Maurel & Prom : Sales for the first half of 2018: US$237m (€196m)

27 Luglio 2018 - 5:48PM

Paris, 27 July

2018

No. 08-18

Sales for the

first half of 2018: US$237m (€196m)

Sales for the

first half of 2018

|

|

|

|

|

|

|

|

|

Q1 2018 |

Q2 2018 |

|

H1 2018 |

|

H1 2017 |

H1 2018

vs H1 2017 change |

|

|

|

|

|

|

|

|

| Amounts sold over the period, M&P working

interest |

|

|

|

|

|

|

|

| millions of

barrels of oil |

1.7 |

1.4 |

|

3.1 |

|

3.3 |

-6% |

| million

MMBTU |

3.4 |

3.7 |

|

7.1 |

|

3.3 |

+115% |

|

|

|

|

|

|

|

|

| Average sale price |

|

|

|

|

|

|

|

| Oil, in

US$/bbl |

66.3 |

73.0 |

|

69.2 |

|

50.7 |

+36% |

| Gas, in

US$/BTU |

3.18 |

3.17 |

|

3.17 |

|

3.19 |

-1% |

|

|

|

|

|

|

|

|

| €/US$ exchange rate |

1.23 |

1.19 |

|

1.21 |

|

1.08 |

+12% |

|

|

|

|

|

|

|

|

|

| SALES (in US$m) |

|

|

|

|

|

|

|

| Oil production |

124 |

107 |

|

231 |

|

178 |

+30% |

| Gabon |

115 |

98 |

|

213 |

|

169 |

|

|

Tanzania |

9 |

9 |

|

18 |

|

9 |

|

| Drilling activities |

4 |

2 |

|

6 |

|

8 |

-25% |

| Consolidated sales (in US$m) |

128 |

109 |

|

237 |

|

186 |

+27% |

| Consolidated sales (in €m) |

104 |

92 |

|

196 |

|

172 |

+14% |

|

|

|

|

|

|

|

|

The increase in sales compared to

H1 2017 was largely due to the substantial rise in the average sale

price of oil produced in Gabon (US$69.2/bbl, 36% higher than in H1

2017).

The entry into force of IFRS 15,

mandatory from 1 January 2018, led the Group to change the way it

recognises sales. Instead of being based on the Group's

entitlements on the production delivered to the oil terminals

("entitlement method"), they are now calculated based on liftings

during the period. In accordance with IFRS 15, this change in

accounting method was applied prospectively, without restating

comparative periods. The effect on sales in first-half 2018 in

Gabon was positive to the tune of some US$18 million, with lifted

volumes exceeding production.

Hydrocarbon

production for the first half of 2018:

|

|

|

|

|

|

|

|

|

|

|

Q1 2018 |

Q2 2018 |

|

H1 2018 |

|

H1 2017 |

H1 2018

vs H1 2017 change |

|

|

|

|

|

|

|

|

|

| Production operated by Maurel & Prom (100%) |

|

|

|

|

|

|

|

|

|

Oil |

bopd |

23,975 |

19,173 |

|

21,561 |

|

24,705 |

-13% |

|

Gas |

MMcf/d |

77.0 |

81.6 |

|

79.3 |

|

36.9 |

+115% |

| TOTAL |

boepd |

36,804 |

32,778 |

|

34,780 |

|

30,860 |

+13% |

|

|

|

|

|

|

|

|

|

|

Maurel & Prom

working interest production |

|

|

|

|

|

|

|

|

|

Oil |

bopd |

19,180 |

15,338 |

|

17,249 |

|

19,764 |

-13% |

|

Gas |

MMcf/d |

37.0 |

39.2 |

|

38.1 |

|

17.8 |

+115% |

| TOTAL |

boepd |

25,346 |

21,877 |

|

23,602 |

|

22,723 |

+4% |

|

|

|

|

|

|

|

|

|

In the first half of 2018,

operated oil production in Gabon stood at 21,561 bopd (17,249 bopd

net to M&P's working interest), down 13% compared to the same

period in 2017. Following pressure increases in the export

pipeline, the operator requested that evacuation of oil volumes be

limited from mid-May. After consultation with partners, a

progressive return to normal production levels started in early

July.

Drilling activities to support the

production profile and offset the fields' natural depletion

resumed. However, the restart the drilling rigs after a three-year

shutdown took longer than originally anticipated, and two of the

eleven wells planned for 2018 have been drilled to date. An

additional rig will soon be put into action to make up for the

delay in the initial drilling schedule in the second half of the

year. A positive impact on production is expected by the end of the

year.

In Tanzania, average operated

production was around 79.3 MMcf/d at 100%, equivalent to 38.1

MMcf/d for M&P's working interest (48.06%). Since February

2018, the monthly average operated production level has exceeded 80

MMcf/d, rising steadily to reach a level of 89 MMcf/d in June

2018.

For more information, visit

www.maureletprom.fr

Contacts

MAUREL &

PROM

Press, shareholder and investor relations

Tel: +33 (0)1 53 83 16

45

ir@maureletprom.fr

NewCap

Financial communications and investor relations

Julie Coulot/Louis-Victor Delouvrier

Tel: +33 (0)1 44 71 98

53

maureletprom@newcap.eu

Media relations

Nicolas Merigeau

Tel: +33 (0)1 44 71 94 98

maureletprom@newcap.eu

This document may

contain forward-looking statements regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By nature, forward-looking statements contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

projections are based on assumptions we believe to be reasonable,

but which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for

trading on Euronext Paris

CAC All-Share - CAC Oil & Gas - Next 150 - PEA-PME and SRD

eligible

Isin FR0000051070 / Bloomberg MAU.FP / Reuters MAUP.PA

MaureletProm_CA_HYR2018_27072018

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Maurel & Prom via Globenewswire

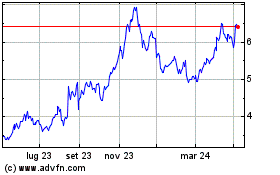

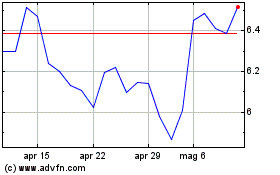

Grafico Azioni Maurel Et Prom (EU:MAU)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Maurel Et Prom (EU:MAU)

Storico

Da Nov 2023 a Nov 2024