HighCo: Q2 2024 Gross Profit

Aix-en-Provence, 18 July 2024

(6 p.m.)

HIGHCO: BUSINESS DECLINE IN Q2 2024

(GROSS PROFIT DOWN 1.6% LFL); STABLE ESTIMATED HALF-YEAR

EARNINGS; 2024 GUIDANCE REITERATED

Business decline in Q2 2024 in line with

expectations

- Q2 2024 gross

profit1 of €18.84 m, down 1.6%

LFL2.

- H1 2024 gross

profit1 of €37.7 m, down slightly by 0.6%

LFL2.

- Decline in

businesses in France (Q2 down 1.3% LFL; H1 unchanged LFL) and in

International businesses (Q2 down 4.1% LFL; H1 down 4.7% LFL).

2024 Half-year earnings: Forecast of

stable HPBIT3 and

operating margin3

Casino: ongoing talks

Additional investment in

RetailTech

2024 Guidance reiterated

- Drop in gross

profit of about 10%.

- Operating margin

of more than 15%.

|

Gross Profit

(€ m)1 |

2024 |

2023 LFL2 |

2024/2023

LFL2

change |

|

Q1 |

18.85 |

18.77 |

+0.5% |

|

Q2 |

18.84 |

19.15 |

-1.6% |

|

H1 |

37.70 |

37.92 |

-0.6% |

1 Limited audit by the Statutory Auditors

currently in progress.

2 Like for like: Based on a comparable scope and at constant

exchange rates (i.e. applying the average exchange rate over the

period to data from the compared period). Furthermore, in

application of IFRS 5 – Non-current Assets Held for Sale and

Discontinued Operations, the activities of High Connexion Italy

were reported as discontinued operations as of the fourth quarter

of 2023. For reasons of consistency, the data reported for the

first half of 2023 has been restated to account for the impact of

High Connexion Italy.

3 Headline PBIT: Profit before interest, tax and restructuring

costs. Operating margin: Headline PBIT/Gross profit.

Didier Chabassieu, Chairman of the Management

Board, stated, “HighCo’s performance in the first part of 2024

is in line with forecasts. The second quarter confirmed the growth

trend in the Activation division and the decline in the marketing

and communication consulting and ad-selling businesses. Based on

this half-year performance, along with the strong decline expected

in our ad-selling business over the second half of the year, due to

finalisation of the sale of Casino stores, we have maintained our

guidance for 2024.”

BUSINESS DECLINE IN Q2 2024 IN LINE WITH

EXPECTATIONS

Following a stable first quarter in 2024 (up

0.5% LFL), HighCo posted gross profit of €18.84 m,

showing a decline in Q2 2024 (down

1.6% LFL).

This business performance is due to:

- Sharp growth in the

Activation division (up 8.7%

LFL), due to the significant increase in the number of

coupons processed in France and the very positive trend in the

promotion management businesses;

- Stability in the

Mobile division (down 0.9% LFL),

resulting from further growth in SMS push notification activity and

a slowdown in Mobile consulting businesses;

- Expected decline in the

Retail Consulting & Advertising division

(down 15.1% LFL).

As a result, in H1 2024 the

Activation division (53.8% of the Group’s gross

profit) grew by 10.9%, while the

Mobile division (20.8% of the Group’s gross

profit) fell by 7.4% and the Retail

Consulting & Advertising division (25.5% of the

Group’s gross profit) also fell, by 14.2%.

Group revenue for H1 2024 came out at

€77 m.

Businesses in France

FRANCE

|

Gross Profit (€ m) |

2024/2023 LFL change

|

% Total gross profit

|

|

2024 |

2023 LFL |

|

Q1 |

16.52 |

16.30 |

+1.3% |

87.6% |

|

Q2 |

16.66 |

16.87 |

-1.3% |

88.4% |

|

H1 |

33.18 |

33.18 |

0% |

88.0% |

In France, Q2 2024 gross profit

fell by 1.3% to €16.66 m. This performance is the

result of strong processing activities for coupons

and other promotional offers but was

counter-balanced by the decline, as anticipated, in the

Mobile consulting and Retail Consulting & Advertising

divisions.

In H1 2024, business in France was

stable, accounting for 88% of the Group’s gross profit.

Trends in business performance are largely comparable between the

two first quarters of the year.

International businesses

INTERNATIONAL

|

Gross Profit (€ m) |

2024/2023 LFL change

|

% Total gross profit

|

|

2024 |

2023 LFL |

|

Q1 |

2.33 |

2.46 |

-5.2% |

12.4% |

|

Q2 |

2.18 |

2.28 |

-4.1% |

11.6% |

|

H1 |

4.52 |

4.74 |

-4.7% |

12.0% |

In International businesses,

Q2 2024 gross profit fell (down 4.1% LFL) to

€2.18 m.

In Belgium, gross profit fell by

4.9% due to the decline in coupon processing, which was

partially offset by the positive trend in traditional promotions

management.

Businesses in Spain showed growth (up 2.3%) and

accounted for 1.3% of the Group’s gross profit.

In H1 2024, International

businesses declined by 4.7% to €4.52 m, accounting

for 12% of the Group’s gross profit.

FORECAST OF STABLE 2024 HALF-YEAR EARNINGS

Based on the half-year closing in progress,

the Group forecasts:

- Stable headline

PBIT3 (H1 2023 restated:

€9.62 m);

- Stable operating

margin3 (H1 2023 restated:

25.4%).

The 2024 half-year earnings will be released on

Wednesday, 11 September after market close. A conference call

for financial analysts is scheduled for Thursday, 12 September

at 10 a.m.

CASINO: ONGOING TALKS

The decline in business with the Casino group reported in the

first half of the year is in line with forecasts.

In parallel, HighCo is continuing its discussions with Casino’s new

executive management to redefine the scope of collaboration for

2025 and 2026.

ADDITIONAL INVESTMENT IN RETAILTECH

HighCo announced that, on 24 June, it finalised the

acquisition of minority shares in the startup

RetailTech, whose SaaS platform

can be used by retailers to

digitise and centralise their promotional

processes. After purchasing an initial minority stake of

29% in April 2022, the Group increased its share ownership to

58%, giving it a controlling interest in the company. RetailTech,

until now accounted for as an associate, will be fully consolidated

within the Group as a result of the deal.

2024 GUIDANCE REITERATED

Based on its reported business activity in

Q2 2024 and its forecast of stable half-year earnings, the

Group reiterates its guidance for 2024:

- Decrease in gross profit of

about 10% (2023 gross profit: €74.35 m);

- Operating margin

(headline PBIT/gross profit) of more than 15%

(2023 operating margin: 22.1%).

About HighCo

As an expert marketing and

communication, HighCo supports brands and retailers in accelerating

the transformation of retail.

Listed in compartment C of Euronext Paris, and eligible

for SME equity savings plans (“PEA-PME”), HighCo has nearly

500 employees.

HighCo has achieved a Gold rating from EcoVadis,

meaning that the Group is ranked in the top 5% of companies in

terms of CSR performance and responsible

purchasing.

Your contacts

Cécile

Collina-Hue Nicolas

Cassar

Managing

Director Press

Relations

+33 1 77 75 65

06 +33

4 88 71 35 46

comfi@highco.com n.cassar@highco.com

Upcoming events

Publications take place after market

close.

2024 Half-year Earnings: Wednesday, 11 September

2024

Conference call on 2024 half-year earnings: Thursday, 12 September

2024 at 10 a.m.

Q3 and 9-month YTD 2024 Gross Profit: Wednesday, 16 October

2024

Q4 and FY 2024 Gross Profit: Wednesday, 22 January 2025

HighCo is a component stock of the indices

CAC® Small (CACS),

CAC® Mid&Small (CACMS),

CAC® All-Tradable (CACT),

Euronext® Tech Croissance (FRTPR) and

Enternext® PEA-PME 150

(ENPME).

ISIN: FR0000054231

Reuters: HIGH.PA

Bloomberg: HCO FP

For further financial information and press releases, go

to www.highco.com.

This English

translation is for the convenience of English-speaking readers.

Consequently, the translation may not be relied upon to sustain any

legal claim, nor should it be used as the basis of any legal

opinion. HighCo expressly disclaims all liability for any

inaccuracy herein.

- HighCo CP T2 2024_FR_VDEF_EN

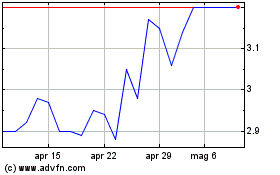

Grafico Azioni High (EU:HCO)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni High (EU:HCO)

Storico

Da Nov 2023 a Nov 2024