2023 Annual Results

Record results for L’Oréal in

2023

A third consecutive year of double-digit

growth1 and another year of market outperformance

Continued improvement in operating

margin

- Sales: 41.18 billion euros,

+7.6% reported and +11.0% like-for-like 1.

- Continued outperformance of a dynamic global

beauty market.

- Like-for-like growth in all Divisions with

particularly noteworthy performances in Consumer Products and

Dermatological Beauty.

- The L’Oréal Luxe Division has become the global market

leader (in sales) in luxury beauty.

- Double-digit like-for-like growth all regions

except North Asia which continued to be impacted by the market

softness in mainland China and the reset in Travel Retail.

- Continued growth in value and volume.

- Further operating

margin improvement:

19.8% (+30bps); operating profit: 8,143.3 million

euros.

- Earnings per share2: 12.08 euros, up by

+7.3%.

- Dividend3: 6.60 euros, an increase of

+10.0%.

- Net cash flow: 6.1 billion euros, up by

+23.9%.

- Creation of the €15 million L’Oréal Climate Emergency

fund to help vulnerable communities prepare for and

recover from climate disasters.

- Sustainability leader: only company in the

world to have been awarded a triple ‘A’ rating by CDP for eight

years in a row; platinum medal by EcoVadis, which ranked L’Oréal in

the global top 1% of best companies in terms of environmental and

social performance.

Commenting on the figures, Nicolas Hieronimus, CEO of L'Oréal,

said: “2023 was a very successful year for the group. I am

immensely grateful to our teams. Their creativity, entrepreneurship

and passion enabled us to report a third consecutive year of

double-digit like-for-like growth, once again outperforming a

dynamic beauty market. We set a new operating margin record and

delivered +7.3% EPS3 growth. In a challenging environment of

geopolitical tensions, inflationary pressures, and a stagnating

beauty market in China, we delivered our best like-for-like growth

in more than 20 years (excluding 2021). This is a clear vindication

of the power of our multi-polar model, and I am particularly

pleased with the strong acceleration in emerging markets. As we

head into 2024, we remain optimistic about the outlook for the

beauty market, and confident in our ability to keep outperforming

it and to achieve another year of growth in sales and profits. More

than ever, L’Oréal is looking to the future – a future that will

have Beauty Tech at its very core. Beauty Tech will shape our

industry and enable us to further strengthen our leadership. It

will allow us to know our consumers ever-better, to bring them

ever-more impactful and sustainable products and services and to

become ever-sharper in our execution.”

Board appointments, renewals and

resignations

Meeting on 8 February 2024, the Board of Directors, on the

advice of the Nominations and Governance Committee, chose to

propose Mr Jacques Ripoll as a new independent director at the

Annual General Meeting. Mr Jacques Ripoll is a partner at Eren

Groupe, which harnesses technological innovation to save natural

resources. Beyond the financial acumen he has honed over the course

of a career with leading banks including Société Générale, Banco

Santander and Crédit Agricole, Mr Jacques Ripoll will bring

strategic vision on innovation, expertise in new climate-related

technologies, and a commitment to sustainable development. He is

set to join the Audit Committee after the Annual General Meeting on

23 April 2024, further enhancing its financial and sustainability

expertise. The Board will recommend that the Annual General Meeting

renew the tenures of Ms Béatrice Guillaume-Grabisch, Ms Ilham

Kadri, Mr Jean-Victor Meyers and Mr Nicolas Meyers. The Board also

acknowledged Ms Belén Garijo's decision to step down as director

due to professional commitments, effective after the Annual General

Meeting on 23 April 2024, two years before the end of her current

term. The Board expressed deepest thanks to Ms Garijo for her

substantial contributions to the work of the Board and the Human

Resources and Remuneration Committee during her ten-year tenure. If

the Annual General Meeting approves the proposed resolutions, the

Board of Directors will continue to comprise 16 directors, i.e. 14

directors appointed by the Annual General Meeting and two directors

representing the employees.

The balance in terms of independence and gender mix will be as

follows:

- Seven independent directors out of 14 directors appointed by

the AGM, i.e. 50%;

- Six women and eight men out of 14 directors appointed by the

AGM, i.e. 43% of female directors.

The Board decided to review the composition of the Committees,

which is set out in detail in the table below. This will take

effect at the end of the Annual General Meeting, subject to the

shareholders’ vote on the appointment and renewal of the

aforementioned tenures.

Projected composition of the Board and

Committees at the end of the

Annual General Meeting to be held on

23 April 2024

|

COMPOSITION OF THE BOARD OF DIRECTORS (end

of 2024 AGM) |

Age |

F/M |

Nationality |

Expiry date of term of office |

Board Committees |

|

|

Strategy & Sustainability |

Audit |

Gov. |

HR & Rem. |

|

Corporate Officers |

Mr Jean-Paul Agon – Chairman |

67 |

M |

French |

2026 |

C |

|

|

|

|

Mr Nicolas Hieronimus – CEO |

60 |

M |

French |

2025 |

|

|

|

|

|

F. Bettencourt Meyers & Family |

Ms F. Bettencourt Meyers - Vice-Chairwoman |

70 |

F |

French |

2025 |

● |

|

● |

● |

|

Mr Jean-Victor Meyers |

37 |

M |

French |

2028 |

● |

|

|

|

|

Mr Nicolas Meyers |

35 |

M |

French |

2028 |

|

● |

|

|

|

Nestlé-related Directors |

Mr Paul Bulcke – Vice-President |

69 |

M |

Belgian/Swiss |

2025 |

● |

|

● |

● |

|

Ms Béatrice Guillaume-Grabisch |

59 |

F |

French |

2028 |

|

● |

|

|

|

Independent Directors ◼ |

Ms Sophie Bellon |

62 |

F |

French |

2027 |

|

|

● |

C |

|

Mr Patrice Caine |

54 |

M |

French |

2026 |

● |

|

C |

|

|

Ms Fabienne Dulac |

56 |

F |

French |

2027 |

|

● |

|

● |

|

Ms Ilham Kadri |

55 |

F |

French/Moroccan |

2028 |

|

● |

|

|

|

Ms Virginie Morgon |

54 |

F |

French |

2025 |

|

C |

|

|

|

Mr Alexandre Ricard |

51 |

M |

French |

2025 |

● |

|

|

● |

|

Mr Jacques Ripoll |

58 |

M |

French |

2028 |

|

● |

|

|

|

Director repr. employees |

Mr Benny de Vlieger |

59 |

M |

Belgian |

2026 |

|

● |

|

|

|

Mr Thierry Hamel |

69 |

M |

French |

2026 |

|

|

|

● |

|

Percentage Independent |

|

NA |

66% |

50% |

60% |

|

◼Independence within the meaning of the criteria of the AFEP-MEDEF

Code as assessed by the Board of Directors. C Chairman/Chairwoman.

● Member of the Committee. |

2023 SALES

Sales amounted to 41.18 billion

euros at 31 December 2023, up +7.6% reported.

Like-for-like, i.e. based

on a comparable structure and identical exchange rates, sales grew

by +11.0%. The net impact of changes in

the scope of consolidation was +1.6%.

Growth at constant exchange rates

came out at +12.6%. Currency

fluctuations had a negative impact of -5.0% at the end of

2023.

Sales by Division and Region

|

|

4th quarter 2023 |

At 31 December 2023 |

|

|

|

Growth |

|

Growth |

|

|

€m |

Like-for-like |

Reported |

€m |

Like-for-like |

Reported |

|

By Division |

|

|

|

|

|

|

|

Professional Products |

1,230.3 |

+6.4% |

+1.0% |

4,653.9 |

+7.6% |

+4.0% |

|

Consumer Products |

3,714.3 |

+7.7% |

+1.0% |

15,172.7 |

+12.6% |

+8.2% |

|

L’Oréal Luxe |

4,139.1 |

+0.4% |

-0.4% |

14,924.0 |

+4.5% |

+2.0% |

|

Dermatological Beauty4 |

1,521.5 |

+27.3% |

+20.0% |

6,432.0 |

+28.4% |

+25.5% |

|

Group total |

10,605.3 |

+6.9% |

+2.8% |

41,182.5 |

+11.0% |

+7.6% |

|

By Region |

|

|

|

|

|

|

|

Europe |

3,267.3 |

+11.6% |

+9.2% |

13,007.8 |

+16.0% |

+13.7% |

|

North America |

2,836.2 |

+9.4% |

+5.4% |

11,147.2 |

+11.8% |

+9.7% |

|

North Asia |

2,965.0 |

-6.2% |

-9.9% |

10,662.9 |

-0.9% |

-5.8% |

|

SAPMENA – SSA5 |

914.4 |

+22.0% |

+18.6% |

3,447.7 |

+23.2% |

+16.4% |

|

Latin America |

622.4 |

+23.4% |

+8.2% |

2,916.9 |

+24.4% |

+22.8% |

|

Group total |

10,605.3 |

+6.9% |

+2.8% |

41,182.5 |

+11.0% |

+7.6% |

Summary by Division

PROFESSIONAL PRODUCTS

The Professional Products Division reported robust

growth of +7.6% like-for-like and +4.0% reported. The

Division significantly outperformed the professional beauty market,

supported by its strategic focus on driving haircare, strengthening

its omni-channel approach and conquering new markets. Its two

biggest brands, L’Oréal Professionnel and Kérastase, grew strongly.

By category, haircare remained particularly dynamic. This was

driven by the ongoing success of Kérastase, especially its key

Genesis and Chronologiste brand franchises, as consumers continued

to premiumise their haircare routines. Growth was underpinned by

L’Oréal Professionnel’s breakthrough innovations, including Metal

Detox and Absolut Repair Molecular. In hair colour, it was driven

by the blockbusters Shades EQ by Redken and the new Inoa by L’Oréal

Professionnel. Momentum was positive across all regions, led by

China, the Division’s second largest market, as well as emerging

markets, notably India, now the fifth largest market. In the

professional beauty industry, the Division further strengthened its

leadership position, supported by its unrivalled Beauty Tech

backbone, which drove strong growth in e-commerce both in B2B and

B2C.

CONSUMER PRODUCTS

The Consumer Products Division had its best growth in

more than 30 years at +12.6% like-for-like and +8.2%

reported. The Division outperformed a dynamic mass market

and delivered strong growth surpassing 15 billion euros. Throughout

the year, growth was driven by volume and value as the Division

continued to pursue its strategy of simultaneously democratising

and premiumising. All four key brands grew in double digits, with

L’Oréal Paris crossing the 7-billion-euro mark. All major

categories posted strong growth, as disruptive innovations met

flawless execution. Makeup was the leading contributor to the

Division’s growth, propelled by the launches of Surreal Mascara by

Maybelline New York, Infallible Matte Resistance lipstick by

L’Oréal Paris, and Fat Oil gloss by NYX Professional Makeup. Hair

was also very dynamic, valorising with premium launches like Elvive

Bond Repair by L’Oréal Paris and Garnier Good haircolor. Skincare

grew significantly, with the very successful global roll out of

Garnier Fast Bright with Vitamin C as well the launches of

Revitalift Clinical and Glycolic Bright by L’Oréal Paris. By

region, the most noteworthy performances were in Europe, where

momentum saw a truly spectacular acceleration, making it a key

growth contributor, and in emerging markets, particularly Mexico,

Brazil, and India. North America delivered robust growth.

LUXE

L'Oréal Luxe grew +4.5% like-for-like, +2.0% reported

and has become the global number one in luxury beauty.

Excluding North Asia, which was impacted by the reset of Travel

Retail and the market softness in mainland China, L’Oréal Luxe grew

in double digits. This was driven by continued investment in its

portfolio of complementary brands, as well as its ambitious

omni-channel strategy, now including Amazon in the US. The Division

has become the global market leader in luxury beauty thanks to its

strong momentum in developed and emerging markets and its

remarkable outperformance in China. There, the early adoption of

Douyin and the ongoing investment in point-of-sale quality paid

off. Fragrances remained the star performer, driven by Yves Saint

Laurent with the worldwide blockbuster Libre and the successful

launch of MYSLF, as well as Born in Roma by Valentino, Paradoxe by

Prada, Wanted by Azzaro and Angel by Mugler. In skincare,

ultra-luxury brand Helena Rubinstein passed the one-billion-euro

mark, and Takami advanced strongly in the medical luxury segment.

Makeup momentum accelerated in the second half of the year, driven

by the Couture brands. More recently added brands like Prada,

Takami and Valentino made strong growth contributions. Aēsop,

integrated since 30 August, is off to a promising start.

DERMATOLOGICAL BEAUTY 4

The Dermatological Beauty Division had spectacular

growth of +28.4% like-for-like and +25.5% reported.

Dermatological Beauty maintained its outstanding momentum, growing

twice as fast as the highly dynamic dermocosmetics market, and

delivering its sixth consecutive year of double-digit growth. As a

result, sales have more than doubled in just three years. This was

driven by the Division’s unrivalled portfolio of highly

complementary brands, its online and offline channel coverage, and

its longstanding medical prescription leadership. Momentum was

strong across all regions and well-balanced between developed and

emerging markets. In mainland China, the Division significantly

outperformed a market that proved resilient. La Roche-Posay, the

number one growth contributor,kept its outstanding pace, driven by

the UVmune400, breakthrough innovation in sun care, as well as the

successful Cicaplast microbiome renovation. CeraVe continued to

advance strongly both in the US, where it is now the number one

skincare brand, and in the rest of the world. Vichy reported its

best growth in 18 years, while the portfolio of aesthetics-related

brands grew in double digits. L’Oréal Dermatological Beauty places

three of its key brands in the top-four most prescribed brands by

dermatologists in the world.

Summary by Region

EUROPE

Sales in Europe saw outstanding growth of +16.0 %

like-for-like and +13.7% reported. Throughout the year,

the beauty market was very dynamic, and L'Oréal outperformed across

all of its core Western and Central European countries. Thanks to

its outstanding progress, the region was the single-largest growth

driver at Group level for the second year running. Volume and value

both contributed strongly, the latter fueled by mix and price. All

categories advanced in double-digits, led by skincare and makeup.

Professional Products continued to recruit new consumers and

develop its position in premium haircare thanks to Kérastase and

the strong momentum of Série Expert by L'Oréal Professionnel. In

Consumer Products, each of the four key brands recorded exceptional

growth. L'Oréal Luxe further strengthened its leadership in

fragrances, driven by Libre by Yves Saint Laurent - now the second

largest female women's fragrance in Europe after Lancôme’s La Vie

Est Belle - and by Paradoxe by Prada. Dermatological Beauty

outperformed its market significantly; thanks to the continued

strong growth of CeraVe, the Division now has three of the top-four

dermo-cosmetics brands in Europe. L'Oréal continued to strengthen

its position in the most dynamic channels: drugstores, e-commerce,

and pharmacies.

NORTH AMERICA

Sales in North America advanced strongly, +11.8%

like-for-like and +9.7% reported. L’Oréal outperformed a

dynamic market, driven by valorising innovations and channel

optimisation. Each of the Divisions grew, led by Dermatological

Beauty and L’Oréal Luxe. The Professional Products Division

outperformed the market thanks to its well-rounded brand portfolio

with Kérastase particularly dynamic. This was backed by its strong

innovation pipeline, and its omni-channel focus, where selective

channels and e-commerce outperformed. Consumer Products grew

strongly in haircare, boosted by the continued success of the core

Elvive and Ever haircare franchises. In a vibrant makeup market,

momentum remained strong, supported by a well-filled innovation

pipeline across all brands. L’Oréal Luxe outperformed the market in

fragrances, led by Born in Roma by Valentino and MYSLF by Yves

Saint Laurent. In makeup, Couture brands Yves Saint Laurent and

Armani were bolstered by new launches. E-commerce remained dynamic,

particularly during the holiday season. Dermatological Beauty

continued its exceptional performance, outperforming the market

thanks to the uninterrupted success of CeraVe, now the number one

skin care brand in the US, and La Roche Posay. Skinbetter Science

maintained strong momentum.

NORTH ASIA

Sales in North Asia contracted, -0.9% like-for-like and

-5.8% reported. North Asia continued to be impacted by the

reset in Travel Retail following the change in policy regarding

daigous. In mainland China, where the beauty market remained flat,

L’Oréal grew +5.4%, significantly strengthening its leadership –

boosted by the Group’s continued investment in the quality of its

offline distribution in a truly O+O (offline plus online) market.

In Hong Kong, momentum was buoyant, as tourist activity resumed. In

Japan, L’Oréal significantly outperformed a dynamic market, driven

by Consumer Products and L’Oréal Luxe. In North Asia, growth was

fuelled by L’Oréal Dermatological Beauty, where all three core

brands grew in double-digits led by CeraVe, and Professional

Products, where Kérastase continued to advance strongly. Both

Divisions significantly outperformed their respective markets.

L’Oréal Luxe continued to outperform its market, with particularly

strong momentum in premium skincare thanks to the remarkable

success of Helena Rubinstein and Takami; Couture brands

like Yves Saint Laurent and the recently

launched Prada Beauty also contributed. The Consumer

Products Division was supported by the rebound of its makeup

brands, Maybelline New York and 3CE Stylenanda. Offline and online

channels both contributed to growth in the region.

SAPMENA – SSA 5

Sales in SAPMENA-SSA had outstanding growth of +23.2%

like-for-like and +16.4% reported. In SAPMENA, growth was

broad-based as each category, Division, and country advanced in

double-digits. Mix-driven value and volume both contributed

strongly. Fragrances was the most dynamic category, followed by

skincare and makeup; haircare was boosted by continued

premiumisation. The stand-out performers by Division were

Dermatological Beauty, where CeraVe continued its successful

expansion, and Consumer Products, where all brands grew in

double-digits. By country, the Australia-New Zealand and GCC6

clusters, as well as India were the top-three growth contributors,

all advancing in excess of +20%. Sales progressed faster online

than offline, driven by India and Vietnam. SSA saw record growth

with all countries advancing in double digits. Skincare and makeup

led category growth; Consumer Products and Dermatological Beauty

were the top performers by Division.

LATIN AMERICA

Sales in Latin America achieved outstanding growth of

+24.4% like-for-like and +22.8% reported. L’Oréal

maintained exceptional momentum with strong contributions from both

value and volume. The Group outperformed a dynamic beauty market.

All categories reported double-digit growth. Skincare, makeup, and

the all-important haircare category were particularly dynamic. By

Division, the stand-out performers were Consumer Products, where

all key brands and categories performed strongly, and

Dermatological Beauty, where La Roche-Posay and CeraVe

continued their outstanding growth. Growth was broad-based across

all countries. The top-two contributors were Brazil and Mexico; the

latter reported spectacular growth in excess of 30%. The

successfully implemented omnichannel strategy resulted in

well-balanced online and offline growth.

IMPORTANT EVENTS DURING 01/10/23-31/12/23 AND

POST-CLOSING

STRATEGY

- In January, L’Oréal’s venture capital fund BOLD (“Business

Opportunities for L’Oréal Development”) acquired a minority

stake in Timeline, a Swiss biotech company developing

innovative solutions for longevity in food, beauty, and

health.

- In January, L’Oréal announced that it has signed an agreement

to acquire the remaining shares in

Gjosa, a Swiss startup pioneering water fractioning.

L’Oréal had previously partnered with Gjosa to launch the

award-winning Water Saver showerhead.

- In December, L’Oréal announced the acquisition of

Lactobio, a leading probiotic and microbiome research

company based in Denmark.

- In January, L’Oréal’s Venture Capital fund BOLD, closed a

minority investment in the luxury Chinese fragrance brand,

To Summer, to expand into global markets and offer global

consumers curated olfactory experiences inspired by eastern art,

culture, philosophy and landscapes.

MANAGEMENT

- In February, L'Oréal announced the appointment of Ezgi

Barcenas as Chief Corporate Responsibility Officer to

continue the Group’s environmental and societal transformation. She

succeeds Alexandra Palt who will be leaving her

responsibilities on April 1, 2024, having established, and anchored

the foundations of this transformation during her 12 years with the

Group. Alexandra Palt remains CEO and administrator of the L’Oreal

Foundation.

RESEARCH, BEAUTY TECH AND

DIGITAL

- In January, Nicolas Hieronimus and Barbara Lavernos gave the

Opening Keynote speech at CES in Las Vegas, making L’Oréal the

first beauty company to be invited to do so. The Group won a record

seven CES Innovation Awards.

- In November, L’Oréal presented its latest tech-enabled

offerings and partnerships at the sixth annual China

International Import Expo (CIIE) in Shanghai, one of the

world’s largest trade shows, with a record 18 beauty tech

innovations spanning inclusive, sustainable and personalised Beauty

Tech solutions.

- In November, L’Oréal announced an industry-first

partnership with Cosmo International Fragrances to develop

a Green Sciences-based extraction process to revolutionise the art

of fine fragrance creation.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

PERFORMANCE

- L’Oréal is the only company in the world to have received for

the eighth consecutive year a triple ‘A’ score

from the global environmental nonprofit CDP. L’Oréal is recognized

as part of companies leading the way in environmental transparency

and demonstrating outstanding performance in addressing climate

change, protecting forests and ensuring water security.

- L’Oréal received a rating of 20 – Low Risk as part of the

assessment carried out by Sustainalytics. This

score ranks the Group in fourth position

within the “Personal Products” sub-industry and in the top

10 companies in the “Household Products” industry.

- L'Oréal and renowned companies from the beauty, scent and

personal care sector gathered for the first time in the

Value of Beauty Alliance to highlight the positive

impact of the industry. The Alliance members presented in Brussels

to key stakeholders from the European Union Institutions a new

report titled ‘What is the Value of Beauty?’.

- In January, a consortium of 15 cosmetics industry companies,

including L'Oréal Groupe, announced that they have joined forces to

create the TRaceability Alliance for Sustainable CosmEtics

(TRASCE) to enhance traceability in key ingredient and

packaging supply chains across the industry.

2023 RESULTS

Audited financial statements, certification in progress.

Operating profitability at 19.8% of sales

Consolidated profit and loss accounts: from sales to operating

profit.

|

|

2022 |

2023 |

|

|

€m |

% sales |

€m |

% sales |

|

Sales |

38,260.6 |

100.0% |

41,182.5 |

100.0% |

|

Cost of sales |

-10,577.4 |

27.6% |

-10,767.0 |

26.1% |

|

Gross profit |

27,683.3 |

72.4% |

30,415.5 |

73.9% |

|

R&I expenses |

-1,138.6 |

3.0% |

-1,288.9 |

3.1% |

|

Advertising and promotion |

-12,059.0 |

31.5% |

-13,356.6 |

32.4% |

|

Selling, general and administrative expenses |

-7,028.8 |

18.4% |

-7,626.7 |

18.5% |

|

Operating profit |

7,456.9 |

19.5% |

8,143.3 |

19.8% |

Gross profit, at 73.9% of sales, improved by

150 basis points. Research & Innovation

expenses increased by 10 basis points to 3.1% of sales.

Advertising and promotional expenses increased by

90 basis points to 32.4% of sales, equivalent to an increase of

more than 10% year-on-year.

Selling, general and administrative expenses

increased by 10 basis points to 18.5% of sales. Overall,

operating profit increased by +9.2% to 8,143.3

million euros, and amounted to 19.8% of sales, an improvement of 30

basis points.

Operating profit by Division

|

|

2022 |

2023 |

|

|

€m |

% sales |

€m |

% sales |

|

By Division |

|

|

|

|

|

Professional Products |

953.6 |

21.3% |

1,005.3 |

21.6% |

|

Consumer Products |

2,774.9 |

19.8% |

3,114.7 |

20.5% |

|

L’Oréal Luxe |

3,350.4 |

22.9% |

3,331.8 |

22.3% |

|

Dermatological Beauty 4 |

1,303.0 |

25.4% |

1,670.9 |

26.0% |

|

Divisions total |

8,381.9 |

21.9% |

9,122.7 |

22.2% |

|

Non-allocated7 |

-925.1 |

-2.4% |

-979.4 |

-2.4% |

|

Group |

7,456.9 |

19.5% |

8,143.3 |

19.8% |

The profitability of the Professional Products

Division came out at 21.6% of sales, up 30 basis points.

The profitability of the Consumer Products

Division came out at 20.5% of sales, up 70 basis points.

The profitability of the Luxe Division came out at

22.3% compared to 22.9% in 2022. The profitability of the

Dermatological Beauty Division

came out at 26.0%, up 60 basis points. Non-allocated

expenses amounted to 979.4 million euros.

Net profit

Consolidated profit and loss accounts: from operating profit to

net profit excluding non-recurring items.

|

€m |

2022 |

2023 |

Growth |

|

Operating profit |

7,456.9 |

8,143.3 |

+9.2% |

|

Financial revenues and expenses excluding Sanofi dividends |

-73.0 |

-113.4 |

|

|

Sanofi dividends |

468.2 |

420.9 |

|

|

Profit before tax excluding non-recurring items |

7,852.1 |

8,450.8 |

+7.6% |

|

Income tax excluding non-recurring items |

-1,793.4 |

-1,957.8 |

|

|

Net profit excluding non-recurring items of equity consolidated

companies |

+1.5 |

+0.2 |

|

|

Non-controlling interests |

-6.1 |

-6.7 |

|

|

Net profit after non-controlling interests excluding

non-recurring items |

6,054.1 |

6,486.6 |

+7.1% |

|

EPS2 (€) |

11.26 |

12.08 |

+7.3% |

|

|

|

|

|

|

Net profit after non-controlling interests |

5,706.6 |

6,184.0 |

+8.4% |

|

Diluted EPS after non-controlling interests (€) |

10.61 |

11.52 |

|

|

Diluted average number of shares |

537,657,548 |

537,021,039 |

|

Net finance costs amounted to 113 million

euros. Sanofi dividends totalled 420.9 million

euros. Income tax excluding non-recurrent items

amounted to 1,958 million euros, representing a tax rate of

23.2%. Net profit excluding non-recurring items after

non-controlling interests stood at 6,487 million euros.

Earnings per share2, at 12.08

euros, increased by +7.3%. Non-recurring items after

non-controlling interests8 amounted to 302 million euros

net of tax. Net profit after non-controlling

interests came out at 6,184 million euros, increasing by

+8.4%.

Cash flow statement, Balance sheet and Cash

position

Gross cash flow amounted to 7,999 million

euros, an increase of +9.7%. The working capital

requirement increased by 395 million euros. At 1,488.7

million euros, investments represented 3.6% of

sales. Net cash flow9, at 6,116 million euros,

increased by 23.9%. The balance sheet remains

strong, with shareholders’ equity amounting to 29.1 billion

euros.

Proposed dividend at the Annual General Meeting of 23

April 2024

The Board of Directors has decided to propose a dividend of 6.60

euros per share at the shareholders’ Annual General Meeting of 23

April 2024, an increase of +10.0% compared with the dividend paid

in 2023. The dividend will be paid on 26 April 2024

(ex-dividend date 30 April at 0:00am, Paris time).

Share capital

At 31 December 2023, the capital of the company is formed by

534,725,475 shares.

The L’Oréal Board of Directors met on 8 February 2024, under the

chairmanship of Jean-Paul Agon and in the presence of the Statutory

Auditors. The Board approved the consolidated financial statements

and the financial statements for 2023.

1 Like-for-like sales growth: based on a comparable structure

and identical exchange rates.

2 Diluted earnings per share (EPS), based on net profit,

excluding non-recurring items, after non-controlling interests.

3 To be proposed at the Annual General Meeting of 23 April

2024.

4Formerly known as the Active Cosmetics Division.

5SAPMENA – SSA: South Asia Pacific, Middle East, North Africa,

Sub-Saharan Africa.

6 GCC: Gulf Cooperation Council

7 Non-allocated = Central Group expenses,

fundamental research expenses, free grant of shares expenses and

miscellaneous items.

8 Non-recurring items include impairment of assets, capital

gains and losses on disposals of long-term assets, restructuring

costs and tax effects of non-recurring items.

9 Net cash flow = Gross cash flow + changes in working capital -

capital expenditure.

“This news release does not constitute an offer to sell, or a

solicitation of an offer to buy L’Oréal shares. If you wish to

obtain more comprehensive information about L’Oréal, please refer

to the public documents registered in France with the Autorité des

Marchés Financiers, also available in English on our website

www.loreal-finance.com.

This news release may contain some forward-looking statements.

While the Company believes that these statements are based on

reasonable assumptions as of the date of publication of this press

release, they are by nature subject to risks and uncertainties

which may lead to a discrepancy between the actual figures and

those indicated or suggested in these statements.”

About L’Oréal

For 115 years, L’Oréal, the world’s leading beauty player, has

devoted itself to one thing only: fulfilling the beauty aspirations

of consumers around the world. Our purpose, to create the beauty

that moves the world, defines our approach to beauty as essential,

inclusive, ethical, generous and committed to social and

environmental sustainability. With our broad portfolio of 37

international brands and ambitious sustainability commitments in

our L’Oréal for the Future programme, we offer each and every

person around the world the best in terms of quality, efficacy,

safety, sincerity and responsibility, while celebrating beauty in

its infinite plurality.

With more than 90,000 committed employees, a balanced

geographical footprint and sales across all distribution networks

(e-commerce, mass market, department stores, pharmacies,

perfumeries, hair salons, branded and travel retail), in 2023 the

Group generated sales amounting to 41.18 billion

euros. With 20 research centers across 11

countries around the world and a dedicated Research and Innovation

team of over 4,000 scientists and 6,400 Digital talents, L’Oréal is

focused on inventing the future of beauty and becoming a Beauty

Tech powerhouse.

More information on https://www.loreal.com/en/mediaroom

L’ORÉAL CONTACTS

Switchboard +33 (0) 1 47 56 70 00

Individual shareholders and market authorities

Pascale Guerin +33 (0)1 49 64 18 89 pascale.guerin@loreal.com

Investor relations Eva Quiroga +33 (0)7

88 14 22 65 eva.quiroga@loreal.com

Journalists Brune Diricq +33 (0)6 63 85 29 87

brune.diricq@loreal.com

Christine BURKE +33 (0)6 75 54 38 15

Christine.burke@loreal.com

For more information, please contact your bank, broker or

financial institution (I.S.I.N. code: FR0000120321), and consult

your usual newspapers, the website for shareholders and investors,

www.loreal-finance.com or the L’Oréal Finance app; alternatively,

call +33 (0)1 40 14 80 50.

This press release has been secured and authenticated with

blockchain technology. You can verify its authenticity on the

website www.wiztrust.com

Appendices

Appendix 1: L’Oréal group sales 2022/2023

(€ million)

|

|

2022 |

2023 |

|

|

€m |

€m |

Like-for-like evolution |

Reported evolution |

|

First quarter |

9,060.5 |

10,380.4 |

+13.0% |

+14.6% |

|

Second quarter |

9,305.8 |

10,193.7 |

+13.7% |

+9.5% |

|

First half total |

18,366.3 |

20,574.1 |

+13.3% |

+12.0% |

|

Third quarter |

9,575.2 |

10,003.1 |

+11.1% |

+4.5% |

|

Nine months total |

27,941.5 |

30,577.2 |

+12.6% |

+9.4% |

|

Fourth quarter |

10,319.1 |

10,605.3 |

+6.9% |

+2.8% |

|

Full year total |

38,260.6 |

41,182.5 |

+11.0% |

+7.6% |

Appendix 2: Compared consolidated income

statements

| €

millions |

2023 |

2022 |

2021 |

|

Net sales |

41,182.5 |

38,260.6 |

32,287.6 |

| Cost of

sales |

-10,767.0 |

-10,577.4 |

-8,433.3 |

|

Gross profit |

30,415.5 |

27,683.3 |

23,854.3 |

| Research

& Innovation expenses |

-1,288.9 |

-1,138.6 |

-1,028.7 |

|

Advertising and promotion expenses |

-13,356.6 |

-12,059.0 |

-10,591.0 |

| Selling,

general and administrative expenses |

-7,626.7 |

-7,028.8 |

-6,074.2 |

|

Operating profit |

8,143.3 |

7,456.9 |

6,160.3 |

| Other

income and expenses |

-449.9 |

-241.5 |

-432.0 |

|

Operational profit |

7,693.4 |

7,215.4 |

5,728.3 |

| Finance

costs on gross debt |

-226.7 |

-70.4 |

-38.0 |

| Finance

income on cash and cash equivalents |

162.1 |

69.8 |

18.5 |

|

Finance costs, net |

-64.6 |

-0.6 |

-19.4 |

| Other

financial income and expenses |

-48.8 |

-72.3 |

-40.2 |

| Sanofi

dividends |

420.9 |

468.2 |

378.3 |

|

Profit before tax and associates |

8,001.0 |

7,610.6 |

6,046.9 |

| Income

tax |

-1,810.6 |

-1,899.4 |

-1,445.4 |

| Share of

profit in associates |

0.2 |

1.4 |

0.6 |

|

Net profit |

6,190.5 |

5,712.6 |

4,602.2 |

|

Attributable to: |

|

|

|

| owners of

the company |

6,184.0 |

5,706.6 |

4,597.1 |

|

non-controlling interests |

6.5 |

6.0 |

5.1 |

| Earnings

per share attributable to owners of the company (euros) |

11.55 |

10.65 |

8.24 |

| Diluted

earnings per share attributable to owners of the company

(euros) |

11.52 |

10.61 |

8.21 |

| Earnings

per share attributable to owners of the company, excluding

non-recurring items (euros) |

12.11 |

11.30 |

8.86 |

| Diluted

earnings per share attributable to owners of the company, excluding

non-recurring items (euros) |

12.08 |

11.26 |

8.82 |

Appendix 3: Consolidated statement of

comprehensive income

|

€ millions |

2023 |

2022 |

2021 |

|

Consolidated net profit for the period |

6,190.5 |

5,712.6 |

4,602.2 |

|

Cash flow hedges |

-137.3 |

288.5 |

-203.7 |

|

Cumulative translation adjustments |

-425.8 |

195.1 |

610.5 |

|

Income tax on items that may be reclassified to profit or loss

(1) |

22.7 |

-58.0 |

41.5 |

|

Items that may be reclassified to profit or

loss |

-540.3 |

425.6 |

448.3 |

|

Financial assets at fair value through other comprehensive

income |

-76.3 |

152.1 |

1,192.2 |

|

Actuarial gains and losses |

-119.3 |

395.6 |

585.5 |

|

Income tax on items that may not be reclassified to profit or loss

(1) |

28.9 |

-111.5 |

-181.7 |

|

Items that may not be reclassified to profit or

loss |

-166.7 |

436.2 |

1,596.0 |

|

Other comprehensive income |

-707.0 |

861.8 |

2,044.3 |

|

CONSOLIDATED COMPREHENSIVE INCOME |

5,483.6 |

6,574.4 |

6,646.5 |

|

Attributable to: |

|

|

|

|

|

5,477.7 |

6,567.6 |

6,641.4 |

- non-controlling interests

|

5.9 |

6.8 |

5.1 |

(1) The tax effect is as follows:

| |

€ millions |

2023 |

2022 |

2021 |

| |

Cash flow hedges |

22.7 |

-58.0 |

41.5 |

| |

Items that may be reclassified to profit or

loss |

22.7 |

-58.0 |

41.5 |

| |

Financial assets at fair value through other comprehensive

income |

-1.3 |

-6.1 |

-37.3 |

| |

Actuarial gains and losses |

30.2 |

-105.5 |

-144.4 |

| |

Items that may not be reclassified to profit or

loss |

28.9 |

-111.5 |

-181.7 |

| |

TOTAL |

51.6 |

-169.5 |

-140.2 |

Appendix 4: Compared consolidated balance

sheets

Assets

|

€ millions |

31.12.2023 |

31.12.2022 |

31.12.2021 |

|

Non-current assets |

35,529.7 |

32,794.5 |

30,937.6 |

|

Goodwill |

13,102.6 |

11,717.7 |

11,074.5 |

|

Other intangible assets |

4,287.1 |

3,640.1 |

3,462.8 |

|

Right-of-use assets |

1,692.4 |

1,482.7 |

1,507.6 |

|

Property, plant and equipment |

3,867.7 |

3,481.7 |

3,266.2 |

|

Non-current financial assets |

11,631.6 |

11,652.8 |

10,920.2 |

|

Investments accounted for under the equity method |

27.0 |

18.4 |

9.9 |

|

Deferred tax assets |

921.2 |

801.1 |

696.5 |

|

Current assets |

16,325.4 |

14,049.6 |

12,075.8 |

|

Inventories |

4,482.4 |

4,079.4 |

3,166.9 |

|

Trade accounts receivable |

5,092.7 |

4,755.5 |

4,021.0 |

|

Other current assets |

2,270.6 |

2,423.2 |

2,037.9 |

|

Current tax assets |

191.6 |

173.9 |

136.2 |

|

Cash and cash equivalents |

4,288.1 |

2,617.7 |

2,713.8 |

|

TOTAL |

51,855.1 |

46,844.2 |

43,013.4 |

Equity & Liabilities

|

€ millions |

31.12.2023 |

31.12.2022 |

31.12.2021 |

|

Equity |

29,081.6 |

27,186.5 |

23,592.6 |

|

Share capital |

106.9 |

107.0 |

111.5 |

|

Additional paid-in capital |

3,370.2 |

3,368.7 |

3,265.6 |

|

Other reserves |

13,799.1 |

11,675.6 |

19,092.2 |

|

Other comprehensive income |

6,123.8 |

6,404.4 |

5,738.6 |

|

Cumulative translation adjustments |

-509.6 |

-83.8 |

-279.1 |

|

Treasury shares |

— |

— |

-8,940.2 |

|

Net profit attributable to owners of the company |

6,184.0 |

5,706.6 |

4,597.1 |

|

Equity attributable to owners of the company |

29,074.3 |

27,178.5 |

23,585.7 |

|

Non-controlling interests |

7.3 |

8.0 |

6.9 |

|

Non-current liabilities |

7,873.9 |

5,937.9 |

2,837.6 |

|

Provisions for employee retirement obligations and related

benefits |

562.0 |

457.9 |

360.6 |

|

Provisions for liabilities and charges |

68.8 |

67.7 |

63.8 |

|

Non-current tax liabilities |

255.7 |

275.6 |

344.8 |

|

Deferred tax liabilities |

846.6 |

905.6 |

810.3 |

|

Non-current borrowings and debt |

4,746.7 |

3,017.6 |

10.7 |

|

Non-current lease debt |

1,394.2 |

1,213.5 |

1,247.5 |

|

Current liabilities |

14,899.7 |

13,719.6 |

16,583.2 |

|

Trade accounts payable |

6,347.0 |

6,345.6 |

6,068.1 |

|

Provisions for liabilities and charges |

977.2 |

1,205.6 |

1,223.3 |

|

Other current liabilities |

4,816.1 |

4,484.6 |

3,980.8 |

|

Income tax |

208.1 |

264.2 |

268.9 |

|

Current borrowings and debt |

2,091.5 |

1,012.8 |

4,619.4 |

|

Current lease debt |

459.8 |

407.0 |

422.8 |

|

TOTAL |

51,855.1 |

46,844.2 |

43,013.4 |

Appendix 5: Consolidated statements of

changes in equity

|

€ millions |

Common shares outstanding |

Capital |

Additional paid-in capital |

Retained earnings and net profit (1) |

Other comprehensive income |

Treasury shares |

Cumulative translation adjustments |

Equity attributable to owners of the

company |

Non-controlling interests |

Total equity |

| At

31.12.2020 |

559,871,580 |

112.0 |

3,259.8 |

22,206.0 |

4,304.5 |

— |

-889.1 |

28,993.0 |

5.8 |

28,998.8 |

|

Consolidated net profit for the period |

|

|

|

4,597.1 |

— |

|

|

4,597.1 |

5.1 |

4,602.2 |

|

Cash flow hedges |

|

|

|

|

-161.9 |

|

|

-161.9 |

-0.3 |

-162.2 |

|

Cumulative translation adjustments |

|

|

|

|

|

|

610.2 |

610.2 |

0.3 |

610.5 |

|

Other comprehensive income that may be

reclassified to profit and loss |

|

|

|

|

-161.9 |

|

610.2 |

448.3 |

— |

448.3 |

|

Financial assets at fair value through other comprehensive

income |

|

|

|

|

1,154.9 |

|

|

1,154.9 |

|

1,154.9 |

|

Actuarial gains and losses |

|

|

|

|

441.1 |

|

|

441.1 |

|

441.1 |

|

Other comprehensive income that may not be

reclassified to profit and loss |

|

|

|

|

1,596.0 |

|

|

1,596.0 |

|

1,596.0 |

|

Consolidated comprehensive income |

|

|

|

4,597.1 |

1,434.1 |

|

610.2 |

6,641.4 |

5.1 |

6,646.5 |

|

Capital increase |

800,780 |

— |

5.8 |

— |

|

|

|

5.8 |

|

5.8 |

|

Cancellation of Treasury shares |

— |

-0.5 |

|

-1,104.3 |

|

1,104.8 |

|

— |

|

— |

|

Dividends paid (not paid on Treasury shares) |

— |

— |

|

-2,264.4 |

|

|

|

-2,264.4 |

-4.7 |

-2,269.1 |

|

Share-based payment |

— |

— |

|

155.2 |

|

|

|

155.2 |

|

155.2 |

|

Net changes in Treasury shares |

-25,260,000 |

— |

|

|

|

-10,045.0 |

|

-10,045.0 |

|

-10,045.0 |

|

Changes in the scope of consolidation |

|

— |

|

— |

|

— |

— |

— |

— |

— |

|

Other movements (1) |

|

— |

|

99.8 |

— |

— |

|

99.8 |

0.6 |

100.4 |

|

At 31.12.2021 |

535,412,360 |

111.5 |

3,265.6 |

23,689.3 |

5,738.6 |

-8,940.2 |

-279.1 |

23,585.7 |

6.9 |

23,592.6 |

|

Impact of the application of the IFRIC decision on SaaS

contracts |

|

|

|

-151.2 |

|

|

|

-151.2 |

|

-151.2 |

|

At 01.01.2022 (2) |

535,412,360 |

111.5 |

3,265.6 |

23,538.1 |

5,738.6 |

-8,940.2 |

-279.1 |

23,434.5 |

6.9 |

23,441.4 |

|

Consolidated net profit for the period |

|

|

|

5,706.6 |

— |

|

— |

5,706.6 |

6.0 |

5,712.6 |

|

Cash flow hedges |

|

|

|

|

229.7 |

|

— |

229.7 |

0.8 |

230.5 |

|

Cumulative translation adjustments |

|

|

|

|

— |

|

195.3 |

195.3 |

-0.2 |

195.1 |

|

Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

229.7 |

|

195.3 |

425.0 |

0.6 |

425.6 |

|

Financial assets at fair value through other comprehensive

income |

|

|

|

|

146.1 |

|

— |

146.1 |

|

146.1 |

|

Actuarial gains and losses |

|

|

|

|

290.0 |

|

— |

290.0 |

0.1 |

290.1 |

|

Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

436.1 |

|

|

436.1 |

0.1 |

436.2 |

|

Consolidated comprehensive income |

|

|

|

5,706.6 |

665.8 |

|

195.3 |

6,567.6 |

6.8 |

6,574.4 |

|

Capital increase |

1,317,073 |

0.3 |

103.1 |

-0.2 |

— |

|

— |

103.2 |

|

103.2 |

|

Cancellation of Treasury shares |

— |

-4.8 |

|

-9,437.7 |

— |

9,442.5 |

— |

— |

|

— |

|

Dividends paid (not paid on Treasury shares) |

— |

— |

|

-2,601.2 |

— |

|

— |

-2,601.2 |

-4.4 |

-2,605.6 |

|

Share-based payment |

— |

— |

|

169.0 |

— |

|

— |

169.0 |

|

169.0 |

|

Net changes in Treasury shares |

-1,542,871 |

— |

|

— |

— |

-502.3 |

— |

-502.3 |

|

-502.3 |

|

Changes in the scope of consolidation |

— |

— |

|

|

— |

— |

|

— |

|

— |

|

Other movements |

— |

— |

|

7.6 |

— |

|

|

7.6 |

-1.2 |

6.4 |

|

At 31.12.2022 |

535,186,562 |

107.0 |

3,368.7 |

17,382.2 |

6,404.4 |

— |

-83.8 |

27,178.5 |

8.0 |

27,186.5 |

(1) Of which €102.2 million pertaining to

the IFRIC 2021 interpretation on IAS19 "Employee Benefits" on

Attributing Benefit to Periods of Service.

(2) After

taking account of the IFRIC final decision in April 2021 on set-up

and customization costs for SaaS-type contracts software.

|

€ millions |

Common shares outstanding |

Capital |

Additional paid-in capital |

Retained earnings and net profit |

Other comprehensive income |

Treasury shares |

Cumulative translation adjustments |

Equity attributable to owners of the company |

Non-controlling interests |

Total equity |

| At

31.12.2022 |

535,186,562 |

107.0 |

3,368.7 |

17,382.2 |

6,404.4 |

— |

-83.8 |

27,178.5 |

8.0 |

27,186.5 |

|

Consolidated net profit for the period |

|

|

|

6,184.0 |

|

|

|

6,184.0 |

6.5 |

6,190.5 |

|

Cash flow hedges |

|

|

|

|

-113.9 |

|

|

-113.9 |

-0.6 |

-114.5 |

|

Cumulative translation adjustments |

|

|

|

|

|

|

-425.9 |

-425.9 |

0.1 |

-425.8 |

|

Other comprehensive income that may be reclassified to

profit and loss |

|

|

|

|

-113.9 |

|

-425.9 |

-539.8 |

-0.6 |

-540.3 |

|

Financial assets at fair value through other comprehensive

income |

|

|

|

|

-77.5 |

|

— |

-77.5 |

|

-77.5 |

|

Actuarial gains and losses |

|

|

|

|

-89.2 |

|

— |

-89.2 |

— |

-89.2 |

|

Other comprehensive income that may not be reclassified to

profit and loss |

|

|

|

|

-166.7 |

|

|

-166.7 |

— |

-166.7 |

|

Consolidated comprehensive income |

|

|

|

6,184.0 |

-280.6 |

|

-425.9 |

5,477.6 |

5.9 |

5,483.6 |

|

Capital increase |

810,545 |

0.2 |

1.5 |

|

|

|

|

1.7 |

|

1.7 |

|

Cancellation of Treasury shares |

|

-0.3 |

|

-503.2 |

|

503.3 |

|

-0.2 |

|

-0.2 |

|

Dividends paid (not paid on Treasury shares) |

|

|

|

-3,248.4 |

|

|

|

-3,248.4 |

-6.2 |

-3,254.6 |

|

Share-based payment |

|

|

|

168.5 |

|

|

|

168.5 |

|

168.5 |

|

Net changes in Treasury shares |

-1,271,632 |

|

|

|

|

-503.3 |

|

-503.3 |

|

-503.3 |

|

Changes in the scope of consolidation |

|

|

|

|

|

|

|

— |

|

— |

|

Other movements |

|

|

|

-0.1 |

— |

|

|

-0.1 |

-0.4 |

-0.6 |

| AT

31.12.2023 |

534,725,475 |

106.9 |

3,370.2 |

19,983.1 |

6,123.8 |

— |

-509.6 |

29,074.3 |

7.3 |

29,081.6 |

Appendix 6: Compared consolidated

statements of cash flows

| €

millions |

2023 |

2022 |

2021 |

|

Cash flows from operating activities |

|

|

|

| Net

profit attributable to owners of the company |

6,184.0 |

5,706.6 |

4,597.1 |

|

Non-controlling interests |

6.5 |

6.0 |

5.1 |

|

Elimination of expenses and income with no impact on cash

flows: |

|

|

|

- depreciation, amortisation, provisions and non-current tax

liabilities (1)

|

1,715.0 |

1,536.1 |

1,781.0 |

- changes in deferred taxes

|

-95.3 |

-96.5 |

83.6 |

- share-based payment (including free shares)

|

168.5 |

169.0 |

155.2 |

- capital gains and losses on disposals of assets

|

6.9 |

7.6 |

0.5 |

| Other

non-cash transactions |

14.1 |

-38.7 |

16.5 |

| Share of

profit in associates net of dividends received |

-0.2 |

-0.5 |

1.3 |

|

Gross cash flow |

7,999.5 |

7,289.6 |

6,640.4 |

| Changes

in working capital (1) |

-394.9 |

-1,011.3 |

88.0 |

|

Net cash provided by operating activities (A) |

7,604.6 |

6,278.3 |

6,728.4 |

|

Cash flows from investing activities |

|

|

|

| Purchases

of property, plant and equipment and intangible assets |

-1,488.7 |

-1,343.2 |

-1,075.2 |

| Disposals

of property, plant and equipment and intangible assets |

12.8 |

9.2 |

14.5 |

| Changes

in other financial assets (including investments in

non-consolidated companies) |

-170.7 |

-142.8 |

-117.3 |

| Effect of

changes in the scope of consolidation |

-2,497.2 |

-746.9 |

-455.7 |

|

Net cash from investing activities (B) |

-4,143.7 |

-2,223.8 |

-1,633.7 |

|

Cash flows from financing activities |

|

|

|

| Dividends

paid |

-3,425.6 |

-2,689.9 |

-2,352.1 |

| Capital

increase of the parent company |

1.5 |

103.2 |

5.8 |

| Disposal

(acquisition) of Treasury shares |

-503.3 |

-502.3 |

-10,060.9 |

| Purchase

of non-controlling interests |

— |

— |

— |

| Issuance

(repayment) of short-term loans |

-823.7 |

-3,563.8 |

3,939.4 |

| Issuance

of long-term borrowings |

3,567.1 |

3,019.9 |

— |

| Repayment

of long-term borrowings |

— |

— |

— |

| Repayment

of lease debt |

-430.6 |

-446.9 |

-396.4 |

|

Net cash from financing activities (C) |

-1,614.6 |

-4,079.9 |

-8,864.2 |

| Net

effect of changes in exchange rates and fair value (D) |

-175.9 |

-70.7 |

77.4 |

|

Change in cash and cash equivalents (A+B+C+D) |

1,670.4 |

-96.1 |

-3,692.1 |

|

Cash and cash equivalents at beginning of the year

(E) |

2,617.7 |

2,713.8 |

6,405.9 |

| CASH AND CASH EQUIVALENTS AT THE

END OF THE PERIOD (A+B+C+D+E) |

4,288.1 |

2,617.7 |

2,713.8 |

1 Following the outcome of the dispute with the

French Competition Authority, the reversal of the provision and the

reversal of the debt for the same amount of €189.5 million

were presented in operations without impact on cash flow.

- CP_FY_2023_AnnualResults_EN

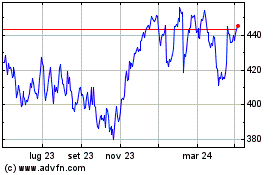

Grafico Azioni LOreal (EU:OR)

Storico

Da Dic 2024 a Gen 2025

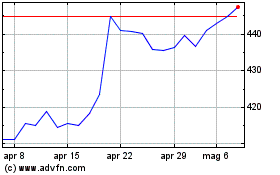

Grafico Azioni LOreal (EU:OR)

Storico

Da Gen 2024 a Gen 2025