Financial highlights

- Financial visibility secured over the next 12 months, until

Q4 2024, supported by additive financing secured in H1-2023 and

reduction of operating expenses.

- €15 million available cash as of June 30, 2023, supplemented

by R&D tax credit of €5.4 million and additive financing

secured post-H1-2023 for almost €14 million, including a capital

increase of €11.6 million driven by the bridge financing announced

in Q2 2023 and amended (1) in September 2023 to support clinical

programs.

Clinical pipeline

highlights

- Tedopi® (T-cell specific immunotherapy - cancer vaccine):

Based on final results of positive data on survival, safety and

quality of life from the first Phase 3 trial in 3rd line in

non-small cell lung cancer published in the international leading

medical journal ‘Annals of Oncology’, confirmatory Phase 3 in

preparation for 2024 in 2nd line, combined with a strategy of

unique companion diagnostic development. Completion of patient

enrollment in the Phase 2 in pancreatic cancer announced in May

2023, clinical readout expected in 2024.

- OSE-127/Lusvertikimab (IL-7R antagonist antibody): Phase 2

in ulcerative colitis with last patient enrollment expected in Q4

2023 and top-line results in the next months.

- OSE-172/BI765063 (SIRPα antagonist antibody): Ongoing

clinical expansion trial in advanced solid tumors by Boehringer

Ingelheim.

- FR104/VEL-101 (CD28 antagonist antibody): Ongoing Phase 1/2

study in kidney transplantation with last patient enrollment

completed in July 2023. International Phase 2 study in kidney

transplantation under preparation by Veloxis.

- OSE-279 (PD1 antagonist antibody): Phase 1/2 clinical trial

in solid tumors and lymphomas initiated in Q4 2022. First clinical

results will be presented in international conference in October

2023.

Regulatory News:

OSE Immunotherapeutics SA (ISIN: FR0012127173; Mnemo:

OSE) today announces its consolidated half-year financial

results and provides updates on key milestones achieved during H1

2023 as well as the Company’s outlook for its immunotherapies in

immuno-oncology and immuno-inflammation.

Nicolas Poirier, Chief Executive Officer of OSE

Immunotherapeutics comments: “OSE’s key priorities for 2023 and

beyond will lie in the successful conduct of the new Tedopi®

pivotal Phase 3 program, along with the maximization of the

near-term value of Lusvertikimab while strengthening our

partnership business-model assuring recurrent revenues from our

first-in-class programs. The full funding of these strategic

programs will be secured in due course through additional financial

resources to deliver on our goals for the benefit of both the

patients and our stakeholders. OSE has today a solid late-stage

clinical and preclinical diversified portfolio in immuno-oncology

(IO) and immuno-inflammation (I&I). The increased interest of

the scientific and medical community in cancer vaccine, in

particular Tedopi®, encourages us to stay strategically focused and

committed to make our drug candidate available to all eligible

cancer patients in secondary resistance. We also look forward to

the Lusvertikimab Phase 2 data readouts in ulcerative colitis in

the next months and to generate additive value in both I&I and

IO with our pre-IND OSE-230 and BiCKI®-IL7 programs. In parallel,

at research level, we will continue to strengthen our first-in-kind

platform built at the intersection of Antibody Engineering, Data

Science, Artificial Intelligence (AI) and novel RNA Therapeutics

technologies which is generating exciting clinical opportunities

for future next-generation immunotherapies.”

Anne-Laure Autret-Cornet, Chief Financial Officer of OSE

Immunotherapeutics, adds: “We have strengthened our cash

position and secured new financing in H1-2023 to extend our

financial visibility for over the next 12 months. In parallel, we

significantly reduced our cash burn compared to last year after a

strict review of strategic expenses and prioritization for

out-licensing. This financial strategy allows us to pursue

strategic investments on Tedopi® and Lusvertikimab while pursuing

innovative research programs to increase their value and interests.

Our force is based on our recurrent €20 million average annual

turnover these last 5 years, driven mainly by collaborations and

licensing agreements with pharma companies. This business model

based mostly on non-dilutive revenues remains our priority and will

be further reinforced.”

CLINICAL PROGRESS IN IMMUNO-ONCOLOGY AND

IMMUNO-INFLAMMATION

PROPRIETARY ASSETS

Tedopi®, T-cell epitope-based therapeutic cancer

vaccine

Most advanced therapeutic cancer vaccine in clinical

development. Confirmatory Phase 3 study with a companion diagnostic

strategy under preparation to support the registration of Tedopi®

as a potential new standard of care in second line for non-small

cell lung cancer (NSCLC) patients in secondary resistance to immune

checkpoint inhibitors (ICI) based on positive regulatory advice

from FDA and EMA; Authorizations for compassionate use in NSCLC in

third line in France, Italy and Spain.

- In September, positive Phase 3 data from Tedopi® in HLA-A2 lung

cancer patients with resistance to previous immunotherapy were

published in the peer-reviewed journal ’Annals of Oncology’.

- In July, the United States Patent and Trademark Office granted

a new patent protecting Tedopi® for its use in cancer patients

after failure with PD1/PD-L1 immune checkpoint inhibitor treatment

and providing protection until year 2037 in the US.

- In June, the Company received €1.5 million in funding from

Bpifrance for the development of a companion diagnostic for Tedopi®

in NSCLC. This test will be used to identify HLA-A2 positive NSCLC

patients eligible for treatment with Tedopi® in the next pivotal

Phase 3 clinical trial under preparation.

- In June, OSE Immunotherapeutics presented a poster at the ASCO

(American Society of Clinical Oncology) annual meeting showing new

data on prognostic factors of overall survival from the ATALANTE-1

Phase 3 study in NSCLC highlighting the correlation between

Tedopi®’s mechanism of action and patients’ overall survival.

- In May, patient enrollment was completed in TEDOPaM Phase 2

clinical trial (sponsored by the oncology group GERCOR) evaluating

Tedopi® in advanced pancreatic cancer. A total of 136 patients were

recruited and the final results are expected in 2024.

- In March, the Spanish Drug Agency has made a new early access

program available allowing access to Tedopi® through a Special

Situation Authorization (1) in the treatment of advanced or

metastatic NSCLC after ICI failure. This Special Situation

Authorization was based on the positive clinical data from the

initial Phase 3 trial of Tedopi® (ATALANTE-1) in third line

treatment and the high unmet need for these patients.

(1)

The Special Situation Authorization (Real Decreto 1015/2009) is

intended to provide early access to medicines for patients with a

severe or rare disease with high unmet need and for which no

authorized therapeutic alternatives are available.

Lusvertikimab (OSE-127), IL-7 Receptor (IL-7R)

antagonist

Most advanced Interleukin-7 antagonist immunotherapy in

clinical development with a strong biological rationale in

refractory IBD patients.

- In July, the trial’s Independent Drug Safety Monitoring Board

(DSMB) provided a positive recommendation on the continuation until

its completion of the Phase 2 clinical trial on Lusvertikimab in

ulcerative colitis. Last patient enrollment is expected for Q4

2023.

- In July, positive opinion for Orphan Drug Designation was

granted by the European Medicines Agency to Lusvertikimab in the

treatment of Acute Lymphoblastic Leukemia based on preclinical

results presented and awarded at last American Society of

Hematology (ASH) annual conference (December 2022) in New Orleans

(US).

- In May, OSE Immunotherapeutics earned the full worldwide rights

on Lusvertikimab for all indications.

- In March, positive Phase 1 results on Lusvertikimab for the

treatment of chronic autoimmune diseases were published and

selected as ‘Top Read’ in the peer-reviewed journal “Journal of

Immunology”.

OSE-279, proprietary PD1 antagonist

High affinity PD1 antibody, recent patent granted in US,

Europe, China, Japan

- In December 2022, first patient dosed in a Phase 1/2 clinical

trial in patients with advanced solid tumors or lymphomas.

- First clinical data will be presented at AACR-NCI-EORTC

(Boston, 11 – 15th October 2023).

PARTNERED ASSETS

BI 765063, first-in-class SIRPα inhibitor on the SIRPα/CD47

myeloid pathway in advanced solid tumors, developed in partnership

with Boehringer Ingelheim

- Phase 1b clinical expansion trial initiated in May 2022 with BI

765063, sponsored and conducted by Boehringer Ingelheim in advanced

hepatocellular carcinoma and head and neck cancer.

- In April, a poster highlighting the predictive response

biomarkers from Phase I clinical trial of BI765063, stand-alone and

in combination with ezabenlimab, has been presented at the AACR

2023 annual conference (Orlando).

FR104/VEL-101, a monoclonal antibody antagonist of CD28,

developed in partnership with Veloxis Pharmaceuticals, Inc. in

kidney transplantation

- In July, patient enrollment was completed in the FIRsT Phase

1/2 clinical trial evaluating FR104/VEL-101 in renal

transplantation, sponsored and conducted by the University Hospital

of Nantes. A longer-term follow-up assessment will be performed one

year after transplantation.

- International Phase 2 clinical trial in kidney transplantation

is under preparation by Veloxis.

RESEARCH PROGRAMS

OSE-230, novel monoclonal antibody to activate a

pro-resolutive GPCR target (ChemR23), a novel and innovative

approach in the management of the resolution of neutrophil-mediated

chronic and severe inflammation

- In July, the second peer-reviewed results on OSE-230 were

published in the leading journal “Frontiers in Immunology” after a

publication in “Sciences Advances” (Trilleaud et al. 2021).

- In June, a poster highlighting the innovative mechanism of

action on neutrophils and inhibition of the pathogenic NETosis

process was presented at the FOCIS 2023 annual conference

(Boston).

CLEC-1, novel myeloid immune checkpoint target in

immune-oncology

- In April, two posters reporting the latest research updates on

CLEC-1 were presented at the 2023 American Association for Cancer

Research (AACR) meeting.

- In November 2022, publication in the peer-reviewed journal

“Sciences Advances” of fundamental discoveries and preclinical

results showing that CLEC-1 is a novel myeloid checkpoint

interacting with a new ligand and highlighting the therapeutic

potential of CLEC-1 antagonist antibodies as innovative cancer

immunotherapy.

BiCKI®IL-7v, a novel bispecific therapy combining anti-PD-1

and the cytokine IL-7

- In June, an invited oral communication and a poster reporting

the differentiated advantages of the IL-7 cytokine to sustain

long-term survival and functions of tumor-reactive T lymphocytes

were presented at the annual cytokine-based drug development summit

(Boston) and at the Antibody Engineering and Therapeutics 2023

Europe conference (Amsterdam).

Novel RNA Therapeutics & Artificial Intelligence

innovative research programs

- OSE Immunotherapeutics is building a first-in-kind research

platform at the intersection of Antibody Engineering, Data Science

and Artificial Intelligence (AI) development programs dedicated to

monoclonal antibodies (AI programs initiated in 2020 and reinforced

in 2021 with the MabSilico collaboration). This cutting-edge

platform adds novel RNA Therapeutics and RNA Delivery methods

recently patented by our research team to continue to develop

next-generation immunotherapy medicines modulating immune cell

responses in the field of immuno-inflammation and

immuno-oncology.

- In August, OSE Immunotherapeutics received a grant from the

French Government and Region Pays de la Loire to support the

Company’s research programs in the field of RNA Therapeutics.

CORPORATE GOVERNANCE

Eric Leire was appointed independent Director of OSE

Immunotherapeutics on June 22, 2023.

Eric Leire is a Medical Doctor and American and French citizen.

He brings a professional international experience, both in the US

and in Europe, in listed biotechnology and pharmaceutical

companies. He is currently President and Chief Executive Officer of

Genflow Biosciences Ltd. Through his active experience in venture

capital funds in the health field (Medwell Capital, Canada and

Biofund Venture, Denmark), he has contributed to develop biotech

companies.

Nicolas Poirier, Chief Executive Officer of OSE

Immunotherapeutics, was appointed as Director and Anne-Laure

Autret-Cornet, Chief Financial Officer, as Director representing

the employee shareholders.

H1 2023 RESULTS

The key figures of the 2023 consolidated half-year results are

reported below:

In k€

June 30, 2023

June 30, 2022

Operating result

(13,504)

(3,425)

Net result

(11,860)

(1,979)

In k€

June 30, 2023

December 31, 2022

Available cash

15,018

25,620

Consolidated balance sheet

80,391

91,781

As of June 30, 2023, available cash amounted to €15 million,

giving a financial visibility until Q4 2024.

During the first half of 2023, OSE Immunotherapeutics

secured:

- (1) An equity financing line with Vester Finance, set up

on April 27, 2023. This financing has triggered at the end of

September a capital increase of €11.6 million (without any discount

on the share price at the date of signature). To supplement its

financial resources and in order to extend its financial visibility

until the fourth quarter of 2024, OSE Immunotherapeutics signed on

27 September 2023, an extension to this equity financing line

agreement with Vester Finance, at the same conditions1. This

extension, approved by the Board of Directors of September 27,

2023, acting on delegation from the general assembly meeting of

shareholders of June 22, 20232, relates to a maximum of 900,000

shares of the Company, representing a maximum of 4,16% of the share

capital, that Vester committed to subscribe on its own initiative,

over a maximum period of 24 months, subject to certain usual

contractual conditions. Assuming that the totality of this

additional line of financing is used in full, a shareholder holding

1.00% of the capital of OSE Immunotherapeutics before its

establishment, would see his stake increase to 0.96% of the capital

on an undiluted basis3 and 0.96% of the share capital on a diluted

basis4. This transaction does not give rise to the preparation of a

prospectus subject to the approval of the “Autorité des Marchés

Financiers,” based on Article 1 of the Prospectus Regulation

granting an exemption when a transaction relates to a dilution less

than 20% of the Company's share capital. The number of shares

issued under this agreement and admitted to trading will be

communicated monthly on the Company's website.

- Loans and “PGE Resilience” The Company obtained the

formal agreement on loans for a total amount of €5.3 million with

the collective support of “La Région Pays de la Loire,” Bpifrance

and its banking pool composed by banks CIC, Crédit Mutuel and BNP

to finance its strategic R&D programs. Favorable conditions

were granted for these loans, with an interest range of 2-4% and

reimbursement timelines within 3 to 5 years. Part of these loans is

composed by a “PGE Resilience” ("Prêt Garanti par l’État") loan

guaranteed by the French State, implemented in the context of the

Ukrainian crisis. At the end of June 2023, €3.1 million have been

drawdown. The balance has been received in Q3 2023.

- €1.5 million in funding from Bpifrance for the

development of a companion diagnostic for the cancer vaccine

Tedopi® in non-small cell lung cancer.

This available cash will enable the Company to finance its

clinical development and R&D costs for earlier stage

products.

During the first half of 2023, the Company recorded a

consolidated net result of €-11,9 million.

Current operating expenses were €14.9 million (versus €19.4

million for the same period in 2022) of which 77% are related to

R&D. After a strategic review of costs and programs, operating

expenses dropped dawn by 25% compared to H1 2022.

The Board of Directors of September 27, 2023, has approved the

Company’s semester accounts as of June 30, 2023. The full

“Half-year financial report” (Regulated information) is available

on: https://www.ose-immuno.com/en/financial-documents/. The limited

review procedures on the consolidated accounts have been performed.

The report on this limited review is being issued.

CONSOLIDATED PROFIT & LOSS

In K€

H1 2023

H1 2022

Turnover

1,358

16,047

OPERATING INCOME - RECURRING

1,358

16,047

Research & Development expenses

(9,693)

(14,395)

Overhead expenses

(3,604)

(3,813)

Expenses related to share-based

payments

(1,562)

(1,182)

OPERATING PROFIT/LOSS -

RECURRING

(13,501)

(3,341)

Other operating income and expenses

(4)

(84)

OPERATING RESULT

(13,504)

(3,425)

Financial income

2,658

2,023

Financial expenses

(1,608)

(708)

PROFIT/LOSS BEFORE TAX

(11,943)

(2,110)

INCOME TAX

84

132

CONSOLIDATED NET RESULT

(11,860)

(1,979)

Of which consolidated net result

attributable to shareholders

(11,860)

(1,979)

Net earnings attributable to

shareholders

Weighted average number of shares

outstanding

18,624,665

18,527,401

- The basic and diluted result per common share (€/share)

(0,64)

(0,11)

(0,64)

(0,11)

In K€

H1 2023

H1 2022

NET RESULT

(11,860)

(1,979)

Amounts to be recycled in the income

statement:

Unrealized gains on securities available

for sale, net of tax

Currency conversion difference

(7)

46

Amounts not to be recycled in the income

statement:

Actuarial gains and losses on

post-employment benefits

0

34

Other comprehensive income in the

period

(7)

(13)

GLOBAL PROFIT/LOSS

(11,867)

(1,992)

CONSOLIDATED BALANCE SHEET

ASSETS in K€

June 30, 2023

December 31, 2022

NON-CURRENT ASSETS

Acquired R&D costs

47,604

48,784

Tangible assets

589

743

Rights of use

3,712

4,236

Financial assets

587

635

Deferred tax assets

184

182

TOTAL NON-CURRENT

ASSETS

52,676

54,581

CURRENT ASSETS

Trade receivables

234

403

Other current assets

12,463

11,177

Cash and cash equivalents

15,018

25,620

TOTAL CURRENT ASSETS

27,714

37,200

TOTAL ASSETS

80,391

91,781

EQUITY & LIABILITIES in K€

June 30, 2023

December 31, 2022

SHAREHOLDERS’ EQUITY

Stated capital

3,806

3,705

Share premium

39,169

38,784

Merger premium

26,827

26,827

Treasury stock

(483)

(549)

Reserves and retained earnings

(34,932)

(18,349)

Consolidated result

(11,860)

(17,760)

TOTAL SHAREHOLDERS’

EQUITY

22,529

32,658

NON-CURRENT DEBTS

Non-current financial liabilities

Lease non current liabilities

34,310

37,231

Non-current lease liabilities

3,157

3,586

Non-current deferred tax liabilities

1,430

1,514

Non-current provisions

423

524

TOTAL NON-CURRENT

DEBTS

39,320

42,856

CURRENT DEBTS

Current financial liabilities

5,433

3,093

Current lease liabilities

858

883

Trade payables

9,421

8,539

Corporate income tax liabilities

18

21

Social and tax payables

2,662

2,916

Other debts and accruals

151

816

TOTAL CURRENT DEBTS

18,542

16,268

TOTAL LIABILITIES

80,391

91,781

ABOUT OSE Immunotherapeutics

OSE Immunotherapeutics is a biotech company dedicated to

developing first-in-class assets in immuno-oncology and

immuno-inflammation.

The Company’s current well-balanced first-in-class clinical

pipeline includes:

- Tedopi® (immunotherapy activating tumor specific

T-cells, off-the-shelf, neoepitope-based): this cancer vaccine is

the Company’s most advanced product; positive results from the

Phase 3 trial (Atalante 1) in Non-Small Cell Lung Cancer patients

in secondary resistance after checkpoint inhibitor failure. Other

Phase 2 trials, sponsored by clinical oncology groups, of Tedopi®

in combination are ongoing in solid tumors.

- OSE-279 (anti-PD1): ongoing Phase 1/2 in solid tumors or

lymphomas (first patient included). OSE-279 is the backbone therapy

of the BiCKI® platform.

- OSE-127 - lusvertikimab (humanized monoclonal antibody

antagonist of IL-7 receptor); ongoing Phase 2 in Ulcerative Colitis

(sponsor OSE Immunotherapeutics); ongoing preclinical research in

leukemia (OSE Immunotherapeutics).

- FR-104/VEL-101 (anti-CD28 monoclonal antibody):

developed in partnership with Veloxis Pharmaceuticals, Inc. in

transplantation; ongoing Phase 1/2 in renal transplant (sponsor

Nantes University Hospital); Phase 1 ongoing in the US (sponsor

Veloxis Pharmaceuticals, Inc.).

- OSE-172/BI 765063 (anti-SIRPα monoclonal antibody on

CD47/SIRPα pathway) developed in partnership with Boehringer

Ingelheim in advanced solid tumors; positive Phase 1 dose

escalation results in monotherapy and in combination, in particular

with anti-PD-1 antibody ezabenlimab; international Phase 1b ongoing

clinical trial in combination with ezabenlimab alone or with other

drugs in patients with recurrent/metastatic head and neck squamous

cell carcinoma (HNSCC) and hepatocellular carcinoma (HCC).

OSE Immunotherapeutics expects to generate further significant

value from its two proprietary drug discovery platforms, which are

central to its ambitious goal to deliver next-generation

first-in-class immunotherapeutics:

- BiCKI® platform focused on immuno-oncology (IO) is a

bispecific fusion protein platform built on the key backbone

component of anti-PD1 combined with a new immunotherapy target to

increase anti-tumor efficacy. BiCKI-IL-7 is the most advanced

BiCKI® candidate targeting anti-PD1xIL-7.

- Myeloid platform focused on optimizing the therapeutic

potential of myeloid cells in IO and immuno-inflammation (I&I).

OSE-230 (ChemR23 agonist mAb) is the most advanced candidate

generated by the platform, with the potential to resolve chronic

inflammation by driving affected tissues to tissue integrity.

Additional information about OSE Immunotherapeutics assets is

available on the Company’s website: www.ose-immuno.com

Click and follow us on Twitter and LinkedIn.

Forward-looking statements

This press release contains express or implied information and

statements that might be deemed forward-looking information and

statements in respect of OSE Immunotherapeutics. They do not

constitute historical facts. These information and statements

include financial projections that are based upon certain

assumptions and assessments made by OSE Immunotherapeutics’

management in light of its experience and its perception of

historical trends, current economic and industry conditions,

expected future developments and other factors they believe to be

appropriate.

These forward-looking statements include statements typically

using conditional and containing verbs such as “expect,”

“anticipate,” “believe,” “target,” “plan,” or “estimate,” their

declensions and conjugations and words of similar import. Although

the OSE Immunotherapeutics management believes that the

forward-looking statements and information are reasonable, the OSE

Immunotherapeutics’ shareholders and other investors are cautioned

that the completion of such expectations is by nature subject to

various risks, known or not, and uncertainties which are difficult

to predict and generally beyond the control of OSE

Immunotherapeutics. These risks could cause actual results and

developments to differ materially from those expressed in or

implied or projected by the forward-looking statements. These risks

include those discussed or identified in the public filings made by

OSE Immunotherapeutics with the AMF. Such forward-looking

statements are not guarantees of future performance. This press

release includes only summary information and should be read with

the OSE Immunotherapeutics Universal Registration Document filed

with the AMF on May 2, 2023, including the annual financial report

for the fiscal year 2022, available on the OSE Immunotherapeutics’

website. Other than as required by applicable law, OSE

Immunotherapeutics issues this press release at the date hereof and

does not undertake any obligation to update or revise the

forward-looking information or statements.

__________________________________ 1 These conditions are

described in the Company's press release dated April 27, 2023. The

shares will therefore be issued on the basis of the lowest average

daily price weighted by volumes over the period of the two trading

sessions preceding each issue, reduced a maximum discount of 6%, in

compliance with the price rule and the ceiling set by the general

meeting. Under the terms of the delegation granted by the general

meeting, the issue price of the shares must be "at least equal to

the weighted average of the prices of the last three trading

sessions preceding the fixing of the issue price, possibly reduced

by a maximum discount of 20%”. 2 21st resolution: delegation of

capital increase with elimination of shareholders' preferential

subscription rights for the benefit of categories of people meeting

specific characteristics. Vester Finance falls well into the

targeted category as a regular investor in so-called “small cap”

growth companies, particularly in the health or biotechnology

sector. 3 Based on the 21,641,101 shares issuable upon exercise of

the dilutive instruments issued by the Company to date. 4 Based on

the 1,830,000 shares that may be issued upon exercise of the

dilutive instruments issued by the Company to date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230927782139/en/

OSE Immunotherapeutics Sylvie Détry

sylvie.detry@ose-immuno.com

Nicolas Poirier Chief Executive Officer

nicolas.poirier@ose-immuno.com

French Media: FP2COM Florence Portejoie

fportejoie@fp2com.fr +33 6 07 768 283

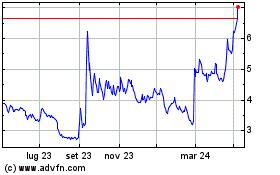

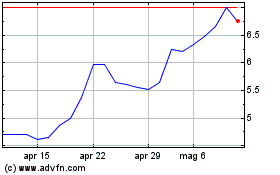

Grafico Azioni OSE Immunotherapeutics (EU:OSE)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni OSE Immunotherapeutics (EU:OSE)

Storico

Da Mag 2023 a Mag 2024