FLOW TRADERS Q120 TRADING UPDATE

FLOW TRADERS Q120 TRADING UPDATE

Amsterdam, the Netherlands - Flow Traders N.V. (Euronext:

FLOW) releases its unaudited Q120 trading update.

|

Flow Traders’ business and operations functioned as normal

following the coronavirus (COVID-19) outbreak. A robust business

continuity plan was successfully implemented in all regions with

the primary focus being the health and wellbeing of employees. Flow

Traders was able to continuously provide liquidity and pricing to

the ETP markets on a global basis, which enabled issuers and

counterparties to efficiently trade across all products in all

circumstances |

Highlights

- Exceptional and challenging market environment experienced

globally during the first quarter across all products; particularly

in March which saw record ETP Value Traded and extremely high

levels of market activity. Overall, Market ETP Value Traded

increased 100% quarter-on-quarter and 80% vs Q119

- Flow Traders ETP Value Traded increased 76% quarter-on-quarter

and increased 71% vs Q119

- Flow Traders recorded NTI of €495.0m in Q120 reflecting this

exceptional market environment with strong performance across all

regions. This compares to NTI of €46.1m in Q419 and €63.1m in

Q119

- Total operating expenses of €171.2m incurred in Q120. €0.9m of

one-off expenses predominantly due to the activation and

implementation of Flow Traders’ business continuity plan

- 503 FTEs as at 31 March 2020 compared to 513 as at 31 December

2019

- Q120 EBITDA reached €323.7m with a margin of 65%

- Q120 Net Profit amounted to €262.3m with EPS of €5.71

- Regulatory Own Funds Requirement (OFR) as at 31 March 2020 was

€261m, resulting in excess capital of €273m as at 31 March 2020.

Trading capital stood at €771m at the end of the first quarter

Financial

Overview

|

€million |

Q120 |

Q419 |

Q120 |

Q119 |

|

Net Trading Income |

495.0 |

46.1 |

495.0 |

63.1 |

|

EMEA (Europe) |

304.9 |

33.4 |

304.9 |

37.5 |

|

Americas |

149.0 |

5.7 |

149.0 |

17.3 |

|

APAC |

41.0 |

7.0 |

41.0 |

8.3 |

|

|

|

|

|

|

|

Net Trading Income |

495.0 |

46.1 |

495.0 |

63.1 |

|

Employee expenses* |

154.9 |

18.4 |

154.9 |

23.3 |

|

Technology expenses |

11.4 |

10.9 |

11.4 |

9.5 |

|

Other expenses |

4.1 |

3.9 |

4.1 |

3.5 |

|

One-off expenses |

0.9 |

1.2 |

0.9 |

- |

|

Total Operating Expenses |

171.2 |

34.4 |

171.2 |

36.3 |

|

EBITDA |

323.7 |

11.7 |

323.7 |

26.8 |

|

Depreciation/Amortisation |

3.6 |

3.7 |

3.6 |

3.6 |

|

Write offs, tangible assets |

- |

- |

- |

- |

|

Results subsidiaries |

- |

1.0 |

- |

- |

|

Profit Before Tax |

320.1 |

9.0 |

320.1 |

23.2 |

|

Tax |

57.8 |

1.8 |

57.8 |

4.0 |

|

Net Profit |

262.3 |

7.2 |

262.3 |

19.2 |

|

EPS** (in €) |

5.71 |

0.16 |

5.71 |

0.41 |

|

EBITDA margin (%) |

65% |

25% |

65% |

42% |

* Of which fixed employee expenses were: Q120 - €11.8m; Q419 -

€11.6m; Q119 - €10.3m ** Weighted average number of shares

outstanding during Q120 was 45,913,486 with 45,527,201 number of

shares outstanding as at 31 March 2020

Management Board Comments

CEO Dennis Dijkstra stated: “Our main focus during the quarter

was on the health and wellbeing of our colleagues and their

families and ensuring the uninterrupted provision of liquidity to

market participants, in line with regulatory requirements, to help

financial markets function in an orderly manner. During the period

of extraordinary market activity following the COVID-19 outbreak,

Flow Traders’ uninterrupted presence in the market allowed

investors to continue to buy or sell ETPs or other financial

instruments and manage their risk efficiently. By providing

liquidity to markets under pressure, we enabled issuers and

counterparties to keep on trading. More liquidity leads to less

volatility and contributes to market stability. Our colleagues have

all demonstrated considerable professionalism, skill, agility and

strength during these most difficult circumstances. It is because

of our colleagues that we continue to operate fully and provide

liquidity to the market during these exceptional circumstances. Our

business continuity plan was implemented smoothly with 80% of our

workforce able to work from home in a matter of days. Moreover, our

continued investment in technology and infrastructure over the last

few years ensured that Flow Traders has a high degree of system

resiliency and was able to cope with stressed and highly active

markets. Flow Traders maintained its conservative capital position

with significant excess capital and a strong balance sheet. This

quarter also demonstrated Flow Traders’ operational leverage with

strong cost discipline.

“In these unprecedented times, we feel that it is more important

than ever to continue to contribute to society’s health and

wellbeing globally. We have already accelerated the availability of

our annual personal charitable budget and donated €2.5 million to a

select number of charitable foundations around the world, including

Erasmus MC, Voedselbank, VentilatorPAL, The Courage Fund, The

Community Chest and Mount Sinai. In addition, we will shortly

establish the Flow Traders Foundation with the aim of promoting and

funding health and wellbeing charities globally on a significant,

structured annual basis.”

Chief Trading Officer Folkert Joling added: “During the

exceptional circumstances of this past quarter, Flow Traders was

able to continuously provide liquidity and pricing to the ETP

markets on a global basis. Issuers and counterparties were

reassured by our constant presence when markets were under pressure

which enabled them to trade in all circumstances. On an ecosystem

level, we saw that exchanges functioned almost flawlessly across

the entire quarter and the ETF mechanism performed as intended.

Given the market environment, we saw substantially increased

volumes and heightened risk, as well as corresponding widening of

spreads. From a trading systems perspective, no outages or downtime

were experienced. The results and trading performance were balanced

across all trading desks this quarter, including during the intense

period in mid-March, and also reflect the focus and investment in

recent quarters on our US operation as well as in fixed

income.”

Value Traded Overview

|

€billion |

Q120 |

Q419 |

Change |

Q120 |

Q119 |

Change |

|

Flow Traders ETP Value Traded |

441.6 |

251.2 |

76% |

441.6 |

258.6 |

71% |

|

EMEA (Europe) |

232.7 |

132.4 |

76% |

232.7 |

128.7 |

81% |

|

Americas |

188.9 |

107.7 |

75% |

188.9 |

121.2 |

56% |

|

APAC ex China |

20.0 |

11.1 |

79% |

20.0 |

8.7 |

130% |

|

|

|

|

|

|

|

|

|

Flow Traders’ non-ETP Value Traded |

1,215 |

746 |

63% |

1,215 |

738 |

65% |

|

|

|

|

|

|

|

|

|

Market ETP Value Traded1 |

10,948 |

5,480 |

100% |

10,948 |

6,093 |

80% |

|

EMEA (Europe) |

679 |

388 |

75% |

679 |

355 |

91% |

|

Americas |

9,421 |

4,573 |

106% |

9,421 |

5,281 |

78% |

|

APAC |

849 |

519 |

64% |

849 |

456 |

86% |

|

|

|

|

|

|

|

|

|

APAC ex China |

476 |

201 |

137% |

476 |

217 |

119% |

1. Source - Flow Traders analysis

Business Continuity and Resilience

- Following the various additional measures implemented by

governments around the world to halt the spread of the coronavirus

(COVID-19), Flow Traders’ business continuity plan has been enacted

to its fullest extent

- Primary focus of this plan is the health and wellbeing of

employees as well as continuing to fulfil Flow Traders’ role with

respect to the undisrupted provision of liquidity globally to

investors and the market. The business continuity plan has been

implemented smoothly with a majority of employees working from home

almost immediately after activation of the plan. Split teams are

operational and back-up trading locations in Amsterdam, New York

and Hong Kong have been activated. Flow Traders trading

capabilities remained fully operational with continuous pricing and

liquidity provided to the market throughout the quarter

- Flow Traders’ robust risk management processes continued to be

highly effective as the business operated within trading limits at

all times. No loss days were recorded in the quarter and the

trading results, reflecting the levels of market activity, were

evenly distributed across regions, asset classes and trading

days

- Flow Traders has tested and retested its systems to take into

account the activation of the business continuity plan as well the

significant increase in trading activity. Flow Traders’ systems

have demonstrated a high degree of resilience

- Despite challenging market circumstances, key market

participants demonstrated considerable resilience with exchanges,

issuers, counterparties, prime brokers and regulators all

performing as intended

Annual General Meeting

·Following the

implementation of additional measures by the Government of the

Netherlands on 23 March 2020, Flow Traders announced the

postponement of the Annual General Meeting which was originally

scheduled to take place on Friday 24 April 2020. A new date for the

meeting will be announced as soon as feasible

Dividend

- Given the postponement of the Annual General Meeting, the

proposed final FY19 dividend of €0.55 will now take the form of an

interim dividend which will be paid as per the previously announced

timetable on 5 May 2020. This does not affect the 2020 interim

dividend which will be announced as part of the half-year

results

- As a result, a final dividend of €0 will be proposed at the

rescheduled Annual General Meeting, resulting in a total dividend

for FY19 of €0.90

Share Buyback

- As at 20 April 2020, the total number of shares purchased under

the €20m share buyback programme announced on 7 February 2020 is

610,119 shares at an average price of €20.43 for a total

consideration of €12.5m

- In addition, c. 200,000 shares have been purchased to satisfy

the requirements of various employee incentive plans

- 1,007,299 shares were held in treasury as at 20 April 2020

Preliminary Financial Calendar

Postponed

AGM 28 April 2020

FY19 interim dividend ex-dividend date 29 April 2020

FY19 interim dividend record date 5 May 2020

FY19 interim dividend payment date 30 June 2020

Silent period starts ahead of 1H20 results 14 August 2020

1H20 results release (incl. analyst conference call) 18 August

2020

Proposed 2020 interim dividend ex-dividend date 19 August

2020

Proposed 2020 interim dividend record date 21 August

2020

Proposed 2020 interim dividend payment date

Contact Details Flow Traders N.V. Jonathan

Berger / Investor Relations Officer Phone: +31 20 7996799

Email:

investor.relations@flowtraders.com

About Flow Traders Flow Traders is a leading

global financial technology-enabled liquidity provider in financial

products, historically specialized in Exchange Traded Products

(ETPs), now expanding into other asset classes. Flow Traders

ensures the provision of liquidity to support the uninterrupted

functioning of financial markets. This allows investors to buy or

sell ETPs or other financial instruments under all market

circumstances. We continuously grow our organization, ensuring that

our trading desks in Europe, the Americas and Asia can provide

liquidity across all major exchanges, globally, 24 hours a day.

Founded in 2004, we continue to cultivate the entrepreneurial,

innovative and team-oriented culture that has been with us since

the beginning.

Important Legal Information

This press release is prepared by Flow Traders

N.V. and is for information purposes only. It is not a

recommendation to engage in investment activities and you must not

rely on the content of this document when making any investment

decisions. The information in this document does not constitute

legal, tax, or investment advice and is not to be regarded as

investor marketing or marketing of any security or financial

instrument, or as an offer to buy or sell, or as a solicitation of

any offer to buy or sell, securities or financial instruments. The

information and materials contained in this press release are

provided ‘as is’ and Flow Traders N.V. or any of its affiliates

(“Flow Traders”) do not warrant the accuracy, adequacy or

completeness of the information and materials and expressly

disclaim liability for any errors or omissions. This press release

is not intended to be, and shall not constitute in any way a

binding or legal agreement, or impose any legal obligation on Flow

Traders. All intellectual property rights, including trademarks,

are those of their respective owners. All rights reserved. All

proprietary rights and interest in or connected with this

publication shall vest in Flow Traders. No part of it may be

redistributed or reproduced without the prior written permission of

Flow Traders. This press release may include forward-looking

statements, which are based on Flow Traders’ current expectations

and projections about future events, and are not guarantees of

future performance. Forward looking statements are statements that

are not historical facts, including statements about our beliefs

and expectations. Words such as “may”, “will”, “would”, “should”,

“expect”, “intend”, “estimate”, “anticipate”, “project”, “believe”,

“could”, “hope”, “seek”, “plan”, “foresee”, “aim”, “objective”,

“potential”, “goal” “strategy”, “target”, “continue” and similar

expressions or their negatives are used to identify these

forward-looking statements. By their nature, forward-looking

statements involve known and unknown risks, uncertainties,

assumptions and other factors because they relate to events and

depend on circumstances that will occur in the future whether or

not outside the control of Flow Traders. Such factors may cause

actual results, performance or developments to differ materially

from those expressed or implied by such forward-looking statements.

Accordingly, no undue reliance should be placed on any

forward-looking statements. Forward-looking statements speak only

as at the date at which they are made. Flow Traders expressly

disclaims any obligation or undertaking to update, review or revise

any forward-looking statements contained in this press release to

reflect any change in its expectations or any change in events,

conditions or circumstances on which such statements are based

unless required to do so by applicable law. Financial objectives

are internal objectives of Flow Traders to measure its operational

performance and should not be read as indicating that Flow Traders

is targeting such metrics for any particular fiscal year. Flow

Traders’ ability to achieve these financial objectives is

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

beyond Flow Traders’ control, and upon assumptions with respect to

future business decisions that are subject to change. As a result,

Flow Traders’ actual results may vary from these financial

objectives, and those variations may be material. Efficiencies are

net, before tax and on a run-rate basis, i.e. taking into account

the full-year impact of any measure to be undertaken before the end

of the period mentioned. The expected operating efficiencies and

cost savings were prepared on the basis of a number of assumptions,

projections and estimates, many of which depend on factors that are

beyond Flow Traders’ control. These assumptions, projections and

estimates are inherently subject to significant uncertainties and

actual results may differ, perhaps materially, from those

projected. Flow Traders cannot provide any assurance that these

assumptions are correct and that these projections and estimates

will reflect Flow Traders’ actual results of operations.

By accepting this document you agree to the

terms set out above. If you do not agree with the terms set out

above please notify legal.amsterdam@nl.flowtraders.com immediately

and delete or destroy this document.

Market Abuse Regulation

This press release contains information within the meaning of

Article 7(1) of the EU Market Abuse Regulation.

- Flow Traders Q120 Trading Update

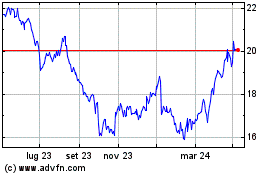

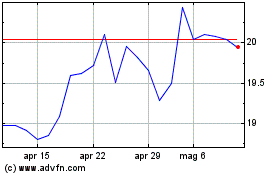

Grafico Azioni Flow Traders (EU:FLOW)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Flow Traders (EU:FLOW)

Storico

Da Feb 2024 a Feb 2025