SES S.A. announces financial results for the nine months and

three months ended 30 September 2024 with solid operational and

financial performance driving the Full Year 2024 revenue and

Adjusted EBITDA outturn which is now expected to close at the top

end of SES’s financial outlook range.

- Revenue of €1,475 million (-1.1% YOY(1)) and Adjusted EBITDA(2)

of €775 million (-2.0% YOY(1))

- Networks up +2.9% YOY(1) with high single digit growth in

Government, Aviation, and Cruise

- Media performance (-5.5% YOY(1) YTD) in line with expectations

and improving trend in Q3 2024 of -3.1% YOY(1)

- €900 million renewals & new business. Signed $200 million

NATO government contract for O3b mPOWER; Thai Airways and Turkish

Airlines for SES Open Orbits(3); multi-year media renewals with

Sky, Warner Brothers Discovery, Telekom Srbija, RTL, and

ORF/ORS

- Adjusted Free Cash Flow of €262 million up 5% YOY with Net

Leverage at 1.1x(4). Cash & cash equivalents at €3.2 billion

including €1 billion of proceeds from the successful Hybrid bonds

issuance

- 2024 Revenue outlook(5) and Adjusted EBITDA outlook(4) are now

both tracking to the top end of the expected range

- Intelsat acquisition on track to complete during H2 2025 with

progress towards regulatory clearances and integration

planning

- IRIS2 concession award enables MEO network expansion to keep

pace with growing customer demand in line with financial

policy

Adel Al-Saleh, CEO of SES, commented: “2024 financial

performance continues to track in line with our expectations,

reflecting solid execution and the strength of SES’s differentiated

customer solutions across our target segments. We expect to deliver

Full Year 2024 revenue and Adjusted EBITDA at the top end of our

outlook, as we work towards improving the business’ growth

trajectory.

Our Networks business continues to grow led by high single digit

growth in Government, Aviation, and Cruise. The launch of mPOWER

satellites 7 and 8 is on track for December 2024 which, along with

the launch of satellites 9, 10, and 11 during 2025 and satellites

12 and 13 at the end of 2026, will add much needed capacity to the

constellation to support the rapidly expanding demand for our

MEO-based vertical solutions. In Media, we expect our solid Q3 2024

performance to continue for Q4, underscoring the underlying value

of our core TV neighbourhoods and customer offerings, as reflected

by the important multi-year deals signed this year.

The regulatory process for the Intelsat acquisition is beginning

to gather pace with a number of clearances already granted, while

the integration planning has further advanced to ensure execution

from Day 1 of closing which remains on course for H2 next year.

Lastly, the award to SES and our consortium partners to design,

deliver, and operate Europe’s sovereign multi-orbit IRIS2

government communications network creates value for the European

Union and enables the expansion of our differentiated MEO

infrastructure, where customer demand continues to grow, while

remaining committed to all our financial policy objectives.”

_____________________________________

1) At constant FX (comparative figures

restated to neutralise currency variations)

2) Excluding operating expenses/income

recognised in relation to U.S. C-band repurposing and other

significant special items (disclosed separately).

3) SES Open OrbitsTM is a partnership

between SES, Neo Space Group, AeroSat Link, and Hughes

Communications India. These new IFC services are delivered by SES

along with one of its key SES Open Orbits™ connectivity service

partners, Neo Space Group

4) Adjusted Net Debt to Adjusted EBITDA

(treats hybrid bonds as 50% debt and 50% equity)

5) Financial outlook assumes a €/$ FX rate

of €1 = $1.09, nominal satellite health, and nominal launch

schedule

Key business and financial highlights (at constant FX unless

explained otherwise)

SES regularly uses Alternative Performance Measures (APM) to

present the performance of the group and believes that these APMs

are relevant to enhance understanding of the financial performance

and financial position.

€ million

YTD 2024

YTD 2023

∆ as reported

∆ at constant FX

Average €/$ FX rate

1.09

1.08

Revenue

1,475

1,494

-1.3%

-1.1%

Adjusted EBITDA

775

792

-2.1%

-2.0%

Adjusted Net Profit

116

180

-35.1%

n/m

Adjusted Net Debt / Adjusted

EBITDA

1.1 times

3.5 times

n/m

n/m

“At constant FX” refers to comparative

figures restated at the current period FX, to neutralise currency

variations.

Networks (53% of total) revenue of €787 million increased +2.9%

year on year driven by growth in Government (+7.2%) and Mobility

(+5.0% including periodic revenue in Q1 2024 and high single digit

growth in Aviation). In Fixed Data (-7.4%), the comparison with YTD

2023 is impacted by periodic revenue recognised in the prior

period, although revenue in Q3 2024 was 16.0% higher than Q2 2024

mainly reflecting the benefit of new Cloud business. YTD the

Networks business secured €545 million of renewals and new

business.

Media (47% of total) revenue of €686 million represented a

reduction of -5.5% compared with YTD 2023, mainly driven by lower

revenue in mature markets which were partially offset by double

digit growth in Sports & Events revenue. So far in 2024, the

Media business secured €355 million of renewals and new

business.

SES’s fully protected contract backlog on 30 September 2024 was

€3.7 billion (€4.6 billion gross backlog including backlog with

contractual break clauses), of which Media was €1.9 billion (€2.0

billion gross backlog) and Networks was €1.8 billion (€2.6 billion

gross backlog).

Adjusted EBITDA of €775 million represented an Adjusted EBITDA

margin of 53% (YTD 2023: 53%). Adjusted EBITDA excludes significant

special items of €41 million (YTD 2023: €2,678 million), comprising

net U.S. C-band income of €2 million (YTD 2023: net income of

€2,701 million) and expenses related to other significant special

items of €43 million (YTD 2023: €23 million).

Adjusted Net Profit of €116 million mainly reflected the lower

year on year Adjusted EBITDA and higher depreciation &

amortisation. This was offset by lower net financing costs of €6

million (YTD 2023: €49 million) which included the benefit of

earning interest income on the group’s cash & cash equivalents

of €92 million (YTD 2023: €13 million). It also included a net

foreign exchange (FX) loss of €8 million (YTD 2023: FX gain of €17

million) and lower capitalised interest of €11 million (YTD 2023:

€24 million).

Adjusted Free Cash Flow (excluding significant special items) of

€262 million was €12 million, or 4.8%, higher year on year

including the benefit of lower year on year investing activities of

€264 million (YTD 2023: €303 million) and higher cash interest

received of €90 million (YTD 2023: €13 million). These items were

partly offset by higher year on year cash tax payments and changes

in working capital.

Adjusted Net Debt to Adjusted EBITDA ratio (treating 50% of

€1.625 billion of hybrid bonds as debt and 50% as equity) on 30

September 2024 was 1.1 times (30 September 2023: 3.5 times, 31

December 2023: 1.5 times). Cash & cash equivalents of €3.2

billion included the proceeds from the hybrid dual-tranche bond

offering totalling €1 billion completed at the end of September

2024.

The total amount of remaining U.S. C-band clearing cost

reimbursements expected to be received in future is now

approximately $150 million and SES is continuing to engage with

insurers regarding the claim of $472 million relating to O3b mPOWER

satellites 1-4.

The Full Year 2024 interim dividend of €0.25 per A-share and

€0.10 per B-share was paid to shareholders on 18 October 2024.

The share buyback programme of €150 million was started in

November 2023 and has been completed in respect of the A-shares in

October 2024 with 24 million A-shares purchased at an average price

of €5.22 per A-share. In addition, 6 million B-shares were

purchased and a further 6 million B-shares will be purchased to

maintain the ratio of two A-shares to one B-share, as required by

the Articles of Association, at a combined average price of €2.09

per B-share. The shares acquired will be cancelled after the expiry

of one year, which will reduce the total number of voting and

economic shares in issue.

For Full Year 2024, group revenue and Adjusted EBITDA (assuming

an FX rate of €1=$1.09, nominal satellite health, and nominal

launch schedule) are expected to be at the top end of the range of

€1,940-2,000 million and €950-1,000 million respectively, with

growth in Networks revenue expected to mostly offset lower year on

year Media revenue. Capital expenditure (net cash absorbed by

investing activities excluding acquisitions, financial investments,

U.S. C-band repurposing, and assuming an FX rate of €1=$1.09) is

expected to be in the range of €500-550 million in 2024 with an

average annual capital expenditure of approximately €350 million

for 2025-2028. This excludes any potential change relating to IRIS2

where the cash flows and investment levels have not yet been

finalised as part of final contract negotiations.

Operational performance

REVENUE BY BUSINESS UNIT

2024

Revenue (€ million) as

reported

Change (YOY) at constant

FX

Q1 2024

Q2 2024

Q3 2024

YTD 2024

Q1 2024

Q2 2024

Q3 2024

YTD 2024

Average €/$ FX rate

1.09

1.08

1.09

1.08

Media

228

225

233

686

-5.2%

-8.2%

-3.1%

-5.5%

Networks

268

255

264

787

+9.6%

+0.7%

-1.0%

+2.9%

Government

125

130

136

391

+6.1%

+10.7%

+5.1%

+7.2%

Fixed Data

59

55

64

179

-0.5%

-15.1%

-6.1%

-7.4%

Mobility

84

70

64

217

+24.5%

-1.5%

-7.4%

+5.0%

Other

2

-

-

2

n/m

n/m

n/m

n/m

Group Total

498

480

497

1,475

+2.5%

-3.7%

-2.0%

-1.1%

“At constant FX” refers to comparative

figures restated at the current period FX, to neutralise currency

variations.

Future satellite launches

Satellite

Region

Application

Launch Date

O3b mPOWER (satellites 7-8)

Global

Fixed Data, Mobility, Government

Late 2024

O3b mPOWER (satellites 9-11)

Global

Fixed Data, Mobility, Government

2025

EAGLE-1

Europe

Government

2026

O3b mPOWER (satellites 12-13)

Global

Fixed Data, Mobility, Government

2026

ASTRA 1Q

Europe

Media, Fixed Data, Mobility,

Government

2027

SES-26

Africa, Asia, Europe, Middle East

Media, Fixed Data, Mobility,

Government

2027

Final launch dates are subject to

confirmation by launch providers.

CONSOLIDATED INCOME STATEMENT

€ million

YTD 2024

YTD 2023

Average €/$ FX rate

1.09

1.08

Revenue

1,475

1,494

U.S. C-band repurposing

income

6

2,718

Operating expenses

(747)

(742)

EBITDA

734

3,470

Depreciation expense

(473)

(447)

Amortisation expense

(106)

(67)

Non-cash impairment

(24)

(1,553)

Operating profit

131

1,403

Net financing income/(costs)

(6)

(49)

(Loss) / profit before

tax

125

1,354

Income tax expense

(42)

(492)

Non-controlling interests

(6)

-

Net Profit attributable to

owners of the parent

77

862

Basic and diluted loss per

A-share (in €)(1)

0.15

1.90

Basic and diluted loss per

B-share (in €)(1)

0.06

0.76

1) Earnings per share is calculated as

profit attributable to owners of the parent divided by the weighted

average number of shares outstanding during the year, as adjusted

to reflect the economic rights of each class of share. For the

purposes of the EPS calculation only, the net profit for the year

attributable to ordinary shareholders has been adjusted to include

the assumed coupon, net of tax, on the perpetual bonds.

€ million

YTD 2024

YTD 2023

Adjusted EBITDA

775

792

U.S. C-band income

6

2,718

U.S. C-band operating

expenses

(4)

(17)

Other significant special

items

(43)

(23)

EBITDA

734

3,470

€ million

YTD 2024

YTD 2023

Adjusted Net Profit

116

180

U.S. C-band income

6

2,718

U.S. C-band operating

expenses

(4)

(17)

Non-cash impairment

(24)

(1,553)

Other significant special

items

(43)

(23)

Tax on significant special

items

26

(443)

Net profit attributable to

owners of the parent

77

862

SUPPLEMENTARY INFORMATION

QUARTERLY INCOME STATEMENT (AS

REPORTED)

€ million

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Average €/$ FX rate

1.07

1.08

1.08

1.07

1.09

1.08

1.09

Revenue

490

497

507

536

498

480

497

U.S. C-band income

2

1

2,715

26

1

4

1

Other income

-

-

-

5

-

-

-

Operating expenses

(240)

(251)

(251)

(355)

(230)

(248)

(269)

EBITDA

252

247

2,971

212

269

236

229

Depreciation expense

(148)

(146)

(153)

(156)

(139)

(162)

(172)

Amortisation expense

(17)

(29)

(21)

(22)

(19)

(49)

(38)

Non-cash impairment

-

-

(1,553)

(2,123)

-

(25)

1

Operating profit

87

72

1,244

(2,089)

111

-

20

Net financing (costs)/income

(29)

(18)

(2)

7

5

(5)

(6)

(Loss)/Profit before

tax

58

54

1,242

(2,082)

116

(5)

14

Income tax benefit/(expense)

(3)

(17)

(472)

316

(43)

5

(4)

Non-controlling interests

-

-

-

(1)

-

-

(6)

Net (Loss)/Profit attributable

to owners of the parent

55

37

770

(1,767)

73

0

4

Basic (loss)/earnings per

share

(in €)(1)

Class A shares

0.10

0.07

1.73

(4.04)

0.16

(0.01)

0.00

Class B shares

0.04

0.03

0.69

(1.62)

0.06

0.00

0.00

Adjusted EBITDA

265

265

262

233

275

250

250

Adjusted EBITDA margin

54%

53%

52%

44%

55%

52%

50%

U.S. C-band income

2

1

2,715

26

1

4

1

Other Income

-

-

-

5

-

-

-

U.S. C-band operating

expenses

(6)

(7)

(4)

(30)

(2)

(1)

(1)

Other significant special

items

(9)

(12)

(2)

(22)

(5)

(17)

(21)

EBITDA

252

247

2,971

212

269

236

229

1) Earnings per share is calculated as

profit attributable to owners of the parent divided by the weighted

average number of shares outstanding during the year, as adjusted

to reflect the economic rights of each class of share. For the

purposes of the EPS calculation only, the net profit for the year

attributable to ordinary shareholders has been adjusted to include

the coupon, net of tax, on the perpetual bonds. Fully diluted

earnings per share are not significantly different from basic

earnings per share.

ALTERNATIVE PERFORMANCE MEASURES

SES regularly uses Alternative Performance Measures (‘APM’) to

present the performance of the Group and believes that these APMs

are relevant to enhance understanding of the financial performance

and financial position. These measures may not be comparable to

similarly titled measures used by other companies and are not

measurements under IFRS or any other body of generally accepted

accounting principles, and thus should not be considered

substitutes for the information contained in the Group’s financial

statements.

Alternative Performance Measure

Definition

Reported EBITDA and EBITDA

margin

EBITDA is profit for the period

before depreciation, amortisation, impairment, net financing cost,

and income tax. EBITDA margin is EBITDA divided by the sum of

revenue and other income including U.S. C-band repurposing

income.

Adjusted EBITDA and Adjusted EBITDA

margin

EBITDA adjusted to exclude

significant special items of a non-recurring nature. The primary

exceptional items are the net impact of the repurposing of U.S.

C-band spectrum, restructuring charges, costs associated with the

development and/or implementation of merger and acquisition

activities, specific business taxes, one-off regulatory charges

arising outside ongoing operations. Adjusted EBITDA margin is

Adjusted EBITDA divided by revenue.

Adjusted Free Cash Flow

Net cash generated by operating

activities less net cash absorbed by investing activities, interest

paid on borrowings, coupon paid on perpetual bond and lease

payments, and adjusted to exclude the effect of cash flows

generated by significant special items of a non-recurring nature.

The primary exceptional items are the net impact of the repurposing

of U.S. C-band spectrum, restructuring charges, costs associated

with the development and/or implementation of merger and

acquisition activities, specific business taxes, one-off regulatory

charges arising outside ongoing operations.

Adjusted Net Debt to Adjusted

EBITDA

Adjusted Net Debt to Adjusted

EBITDA represents the ratio of Net Debt plus 50% of the group’s

hybrid bonds (per the rating agency methodology) divided by the

last 12 months’ (rolling) Adjusted EBITDA.

Adjusted Net Profit

Net profit attributable to owners

of the parent adjusted to exclude the after-tax impact of

significant special items.

Presentation of Results:

A presentation of the results for investors and analysts will be

hosted at 9.30 CET on 7 November 2024 and will be broadcast via

webcast and conference call. The details for the conference call

and webcast are as follows:

U.K.

+44 (0) 33 0551 0200

France

+33 (0) 1 70 37 71 66

Germany

+49 (0) 30 3001 90612

U.S.A.

+1 786 697 3501

Confirmation code

SES

Webcast registration

https://channel.royalcast.com/landingpage/ses/20241107_1/

The presentation is available for download from

https://www.ses.com/company/investors/financial-results and a

replay will be available shortly after the conclusion of the

presentation.

Follow us on:

Twitter | Facebook | YouTube | LinkedIn | Instagram Read our Blogs >

Visit the Media Gallery >

About SES

SES has a bold vision to deliver amazing experiences everywhere

on Earth by distributing the highest quality video content and

providing seamless data connectivity services around the world. As

a provider of global content and connectivity solutions, SES owns

and operates a geosynchronous orbit fleet and medium earth orbit

(GEO-MEO) constellation of satellites, offering a combination of

global coverage and high performance services. By using its

intelligent, cloud-enabled network, SES delivers high-quality

connectivity solutions anywhere on land, at sea or in the air, and

is a trusted partner to telecommunications companies, mobile

network operators, governments, connectivity and cloud service

providers, broadcasters, video platform operators and content

owners around the world. The company is headquartered in Luxembourg

and listed on Paris and Luxembourg stock exchanges (Ticker: SESG).

Further information is available at: www.ses.com.

Forward looking statements

This communication contains forward-looking statements.

Generally, the words “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “contemplate,” “predict,” “forecast,” “likely,”

“believe,” “target,” “will,” “could,” “would,” “should,”

“potential,” “may” and similar expressions or their negative, may,

but are not necessary to, identify forward-looking statements.

Such forward-looking statements, including those regarding the

timing and consummation of the transaction described herein,

involve risks and uncertainties. SES’s and Intelsat’s experience

and results may differ materially from the experience and results

anticipated in such statements. The accuracy of such statements is

subject to a number of risks, uncertainties and assumptions

including, but not limited to, the following factors: the risk that

the conditions to the closing of the transaction are not satisfied,

including the risk that required approvals of the transaction from

the shareholders of Intelsat or from regulators are not obtained;

litigation relating to the transaction; uncertainties as to the

timing of the consummation of the transaction and the ability of

each party to consummate the transaction; risks that the proposed

transaction disrupts the current plans or operations of SES or

Intelsat; the ability of SES and Intelsat to retain and hire key

personnel; competitive responses to the proposed transaction;

unexpected costs, charges or expenses resulting from the

transaction; potential adverse reactions or changes to

relationships with customers, suppliers, distributors and other

business partners resulting from the announcement or completion of

the transaction; the combined company’s ability to achieve the

synergies expected from the transaction, as well as delays,

challenges and expenses associated with integrating the combined

company’s existing businesses; the impact of overall industry and

general economic conditions, including inflation, interest rates

and related monetary policy by governments in response to

inflation; geopolitical events, and regulatory, economic and other

risks associated therewith; and continued uncertainty around the

macroeconomy. Other factors that might cause such a difference

include those discussed in the prospectus on Form F-4 to be filed

in connection with the proposed transaction. The forward-looking

statements included in this communication are made only as of the

date hereof and, except as required by federal securities laws and

rules and regulations of the SEC, SES and Intelsat undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Additional Information and Where to Find It

In connection with the proposed transaction, SES intends to file

with the SEC a registration statement on Form F-4 that also

constitutes a prospectus of SES. SES also plans to file other

relevant documents with the SEC regarding the proposed transaction.

No offer of securities shall be made, except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended. INVESTORS AND SHAREHOLDERS ARE URGED TO

READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS

THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF

AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and

shareholders will be able to obtain free copies of these documents

(if and when available), and other documents containing important

information about SES and Intelsat, once such documents are filed

with the SEC through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed with the SEC by

SES will be available free of charge on SES’s website at

www.ses.com or by contacting SES’s Investor Relations Department by

email at ir@ses.com. Copies of the documents filed with the SEC by

Intelsat will be available free of charge on Intelsat’s website at

www.intelsat.com or by contacting Intelsat’s Investor Relations

Department by email at investor.relations@intelsat.com.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction. No offer of securities shall

be made, except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106530175/en/

Richard Whiteing Investor Relations Tel: +352 710 725 261

richard.whiteing@ses.com

Suzanne Ong Communications Tel: +352 710 725 500

suzanne.ong@ses.com

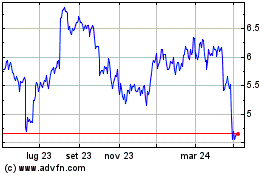

Grafico Azioni SES (EU:SESG)

Storico

Da Gen 2025 a Feb 2025

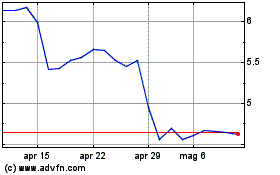

Grafico Azioni SES (EU:SESG)

Storico

Da Feb 2024 a Feb 2025