PRESS

RELEASE

| |

|

| |

July 22, 2016 |

|

| |

|

|

First-half

2016

Solid like-for-like growth in sales and EBIT

|

|

|

| |

| |

|

| |

|

|

| |

Issue volume

€9,079 million |

+8.4% |

|

Total revenue

€526 million |

+6.1% |

|

| |

EBIT

€161 million

|

+13.0% |

|

Funds from operations[1]

€125 million |

+14.2% |

|

| |

-

EBIT maintained at a high

level of €161 million thanks to strong like-for-like

growth and despite unfavorable currency

effects.

-

Operating EBIT

margin[2] of

26.3%, up both like-for-like (+2.5 points) and as

reported (+0.7 point).

-

Net profit, Group share of

€71 million.

-

Significant achievements in

first-half 2016:

-

Continuous digital and mobility-related

innovation in the Employee Benefits business,

with the launch of Apple Pay for the Ticket Restaurant®

card holders in France and the roll-out of the Ticket

Restaurant® card in Japan

and Uruguay.

-

Accelerated development in Expense Management, with the closing of the Embratec

acquisition in Brazil and the launch of a fuel card solution in

France.

|

|

FIRST-HALF 2016

RESULTS

At its meeting on July 21, 2016,

the Board of Directors reviewed the consolidated financial

statements for the six months ended June 30, 2016.

First-half 2016

key financial metrics

| (in € millions) |

First-half 2016 |

First-half 2015 |

% change |

| Reported |

Like-for-like[3] |

| Issue volume |

9,079 |

9,110 |

-0.3% |

+8.4% |

Operating

revenue with IV[4]

Operating revenue without IV

Financial revenue

Total revenue |

420

74

32

526 |

428

75

36

539 |

-1.7%

-1.3%

-12.6%

-2.4% |

+6.8%

+5.8%

-1.6%

+6.1% |

Operating

EBIT

Financial EBIT

Total EBIT |

129

32

161 |

129

36

165 |

+0.7%

-12.6%

-2.2% |

+17.1%

-1.6%

+13.0% |

| Net profit,

Group share |

71 |

82 |

-12.8% |

|

| |

|

|

|

|

First-half issue

volume up 8.4% like-for-like to €9.1 billion

Issue volume totaled €9,079 million in first-half 2016, representing a

like-for-like increase of 8.4%. This strong

performance reflected continued acceleration in Europe, partly

supported by favorable calendar effects, and sustained growth in

Latin America despite a difficult economic environment in Brazil

and a high basis of comparison in Mexico.

On a reported basis, issue volume

was down 0.3%. The reported decline reflects the 2.9% positive

impact of changes in the scope of consolidation[5] and

the 11.6% unfavorable currency effect due mainly to the

depreciation of certain currencies against the euro, particularly

the Brazilian real (down 19.9%), the Mexican peso (down 16.2%) and

the Venezuelan bolívar (down 52.6%).

| Like-for-like growth |

First-quarter 2016 |

Second-quarter 2016 |

First-half 2016 |

| Europe |

+6.9% |

+9.7% |

+8.3% |

| Latin America |

+7.5% |

+8.7% |

+8.1% |

| Rest of the

World |

+12.1% |

+11.1% |

+11.6% |

| TOTAL |

+7.4% |

+9.3% |

+8.4% |

In Europe,

issue volume for the first half was €4.6 billion (or 50% of the Group's total issue

volume), up 8.3% like-for-like.

Europe

(excluding France) posted strong growth in the first half of the

year (+9.9% like-for-like), driven by solid operating performances

in an improving economic environment and positive calendar effects

in the second quarter. Growth was 4.9% like-for-like in Italy and continued to accelerate in Central Europe (+9.9% like-for-like for the period),

thanks to a healthy sales dynamic. In Germany,

strong gains in the Ticket Plus Card solution helped deliver

significant growth, and in the United Kingdom,

the Childcare Vouchers business expanded by +5.4% like-for-like.

The other countries in the region posted double-digit growth on

average for the period.

The positive trend continued in

France, where 5.2% like-for-like growth

reflected solid gains in the Ticket Restaurant®

solution (up 4.5%), driven in particular by a good sales

performance as well as positive calendar effects in the second

quarter. With 200,000 Ticket Restaurant® card

beneficiaries at end-June 2016, Edenred has consolidated its

leadership in the French digital meal voucher market. Incentive

& Rewards solutions, especially Ticket Kadéos, also performed

solidly in the first half.

In Latin

America, issue volume for the period was up 8.1% like-for-like to €4.1 billion, which represents 45% of the Group's

total issue volume.

In Brazil,

issue volume rose by 4.5% like-for-like in the first half of 2016

despite a tough economic environment. Reflecting this market's

significant growth potential, Expense Management continued to enjoy

strong like-for-like growth (16.8%), driven by new client wins and

an increase in existing client sales. Issue volume in Employee

Benefits solutions was positive and grew 0.7% like-for-like in

spite of a surge in the country's unemployment rate, which rose

from around 8% in May 2015 to close to 11% in May 2016[6].

In Hispanic Latin

America, issue volume grew by 13.8% like-for-like. The Employee

Benefits business rose by 19.1% like-for-like, reflecting improving

momentum in Mexico (despite a tough basis of comparison in the

prior-year period) and high inflation in Venezuela. The Expense

Management business grew by 6.5% like-for-like due to the high

basis of comparison in Mexico in first half 2015.

Lastly, issue volume in the

Rest of the World was up by 11.6% like-for-like in the first half, led mainly by

strong growth in Turkey, the region's primary

contributor.

| |

Employee

Benefits |

Expense Management |

Incentive & Rewards |

Public Social

Programs |

TOTAL |

Issue volume

(in € millions) |

6,943 |

1,572 |

359 |

205 |

9,079 |

| % of total IV |

77% |

17% |

4% |

2% |

100% |

| Like-for-like growth |

+7.1% |

+11.6% |

+17.9% |

N/A |

+8.4% |

Employee

Benefits associated with meals and food and quality of life

represented 77% of total issue volume at June 30, 2016 and

recorded robust 7.1% growth in issue volume in the first half,

driven by Europe and Hispanic Latin America. Expense Management, Edenred's second growth engine, now

accounts for 17% of issue volume. It grew by 11.6% in first-half

2016, reflecting a significant increase in Brazil and more modest

gains in Mexico due to the high basis of comparison. Incentive & Rewards and Public

Social Programs both posted strong growth in the first six

months of the year, accounting for 4% and 2% of consolidated issue

volume, respectively, at June 30, 2016.

Total revenue up

6.1% like-for-like at €526 million

| Like-for-like growth |

First-quarter 2016 |

Second-quarter 2016 |

First-half 2016 |

| Operating revenue with

IV |

+5.8% |

+7.8% |

+6.8% |

| Operating revenue

without IV |

+6.6% |

+5.2% |

+5.8% |

| Financial

revenue |

-3.1% |

+0.1% |

-1.6% |

| Total revenue |

+5.2% |

+6.9% |

+6.1% |

Total revenue

for the first half of 2016 amounted to €526 million, representing a 6.1% like-for-like increase. Total revenue comprises

operating revenue with issue volume (up 6.8% like-for-like),

operating revenue without issue volume (up 5.8% like-for-like) and

financial revenue (down 1.6% like-for-like).

On a reported basis, the

year-on-year change was a decline of 2.4%,

after taking into account the 2.3% positive impact of changes in

the scope of consolidation and the 10.8% negative currency

effect.

Operating revenue

with issue volume rose 6.8% like-for-like to €420 million,

reflecting solid performances in all regions, with an acceleration

in Europe and further sustained growth in Latin America.

Operating revenue

with issue volume by region

| Like-for-like growth |

First-quarter 2016 |

Second-quarter 2016 |

First-half 2016 |

| Europe |

+5.1% |

+8.9% |

+7.0% |

| Latin America |

+6.2% |

+6.6% |

+6.4% |

| Rest of the World |

+7.9% |

+8.6% |

+8.2% |

| TOTAL |

+5.8% |

+7.8% |

+6.8% |

The take-up

rate [7]in

first-half 2016 stood at 4.6%, virtually unchanged from the

prior-year period (4.7%).

Operating revenue

without issue volume amounted to €74

million, up 5.8% like-for-like, reflecting the contribution of

ProwebCE in France, which is subject to a higher seasonality than

other operations within the Group.

Financial

revenue totaled €32 million for the

period, down 1.6% like-for-like resulting from a solid 9.8%

like-for-like increase in Latin America and a

15.4% like-for-like decline in Europe,

reflecting interest rate trends in the two regions.

EBIT up 13.0%

like-for-like at €161 million

In first-half 2016, total EBIT stood at €161 million, up 13.0%, or

€21 million, like-for-like compared with total revenue growth

of 6.1%. On a reported basis, EBIT was down by a slight 2.2% after

taking into account the €3 million positive contribution of

changes in scope of consolidation and the €28 million negative

currency effect.

The total EBIT of

€161 million for first-half 2016 comprises operating EBIT of

€129 million and financial EBIT, which is equal to financial

revenue, of €32 million.

First-half 2016

operating EBIT by region

| (in € millions) |

First-half 2016

|

First-half 2015

|

% change |

| Reported |

Like-for-like |

|

| Europe |

61 |

48 |

+27.1% |

+27.7% |

| Latin America |

71 |

87 |

-17.1% |

+10.8% |

| Rest of the World |

4 |

3 |

N/A |

N/A |

| Worldwide

structures |

(7) |

(9) |

+26.6% |

+9.5% |

| TOTAL |

129 |

129 |

+0.7% |

+17.1% |

Operating

EBIT (which excludes financial revenue) rose by 17.1% like-for-like to €129 million. This good performance reflects a

high operating flow-through ratio[8] of 66%,

which was achieved through a combination of dynamic revenue growth

and effective cost management.

Europe

performed strongly over the period, delivering operating EBIT

growth of 27.7% like-for-like, versus growth

in operating revenue of 6.6%. In Latin

America, like-for-like operating EBIT growth was 10.8%, outperforming the 6.2% like-for-like increase in

operating revenue.

These strong performances saw the

Group increase its profitability in the first half of 2016, with an

operating EBIT margin (which excludes

financial EBIT) of 26.3% for the period, up 2.5 points

like-for-like and 0.7 point as reported compared with

first-half 2015.

Net

profit

Net profit, Group

share totaled €71 million for

first-half 2016, versus €82 million in the six months to June

30, 2015. This figure includes €18 million in non-recurring

costs due notably to acquisition-related expenses and to

initiatives undertaken as part of a reorganization of the Group. It

also takes into account €23 million in net financial expense,

€4 million in the share of associate net profit,

€49 million in taxes and €4 million in minority

interests.

A solid financial

position

The Edenred business model

generates significant cash flow. In the first half of 2016, funds

from operations before non-recurring items (FFO) totaled €125 million, a

year-on-year increase of 14.2%

like-for-like.

The Group had net debt of

€1,092 million at June 30, 2016

(versus €841 million at end-June 2015). The change in net debt

includes a negative impact of €155 million related to currency

effect and other non-recurring items, and takes into account the

€192 million in acquisition expenses related mainly to the

Embratec acquisition in Brazil, and the €192 million in

dividends paid to Edenred SA shareholders.

In the first half of the year,

Edenred also announced that it had successfully completed the issue

of a €250 million Schuldschein loan - a German form of private

placement - consisting of fixed- and floating-rate coupons

with an average maturity of 6.1 years, and an average financing

cost of 1.2%. In addition, on July 21, 2016, Edenred signed an

agreement with its banking syndicate to extend its

€700 million (undrawn) revolving credit

facility until July 2021 (versus June 2019 previously), while

taking advantage of significantly more favorable financing

conditions. The renegotiation also introduced two 1-year extension

options, potentially adding an additional two years to the credit

facility's maturity date (July 2023). Both of these

transactions help improve the Group's debt profile.

FIRST-HALF

HIGHLIGHTS

The first half of 2016 was shaped by a number of

achievements aligned with the Group's growth strategy in the

Employee Benefits and Expense Management businesses.

Pursuit of digital growth in France and launch of

Apple Pay

Since the launch of the Ticket

Restaurant® card in 2014,

23 million transactions have been carried out in affiliated

restaurants and merchants, with a peak of 300 transactions per

minute at lunchtime, for an average amount of €11.43. There are

currently 200,000 employee beneficiaries, 80% of whom have already

made a transaction using contactless (NFC) payment.

Since July 19, 2016, Edenred has been

offering holders of Ticket Restaurant® cards in

France the possibility of paying for their lunch using Apple

Pay[9]. Payment

can be made directly with an iPhone or Apple Watch at all Ticket

Restaurant®-affiliated

restaurants and merchants equipped with a contactless payment

terminal. As the first meal voucher issuer to offer Apple Pay from

the moment of its launch in France, Edenred provides its

200,000 Ticket Restaurant® card

beneficiaries in France with a unique, comprehensive range of

services.

Continuing shift to digital with the launch of the

Ticket Restaurant® card in Japan

and faster digitalization in Uruguay

Edenred launched several new solutions in the

first half, including the first Ticket Restaurant® card in

Japan on April 20, 2016.

In Uruguay, the Group completed the shift to

digital of the Ticket Restaurant® solution,

with issue volume nearly 100% paperless at end-June and more than

110,000 employee beneficiaries of the Ticket

Restaurant® card.

Further client wins in Employee Benefits

solutions

The Group maintained a healthy sales dynamic in

the first half of 2016, which resulted in numerous client wins in

all operating regions.

In Europe, for example, Edenred has gained a new

client in Germany in the form of Datev, an IT services company with

nearly 7,000 Ticket Plus Card solution beneficiaries.

In Latin America, the Group achieved two

significant client wins in Brazil for the Ticket

Restaurant® solution:

LATAM Airlines (around 25,000 beneficiaries) and pharmaceutical

company Pfizer (around 1,300 beneficiaries).

Lastly, in the Rest of the World region, new

Ticket Restaurant® card clients

include engineering group Siemens in India (around 1,400

beneficiaries) and jewelry brand Swarovski in Japan (nearly 400

beneficiaries).

Finalization of the Embratec alliance in

Brazil

In accordance with an agreement

signed in January, Edenred finalized on May 31, 2016 the

combination of its Expense Management assets in Brazil with those

of Embratec in a new company 65%-owned by Edenred and 35%-owned by

Embratec's founding shareholders, thereby creating a leading player in this fast-growing segment.

The entity created by the

transaction will bring together Edenred's Ticket Car and Repom

assets and Embratec's fuel card and maintenance activities,

operated under the Ecofrotas and Expers brands. These activities

are now united under a new brand, Ticket Log,

which serves around 27,000 clients, representing more than one

million active cards that can be used at more than

24,500 affiliated service stations and maintenance workshops,

or 58% of Brazil's domestic network.

Thanks to this transaction,

Edenred is doubling the size of its Expense

Management business in Brazil to become the leading provider of

fuel card and maintenance solutions for light vehicles and number

two for heavy vehicles. With a low penetration rate of between 15%

and 20%, the Brazilian B2B fuel card segment holds significant

potential for growth.

As announced, Edenred financed the

deal mainly by contributing assets to the new entity, with an

additional cash payment of BRL

810 million, financed locally.

The Group also confirms that the

transaction will have an accretive impact of

around 2% on net profit, Group share (on an annual basis and

before purchase accounting impact).

Successful issue of a €250 million Schuldschein loan

On June 29, 2016, Edenred

announced that it had successfully completed the issue of a

Schuldschein loan - a German form of

private placement - consisting of 5- and 7-year tranches with

fixed- and floating-rate coupons, with an average maturity of 6.1

years, for a total amount of €250 million.

With an average financing cost of

approximately 1.2%, this transaction allows the Group to reduce its

average cost of debt, while extending the average maturity. It also

diversifies Edenred's sources of financing and expands its investor

base.

Appointment to

Edenred's Board of Directors

At its meeting on March 23,

2016, Edenred's Board of Directors appointed Sylvia Coutinho, Country Head of UBS Brazil, as a

Director of Edenred.

The Board of Directors noted that

Sylvia Coutinho qualifies as an independent Director according to

the AFEP/MEDEF corporate governance code. Shareholders ratified the

appointment at the Annual Meeting on May 4, 2016.

Appointments to

the Executive Committee

To simplify operating procedures

and structures, the operating responsibilities of Edenred's

Executive Committee are now organized into five regions instead of

seven. In line with this change, Edenred announced on July 1,

2016 the appointment of Arnaud Erulin to the

newly created position of Chief Operating Officer, Northern Europe,

Central Europe, France and Belgium. The new position expands Arnaud

Erulin's role within the Group's Executive Committee, of which he

was already a member in his previous position as Chief Operating

Officer, Central Europe and Scandinavia.

Southern Europe, led by Graziella Gavezotti, has now been extended to include

Lebanon and Morocco, in addition to Greece, Italy, Portugal, Spain

and Turkey.

Operating responsibilities within

Edenred's Executive Committee are now organized into the five

following regions:

-

Hispanic and North America - Chief Operating

Officer: Diego Frutos

-

Asia-Pacific and Middle East - Chief Operating

Officer: Laurent Pellet

-

Brazil - Chief Operating Officer: Gilles

Coccoli

-

Northern Europe, Central Europe, France and

Belgium - Chief Operating Officer: Arnaud Erulin

-

Southern Europe - Chief Operating Officer:

Graziella Gavezotti

2016

OUTLOOK

Issue volume

growth is expected to remain solid in the second half of 2016,

reflecting, on one hand, sustained sales momentum and unfavorable

calendar effects in Europe (about two days on average in the second

half) and, on the other hand, improved trends in Latin America

thanks notably to Mexico and increased exposure to the fast-growing

and under-penetrated expense management market in Brazil.

In this context, Edenred has set a

full-year EBIT target of between €350 million

and €370 million. This objective takes into account an

estimated negative currency effect of €35 million[10].

For full-year 2016, the Group also

confirms its target for like-for-like issue volume

growth of between 8% and 14% (lower end of the range), in line

with its historical target. After rising to high levels in the

first half of the year, the operating flow-through

ratio will reflect additional operating expenses in the second

half and should end the year in line with the Group's historical

guidance of more than 50%. Lastly, annual

like-for-like growth in funds from operations (FFO) is expected

to be in line with the historical guidance of more than 10%.

UPCOMING

EVENTS

October 13, 2016: Third-quarter

2016 revenue

October 19, 2016: Investor Day in

London

February 23, 2017: Full-year 2016

results

___

Edenred, which invented the Ticket

Restaurant® meal voucher

and is the world leader in prepaid corporate services, designs and

manages solutions that improve the efficiency of organizations and

purchasing power to individuals.

By ensuring that allocated funds are used

specifically as intended, these solutions enable companies to more

effectively manage their:

-

Employee benefits (Ticket

Restaurant®, Ticket

Alimentación, Ticket CESU, Childcare Vouchers, etc.)

-

Expense management process (Ticket

Car, Ticket Clean Way, Repom, etc.)

-

Incentive and reward programs (Ticket Compliments, Ticket Kadéos, etc.)

The Group also

supports public institutions in managing their social programs.

Listed on the Euronext Paris stock exchange,

Edenred operates in 42 countries, with 6,300 employees, 660,000

companies and public sector clients, 1.4 million affiliated

merchants and 41 million beneficiaries. In 2015, total issue volume

amounted to €18.3 billion.

Ticket

Restaurant® and all other

tradenames of Edenred products and services are registered

trademarks of Edenred SA.

Follow Edenred on

Twitter: www.twitter.com/Edenred

___

CONTACTS

Media Relations

Anne-Sophie Sibout

+33 (0)1 74 31 86 11

anne-sophie.sibout@edenred.com

Astrid de Latude

+33 (0)1 74 31 87 42

astrid.delatude@edenred.com

|

Investor and Shareholder Relations

Louis Igonet

+33 (0)1 74 31 87 16

louis.igonet@edenred.com

Aurélie Bozza

+33 (0)1 74 31 84 16

aurelie.bozza@edenred.com

|

APPENDICES

Issue

volume

| |

Q1 |

Q2 |

|

H1 |

| |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

767 |

735 |

806 |

696 |

|

1,573 |

1,431 |

| Rest of

Europe |

1,452 |

1,346 |

1,536 |

1,395 |

|

2,989 |

2,741 |

| Latin

America |

1,872 |

2,284 |

2,252 |

2,274 |

|

4,124 |

4,558 |

| Rest of

the world |

193 |

188 |

200 |

192 |

|

393 |

380 |

|

|

|

|

|

|

|

|

|

| Total |

4,284 |

4,553 |

4,794 |

4,557 |

|

9,079 |

9,110 |

| |

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

|

H1 |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

4.4% |

4.2% |

15.8% |

6.2% |

|

9.9% |

5.2% |

| Rest of

Europe |

7.9% |

8.4% |

10.1% |

11.5% |

|

9.0% |

9.9% |

| Latin

America |

-18.0% |

7.5% |

-1.0% |

8.7% |

|

-9.5% |

8.1% |

| Rest of

the world |

2.7% |

12.1% |

4.2% |

11.1% |

|

3.5% |

11.6% |

|

|

|

|

|

|

|

|

|

| Total |

-5.9% |

7.4% |

5.2% |

9.3% |

|

-0.3% |

8.4% |

Operating revenue

with issue volume

| |

Q1 |

Q2 |

|

H1 |

| |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

32 |

31 |

33 |

30 |

|

65 |

61 |

| Rest of

Europe |

73 |

68 |

77 |

71 |

|

149 |

139 |

| Latin

America |

83 |

104 |

104 |

105 |

|

187 |

209 |

| Rest of

the world |

9 |

10 |

10 |

9 |

|

19 |

19 |

|

|

|

|

|

|

|

|

|

| Total |

197 |

213 |

224 |

215 |

|

420 |

428 |

| |

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

|

H1 |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

1.4% |

1.9% |

11.0% |

5.6% |

|

6.1% |

3.7% |

| Rest of

Europe |

6.3% |

6.6% |

9.2% |

10.3% |

|

7.8% |

8.5% |

| Latin

America |

-20.1% |

6.2% |

-0.8% |

6.6% |

|

-10.4% |

6.4% |

| Rest of

the world |

-2.2% |

7.9% |

1.7% |

8.6% |

|

-0.3% |

8.2% |

|

|

|

|

|

|

|

|

|

| Total |

-7.7% |

5.8% |

4.2% |

7.8% |

|

-1.7% |

6.8% |

Operating revenue

without issue volume

| |

Q1 |

Q2 |

|

H1 |

| |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

13 |

6 |

14 |

20 |

|

27 |

26 |

| Rest of

Europe |

10 |

11 |

9 |

8 |

|

19 |

19 |

| Latin

America |

5 |

6 |

5 |

7 |

|

10 |

13 |

| Rest of

the world |

8 |

8 |

9 |

9 |

|

18 |

17 |

|

|

|

|

|

|

|

|

|

| Total |

36 |

31 |

37 |

44 |

|

74 |

75 |

| |

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

|

H1 |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

129.0% |

4.4% |

-32.0% |

2.6% |

|

3.0% |

3.0% |

| Rest of

Europe |

0.7% |

8.7% |

1.6% |

5.1% |

|

1.1% |

6.9% |

| Latin

America |

-23.6% |

4.4% |

-20.9% |

0.8% |

|

-22.3% |

2.7% |

| Rest of

the world |

3.2% |

7.5% |

7.7% |

15.1% |

|

5.5% |

11.3% |

|

|

|

|

|

|

|

|

|

| Total |

20.0% |

6.6% |

-16.0% |

5.2% |

|

-1.3% |

5.8% |

Financial

revenue

| |

Q1 |

Q2 |

|

H1 |

| In €

millions |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| |

| |

|

|

|

|

|

|

|

|

|

|

France |

3 |

4 |

3 |

3 |

|

5 |

7 |

| Rest of

Europe |

4 |

4 |

4 |

5 |

|

9 |

9 |

| Latin

America |

7 |

10 |

8 |

8 |

|

16 |

18 |

| Rest of

the world |

2 |

1 |

1 |

1 |

|

2 |

2 |

|

|

|

|

|

|

|

|

|

| Total |

16 |

19 |

16 |

17 |

|

32 |

36 |

| |

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

|

H1 |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

| |

|

|

|

|

|

|

|

| France |

-25.1% |

-25.1% |

-22.1% |

-22.1% |

|

-23.7% |

-23.7% |

| Rest of

Europe |

-9.8% |

-9.1% |

-10.9% |

-8.9% |

|

-10.3% |

-9.0% |

| Latin

America |

-19.4% |

7.1% |

-1.5% |

13.0% |

|

-11.2% |

9.8% |

| Rest of the

world |

2.5% |

14.3% |

5.1% |

14.4% |

|

3.8% |

14.3% |

|

|

|

|

|

|

|

|

|

| Total |

-17.0% |

-3.1% |

-7.8% |

0.1% |

|

-12.6% |

-1.6% |

Total

revenue

| |

Q1 |

Q2 |

|

H1 |

| |

2016 |

2015 |

2016 |

2015 |

|

2016 |

2015 |

| In € millions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

48 |

41 |

50 |

53 |

|

97 |

94 |

| Rest of

Europe |

87 |

83 |

90 |

84 |

|

177 |

167 |

| Latin

America |

95 |

120 |

117 |

120 |

|

213 |

240 |

| Rest of

the world |

19 |

19 |

20 |

19 |

|

39 |

38 |

|

|

|

|

|

|

|

|

|

| Total |

249 |

263 |

277 |

276 |

|

526 |

539 |

| |

|

|

|

|

|

|

|

| |

Q1 |

Q2 |

|

H1 |

| |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

| In % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

France |

16.7% |

-0.3% |

-7.5% |

2.7% |

|

2.9% |

1.4% |

| Rest of

Europe |

4.7% |

6.0% |

7.3% |

8.7% |

|

6.0% |

7.3% |

| Latin

America |

-20.3% |

6.2% |

-1.9% |

6.7% |

|

-11.1% |

6.5% |

| Rest of

the world |

0.5% |

8.0% |

4.5% |

11.8% |

|

2.5% |

9.9% |

|

|

|

|

|

|

|

|

|

| Total |

-5.2% |

5.2% |

0.2% |

6.9% |

|

-2.4% |

6.1% |

EBIT

| |

H1 2016 |

H1

2015 |

|

Change reported |

Change L/L |

| In € millions |

|

| |

|

| |

|

|

|

|

|

|

France |

17 |

18 |

|

-5.2% |

-6.2% |

| Rest of

Europe |

58 |

46 |

|

24.2% |

25.5% |

| Latin

America |

87 |

105 |

|

-16.1% |

10.6% |

| Rest of

the world |

6 |

5 |

|

9.0% |

10.2% |

| Worldwide

structures |

(7) |

(9) |

|

-26.6% |

9.5% |

|

|

|

|

|

|

|

| Total |

161 |

165 |

|

-2.2% |

13.0% |

[1] Before

non-recurring items.

[2] Ratio of

operating EBIT to operating revenue.

[3] At constant

scope of consolidation and exchange rates (corresponding to organic

growth).

[5]

Including the contribution of the Embratec acquisition in Brazil

for two months of the first half and of La Compagnie des Cartes

Carburant for six months.

[6]

Source: Instituto Brasileiro de Geografia e Estatística.

[7] Ratio of

operating revenue with issue volume to total issue volume.

[8] Ratio

of the like-for-like change in operating EBIT to the like-for-like

change in operating revenue.

[9] Apple

Pay is compatible with the iPhone 6s, iPhone 6s Plus,

iPhone 6, iPhone 6 Plus, iPhone SE and Apple Watch.

[10]

Calculated based on an assumption of an average Brazilian real/euro

exchange rate of 4.00 for full-year 2016.

Edenred_CP résultats semestriels

2016_EN_DEF

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: EDENRED S.A. via Globenewswire

HUG#2030101

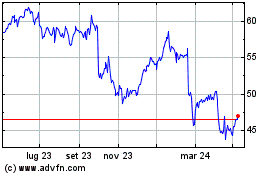

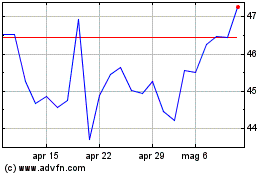

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Lug 2023 a Lug 2024