LVMH: Good results for LVMH in the first half of the year despite

the prevailing environment

Paris, July 23, 2024

LVMH Moët Hennessy Louis Vuitton, the world’s

leading high-quality products group, recorded revenue of €41.7

billion in the first half of 2024. Growth continued over the period

(2% organic growth) despite a geopolitical and economic environment

that remained uncertain. Europe and the United States achieved

growth on a constant consolidation scope and currency basis; Japan

recorded double-digit revenue growth; the rest of Asia reflected

the strong growth in spending by Chinese customers in Europe and

Japan. In the second quarter, organic revenue growth was 1%.

Profit from recurring operations for the first

half of 2024 came to €10.7 billion, equating to an operating

margin of 25.6%, significantly exceeding pre-Covid levels. Exchange

rate fluctuations had a substantial negative impact on the

half-year period. The Group share of net profit amounted to

€7.3 billion.

Bernard Arnault, Chairman and CEO of LVMH,

commented: “The results for the first half of the year reflect

LVMH’s remarkable resilience, backed by the strength of its Maisons

and the responsiveness of its teams in a climate of economic and

geopolitical uncertainty. Driven as ever by our dual focus on

desirability and responsibility, we have continued to work towards

achieving the targets set out in our environmental and social

action programs. In a year marked by our partnership with the Paris

2024 Olympic and Paralympic Games, we are honored to share our

creativity, excellent craftsmanship and deep commitment to society

to make this event a resounding success and an opportunity for

France to shine on the world stage. While remaining vigilant in the

current context, the Group approaches the second half of the year

with confidence, and will count on the agility and talent of its

teams to further strengthen its global leadership position in

luxury goods in 2024.”

Highlights of the first half of 2024 included

the following:

- Continued organic revenue growth.

- Substantial negative impact of exchange rate fluctuations,

particularly on Fashion & Leather Goods.

- Growth in revenue in Europe and the United States, exceptional

growth in Japan arising in particular from purchases made by

Chinese travelers.

- Performance of Wines & Spirits reflecting the ongoing

normalization of demand that began in 2023.

- Good resilience in Fashion & Leather Goods, which saw its

operating margin remain at an exceptional level, especially for

flagship brands Louis Vuitton and Christian Dior.

- Rapid growth in fragrances and makeup, and ongoing success of

our Maisons’ iconic lines.

- Powerful creative momentum at all the Watches & Jewelry

Maisons, and sustained investments in communications and in

renovating stores.

- Exceptional performance by Sephora, which consolidated its

position as world leader in beauty retail.

- Significant increase in operating free cash flow, which came to

more than €3 billion.

Financial highlights

|

In millions of euros |

First-half

2023 |

First-half

2024 |

% Change |

|

Revenue |

42 240 |

41 677 |

-1% |

|

Profit from recurring operations |

11 574 |

10 653 |

-8% |

|

Net profit, Group share |

8 481 |

7 267 |

-14% |

|

Operating free cash flow |

1 797 |

3 130 |

+74% |

|

Net financial debt |

12 465 |

12 158 |

-2% |

|

Equity |

59 449 |

66 480 |

+12% |

Revenue by business group changed

as follows:

|

In millions of euros |

First-half

2023 |

First-half

2024 |

% Change

Reported Organic* |

|

Wines & Spirits |

3 181 |

2 807 |

-12% |

-9% |

|

Fashion & Leather Goods |

21 162 |

20 771 |

-2% |

+1% |

|

Perfumes & Cosmetics |

4 028 |

4 136 |

+3% |

+6% |

|

Watches & Jewelry |

5 427 |

5 150 |

-5% |

-3% |

|

Selective Retailing |

8 355 |

8 632 |

+3% |

+8% |

|

Other activities and eliminations |

87 |

181 |

- |

- |

|

Total LVMH |

42 240 |

41 677 |

-1% |

+2% |

* On a constant consolidation scope and

currency basis. For the Group, the impact of changes in scope

compared with the first half of 2023 was

negligible and the exchange rate impact was -3%.

Profit from recurring operations

by business group changed as follows:

|

In millions of euros |

First-half

2023 |

First-half

2024 |

% Change |

|

Wines & Spirits |

1 046 |

777 |

-26% |

|

Fashion & Leather Goods |

8 562 |

8 058 |

-6% |

|

Perfumes & Cosmetics |

446 |

445 |

0% |

|

Watches & Jewelry |

1 089 |

877 |

-19% |

|

Selective Retailing |

734 |

785 |

+7% |

|

Other activities and eliminations |

(303) |

(289) |

- |

|

Total LVMH |

11 574 |

10 653 |

-8% |

Wines & Spirits: Gradual recovery in

cognac in the United States; cautious management of inventory

levels among distributors

The Wines & Spirits

business group saw a revenue decline (-9% organic) in the first

half of 2024. Profit from recurring operations was down 26%.

Champagne was down, reflecting the ongoing normalization of

post-Covid demand, but remained significantly higher than in 2019.

Moreover, the beginning of the year was compared to a good first

half of 2023. Hennessy cognac was held back by weak local demand in

the Chinese market, while the United States saw a return to growth

in sales volumes in the second quarter, in a market that remained

cautious. In Provence rosé wines, Château d’Esclans stepped up its

international expansion while the prestigious Minuty estate was

consolidated for the first time in the accounts.

Fashion & Leather Goods: Continued

growth on a high basis of comparison; operating margin remained at

an exceptional level

The Fashion & Leather Goods

business group recorded organic revenue growth of 1% in the first

half of 2024. Profit from recurring operations was down 6%. The

operating margin remained at historically high levels. Louis

Vuitton had a good start to the year, once again driven by its

successful high-quality strategy. Nicolas Ghesquière’s Fall/Winter

fashion show was the opportunity to celebrate ten years of his

visionary designs at the Maison. Pharrell Williams celebrated Louis

Vuitton’s spirit of travel at his latest fashion show, entitled

“The World is Yours”, held at UNESCO’s headquarters in Paris. The

Maison unveiled the latest chapter of its iconic Core Values

campaign, featuring tennis champions Roger Federer and Rafael

Nadal. Christian Dior continued to show remarkable creative

momentum, driven by the desirability of collections designed by

Maria Grazia Chiuri and Kim Jones, whose fashion shows attracted a

record number of viewers. The show presenting the 2025 Women’s

Cruise collection at Drummond Castle in Scotland, showcasing

traditional Scottish craftsmanship, received an extraordinary

welcome. The Diorama high jewelry collection presented in

Florence showcased Victoire de Castellane’s exquisite

craftsmanship. The opening in Geneva of an exceptional store

designed by architect Christian de Portzamparc was a highlight of

the half-year period. Following the success of the leather goods

Triomphe line designed by Hedi Slimane, Celine benefited

from growing demand for its accessories. Loewe launched its first

major exhibition in Shanghai, commissioned by Jonathan Anderson, as

a tribute to the Maison’s Spanish heritage and its commitment to

craftsmanship. Fendi launched the Pequin line,

reinterpreting the Maison’s signature stripe. Loro Piana and Rimowa

confirmed their excellent momentum. Berluti experienced a good

start to the year.

Perfumes & Cosmetics: Solid momentum

in fragrances and makeup; selective distribution strategy

maintained

The Perfumes & Cosmetics

business group recorded organic revenue growth of 6% in the first

half of 2024 thanks to the ongoing success of its flagship lines,

combined with powerful innovative momentum and a selective

distribution policy. Profit from recurring operations remained

stable. Christian Dior turned in a solid performance in all product

categories and reinforced its leadership position in its strategic

markets. Sauvage confirmed its position as the world’s

leading fragrance, while the Maison’s iconic women’s perfume

J’adore saw ongoing success. The new Miss Dior

Parfum edition achieved strong growth. Makeup and skincare

also contributed to the Maison’s good results, in particular

Rouge Dior and Capture Totale. Guerlain enjoyed

the strong performance of its fragrance innovations, in particular

Néroli Plein Sud in its L’Art et la Matière

collection of exceptional fragrances. Givenchy continued to see

growth, driven by its L’Interdit fragrance. Benefit added

new brow products to its Precisely, My Brow collection

while Fenty Beauty launched a new range of haircare products and

expanded its retail presence in China.

Watches & Jewelry: Sustained

innovation in jewelry and watches; ongoing store renovation

program, in particular at Tiffany & Co.

The Watches & Jewelry

business group saw a revenue decline (-3% organic) in the first

half of 2024. Profit from recurring operations was down 19%,

heavily affected by exchange rate fluctuations. Tiffany & Co.

continued to showcase its iconic lines through initiatives

including a new campaign that received an excellent welcome. The

new Tiffany Titan by Pharrell Williams collection

generated an exceptional level of interest. Céleste – the

2024 Blue Book high jewelry line, unveiled in Beverly

Hills in May – drew inspiration from the boundless imagination of

Jean Schlumberger. Bulgari celebrated its 140th anniversary with

the “Eternally Reborn” campaign, and presented the new

Aeterna high jewelry collection in Rome, which achieved

record-breaking revenue. Chaumet unveiled the medals for the Paris

2024 Olympic and Paralympic Games, created by its design studio. In

watches, TAG Heuer strengthened its ties with sports, particularly

motor sports with the successful relaunch of its historic

Formula 1 collection. Hublot reaffirmed its

pioneering role in the art world with a pocket watch designed in

collaboration with Daniel Arsham. LVMH Watch Week – now a leading

event on the international watch scene – was a major success. LVMH

announced the acquisition of prestigious high-end Swiss clock

manufacturer L’Epée 1839.

Selective Retailing: Remarkable

performance by Sephora; DFS still held back by

prevailing international

conditions

In Selective Retailing, organic

revenue growth was 8% in the first half of 2024. Profit from

recurring operations was up 7%. Sephora achieved remarkable growth

and continued to gain market share, reaffirming the brand’s

strength and the powerful draw of its unique approach within the

prestige beauty market, as well as its position as the world’s

leading fragrance and cosmetics retailer. North America, Europe and

the Middle East continued to see strong growth. DFS saw business

activity remain below its 2019 pre-Covid level, with marked

differences in tourist traffic between its various destinations. Le

Bon Marché continued to achieve growth, driven by the department

store’s differentiation strategy, with its continuously renewed

selection of products and services and unique slate of events.

2024 Outlook

In an uncertain geopolitical and economic

environment, the Group remains confident and will maintain a

strategy focused on continuously enhancing the desirability of its

brands, drawing on the exceptional quality of its products and

excellence in retail.

Our strategy of focusing on the highest quality across all of our

activities, combined with the energy and unparalleled creativity of

our teams, will enable us to reinforce the LVMH Group’s global

leadership position in luxury goods once again in 2024.

An interim dividend of €5.50 will be paid on

Wednesday, December 4, 2024.

Regulated information related to this press

release, the presentation of half-year results and the Interim

Financial Report are available at

www.lvmh.com.

Limited review procedures have been carried out and the related

report will be issued following the Board of Directors’

meeting.

Details from the webcast on the publication of

2024 half-year results are available at

www.lvmh.com.

APPENDIX

The condensed consolidated financial statements

for the first half of 2024 are included in the PDF version of the

press release.

LVMH – Revenue by business group and by

quarter

Revenue for 2024 (in millions of

euros)

|

2024 |

Wines &

Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches &

Jewelry |

Selective Retailing |

Other activities

and eliminations |

Total |

|

First quarter |

1 417 |

10 490 |

2 182 |

2 466 |

4 175 |

(36) |

20 694 |

|

Second quarter |

1 391 |

10 281 |

1 953 |

2 685 |

4 457 |

216 |

20 983 |

|

First half |

2 807 |

20 771 |

4 136 |

5 150 |

8 632 |

181 |

41 677 |

Revenue for 2024 (organic growth versus

same period in 2023)

|

2024 |

Wines &

Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches &

Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

-12% |

+2% |

+7% |

-2% |

+11% |

- |

+3% |

|

Second quarter |

-5% |

+1% |

+4% |

-4% |

+5% |

- |

+1% |

|

First half |

-9% |

+1% |

+6% |

-3% |

+8% |

- |

+2% |

Revenue for 2023 (in millions of

euros)

|

2023 |

Wines &

Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches &

Jewelry |

Selective Retailing |

Other activities

and eliminations |

Total |

|

First quarter |

1 694 |

10 728 |

2 115 |

2 589 |

3 961 |

(52) |

21 035 |

|

Second quarter |

1 486 |

10 434 |

1 913 |

2 839 |

4 394 |

140 |

21 206 |

|

First half |

3 181 |

21 162 |

4 028 |

5 427 |

8 355 |

87 |

42 240 |

Alternative performance

measures

For the purposes of its financial communications, in addition to

the accounting aggregates defined by IAS/IFRS, LVMH uses

alternative performance measures established in accordance with AMF

position DOC-2015-12.

The table below lists these performance measures and the reference

to their definition and their reconciliation with the aggregates

defined by IAS/IFRS in the published documents.

|

Performance measures |

Reference to published documents |

|

Operating free cash flow |

URD (consolidated financial statements, consolidated cash flow

statement) |

|

Net financial debt |

URD (Notes 1.22 and 19 to the consolidated financial

statements) |

|

Gearing |

URD (Part 2, “Comments on the consolidated balance sheet”) |

|

Organic growth |

URD (Part 1, “Comments on the consolidated income statement”) |

URD: Universal Registration Document as of

December 31, 2023

LVMH

LVMH Moët Hennessy Louis Vuitton is represented in Wines and

Spirits by a portfolio of brands that includes Moët & Chandon,

Dom Pérignon, Veuve Clicquot, Krug, Ruinart, Mercier, Château

d’Yquem, Domaine du Clos des Lambrays, Château Cheval Blanc, Colgin

Cellars, Hennessy, Glenmorangie, Ardbeg, Belvedere, Woodinville,

Volcán de Mi Tierra, Chandon, Cloudy Bay, Terrazas de los Andes,

Cheval des Andes, Newton, Bodega Numanthia, Ao Yun, Château

d’Esclans, Château Galoupet, Joseph Phelps and Château Minuty. Its

Fashion and Leather Goods division includes Louis Vuitton,

Christian Dior, Celine, Loewe, Kenzo, Givenchy, Fendi, Emilio

Pucci, Marc Jacobs, Berluti, Loro Piana, RIMOWA, Patou, Barton

Perreira and Vuarnet. LVMH is present in the Perfumes and Cosmetics

sector with Parfums Christian Dior, Guerlain, Parfums Givenchy,

Kenzo Parfums, Perfumes Loewe, Benefit Cosmetics, Make Up For Ever,

Acqua di Parma, Fresh, Fenty Beauty by Rihanna, Maison Francis

Kurkdjian and Officine Universelle Buly. LVMH's Watches and Jewelry

division comprises Bulgari, Tiffany & Co., TAG Heuer,

Chaumet, Zenith, Fred and Hublot. LVMH is also active in selective

retailing as well as in other activities through DFS, Sephora, Le

Bon Marché, La Samaritaine, Groupe Les Echos, Cova, Le Jardin

d’Acclimatation, Royal Van Lent, Belmond and Cheval Blanc

hotels.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in LVMH’s

Universal Registration Document which is available on the website

(www.lvmh.com). These forward looking statements should

not be considered as a guarantee of future performance, the actual

results could differ materially from those expressed or implied by

them. The forward looking statements only reflect LVMH’s views as

of the date of this document, and LVMH does not undertake to revise

or update these forward looking statements. The forward looking

statements should be used with caution and circumspection and in no

event can LVMH and its Management be held responsible for any

investment or other decision based upon such statements. The

information in this document does not constitute an offer to sell

or an invitation to buy shares in LVMH or an invitation or

inducement to engage in any other investment

activities.”

LVMH CONTACTS

Analysts and investors

Rodolphe Ozun

LVMH

+ 33 1 44 13 27 21 |

Media

Jean-Charles Tréhan

LVMH

+ 33 1 44 13 26 20 |

MEDIA CONTACTS |

|

France

Charlotte Mariné / +33 6 75 30 43 91

Axelle Gadala / +33 6 89 01 07 60

Publicis Consultants

+33 1 44 82 46 05 |

France

Michel Calzaroni / + 33 6 07 34 20 14

Olivier Labesse / Hugues Schmitt / Thomas Roborel de

Climens /

+ 33 6 79 11 49 71 |

Italy

Michele Calcaterra / Matteo Steinbach

SEC and Partners

+ 39 02 6249991 |

UK

Hugh Morrison / Charlotte McMullen

Montfort Communications

+ 44 7921 881 800 |

US

Nik Deogun / Blake Sonnenshein

Brunswick Group

+ 1 212 333 3810

|

China

Daniel Jeffreys

Deluxewords

+ 44 772 212 6562

+ 86 21 80 36 04 48 |

- LVMH Half Year Results 2024

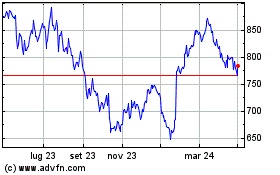

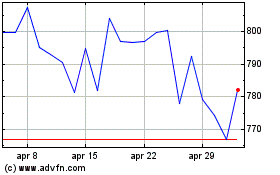

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Dic 2023 a Dic 2024