McPhy Energy: Approval by the Combined General Meeting of May 30,

2024 of the transfer of the listing of McPhy shares from Euronext

Paris to Euronext Growth Paris

Grenoble, May 30, 2024 - 6:15 pm

CEST – The Combined General Meeting of shareholders of

McPhy Energy (the "Company" or

"McPhy"), held today (the “General

Meeting”)1, approved, in accordance with the provisions of

Article L. 421-14 of the French Commercial Code, the proposed

transfer of listing of its shares from the Euronext Paris regulated

market (compartment C) to the Euronext Growth Paris multilateral

trading facility, and granted full power to the Board of Directors

to implement this transfer of listing.

The Board of Directors, which also met today

following the General Meeting, decided to implement this

transfer.

In the next few days, the Company will file an

application with Euronext Paris for the delisting of its shares

from Euronext Paris and their concomitant listing on Euronext

Growth.

Reasons for the transfer

This transfer would enable the Company to have

its shares admitted to trading on a growth market for SMEs, in line

with its current size and share profile, and would alleviate the

obligations and constraints with which it has currently to

comply.

This would enable the Company to simplify and

reduce the resources mobilized for its listing, while benefiting

from the attractiveness of Euronext Growth, a market open to both

professional and retail investors, with nearly 600 listed

companies.

Conditions of the transfer

This transfer operation involves applying to

Euronext to have the shares delisted from the Euronext Paris market

and simultaneously admitted to trading on the organized

multilateral trading facility of Euronext Growth Paris.

Subject to the agreement of Euronext Paris, this

direct listing will be carried out via an accelerated admission to

trading procedure for the Company's existing shares, without the

issuance of new shares.

The Company currently meets the eligibility

requirements for the transfer procedure, i.e. a market

capitalization of less than one billion euros and a minimum public

float of 2.5 million euros. These conditions will also have been

met on the day of the transfer request. The Company is also up to

date with its disclosure obligations on the Euronext Paris

regulated market.

Main consequences of the transfer

(non-exhaustive list)

In accordance with current regulations, McPhy

wishes to inform its shareholders of certain possible consequences

of this transfer:

Protection of minority

shareholders

Obligation to file the crossing of

thresholds. For a period of 3 years from the listing of

McPhy shares on Euronext Growth Paris, the obligation to file to

the Autorité des Marchés Financiers ("AMF") and to

McPhy the crossing of thresholds of 5%, 10%, 15%, 20%, 25%, 30%,

1/3, 50%, 2/3, 90% and 95% of McPhy's capital or voting rights will

be maintained, in accordance with article 223-15-2 of the AMF's

General Regulation. At the end of this period, only the crossing of

the thresholds of 50% and 90% of McPhy's capital or voting rights

will have to be reported to the AMF and the Company, in accordance

with Article 223-15-1 of the AMF's General Regulation, subject,

where applicable, to the crossing of statutory thresholds to be

reported to McPhy.

Public tenders. In accordance

with the provisions of article 231-1 4° of the AMF's General

Regulation, the provisions governing public tenders for shares

admitted to trading on Euronext Paris will remain applicable for a

period of 3 years from the effective date of their admission to

trading on Euronext Growth Paris. This means that a public tender

will still have to be filed if the threshold of 30% of the share

capital or voting rights is exceeded. At the end of this period,

McPhy will be subject to the regulation applicable to companies

listed on Euronext Growth Paris, and the obligation to file a

public offer will apply if the threshold of 50% of the Company's

capital or voting rights is upward crossed.

Periodic information

McPhy will publish, within 4 months of the

year-end, a report including its annual statutory and consolidated

financial statements, a management report (simplified content) and

the Statutory auditors' reports. The Company will also

publish a corporate governance report (simplified content).

McPhy will also publish, within 4 months of the

end of the first semester, a half-year report including its

consolidated financial statements and the related activity

report.

McPhy confirms that it will maintain the same

level of quality in its financial information as today and will

continue to prepare its consolidated financial statements in

accordance with IFRS standards.

Permanent information

McPhy will continue to be subject to the

provisions governing permanent information, which also apply to

companies listed on Euronext Growth Paris.

McPhy will continue to effectively disseminate

regulated information and deliver accurate, precise and truthful

information, bringing to the public's attention any information

likely to have a significant influence on the share price (inside

information), in accordance with the provisions of Regulation (EU)

No. 596-2014 of April 16, 2014 on market abuse.

In addition, the Company's executives (and

persons related to them) will remain subject to the obligation to

file any transactions they carry out involving the Company's

securities.

Governance

Board composition. The

mandatory rules on parity within the Board of Directors set out in

Articles L. 225-18-1 and L. 22-10-3 of the French Commercial Code

will no longer apply. It should be noted that McPhy could be

subject to these parity rules if it exceeds certain thresholds,

which is not currently the case.

Compensation of corporate

officers. The rules governing the compensation of

corporate officers (Say On Pay) set out in Articles L. 22-10-8 et

seq. of the French Commercial Code will no longer be mandatory.

Audit committee. The Company

will no longer be subject to the provisions of Articles L. 821-67

and seq. of the French Commercial Code (previously codified in L.

821-19 and seq. of the French Commercial Code) concerning audit

committee.

Offices of the Statutory

Auditors

The rules specific to public-interest entities,

particularly those relating to seniority limitations, the selection

of Statutory Auditors and tendering for their appointment, as set

out in Article L. 823-1 II-al. 1 of the French Commercial Code and

the provisions of Regulation (EU) n°537/2014 of April 16, 2014,

will no longer be applicable.

Liquidity of the share

As this is a non-regulated market, the Company

draws attention to the fact that the transfer to Euronext Growth

Paris could result in a different trend in the liquidity of the

shares than the one observed on the Euronext Paris regulated

market. The said transfer could also lead certain investors, who

give preference to shares of issuers listed on a regulated market,

to sell their McPhy shares.

Listing Sponsor

As part of its transfer to Euronext Growth

Paris, McPhy is supported by Swiss Life Banque Privée as Listing

Sponsor.

Indicative timetable for the transfer

(subject to approval by Euronext Paris SA):

|

June 10, 2024 |

Application filed with Euronext Paris to delist the shares from

Euronext Paris and list them on Euronext Growth Paris |

|

Starting July 24, 2024 |

- Transfer authorization by Euronext Paris SA

- Transfer information document available online

- Third press release from the Company announcing the effective

transfer dates

- Publication by Euronext of a notice of delisting of McPhy

shares from Euronext Paris (before trading)

- Publication by Euronext of a notice of listing of McPhy shares

on Euronext Growth Paris (at opening)

|

|

Earliest on July 30, 2024 |

- First listing of McPhy shares on Euronext Growth Paris

|

Listing on Euronext Growth Paris would take

place at the earliest after the expiration of a period of 2 months

from the General Meeting, i.e. at the earliest on July 30,

2024.

ABOUT MCPHY

Specialized in hydrogen production and

distribution equipment, McPhy is contributing to the global

deployment of low-carbon hydrogen as a solution for energy

transition. With its complete range of products dedicated to the

industrial, mobility and energy sectors, McPhy offers its customers

turnkey solutions adapted to their applications in industrial raw

material supply, recharging of fuel cell electric vehicles or

storage and recovery of electricity surplus based on renewable

sources. As designer, manufacturer and integrator of hydrogen

equipment since 2008, McPhy has three development, engineering and

production centers in Europe (France, Italy, Germany). Its

international subsidiaries provide broad commercial coverage for

its innovative hydrogen solutions. McPhy is listed on Euronext

Paris (compartment C, ISIN code: FR0011742329, MCPHY).

CONTACTS

|

Investor

RelationsNewCapEmmanuel HuynhT. +33 (0)1

44 71 94 99mcphy@newcap.eu |

Press RelationsDGM

conseil Pascal POGAM (p.pogam@dgm-conseil.fr / T. +33 (0)6

03 62 27 65)Sophie BODIN(s.bodin@dgm-conseil.fr / T. +33 (0)6 08 81

77 57) |

Follow-us on @McPhyEnergy

1 For further details on the General Meeting,

please refer to the related press release also published today

(https://mcphy-finance.com/index.php/en/financial-publications/press-releases).

- PR_McPhy_Transfert Euronext Growth_EN

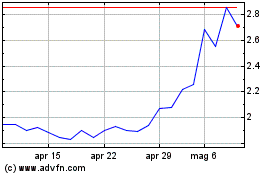

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Dic 2023 a Dic 2024