Christian Dior: 2023 : New record year for Christian Dior group

2023: New record year for Christian Dior

group

. Revenue: €86.2 billion.

Profit from recurring operations: €22.8 billion.

Growth higher in the fourth quarter than in the third

quarter. Major economic and social impact in

France and around the world

Paris, January 25th, 2024

Christian Dior group recorded revenue of €86.2

billion in 2023, equating to organic growth of 13% with respect to

2022. All business groups reported strong organic revenue growth,

with the exception of Wines & Spirits, which was faced with a

high basis of comparison and high inventory levels. Europe, Japan

and the rest of Asia achieved double-digit organic growth. In the

fourth quarter, organic revenue growth came to 10%.

Profit from recurring operations stood at €22.8

billion for 2023, up 8%. The current operating margin remained

stable with respect to 2022. Group share of net profit amounted to

€6.3 billion, up 9%.

Highlights of 2023 include:

Another record year despite a disrupted

environment

- Strong organic revenue growth across all business groups except

Wines & Spirits, and market share gains worldwide.

- Double-digit organic revenue growth in Europe, Japan and the

rest of Asia.

- Negative currency impact in the second half of the year.

- Growth in champagne driven by the value strategy and a

transitional year for cognac after two years of strong growth.

- Remarkable performance by the Fashion & Leather Goods

business group, in particular Louis Vuitton, Christian Dior

Couture, Celine, Fendi, Loro Piana, Loewe and Marc Jacobs, which

gained market share worldwide and achieved record levels of revenue

and profits.

- Particularly strong momentum in fragrances and makeup across

all regions, and ongoing global success of Dior’s Sauvage, once

again the world’s best-selling fragrance in 2023.

- Robust growth in jewelry and powerful creative momentum for all

the Watches & Jewelry Maisons, in particular Tiffany, Bulgari

and TAG Heuer.

- Exceptional performance by Sephora, which confirmed its

position as world leader in beauty retail.

2023 targets met under the LIFE 360

environmental program

- New circular services launched at most Group Maisons; research

and innovation program focused on new materials; environmental

training center (LIFE Academy).

- Tangible progress made towards targets for 2026 and 2030: 3.1

million hectares of flora and fauna habitat protected as of

year-end 2023 (target: 5 million hectares by 2030); 63% improvement

(up 16 points) in the proportion of renewable and low-carbon energy

used in the Group’s energy mix; 28% decrease in

energy-related CO2 emissions with respect to 2019.

- Launch of LIFE 360 Business Partners, a groundbreaking plan to

assist suppliers and partners to accelerate the reduction of Scope

3 impacts, particularly in relation to raw materials and

transport.

Major economic and social

impact of the Group in France and

around the world

- More than 213,000 employees worldwide as of year-end 2023

(including nearly 40,000 employees in France).

- France’s largest private-sector recruiter.

- Preserving and passing on skills and expertise in more than 280

professions of excellence in design, craftsmanship and customer

experience, with over 2,700 apprentices trained by LVMH’s IME

(Institut des Métiers d’Excellence) program since its launch in

2014, more than 8,000 employees worldwide hired in these

professions in 2023, and more than 3,500 positions to be filled in

these professions at the Group’s Maisons in France by year-end

2024.

- Over €1 billion invested in France every year.

- 118 production facilities and craft workshops in France, 26 in

Italy.

- More than €6 billion in corporate tax paid worldwide in 2023,

around half of which in France.

- Support for over 950 nonprofits and charitable foundations in

2023, with more than 65,000 Group employees taking part in a

community involvement partnership.

Financial highlights

|

In millions of euros |

2022 |

2023 |

Change 2023/2022 |

|

Revenue |

79 184 |

86 153 |

+9% |

|

Profit from recurring operations |

21 050 |

22 796 |

+8% |

|

Net profit, Group share |

5 797 |

6 304 |

+9% |

|

Operating free cash flow |

10 110 |

8 101 |

-20% |

|

Net financial debt |

8 867 |

10 548 |

+19% |

|

Total equity |

54 314 |

60 293 |

+11% |

Revenue by business group changed

as follows:

|

In millions of euros |

2022 |

2023 |

Change2023/2022Reported

Organic* |

|

Wines & Spirits |

7 099 |

6 602 |

-7% |

-4% |

|

Fashion & Leather Goods |

38 648 |

42 169 |

+9% |

+14% |

|

Perfumes & Cosmetics |

7 722 |

8 271 |

+7% |

+11% |

|

Watches & Jewelry |

10 581 |

10 902 |

+3% |

+7% |

|

Selective Retailing |

14 852 |

17 885 |

+20% |

+25% |

|

Other activities & eliminations |

282 |

324 |

- |

- |

|

Total |

79 184 |

86 153 |

+9% |

+13% |

* On a constant consolidation scope and currency

basis. For the Group, the impact of changes in scope was nil; the

impact of exchange rate fluctuations was -4%.

Profit from recurring operations

by business group changed as follows:

|

In millions of euros |

2022 |

2023 |

Change 2023/2022 |

|

Wines & Spirits |

2 155 |

2 109 |

-2% |

|

Fashion & Leather Goods |

15 709 |

16 836 |

+7% |

|

Perfumes & Cosmetics |

660 |

713 |

+8% |

|

Watches & Jewelry |

2 017 |

2 162 |

+7% |

|

Selective Retailing |

788 |

1 391 |

+76% |

|

Other activities & eliminations |

(279) |

(415) |

- |

|

Total |

21 050 |

22 796 |

+8% |

Wines & Spirits: Contrasting trends

across different markets following an exceptional year in

2022

The Wines & Spirits

business group saw a revenue decline (-4% organic) in 2023, faced

with a particularly high basis of comparison. Profit from recurring

operations was down 2%. Driven by its value strategy, the champagne

business posted growth, with a good performance in Europe and Japan

offsetting the effects of an unfavorable macroeconomic environment

in the United States. Hennessy cognac was affected by a mixed

recovery in China and by the post-Covid normalization of demand in

the United States, while efforts continued to maintain optimal

inventory levels among retailers. In Provence rosé wines, LVMH

acquired the prestigious Minuty estate, the second-largest market

player after Château d’Esclans, which also continued its

international development.

Fashion & Leather Goods: Exceptional

performances by Louis Vuitton, Christian Dior, Celine, Loro Piana,

Loewe, Rimowa and Marc Jacobs

The Fashion & Leather Goods

business group achieved organic revenue growth of 14% in 2023.

Profit from recurring operations was up 7%. Louis Vuitton had an

excellent year, once again buoyed by the creativity and quality of

its products, and by its strong ties to art and culture. Many new

designs were unveiled, including the GO-14 leather goods line and

the new Tambour watch, a fusion of Swiss watchmaking expertise and

Louis Vuitton’s Parisian elegance. Nicolas Ghesquière, who

celebrated his 10th anniversary designing the Maison’s Women’s

collections and renewed his contract for a further five years,

continued to captivate audiences with his boundless creativity. Set

on the stage of the Pont-Neuf bridge in Paris in July, the first

fashion show of the new Creative Director of Menswear Pharrell

Williams sparked enthusiasm worldwide. Christian Dior Couture

continued to deliver remarkable growth in all its product lines.

Giving center stage to excellent craftsmanship, fashion shows

curated by Maria Grazia Chiuri and Kim Jones reinvented the magic

of the Dior name, season after season. Victoire de Castellane’s

creative verve was once again on full display in her new high

jewelry collection, Les Jardins de la Couture. The year ended

on a high note, with a spectacular Dior display at Saks Fifth

Avenue in New York, whose facade was bedecked with a captivating

“Carousel of Dreams” and 24 enchanting window displays. Celine

continued to enhance its desirability, driven by the success of

Hedi Slimane’s designs and fashion shows. Loewe’s robust growth

continued to be driven by J.W. Anderson’s bold, creative leadership

and by the success of the latest new leather goods designs. Loro

Piana confirmed its superb momentum and its leadership position in

ultra-premium, sophisticated luxury. Fendi expanded its retail

network. Rimowa, Marc Jacobs and Berluti all turned in an excellent

performance.

Perfumes & Cosmetics: Excellent

momentum in fragrances and makeup

The Perfumes & Cosmetics

business group posted organic revenue growth of 11% in 2023 thanks

to its highly selective retail policy and dynamic innovation

strategy, backed by the scientific excellence of LVMH’s research

center. Profit from recurring operations was up 8%. Parfums

Christian Dior achieved a remarkable performance, extending its

lead in its key markets. Fragrances were once again buoyed by the

success of iconic scents Sauvage, Miss Dior and J’adore, which was

enriched with Francis Kurkdjian’s latest creation, L’Or de J’adore.

Makeup (with Dior Addict) and skincare (with Prestige and L’Or de

Vie) also contributed to the Maison’s growth. Guerlain continued to

grow, driven by the popularity of its Aqua Allegoria line and its

L’Art et la Matière high-end fragrance collection, as well as the

excellent response to its Terracotta Le Teint makeup. Parfums

Givenchy benefited from its fragrances’ ongoing success. Benefit

was buoyed by its The Porefessional skincare line, while Fenty

Beauty posted robust growth, driven in particular by one of its

latest innovations in mascara.

Watches & Jewelry:

Rapid growth in jewelry and further innovation in

watches

The Watches & Jewelry

business group recorded organic revenue growth of 7% in 2023.

Profit from recurring operations was up 7%. Tiffany & Co.

embarked on a new chapter in its history with the reopening of

“The Landmark” in New York. Substantially raising the bar

for jewelry retail worldwide, the spectacular transformation of

this legendary flagship store was exceptionally well received. The

new Lock collection, which continued to be rolled out worldwide,

was a huge success, and Blue Book: Out of the Blue – the new high

jewelry collection designed by Creative Director for Jewelry

Nathalie Verdeille – was unveiled. Bulgari posted strong growth,

driven by high jewelry, in particular the success of the

Mediterranea collection. Its iconic Serpenti line, which celebrated

its 75th anniversary, turned in a remarkable performance, both in

jewelry and in women’s watches, taking home awards at the Geneva

Watchmaking Grand Prix. Chaumet continued to channel its powerful

creativity through a new high jewelry line and held its A Golden

Age: 1965-1985 retrospective exhibition in the historic salons of

its 12 place Vendôme location. Fred inaugurated its Fred: Jewelry

Designer exhibition in South Korea, where it was a major success.

In watchmaking, highlights of the year included TAG Heuer’s

achievement of record-breaking revenue and its celebration of the

60th anniversary of its Carrera collection, along with Hublot’s

appointment as the official timekeeper for the FIFA Women’s World

Cup in Australia.

Selective Retailing: Exceptional

performance by Sephora; DFS growth supported by the recovery in

international travel

The Selective Retailing

business group posted organic revenue growth of 25% in 2023. Profit

from recurring operations was up 76%. Sephora achieved another

historic year, both in terms of sales and profit, continuing to

gain market share through its distinctive, innovative range of

products and services. Momentum was particularly strong in North

America, Europe and the Middle East. The expansion of its store

network continued, with the highly successful opening of its first

two stores in the United Kingdom and the thriving collaboration

with Kohl’s in the United States. Another major event during the

year was the reopening of its Champs-Élysées flagship store in

Paris, whose renovation reflected Sephora’s sustainability

strategy, aimed at reducing the energy consumption of its sales

floor area by 50%. DFS benefited from the gradual recovery in

international travel and, in particular, from the return of

tourists to flagship destinations Hong Kong and Macao. The Maison

announced its plans to open a new Galleria on the island of Hainan

in China by 2026. Le Bon Marché, which is growing steadily,

continued to develop innovative concepts and benefit from a loyal

French customer base as well as the return of international

travelers.

Confidence for 2024

While the geopolitical and macroeconomic

environment remains uncertain, the Christian Dior group is

confident in its ability to continue to grow in 2024, in the highly

distinctive quality and creativity that its products offer its

customers, as well as in the professionalism of its management, to

stand out and gain market share. The Group will pursue its brand

development-focused strategy, underpinned by continued innovation

and investment as well as an extremely exacting quest for

desirability and quality in its products and their highly selective

distribution.

Driven by the agility of its teams, their

entrepreneurial spirit and its well-diversified presence across the

geographic areas in which its customers are located, the Group

therefore enters 2024 with confidence and once again sets an

objective of reinforcing its global leadership position in luxury

goods.

Dividend for 2023

At the Shareholders’ Meeting on April 18, 2024,

Christian Dior will propose a dividend of €13 per share. An interim

dividend of €5.50 per share was paid on December 6, 2023. The final

dividend of €7.50 per share will be paid on April 25, 2024.

The Board of Directors met on January 25

to approve the financial statements for fiscal year 2023. Audit

procedures have been carried out and the audit report is being

issued.

This press release is available

at

www.dior-finance.com.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in Christian

Dior’s Annual report which is available on the website

(www.dior-finance.com). These forward looking statements should not

be considered as a guarantee of future performance, the actual

results could differ materially from those expressed or implied by

them. The forward looking statements only reflect Company’s views

as of the date of this document, and Christian Dior does not

undertake to revise or update these forward looking statements. The

forward looking statements should be used with caution and

circumspection and in no event can the Company and its Management

be held responsible for any investment or other decision based upon

such statements. The information in this document does not

constitute an offer to sell or an invitation to buy shares in

Christian Dior or an invitation or inducement to engage in any

other investment activities.”

APPENDIX

Financial statements for 2023 are included

in the PDF version of the press release.

Revenue by business group and by quarter

Revenue for 2023 (in millions of

euros)

|

Full-year 2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities & eliminations |

Total |

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

|

Third quarter |

1 509 |

9 750 |

1 993 |

2 524 |

4 076 |

113 |

19 964 |

|

First nine months |

4 689 |

30 912 |

6 021 |

7 951 |

12 431 |

201 |

62 205 |

|

Fourth quarter |

1 912 |

11 257 |

2 250 |

2 951 |

5 454 |

124 |

23 948 |

|

Total 2023 |

6 602 |

42 169 |

8 271 |

10 902 |

17 885 |

324 |

86 153 |

Revenue for 2023 (organic change versus

same period in 2022)

|

Full-year 2023 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities & eliminations |

Total |

|

First quarter |

+3% |

+18% |

+10% |

+11% |

+28% |

- |

+17% |

|

Second quarter |

-8% |

+21% |

+16% |

+14% |

+25% |

- |

+17% |

|

First half |

-3% |

+20% |

+13% |

+13% |

+26% |

- |

+17% |

|

Third quarter |

-14% |

+9% |

+9% |

+3% |

+26% |

- |

+9% |

|

First nine months |

-7% |

+16% |

+12% |

+9% |

+26% |

- |

+14% |

|

Fourth quarter |

+4% |

+9% |

+10% |

+3% |

+21% |

- |

+10% |

|

Total 2023 |

-4% |

+14% |

+11% |

+7% |

+25% |

- |

+13% |

Revenue for 2022 (in millions of

euros)

|

Full-year 2022 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities & eliminations |

Total |

|

First quarter |

1 638 |

9 123 |

1 905 |

2 338 |

3 040 |

(41) |

18 003 |

|

Second quarter |

1 689 |

9 013 |

1 714 |

2 570 |

3 591 |

149 |

18 726 |

|

First half |

3 327 |

18 136 |

3 618 |

4 909 |

6 630 |

109 |

36 729 |

|

Third quarter |

1 899 |

9 687 |

1 959 |

2 666 |

3 465 |

79 |

19 755 |

|

First nine months |

5 226 |

27 823 |

5 577 |

7 575 |

10 095 |

189 |

56 485 |

|

Fourth quarter |

1 873 |

10 825 |

2 145 |

3 006 |

4 757 |

93 |

22 699 |

|

Total 2022 |

7 099 |

38 648 |

7 722 |

10 581 |

14 852 |

282 |

79 184 |

Alternative performance

measures

For the purposes of its financial

communications, in addition to the accounting aggregates defined by

IAS/IFRS, Christian Dior uses alternative performance measures

established in accordance with AMF position DOC-2015-12.

The table below lists these performance measures

and the reference to their definition and their reconciliation with

the aggregates defined by IAS/IFRS, in the published documents.

|

Performance measures |

Reference to published documents |

|

Operating free cash flow |

AR (condensed consolidated financial statements, consolidated cash

flow statement) |

|

Net financial debt |

AR (Notes 1.22 and 19 to the condensed consolidated financial

statements) |

|

Gearing |

AR (Part 7, “Comments on the consolidated balance sheet”) |

|

Organic growth |

AR (Part 1, “Comments on the consolidated income statement”) |

AR: Annual Report as of December 31, 2023

This document is a free translation into English

of the original French financial release dated January 25th,

2024.It is not a binding document. In the event of a conflict in

interpretation, reference should be made to the French version,

which is the authentic text.

- Financial release Christian Dior 2023

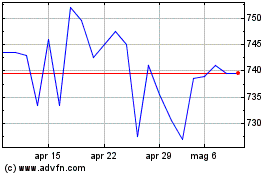

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Christian Dior (EU:CDI)

Storico

Da Gen 2024 a Gen 2025