IEIF SIIC France indices.www.argan.fr

| Francis

Albertinelli – CFO Aymar de Germay – General SecretarySamy Bensaid

– Head of Investor RelationsPhone: +33 1 47 47 47 40 E-mail:

contact@argan.frwww.argan.fr |

Marlène Brisset – Media relationsPhone: +33 6 59 42 29

35E-mail: argan@citigatedewerogerson.com |

|

|

1 For more information, readers are referred to

press releases published on April 23 and April 24, 2024, under the

“Capital increase” section of the regulated information available

on argan.fr.2 LTV EPRA (excluding duties), assuming a cap. rate of

5.25% excluding duties.

- 20240513 - Argan S&P Rating Stable Outlook

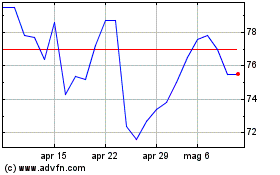

Grafico Azioni Argan (EU:ARG)

Storico

Da Gen 2025 a Feb 2025

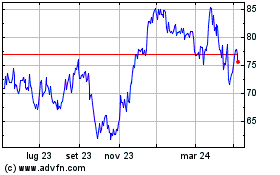

Grafico Azioni Argan (EU:ARG)

Storico

Da Feb 2024 a Feb 2025