Biotalys Reports Half-Year 2023 Financial Results and Business

Highlights

Press release - regulated information

- Strategic

partnership with Syngenta to collaborate on the research and

development and commercialisation of a new bio-insecticide

- Field trials

with Evoca™* continue to demonstrate competitive performance in

fruits and vegetables; trials now ongoing for additional crops such

as blueberries and hemp

- Update on

regulatory approval process for Evoca

- Successful CFO

succession with Douglas Minder in function since July 1st

- Private

placement of new shares for €7 million at market value

- Cash and cash

equivalents amounted to €32 million end of June 2023

- Management to

host a conference call and live webcast today at 15:00 CEST / 14:00

BST / 09:00 EDT, details below

Biotalys (Euronext - BTLS), an Agricultural

Technology (AgTech) company developing protein-based biocontrol

solutions for crop and food protection, today announces its key

business achievements and consolidated financial results for the

first half of 2023, prepared in accordance with International

Accounting Standard 34 ‘Interim Financial Reporting’ as adopted by

the European Union. The full half year report including the interim

financial results is available here on the Biotalys website.

Patrice Sellès, Chief Executive Officer

of Biotalys, noted:

“Throughout the first half of 2023, Biotalys made significant

progress in the buildup of its pipeline, technology and platform

validation with industry leaders. We are continuing to work with

the EPA to obtain regulatory approval in the U.S. for Evoca, the

company’s first biocontrol solution, to help address the needs of

growers seeking safer tools to make their crop protection

strategies more sustainable. At the same time, we are working with

partners on the future market positioning of Evoca, as well as on

continuing to improve cost of goods for this important first

product.”

H1 2023

operational

highlights

In the first half of this year, Biotalys

continued to seal partnerships, prepare for the launch of Evoca,

and strengthen its patent portfolio.

- In April 2023,

Biotalys entered into a strategic partnership with Syngenta to

collaborate on the research, development and commercialization of a

new bio-insecticide to counter the threat of pest resistance and

advance sustainable agriculture.

- Evoca, Biotalys’

first protein-based biocontrol, further demonstrated its efficacy

in recent global field trials in preparation for its U.S. market

introduction. Announcing the results of over 160 field trials in

partnership with industry leaders Biobest and Beck Ag

across various high-value crops in May 2023, Evoca outperformed

leading chemical and biological solutions in several trials.

- Earlier this year, Biotalys

announced a major advance in manufacturing efficiency for Evoca,

strengthening the production and distribution path for the product.

The scientific breakthrough, based on the development of multiple

proprietary yeast strains, increased the production efficiency of

Evoca’s bioactive ingredient by 50 to 70%.

- Following the successful outcome of

the feasibility study with Novozymes at the end of last year,

Biotalys and Novozymes have been further exploring manufacturing

possibilities for a next generation of Evoca based on Novozymes’

production hosts to create significant cost of goods and scaling

advantages. The companies are also exploring collaborations beyond

Evoca to address the need for effective and more sustainable

protein-based biocontrols in new markets and

indications.

- In March 2023, Biotalys announced a

succession plan for its Chief Financial Officer. The transition was

successfully completed as planned with the promotion of Douglas

Minder to CFO, effective 1 July 2023.

- Biotalys continued to

strengthen its patent portfolio to protect its science and

products. In H1 2023, two additional patents were granted to the

company in India and Australia, both patents providing further IP

protection relating to antibodies binding to fungal plant

pests.

- Early in 2023, Biotalys

earned Top 100 status in Forward

Fooding’s FoodTech 500 list, climbing to #65.

Biotalys was also honored in its inaugural FoodTech 500 $100

Million Club. A highly competitive event with thousands of

nominations from 50+ countries, the FoodTech 500 ranks global

entrepreneurial talent at the intersection of food, technology and

sustainability.

Regulatory update for

Evoca

-

The U.S. Environmental Protection Agency

(EPA) has recently changed its review process and no

longer sets dates for expected decisions to applicants. Biotalys

continues to work with the EPA as it reviews the submitted

regulatory dossier. Pending regulatory approval, Biotalys is

preparing for the start of the market calibration with Evoca in

2024 and for the launch of the commercial version of the product in

2026.

- In

Europe, the rapporteur Member State is The

Netherlands where the CTGB

(College voor

de Toelating

Gewasbeschermingsmiddelen en

Biociden) is currently reviewing

the regulatory dossier. Importantly, the authority has recently

approved the sale of cucumbers treated with Evoca in greenhouse

trials. While normally crops used in such trials have to be

destroyed, as they are treated with products that are not yet

authorized, the Dutch authority granted an exemption allowing sale

of cucumbers treated with Evoca in greenhouse trials. This decision

reinforces Biotalys’ confidence that the product is safe to

use.

Private placement

- In June 2023, Biotalys successfully

closed a private placement for €7 million. The company issued

1,135,257 new shares (approximately 3.67% of the company’s shares

outstanding prior to the transaction) at €6.166 per share to deepen

its relationship with existing shareholders, Agri Investment Fund

BV (A.I.F.) and the Belgian Sovereign Wealth Fund (“Federale

Participatie- en Investeringsmaatschappij NV” – SFPIM).

New board member

(post-period)

- Connected to the private placement,

Biotalys nominated Agri Investment Fund BV (A.I.F.), represented by

Patrik Haesen, to the Board of Directors, which

was approved by the Special Shareholders Meeting of 21 August 2023.

Patrik Haesen is currently Chief Executive Officer of A.I.F. and

General Manager Investments at M.R.B.B., the holding company of the

Farmers Union in Belgium. He has in-depth expertise in audit,

finance and investment. He also is a director in Arvesta, Acerta

and Iscal Sugar and in several other innovative AgTech companies.

Mr. Haesen holds a Master’s degree in commercial engineering (KU

Leuven) and a European Master in public administration (KU Leuven

and Corvinus University in Budapest), as well as a postgraduate

degree in finance (EHSAL, Management School).

* Evoca™: Pending Registration. This product is

not currently registered for sale or use in the United States, the

European Union, or elsewhere and is not being offered for sale.

Select financial information

|

In € thousands |

June 30, 2023 |

June 30, 2022 |

|

Other operating income |

1,318 |

|

1,140 |

|

|

Research and development expenses |

(8,661 |

) |

(7,574 |

) |

|

General and administrative expenses |

(2,771 |

) |

(2,596 |

) |

|

Marketing expenses |

(741 |

) |

(718 |

) |

|

Other operating expenses |

- |

|

- |

|

|

Operating loss |

(10,855 |

) |

(9,748 |

) |

|

Loss of the period |

(10,664 |

) |

(9,892 |

) |

|

Net cash used in operations |

(8,516 |

) |

(9,559 |

) |

|

Net cash outflow of the period |

(2,208 |

) |

(10,547 |

) |

|

Cash and cash equivalents |

31,886 |

|

45,560 |

|

-

Other operating income for the first half of 2023

amounted to €1.3 million and related to R&D tax incentives

received and grants awarded to support R&D activities.

-

Research and development expenses amounted to €8.7

million for the first half year, an increase of €1.1 million

compared to the same period in 2022. These increases primarily

related to higher costs for external consultants and wages (+€0.7

million), increased depreciations and maintenance costs for lab

equipment, and additional IT costs.

-

General and administrative expenses amounted to

€2.8 million for the first half of 2023, compared to €2.6 million

for the same period in 2022. The increase was mainly driven by

higher wage costs related to the wage index increases and to a

lesser extent the expansion of the team.

- Net cash

used in operating activities decreased by €1.0 million, to

€8.5 million for the six months ended 30 June 2023. This decrease

was primarily caused by changes in working capital driven by

advances received from various project grants.

Outlook

-

Biotalys expects to initiate the market calibration of

Evoca in 2024 with Biobest in selected U.S. states

upon registration of the product. In the meantime, the company is

focusing its field trial program with Evoca in a broader number of

crops such as blueberries and hemp where demand for safe and

sustainable solutions is high.

-

In addition, Biotalys is now conducting field trials with the

next generation of Evoca on a

wide variety of fruits and vegetables to work towards market

introduction of a commercial version of the product in 2026.

-

The company expects to advance the product pipeline in H2 2023,

with the planned promotion of the BioFun-6 program

into development stage while progressing other current pipeline

programs further in the discovery stage.

-

Looking ahead, Biotalys plans to leverage the AGROBODY

Foundry™ platform and

pipeline to expand into new markets and crops, and will continue to

explore strategic collaborations with the potential to create

additional value.

-

While maintaining the planned investment in the product pipeline

and the technology platform, the company has decided to pause its

sole bactericide program (BioBac-1) and focus

its activities

on the

fungicide and

insecticide

programs where the commercial opportunity is

higher.

-

Excluding the funds raised in the private placement of June 2023,

the company expects cash burn for FY 2023 to be

slightly lower than in FY 2022 (2022: €22 million).

Auditor

statement

The condensed consolidated financial statements

for the six-months’ period ended 30 June 2023 have been prepared in

accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by

the European Union. They do not include all the information

required for the full annual financial statements and should

therefore be read in conjunction with the financial statements for

the year ended 31 December 2022. The condensed consolidated

financial statements are presented in thousands of Euros (unless

stated otherwise). The condensed consolidated financial statements

have been approved for issue by the Board of Directors. The

statutory auditor, Deloitte Bedrijfsrevisoren/Reviseurs

d’Entreprises, represented by Pieter-Jan Van Durme, has performed a

limited review of the interim financial report. The interim

financial report 2023 and the review opinion of the auditor are

available on www.biotalys.com.

Upcoming IR events

- 23 August 2023:

Biotalys’ management will host a webcast on the HY23 financial

figures and business highlights (see below for details)

- 13 September

2023: Biotalys' management will meet with institutional investors

at the Berenberg Food & Chemicals Conference in London

(UK)

- 26-27 September

2023: Biotalys’ management will meet with investors at the World

AgriTech Conference in London (UK)

- 9 -10 October

2023: Biotalys’ management will meet with institutional investors

in Paris (France)

- 14 November

2023: Biotalys’ management will meet with institutional investors

at the AgTech Answers Conference organized by Roth MKM in New York

(US)

- 16 November

2023: Biotalys’ management will meet with institutional investors

at the Global Agriculture Forum organized by Kepler Cheuvreux

(virtual)

- 16 November

2023: Biotalys’ management will present to retail investors at the

VFB Biotech event in Ghent (Belgium)

- 30 November

2023: Biotalys’ management will meet with institutional investors

at the Canaccord Genuity AgriFood Tech conference (virtual)

Live webcast and conference call

Company management will host a live webcast to

discuss its half-year 2023 results and recent business performance

today, 23 August 2023 at 15:00 CEST / 14:00 BST / 09:00 AM EDT.

Webcast link:

https://edge.media-server.com/mmc/p/4fyq6uyq

Dial-in details: To ask questions live to the

management, please also register for the conference call via

https://register.vevent.com/register/BIb590908b4b514a3c8cdadbeb329437d6

About Biotalys

Biotalys is an Agricultural Technology (AgTech)

company developing protein-based biocontrol solutions for the

protection of crops and food and aiming to provide alternatives to

conventional chemical pesticides for a more sustainable and safer

food supply. Based on its novel AGROBODY™ technology platform,

Biotalys is developing a strong and diverse pipeline of effective

product candidates with a favorable safety profile that aim to

address key crop pests and diseases across the whole value chain,

from soil to plate. Biotalys was founded in 2013 as a spin-off from

the VIB (Flanders Institute for Biotechnology) and has been listed

on Euronext Brussels since July 2021. The company is based in the

biotech cluster in Ghent, Belgium. More information can be found on

www.biotalys.com.

For further information, please

contact

Toon Musschoot, Head of IR & CommunicationT:

+32 (0)9 274 54 00E: Toon.Musschoot@biotalys.com

Important

Notice

Biotalys, its business, prospects and financial

position remain exposed and subject to risks and

uncertainties. A description of and reference to these risks

and uncertainties can be found in the 2022 annual report on the

consolidated annual accounts and the full half-year report.

This announcement contains statements which are

"forward-looking statements" or could be considered as such. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words ‘aim’, 'believe',

'estimate', 'anticipate', 'expect', 'intend', 'may', 'will',

'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans',

'target', 'seek', 'would' or 'should', and contain statements made

by the company regarding the intended results of its strategy. By

their nature, forward-looking statements involve risks and

uncertainties and readers are warned that none of these

forward-looking statements offers any guarantee of future

performance. Biotalys’ actual results may differ materially from

those predicted by the forward-looking statements. Biotalys makes

no undertaking whatsoever to publish updates or adjustments to

these forward-looking statements, unless required to do so by

law.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

|

ASSETS (in thousands of

euros) |

Note |

30

June 2023 |

31 December 2022 |

|

Non-current assets |

|

11,859 |

11,755 |

|

Intangible assets |

|

562 |

596 |

|

Property, plant and equipment |

5 |

5,245 |

5,335 |

|

Right-of-use assets |

5 |

3,638 |

3,667 |

|

Deferred tax assets |

|

164 |

125 |

| Other

non-current assets |

|

2,250 |

2,031 |

|

|

|

|

|

|

Current assets |

|

35,352 |

37,762 |

|

Receivables |

|

507 |

820 |

| Other

financial assets |

|

2,108 |

2,100 |

| Other

current assets |

6 |

851 |

746 |

| Cash

and cash equivalents |

7 |

31,886 |

34,096 |

|

|

|

|

|

|

TOTAL ASSETS |

|

47,211 |

49,517 |

|

EQUITY AND LIABILITIES(in thousands of

euros) |

Note |

30 June 2023 |

31 December 2022 |

|

|

|

|

|

|

|

|

|

|

Equity attributable to owners of the parent |

|

35,187 |

|

38,114 |

|

|

| Share

capital |

8 |

46,198 |

|

44,548 |

|

|

| Share

premium |

8 |

15,542 |

|

10,164 |

|

|

|

Accumulated losses |

|

(30,326 |

) |

(19,661 |

) |

|

| Other

reserves |

|

3,772 |

|

3,064 |

|

|

|

|

|

|

|

|

|

Total equity |

|

35,187 |

|

38,114 |

|

|

| |

|

|

|

|

|

Non-current liabilities |

|

6,414 |

|

5,443 |

|

|

|

Borrowings |

9 |

5,196 |

|

5,338 |

|

|

|

Employee benefits obligations |

|

18 |

|

16 |

|

|

|

Provisions |

|

90 |

|

89 |

|

|

| Other

non-current liabilities |

10 |

1,110 |

|

- |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

5,610 |

|

5,960 |

|

|

|

Borrowings |

9 |

1,167 |

|

1,163 |

|

|

| Trade

and other liabilities |

|

3,109 |

|

4,204 |

|

|

| Other

current liabilities |

10 |

1,334 |

|

592 |

|

|

|

Total liabilities |

|

12,024 |

|

11,402 |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

47,211 |

|

49,517 |

|

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND

OTHER COMPREHENSIVE INCOME FOR THE 6 MONTHS

ENDED 30 JUNE

|

in € thousands |

Note |

2023 |

|

2022 |

|

| Other

operating income |

12 |

1,318 |

|

1,140 |

|

|

Research and development expenses |

13 |

(8,661 |

) |

(7,574 |

) |

| General

and administrative expenses |

13 |

(2,771 |

) |

(2,596 |

) |

| Sales

and marketing expenses |

13 |

(741 |

) |

(718 |

) |

|

Operating loss (EBIT) |

|

(10,855 |

) |

(9,748 |

) |

|

Financial income |

|

422 |

|

141 |

|

|

Financial expenses |

|

(191 |

) |

(269 |

) |

|

Loss before taxes |

|

(10,624 |

) |

(9,877 |

) |

| Income

taxes |

|

(40 |

) |

(15 |

) |

|

LOSS FOR THE PERIOD |

|

(10,664 |

) |

(9,892 |

) |

|

|

|

|

|

|

Other comprehensive income (OCI) |

|

|

|

| Items

of OCI that will be reclassified subsequently to profit or

loss |

|

|

|

|

Exchange differences on translating foreign operations |

|

(3 |

) |

9 |

|

|

|

|

|

|

|

TOTAL COMPREHENSIVE LOSS

OF THE PERIOD |

|

(10,667 |

) |

(9,883 |

) |

| |

|

|

|

|

Basic and diluted loss per share (in €) |

14 |

(0.34 |

) |

(0.32 |

) |

| |

|

|

|

|

Loss for the period attributable to the owners of the Company |

|

(10,664 |

) |

(9,892 |

) |

| |

|

|

|

|

Total comprehensive loss for the period attributable to the owners

of the Company |

|

(10,667 |

) |

(9,883 |

) |

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY FOR THE 6 MONTHS ENDED 30

JUNE

|

(in thousands of euros) |

Attributable to equity holders of the Company |

Total Equity |

|

Share capital |

Share premium |

Other reserves |

Accumulated losses |

|

|

Share-based payment reserve |

Currency translation reserve |

|

|

|

Balance at 31 December 2021 |

81,969 |

31,303 |

1,473 |

|

25 |

(55,855 |

) |

58,915 |

|

|

Share-based payments |

- |

- |

847 |

|

- |

- |

|

847 |

|

| Exercise of ESOP Warrants |

125 |

91 |

(91 |

) |

- |

- |

|

125 |

|

| Total

comprehensive loss |

- |

- |

- |

|

9 |

(9,892 |

) |

(9,883 |

) |

|

Balance at 30 June 2022 |

82,094 |

31,394 |

2,229 |

|

34 |

(65,747 |

) |

50,004 |

|

|

(in thousands of euros) |

Attributable to equity holders of the Company |

Total Equity |

|

Share capital |

Share premium |

Other reserves |

Accumulated losses |

|

|

Share-based payment reserve |

Currency translation reserve |

|

|

|

Balance at 31 December

2022 |

44,548 |

10,164 |

3,035 |

|

29 |

|

(19,662 |

) |

38,114 |

|

|

Share-based payments |

- |

- |

723 |

|

- |

|

- |

|

723 |

|

| Exercise of ESOP Warrants |

16 |

12 |

(12 |

) |

- |

|

- |

|

16 |

|

| Issuance of shares |

1,634 |

5,366 |

- |

|

- |

|

- |

|

7,000 |

|

| Total

comprehensive loss |

- |

- |

- |

|

(3 |

) |

(10,664 |

) |

(10,667 |

) |

|

Balance at 30 June 2023 |

46,198 |

15,542 |

3,746 |

|

26 |

|

(30,326 |

) |

35,187 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE 6 MONTHS ENDED 30 JUNE

|

in € thousands |

Note |

2023 |

|

2022 |

|

| |

|

|

|

| CASH FLOW FROM

OPERATING ACTIVITIES |

|

|

|

|

Operating result |

|

(10,855 |

) |

(9,748 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Depreciation, amortization and impairments |

|

888 |

|

771 |

|

|

Share-based payment expense |

|

723 |

|

855 |

|

|

Changes in provisions |

|

- |

|

4 |

|

|

R&D tax credit |

|

(355 |

) |

(203 |

) |

|

Other |

|

(41 |

) |

- |

|

|

|

|

|

|

| Changes

in working capital: |

|

|

|

|

Receivables |

|

447 |

|

(52 |

) |

|

Other current assets |

|

(106 |

) |

(397 |

) |

|

Trade and other payables |

|

(953 |

) |

(831 |

) |

|

Other current and non-current liabilities |

|

1,861 |

|

62 |

|

|

Cash used in

operations |

|

(8,392 |

) |

(9,539 |

) |

|

|

|

|

|

| Taxes

paid |

|

(124 |

) |

(20 |

) |

|

|

|

|

|

|

Net cash used in

operating activities |

|

(8,516 |

) |

(9,559 |

) |

| |

|

|

|

| CASH FLOW FROM

INVESTING ACTIVITIES |

|

|

|

|

Interest received |

|

251 |

|

- |

|

|

Purchases of property, plant and equipment |

5 |

(224 |

) |

(328 |

) |

|

Investments in other financial assets |

|

(8 |

) |

- |

|

|

|

|

|

|

|

Net cash provided by / (used in) investing

activities |

|

20 |

|

(328 |

) |

| |

|

|

|

| CASH FLOW FROM

FINANCING ACTIVITIES |

|

|

|

|

Repayment of borrowings |

9 |

(211 |

) |

(207 |

) |

|

Repayment of lease liabilities |

9 |

(438 |

) |

(416 |

) |

|

Interests paid |

|

(79 |

) |

(164 |

) |

|

Proceeds from issue of equity instruments of the Company |

8 |

7,016 |

|

126 |

|

|

|

|

|

|

|

Net cash provided by (used in) financing

activities |

|

6,289 |

|

(661 |

) |

| |

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

(2,208 |

) |

(10,547 |

) |

| |

|

|

|

|

CASH AND CASH EQUIVALENTS at beginning of period |

|

34,096 |

|

56,107 |

|

|

Effect of foreign exchange rates |

|

(2 |

) |

- |

|

| CASH

AND CASH EQUIVALENTS at end of period, calculated |

|

31,886 |

|

45,560 |

|

The accompanying notes are an integral part of

these condensed consolidated financial statements. Please see the

full interim report available on www.biotalys.com.

- Biotalys kondigt financiële resultaten en bedrijfshoogtepunten

aan voor H12023

- Biotalys Reports HY 23 Financial Results and Business

Highlights

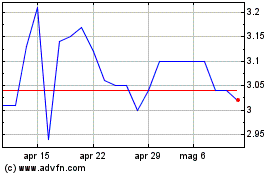

Grafico Azioni Biotalys (EU:BTLS)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Biotalys (EU:BTLS)

Storico

Da Mar 2024 a Mar 2025