Valeo Q3 2023 Sales

PARISOctober 26, 2023

Third-quarter sales of 5.2 billion euros, up 4% like for

like

Full-year 2023 guidance

reaffirmed

-

Sales of 5.2 billion euros, up 4% on a like-for-like basis

(LFL), including a negative currency effect of 5%

- Original

equipment sales up 4% LFL (up 14% in the first nine months of the

year on an adjusted

basis(1))

- Performance in line with

automotive production (5 percentage point outperformance in the

first nine months of the year on an adjusted

basis(1))

- 4 percentage point

outperformance by CDA (7 percentage points for ADAS)

- THS and VIS performance in line

with automotive production

- 2 percentage point

underperformance by PTS due to temporarily lower production volumes

on certain electric vehicle platforms in Europe, amplified by

significant inventory drawdowns. Other PTS activities posted a 9

percentage point outperformance (up 13% LFL)

-

Aftermarket sales up 3% LFL (up 4% in the first nine months

of the year on an adjusted

basis(1))

- Full-year

2023 guidance reaffirmed

“Valeo delivered 4% like-for-like growth in

third-quarter 2023, driven by the increase in automotive production

in our main regions (Europe and North America), the strong momentum

of the ADAS activity and the resilience of the Thermal Systems and

Lighting Systems activities. The Powertrain Systems Business Group

was impacted, however, by temporarily lower production volumes on

certain electric vehicle platforms in Europe, amplified by

significant inventory drawdowns. It recorded 1 billion euros in new

orders during the third quarter (6 billion euros since the start of

the year), which strengthens our confidence in the acceleration of

electrification. Aftermarket sales performed well during the

period, rising 3% on a like-for-like basis.

In a tighter automotive market and macroeconomic

environment, we are reaffirming our 2023 objectives, supported by

our operating efficiency action plan and new cost reduction

measures.

Our long-term vision and ambitions for Valeo remain

unchanged.

I would like to thank all our teams for their

commitment.”

Christophe Périllat, Valeo’s Chief

Executive Officer

Sales of 5,224 million euros in

third-quarter 2023, up 4% like for

like

In third-quarter 2023, automotive production

increased by 4% compared with the same period in 2022, lifted by an

increase in production volumes in Europe and North America. In

China, automotive production was stable due to an unfavorable basis

for comparison linked to the adjustment for the Covid impact over

the same period in 2022.

|

Sales(in millions of euros) |

As a % of Q3 2023 sales |

|

Q3 2023 |

|

Q3 2022 |

Change |

FX |

Scope |

LFL* change |

|

Original equipment |

85 % |

|

4,433 |

|

4,474 |

-1 % |

-5 % |

— % |

+4 % |

|

Aftermarket |

11 % |

|

569 |

|

573 |

-1 % |

-3 % |

— % |

+3 % |

|

Miscellaneous |

4 % |

|

222 |

|

212 |

+5 % |

-5 % |

— % |

+10 % |

|

Total |

100 % |

|

5,224 |

|

5,259 |

-1

% |

-5

% |

—

% |

+4

% |

*Like for like (See financial

glossary, page 7).

Total sales for third-quarter

2023 came in at 5,224 million euros, down 1 % compared with the

same period in 2022.

Changes in exchange rates had a negative 4.7%

impact, primarily due to the appreciation of the euro against the

Chinese yuan, the US dollar and the Japanese yen.

Changes in Group structure had a negligible

impact (positive 0.4%).

On a like-for-like basis, sales rose by 4 %.

Original equipment sales were

up 4 % on a like-for-like basis, driven by growth in all four

Business Groups, with growth of 8% for Comfort & Driving

Assistance Systems (11% for ADAS), 4% for Visibility Systems, 4%

for Thermal Systems and 2% for Powertrain Systems despite

temporarily lower production volumes on certain electric vehicle

platforms in Europe, amplified by significant inventory

drawdowns.

Aftermarket sales rose by 3 % on a

like-for-like basis, boosted by the increased number and age of

vehicles on the road, a more attractive offering with a shift

towards more value-added products (for example, transmissions

systems kits) and the impact of price increases.

“Miscellaneous” sales (tooling and customer contributions to

R&D) increased by 10 % like for like.

Performance in line with global

automotive production in third-quarter 2023 (outperformance of 5

percentage points in the first nine months of the year on an

adjusted basis(2))

|

Original equipment sales***(in millions of

euros) |

As a % of sales |

|

Q3 2023 |

|

Q3 2022 |

LFL* change |

Perf. ** |

|

Europe & Africa |

44 % |

|

1,966 |

|

1,877 |

+4 % |

-2 pts |

|

Asia, Middle East & Oceania |

33 % |

|

1,446 |

|

1,578 |

+3 % |

+1 pt |

| o/w Asia

(excluding China) |

16 % |

|

724 |

|

711 |

+13 % |

+9 pts |

|

o/w China |

16 % |

|

722 |

|

867 |

-5

% |

-5 pts |

|

North America |

21 % |

|

918 |

|

918 |

+7 % |

-2 pts |

|

South America |

2 % |

|

103 |

|

101 |

+2 % |

+2 pts |

|

Total |

100 % |

|

4,433 |

|

4,474 |

+4 % |

0 pt |

*Like for like(2). **Based on S&P Global

Mobility automotive production estimates released on October 16,

2023.*** Original equipment sales by destination region.

In third-quarter 2023, like-for-like growth in

original equipment sales was in line with the market:

- in

Europe and Africa, original equipment sales underperformed

automotive production by 2 percentage points. The Thermal Systems

Business Group benefited from growth in technologies for

electrified vehicles (battery cooling systems, dedicated air

conditioning systems for electrified vehicles, heat pumps, etc.).

The Visibility Systems Business Group was boosted by production

launches for several European automakers. The Powertrain Systems

Business Group’s performance was impacted by temporarily lower

production volumes on certain electric vehicle platforms in Europe,

amplified by significant inventory drawdowns. The impact of the

decline in the high-voltage electric powertrain activity was

mitigated by the growth in the Powertrain Systems Business Group’s

traditional activities, such as transmission systems and 48V;

-

in Asia, the Group outperformed automotive

production by 1 percentage point:

-

in China, original equipment sales underperformed automotive

production by 5 percentage points. The Comfort & Driving

Assistance Systems Business Group reported strong growth in front

cameras and computer-vision cameras with Chinese and international

customers. The Visibility Systems Business Group, which was

penalized by an unfavorable customer mix, will start to fully

benefit, as from the fourth quarter, from start of production on an

electrification project for a North American automaker. The Group

is also implementing a plan to reposition its customer portfolio

over the coming six-month periods to focus on players offering the

best growth prospects,

-

in Asia excluding China, Valeo recorded an outperformance of 9

percentage points, thanks to the strong momentum of the Comfort

& Driving Assistance Systems Business Group in cameras, and the

Powertrain Systems Business Group in traditional technologies for a

South Korean automaker. The Visibility Systems Business Group

benefited in Japan from the good performance of its business with a

leading Japanese automaker through its subsidiary Ichikoh;

-

in North America, original equipment sales

underperformed automotive production by 2 percentage points. The

Comfort & Driving Assistance Systems Business Group benefited

from the production ramp-up for an American automaker in ADAS,

particularly front cameras. The Thermal Systems Business Group was

impacted by the expiry of a front-end modules contract with a

Japanese automaker. The Visibility Systems Business Group will

start to fully benefit, as from the fourth quarter, from the

ramp-up of production for a newly contracted electrification

project for a North American automaker. Lastly, the impact of the

UAW strike had a negligible impact on third-quarter sales;

-

in South America, the Group outperformed

automotive production by 2 percentage points.

Segment reporting: further strong

momentum in ADAS, while the high-voltage electrification business

was impacted by temporarily lower volumes on certain electric

vehicle platforms in Europe, amplified by

significant inventory

drawdowns

The sales performance for the Business Groups

reflects the specific product, geographic and customer mix and the

relative weighting of the aftermarket in their activity as a

whole.

|

Sales by Business Group(in millions of

euros) |

Q3 2023 |

|

Q3 2022 |

Change in sales |

Change in OE sales* |

Perf. ** |

|

Comfort & Driving Assistance Systems*** |

1,158 |

|

1,120 |

+3 % |

+8 % |

+4 pts |

|

Powertrain Systems |

1,548 |

|

1,580 |

-2 % |

+2 % |

-2 pts |

|

Thermal Systems |

1,146 |

|

1,192 |

-4 % |

+4 % |

0 pt |

|

Visibility Systems |

1,280 |

|

1,322 |

-3 % |

+4 % |

0 pt |

|

Other |

92 |

|

45 |

N/A |

N/A |

N/A |

|

Group |

5,224 |

|

5,259 |

-1 % |

+4 % |

0 pt |

* Like for like(3).**Based on S&P Global

Mobility automotive production estimates released on October 16,

2023. (Q3 2023 global production growth: 4%).*** Excluding the TCM

(Top Column Module) business.

Since the start of the year, all the Business

Groups have conducted negotiations with customers in an effort to

obtain compensation for the effects of inflation, particularly on

raw materials, electronic components, wages and energy costs. At

this stage, most of the negotiations are complete, with the

exception of a few customers with whom Valeo is confident of

reaching an agreement in the fourth quarter.

The Comfort & Driving Assistance

Systems Business Group recorded an outperformance of 4

percentage points, thanks to strong growth – notably in North

America and China – for ADAS, particularly front cameras and

computer-vision cameras, strengthening its position as world

leader. In the third quarter, like-for-like original equipment

sales were up 11% for ADAS to 793 million euros and 3% for

Reinvention of the interior experience to 357 million euros.

The Powertrain Systems Business

Group’s performance was impacted by temporarily lower

production volumes on certain electric vehicle platforms in Europe,

amplified by significant inventory drawdowns (sales for the

high-voltage business represented 220 million euros for the period

compared with 321 million euros for the same period in 2022, with a

sequential improvement expected in the fourth quarter in a market

that will remain volatile). Traditional activities (transmission

systems and 48V) delivered 13% like-for-like growth, outperforming

automotive production by 9 percentage points. This helped to

mitigate the impact of the decline in the high-voltage electric

powertrain activity and to limit the Business Group’s

underperformance over the period to 2 percentage points.

Since 2021, the Group has pursued a new strategy

in the field of high-voltage electrification, aimed at diversifying

its business through new orders (10 billion euros since 2021,

including 1 billion euros in third-quarter 2023) in new production

regions with new automakers, notably North American and Asian

companies. These new orders cover all types of high-voltage

electrification technologies, including 800V SiC technology. Valeo

reaffirms its goal of achieving 4 billion euros in sales by

2030.

The Thermal Systems Business

Group performed in line with automotive production. In

Europe, the Business Group was lifted by the ramp-up of certain

platforms for manufacturing high-voltage electrified vehicles

(battery cooling systems, dedicated air conditioning systems for

electrified vehicles, heat pumps, etc.). In North America, the

Business Group was impacted by the expiry of a front-end modules

contract with a Japanese automaker.

The Visibility Systems Business

Group performed in line with automotive production. In

Europe, the Business Group benefited from production launches for

lighting projects for several European automakers. In China, the

Business Group, which was penalized by an unfavorable customer mix,

will start to fully benefit, as from the fourth quarter, from a

production launch for an electrification project for a North

American

automaker.

Full-year 2023 guidance reaffirmed

|

|

2022 (adjusted)* |

H1 2023 |

2023 guidance** reaffirmed |

Move Up 2025 |

|

Sales (in billions of euros) |

20.4 |

11.2 |

22.0 - 23.0 |

~ 27.5 |

|

EBITDA (as a % of

sales) |

11.4% |

11.6% |

11.5% - 12.3% |

~ 14.5% |

|

Operating margin (as a % of

sales) |

2.4% |

3.2% |

3.2% - 4.0% |

~ 6.5% |

|

Free cash flow |

€205m |

€(156)m*** |

> €320m |

~ €0.8 - €1bn |

* 2022 data has been adjusted as though the high-voltage

electrification business (formerly Valeo Siemens eAutomotive) had

been consolidated within the Powertrain Systems Business Group as

from January 1, 2022.** Based on S&P Global Mobility automotive

production estimates released on October 16, 2023.

*** Around 260 million euros recorded in the

first half with cash impact in the third quarter.

Upcoming events

Full-year 2023 results: February 29, 2024

Highlights

ESG

On March 31, Valeo announced

that it had published its 2022 Universal Registration Document.

Click here

On May 24, Valeo held its 2023 General

Shareholders' Meeting. Click here

On September 14, Valeo received the Jury’s

Prize at the Zepros Awards de l’Auto for its engagement and actions

in terms of sustainable development, CSR and remanufacturing. Click

here

Industrial partnership

On January 4, NTT Data, Valeo and Embotech

announced that they had formed a consortium to provide automated

parking solutions. Click here

On February 14, BMW and Valeo announced that

they had engaged in a strategic cooperation to co-develop the

next-generation Level 4 automated parking experience. Click

here

On May 17, ZutaCore and Valeo presented their

new solution for cooling of data centers at Dell Technologies World

2023. Click here

On May 23, Renault Group and Valeo announced

that they had signed a partnership in Software Defined Vehicle

development. Click here

On May 29, Valeo and DiDi Autonomous Driving

announced that they had reached a strategic cooperation and

investment agreement to jointly develop safety solutions for

robotaxis. Click here

On June 14, at VivaTech 2023 in Paris, Valeo

and Equans signed a partnership agreement to meet the challenges

facing cities. Click here

On September 4, Mobileye and Valeo launched a

partnership for world-class imaging radars. Click here

On September 25, eSTACA and Valeo signed a

partnership agreement to work together towards the mobility of

tomorrow.

Strategic and financial operations

On August 18, Valeo announced the sale of its

propulsion systems business in Russia to NPK Avtopribor. Click

here

On September 18, Valeo announced a new edition

of its share subscription offering reserved for Group employees.

Click here

On October 6, Valeo issued its first

600-million-euro green bond and welcomed the significant investment

by the European Investment Bank. Click here

Products/technologies and patents

On January 3, Valeo announced that it would be

taking part in the 2023 Consumer Electronics Show (CES) in Las

Vegas between January 3 and January 8, 2023. Click here

On January 12, Valeo announced that it would be

taking part in the 16th Auto Expo 2023 Components at Pragati Maidan

in New Delhi, India from January 12 to January 15, 2023. Click

here

On March 7, Valeo celebrated 100 years of

innovating and constantly striving to make mobility simpler, safer

and more sustainable. Click here

On March 20, Valeo announced that it would be

taking part in the 2023 Taipei Cycle Show in Taiwan between March

22 and March 25, 2023. Click here

On March 23, Valeo received an Innovation award

in the “Infrastructure and Vehicle Improvement” category from

Sécurité routière – the French national road safety authority – for

its new EverguardTM silicone wiper blades. Click here

On March 27, Valeo announced that it had been

named Supplier of the Year in the Advanced Driver Assistance

Systems (ADAS) category by General Motors at a ceremony held on

March 23, 2023. Click here

On March 28, Valeo announced that it was the

number one French patent filer with the European Patent Office

(EPO), with 588 patent applications filed in 2022. Click here

On March 30, Valeo announced it had signed two

new major contracts for its third-generation LiDAR. Click here

On April 11, Valeo announced it would be

participating for the first time, from April 12 to April 14, 2023,

in the Laval Virtual trade show, during which the Group presented

its innovations in the field, both for accelerating the design of

solutions and for in-vehicle applications. Click here

On April 14, Valeo announced it would be

participating in Auto Shanghai 2023, where presented its latest

technologies for smarter, safer and greener mobility. Click

here

On April 21, Valeo announced it would be

presenting its composite solutions at JEC World 2023, from April 25

to 27, for the third consecutive year. Click here

On May 4, at the Car Symposium 2023 (May 3-4,

2023) in Bochum, Germany, leading market participants discussed the

key trends in the automotive industry. Christophe Périllat, Valeo’s

Chief Executive Officer, was invited to give a keynote on the “Next

Steps to the Green Car”. Click here

On May 11, Valeo received awards from three

major customers for its aftermarket business. Click here

On May 16, Valeo’s LiDAR technology received

two new awards. Click here

On June 8, Valeo announced that it would be

presenting its solutions for greener, safer and affordable mobility

at the SIA Powertrain show, held in Paris on June 14 and 15. Click

here

On June 15, Valeo announced it would be

presenting at the Eurobike 2023 trade show, held from June 21 to 25

in Frankfurt. Click here

On June 21, Valeo received an award from Auto

Plus for Ineez, a simple electric charging solution adapted to

every use. Click here

On June 22, Valeo announced it would be taking

part in Rematec, the world's leading remanufacturing trade show for

industry professionals, which took place from June 27 to 29 in

Amsterdam. Click here

On June 29, Valeo announced the launch of

Canopy, the first wiper blade designed to reduce CO2 emissions.

Click here

On August 30, Valeo showcased its technologies

for the software-defined vehicle and the future of mobility at IAA

Mobility 2023. Click here

On September 4, Valeo launched Valeo anSWer,

its offer for software solutions and services on demand. Click

here

On September 11, Valeo presented its

sustainable thermal management solutions at Busworld Europe 2023.

Click here

Financial glossary

Order intake corresponds

to business awarded by automakers during the period to Valeo, and

to joint ventures and associates based on Valeo’s share in net

equity, (except Valeo Siemens eAutomotive, for which 100% of orders

are taken into account), less any cancellations, based on Valeo’s

best reasonable estimates in terms of volumes, selling prices and

project lifespans. Unaudited indicator.

Like for like (or LFL): the

currency impact is calculated by multiplying sales for the current

period by the exchange rate for the previous period. The Group

structure impact is calculated by (i) eliminating, for the current

period, sales of companies acquired during the period, (ii) adding

to the previous period full-year sales of companies acquired in the

previous period, and (iii) eliminating, for the current period and

for the comparable period, sales of companies sold during the

current or comparable period.

Adjusted data: Data for

first-half 2022 has been adjusted as though the high-voltage

electrification business (formerly Valeo Siemens eAutomotive) had

been consolidated in the Group’s financial statements as of

January 1, 2022. To calculate year-on-year changes in

sales on an adjusted basis, first-half 2022 figures have been

adjusted as though the high-voltage electrification business had

been consolidated in the Group's financial statements as of January

1, 2022.

Operating margin including share in net

earnings of equity-accounted companies corresponds to

operating income before other income and expenses.

EBITDA corresponds to (i)

operating margin before depreciation, amortization and impairment

losses (included in the operating margin) and the impact of

government subsidies and grants on non-current assets, and (ii) net

dividends from equity-accounted companies.

Free cash flow corresponds to

net cash from operating activities (excluding changes in

non-recurring sales of receivables and net payments for the

principal portion of lease liabilities) after taking into account

acquisitions and disposals of property, plant and equipment and

intangible assets.

Appendices

Year-to-date 2023 sales by type

|

Sales(in millions of euros) |

As a % of YTD 2023 sales |

|

YTD 2023 |

|

YTD 2022 |

Change |

FX |

Scope |

LFL* change |

|

YTD 2022 (adjusted) |

LFL* change (adjusted) |

|

Original equipment |

85 % |

|

13,977 |

|

12,287 |

+14 % |

-3 % |

+6 % |

+11 % |

|

12,662 |

+14 % |

|

Aftermarket |

11 % |

|

1,736 |

|

1,713 |

+1 % |

-4 % |

+1 % |

+4 % |

|

1,726 |

+4 % |

|

Miscellaneous |

4 % |

|

723 |

|

678 |

+7 % |

-3 % |

+13 % |

-4 % |

|

678 |

— % |

|

Total |

100 % |

|

16,436 |

|

14,678 |

+12

% |

-3

% |

+6

% |

+9

% |

|

15,066 |

+12

% |

* Like for like.

Year-to-date 2023 sales by destination

region

|

Original equipment sales***(in millions of

euros) |

As a % of sales |

|

YTD 2023 |

|

YTD 2022 |

LFL* change |

Perf. ** |

|

Perf. (adjusted) |

|

Europe & Africa |

48 % |

|

6,657 |

|

5,425 |

+12 % |

-2 pts |

|

+4 pts |

|

Asia, Middle East & Oceania |

31 % |

|

4,331 |

|

4,063 |

+10 % |

+3 pts |

|

+4 pts |

| o/w Asia

(excluding China) |

16 % |

|

2,254 |

|

2,012 |

+19 % |

+10 pts |

|

+11 pts |

|

o/w China |

15 % |

|

2,077 |

|

2,051 |

+2 % |

-3 pts |

|

-3 pts |

|

North America |

19 % |

|

2,702 |

|

2,532 |

+9 % |

-2 pts |

|

-2 pts |

|

South America |

2 % |

|

287 |

|

267 |

+7 % |

+1 pt |

|

+1 pt |

|

Total |

100 % |

|

13,977 |

|

12,287 |

+11 % |

+2 pts |

|

+5 pts |

*Like for like.**Based on S&P Global

Mobility automotive production estimates released on October 16,

2023.*** By destination region.

Year-to-date 2023 sales by Business Group

|

Sales by Business Group(in millions of

euros) |

YTD 2023 |

|

YTD 2022 |

Change in sales |

Change in OE sales* |

Perf. ** |

|

YTD 2022 (adjusted) |

Change in OE sales (adjusted) |

Perf.** (adjusted) |

|

Comfort & Driving Assistance Systems*** |

3,489 |

|

3,078 |

+13 % |

+16 % |

+7 pts |

|

3,078 |

+16 % |

+7 pts |

|

Powertrain Systems |

5,119 |

|

4,129 |

+24 % |

+9 % |

0 pt |

|

4,499 |

+20 % |

+11 pts |

|

Thermal Systems |

3,530 |

|

3,363 |

+5 % |

+11 % |

+2 pts |

|

3,363 |

+11 % |

+2 pts |

|

Visibility Systems |

4,096 |

|

3,961 |

+3 % |

+9 % |

0 pt |

|

3,961 |

+9 % |

0 pt |

|

Other |

202 |

|

147 |

N/A |

N/A |

N/A |

|

147 |

N/A |

N/A |

|

Group |

16,436 |

|

14,678 |

+12 % |

+11 % |

+2 pts |

|

15,048 |

+14 % |

+5 pts |

* Like for like. **Based on S&P Global

Mobility automotive production estimates released on October 16,

2023. (YTD global production growth: 9%).*** Excluding the TCM (Top

Column Module) business.

Year-to-date 2023 original equipment sales by

customer

|

Customers |

YTD 2023 |

|

YTD 2022 |

|

German |

33 % |

|

31 % |

|

Asian |

31 % |

|

31 % |

|

American |

17 % |

|

19 % |

|

French |

13 % |

|

13 % |

|

Other |

6 % |

|

6 % |

|

Total |

100 % |

|

100 % |

Year-to-date 2023 original equipment sales by

region

|

Production regions |

YTD 2023 |

|

YTD 2022 |

|

Western Europe |

30 % |

|

29 % |

|

Eastern Europe & Africa |

18 % |

|

16 % |

|

China |

16 % |

|

18 % |

|

Asia excluding China |

15 % |

|

15 % |

|

United States & Canada |

7 % |

|

8 % |

|

Mexico |

12 % |

|

12 % |

|

South America |

2 % |

|

2 % |

|

Total |

100 % |

|

100 % |

| Asia and

emerging countries |

63 % |

|

63 % |

Safe Harbor Statement

Statements contained in this document, which are

not historical fact, constitute “forward-looking statements”. These

statements include projections and estimates and their underlying

assumptions, statements regarding projects, objectives, intentions

and expectations with respect to future financial results, events,

operations, services, product development and potential, and

statements regarding future performance. Even though Valeo’s

Management feels that the forward-looking statements are reasonable

as at the date of this document, investors are put on notice that

the forward-looking statements are subject to numerous factors,

risks and uncertainties that are difficult to predict and generally

beyond Valeo’s control, which could cause actual results and events

to differ materially from those expressed or projected in the

forward-looking statements. Such factors include, among others, the

Company’s ability to generate cost savings or manufacturing

efficiencies to offset or exceed contractually or competitively

required price reductions. The risks and uncertainties to which

Valeo is exposed mainly comprise the risks resulting from the

investigations currently being carried out by the antitrust

authorities as identified in the Universal Registration Document,

risks which relate to being a supplier in the automotive industry

and to the development of new products and risks due to certain

global and regional economic conditions. It is also exposed to

environmental and industrial risks, risks associated with the

Covid-19 epidemic, risks related to the Group’s supply of

electronic components and the rise in raw material prices, risks

related to the Russia-Ukraine conflict, as well as risks and

uncertainties described or identified in the public documents

submitted by Valeo to the French financial markets authority

(Autorité des marchés financiers – AMF), including those set out in

the “Risk Factors” section of the 2022 Universal Registration

Document registered with the AMF on March 30, 2023 (under number

D.23-0200).

The Company assumes no responsibility for any

analyses issued by analysts and any other information prepared by

third parties which may be used in this document. Valeo does not

intend or assume any obligation to review or to confirm the

estimates issued by analysts or to update any forward-looking

statements to reflect events or circumstances which occur

subsequent to the date of this document.

About ValeoAs a technology company and partner

to all automakers and new mobility players, Valeo is innovating to

make mobility cleaner, safer and smarter. Valeo enjoys

technological and industrial leadership in electrification, driving

assistance systems, reinvention of the interior experience and

lighting everywhere. These four areas, vital to the transformation

of mobility, are the Group's growth drivers.Valeo in figures: 20

billion euros in sales in 2022 | 109,900 employees at December 31,

2022 | 29 countries, 183 plants, 21 research centers,

44 development centers, 18 distribution platforms.Valeo is

listed on the Paris Stock Exchange.

VALEO100, rue de

Courcelles,75017 Paris,

Francewww.valeo.com

Media RelationsDora

Khosrof | +33 7 61 52 82 75Caroline De Gezelle | +

33 7 62 44 17

85press-contact.mailbox@valeo.com

Investor Relations+33 1

40 55 37

93valeo.corporateaccess.mailbox@valeo.com

(1) Data for first-half 2022 has been adjusted as though the

high-voltage electrification business (formerly Valeo Siemens

eAutomotive) had been consolidated within the Powertrain Systems

Business Group as from January 1, 2022.(2) (See financial glossary,

page 7). (3) (See financial glossary, page 7).

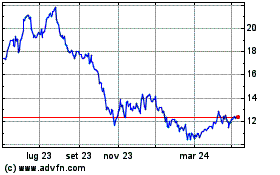

Grafico Azioni Valeo (EU:FR)

Storico

Da Ott 2024 a Nov 2024

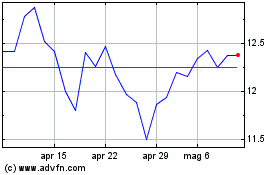

Grafico Azioni Valeo (EU:FR)

Storico

Da Nov 2023 a Nov 2024