Fagron reports 19% topline growth, 11% increase in REBITDA and free cash flow of €91 million for 2022

09 Febbraio 2023 - 7:00AM

Fagron reports 19% topline growth, 11% increase in REBITDA and free

cash flow of €91 million for 2022

Regulated informationNazareth (Belgium)/Rotterdam

(The Netherlands), 9 February 2023 – 7.00 AM CET

Fagron reports 19% topline growth, 11%

increase in REBITDA and free cash flow of €91 million for

2022

Fagron, the leading global player in pharmaceutical

compounding today publishes its full year results for the period

ending 31 December 2022.

FY 2022 Key Highlights

- Revenue

growth of 10.3% at CER with organic revenue growth of 3.8% at CER

to €683.9 million (€676.7 million excluding Boston)

- REBITDA

increased by 10.5% to €130.7 million; 19.1% REBITDA margin (19.6%

excluding Boston)

- Combined

run-rate of Wichita and Boston sterile outsourcing facilities

exceeded US$110 million

- Earnings per

share increased by 14.3% to €0.96

- Highly cash

generative business delivering 57.7% increase in free cash flow to

€91.0 million

- Five

acquisitions completed in line with buy-and-build

strategy

- Leverage

ratio of 1.9x allows sufficient headroom to support disciplined

M&A strategy

- Outperformed

greenhouse gas intensity reduction target as we remain committed to

our sustainability agenda

- Dividend

proposal of €0.25 per share

- For FY 2023,

we expect mid-to-high single digit organic revenue growth with an

increase in profitability, both developing progressively through

the year, and one-off capex investments in North

America

Rafael Padilla, CEO of Fagron

commented

“The continued resilience of our industry, allied

with strong execution capabilities and our teams’ relentless focus

on strategic execution enabled us to deliver strong results for the

year.

We expanded our operating profit in the second

semester to deliver a margin of 19.8% excluding the impact of the

Boston acquisition. For the full year and including the Boston

impact, margin came in at 19.1% despite the inflationary pressures.

This was driven by the continued and impressive turnaround in EMEA

because of positive developments across our traditional and smaller

markets. We made further progress in North America with pleasing

organic growth supplemented by two sizeable acquisitions that

demonstrate our long-term commitment to the region. The combined

run-rate of our Wichita and Boston sterile outsourcing facilities

exceeded US$110 million in line with our expectations. Over the

course of this year, we have witnessed an industry wide increase in

regulatory scrutiny in the US and we have adopted a pragmatic

approach to ensure that quality remains our key competitive

advantage. The Latin America region has faced numerous external

challenges this year and we have taken the necessary actions to

ensure we maintain our market leading position and are already

seeing benefits, with an expansion of our margin in the second half

of the year. Free cash generation was outstanding with 58% growth

year over year, further reinforcing the underlying strength of our

business model and supporting our ability to maximize stakeholder

value over the long term.

Although we expect further macro challenges in

2023, I am confident we will manage these developments and deliver

on our ambitions as the global demand for personalizing medicine

continues to accelerate and Fagron is best positioned to capitalize

on this opportunity.

Finally, Michael Schenck stepped down as

non-executive director from our Board. We thank him for his

valuable contribution to the Board of Directors.”

Please open the link below for the full press

release:Fagron reports 19% topline growth, 11% increase in REBITDA

and free cash flow of €91 million for 2022

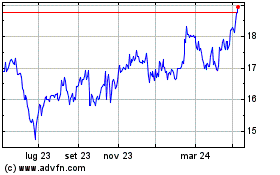

Grafico Azioni Fagron NV (EU:FAGR)

Storico

Da Gen 2025 a Feb 2025

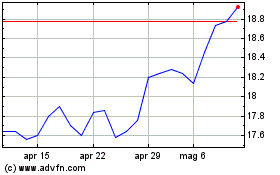

Grafico Azioni Fagron NV (EU:FAGR)

Storico

Da Feb 2024 a Feb 2025