Atos receives non-binding offer from the French State to acquire

its Advanced Computing activities for an enterprise value of €500

million and up to €625 million including earn-outs

Press Release

Atos receives non-binding offer from the

French State to acquire its Advanced Computing activities for an

enterprise value of €500 million and up to €625 million including

earn-outs

Exclusive negotiations with the French State for the

potential acquisition of 100% of BDS's Advanced Computing

activities

- Proposed enterprise value of €500 million and up to €625

million including earn-outs

- Previous non-binding offer sent by the French State was on a

wider perimeter including Mission Critical System and Cybersecurity

Products businesses, in addition to the Advanced Computing

business

- Exclusivity granted until May 31, 2025

- Target to sign a Share Purchase Agreement by May 31, 2025 upon

reception of customary commercial, employee and administrative

authorizations

- Initial payment of €150 million to be made available upon

signing of the Share Purchase Agreement

Commitment to launch a formal sale process for BDS's

Mission-Critical Systems and Cybersecurity Products

businesses

Impact of the sale of Advanced Computing on the current

financial restructuring process and timetable

- 2027 financial leverage1 expected to be between 1.8x

and 2.1x depending on the outcome of the ongoing €233 million

rights issue

- Supplement to the prospectus relating to the ongoing €233

million rights issue to be filed with the French Autorité des

Marchés Financiers (“AMF”), in accordance with applicable

regulations

- Subscription period of the ongoing rights issue to be extended,

in accordance with the indicative timetable that will be included

in the supplement

- Indicative closing date of the financial restructuring

transactions still planned by year-end or early January 2025

Paris, France – November 25, 2024

– Further to its press release dated October 7, 2024, Atos

SE (“Atos” or the “Company”)

announces it has received a non-binding offer from the French State

for the potential acquisition of 100% of the Advanced Computing

activities of its BDS division, based on an enterprise value of

€500 million, to be potentially increased to €625 million including

earn-outs.

Atos’ Advanced Computing business regroups the

High-Performance Computing (HPC) & Quantum as well as the

Business Computing & Artificial intelligence divisions. The

business currently employs approximatively 2,500 employees and

generated revenue of circa €570 million in 2023.

The offer received from the French State

provides for an exclusivity period until May 31, 2025. If the

exclusive negotiations lead to an agreement and subject to

obtaining the customary commercial, employee and administrative

authorizations, a Share Purchase Agreement may be signed by that

date. An initial payment of €150 million is expected to be made

available to Atos upon signing of the Share Purchase Agreement.

As agreed upon with financial creditors, a

valuation of the disposed perimeter will be carried by an

independent expert appointed by the Company to assess notably that

the terms of the transaction reflects a fair market value. In

addition, in accordance with the judgement approving the Company’s

accelerated safeguard plan and in the absence of a substantial

change in the objectives and resources of the plan, the transaction

is subject to the information of the specialized commercial court

of Nanterre via the SELARL AJRS, represented by Mr Thibaut

Martinat, acting as plan supervisor (commissaire à l’exécution

du plan).

In addition, Atos would commit to launch a

formal sale process for its Cybersecurity products and Mission

Critical Systems, which generated revenue of circa €340 million in

2023.

Impact of the sale of Advanced Computing on the current

financial restructuring process and timetable

The accelerated safeguard plan, approved by the

classes of affected parties on 27 September 2024 and by the

specialized commercial court of Nanterre on 24 October 2024,

included the possibility of the disposal of the Group’s Advanced

Computing activities. The forecasts presented in the accelerated

safeguard plan, however, did not take this disposal into account

considering the ongoing discussions.

On the basis of an enterprise value of €500

million, the proposed transaction is expected to lead to a 2027

financial leverage2 of between 1.8x and 2.1x, depending

on the outcome of the ongoing €233 million rights issue.

The Company will file with the French Autorité

des Marchés Financiers (the “AMF”) a supplement to

the prospectus relating to the ongoing €233 million rights issue,

approved by the AMF under number 24-474 on 7 November 2024:

- Investors who have already placed

subscription orders will have the option of withdrawing them for

two (2) trading days following the approval of the supplement by

the AMF.

- The subscription period for the

rights issue, which was supposed to close on 25 November 2024, will

be extended, in accordance with the indicative timetable that will

be included in the supplement.

The indicative closing date of the financial

restructuring transactions is still planned by year-end or early

January 2025.

The Company will continue to inform the market

in due course of the next steps of its financial restructuring.

*

Atos SE confirms that information that could be

qualified as inside information within the meaning of Regulation

No. 596/2014 of 16 April 2014 on market abuse and that may have

been given on a confidential basis to its financial creditors has

been published to the market, either in the past or in the context

of this press release, with the aim of reestablishing equal access

to information relating to the Atos Group between the

investors.

***

Disclaimer

This document contains

forward-looking statements that involve risks and uncertainties,

including references, concerning the Group’s expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Atos’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Atos’s plans, objectives, strategies, goals, future events, future

revenues or synergies, or performance, and other information that

is not historical information. Actual events or results may differ

from those described in this document due to a number of risks and

uncertainties that are described within the 2023 Universal

Registration Document filed with the Autorité des Marchés

Financiers (AMF) on May 24, 2024 under the registration number

D.24-0429, in the June 30, 2024 half-year financial report

published by Atos SE on August 5, 2024 and in the amendment to the

2023 Universal Registration Document filed on 7 November 2024 with

the Autorité des Marchés Financiers (AMF). Atos does not undertake,

and specifically disclaims, any obligation or responsibility to

update or amend any of the information above except as otherwise

required by law.

This document does not

contain or constitute an offer of Atos’s shares for sale or an

invitation or inducement to invest in Atos’s shares in France, the

United States of America or any other jurisdiction. This document

includes information on specific transactions that shall be

considered as projects only. In particular, any decision relating

to the information or projects mentioned in this document and their

terms and conditions will only be made after the ongoing in-depth

analysis considering tax, legal, operational, finance, HR and all

other relevant aspects have been completed and will be subject to

general market conditions and other customary conditions, including

governance bodies and shareholders’ approval as well as appropriate

processes with the relevant employee representative bodies in

accordance with applicable laws.

About

Atos

Atos is a global

leader in digital transformation with circa 82,000 employees and

annual revenue of circa €10 billion. European number one in

cybersecurity, cloud and high-performance computing, the Group

provides tailored end-to-end solutions for all industries in 69

countries. A pioneer in decarbonization services and products, Atos

is committed to a secure and decarbonized digital for its clients.

Atos is a SE (Societas Europaea) and listed on Euronext

Paris.

The purpose of

Atos is to help design the future of the information space.

Its expertise and services support the development of knowledge,

education and research in a multicultural approach and contribute

to the development of scientific and technological excellence.

Across the world, the Group enables its customers and employees,

and members of societies at large to live, work and develop

sustainably, in a safe and secure information space.

Contacts

Investor

relations:

David Pierre-Kahn | investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33 6 29 34 85 67

Individual

shareholders: 0805 65 00 75

Press contact: globalprteam@atos.net

1 Ratio net debt pre-IFRS16 over EBITDA pre-IFR16; EBITDA

computed as OMDA pre-IFRS16 minus anticipated RRI (restructuring,

rationalization, integration) costs and Other changes

2 Ratio net debt pre-IFRS16 over EBITDA pre-IFR16; EBITDA computed

as OMDA pre-IFRS16 minus anticipated RRI (restructuring,

rationalization, integration) costs and Other changes

- PR - Atos receives non-binding offer from the French State to

acquire its Advanced Computing activities - 25 november 2024

(003)

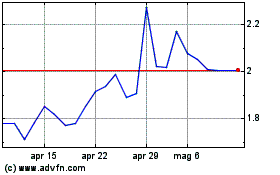

Grafico Azioni Atos (EU:ATO)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Atos (EU:ATO)

Storico

Da Gen 2024 a Gen 2025