Press Release - SMCP - 2023 Q1 Sales

2023

First quarterPress release -

Paris, April 27th, 2023

Strong start

to the year +8% at

constant FX,driven by

an excellent momentum in

France and a shift back to growth

in APAC

- Q1 2023 sales

at €305m, +8% at constant exchange rates (+7% on an organic basis)

versus 2022 driven by like-for-like growth despite a high basis of

comparison.

- Excellent

performance in Europe driven by B&M and digital; Asia back to

growth with China’s gradual economic recovery; after an outstanding

year in 2022, the trend in America is stabilizing, supported by

like-for-like positive growth in the US.

- Continued

reduction of the average discount rate with a one-point decrease

compared to the first quarter of 2022, coming in particular from

digital and Asia.

- The network is

decreasing this quarter, mainly due to the permanent shutdown of

stores in Russia which had not been supplied since February

2022.

-

Full-year financial guidance

confirmed.

Commenting on these results, Isabelle

Guichot, CEO of SMCP, stated: “The Group has again

delivered a good performance over the first quarter of the year. We

are particularly pleased with the strong momentum in France, the

dynamism in Europe, the return to growth in Asia and the resilience

of our sales in America after an excellent 2022. This quarter also

saw the progress in the implementation of our ambitious CSR

strategy with the acceleration of the full-traceability project

roll-out on brand collections, the launch of Sandro clothing rental

in the UK and the launch of our SMCP Retail Lab training school. We

remain vigilant regarding the evolution of the macro-economic,

social, and geopolitical context but are confident that the

positive momentum will continue in the coming quarters and thus

confirm our annual targets.”

|

€m except

%Unaudited

figures |

Q1

2022 |

Q1

2023 |

Organicchange |

Reportedchange |

Constant Fx

change |

| |

Sales by region

|

|

France |

93.7 |

106.0 |

+13.1% |

+13.1% |

+13.1% |

|

EMEA |

83.1 |

88.6 |

+7.0% |

+6.6% |

+7.0% |

|

America |

38.6 |

39.0 |

-2.5% |

+1.0% |

-2.5% |

|

APAC |

67.6 |

71.0 |

+2.7% |

+5.1% |

+6.9% |

|

|

Sales by brand |

|

Sandro |

134.1 |

146.0 |

+7.8% |

+8.9% |

+8.9% |

|

Maje |

112.2 |

113.8 |

+0.4% |

+1.5% |

+1.5% |

|

Other brands1 |

36.8 |

44.8 |

+21.8% |

+21.7% |

+21.9% |

|

TOTAL |

283.0 |

304.6 |

+6.7% |

+7.6% |

+7.6% |

SALES BY

REGION

In France, sales reached a

record level of €106m in the first quarter, with an organic growth

of +13% compared to 2022. They were mainly driven by the

performance of the like-for-like network and by the demand of local

and tourist customers, who are increasingly numerous both in

physical shops and on the brands' websites. This double-digit

growth is even more remarkable given the high basis of comparison

in 2022 and the adverse social environment. The “Other brands”

division (Claudie Pierlot and Fursac) recorded a strong momentum in

the quarter. The Group also carried on its strategy of reducing the

average discount rate, particularly in digital. The network is

decreasing by four POS including the closure of the remaining two

Suite 341 stores.

In EMEA, the Group maintained a

very good momentum with a robust growth despite a high basis of

comparison. Sales reached €89m, +7% on an organic basis vs 2022

with a strong retail like-for-like growth of +15% from both B&M

and digital sales. The good performance of the largest markets such

as the United Arab Emirates, Italy and Spain was partially offset

by the end of the wholesale partnership in Russia (last deliveries

in February 2022). The average discount rate registered a slight

decrease which comes from digital. The network is down by seven POS

in Q1 excluding the impact of Russia (40 POS).

In America, after an

outstanding performance in 2022, sales are stabilizing in reported

change and decreasing by -3% on an organic basis. During the first

quarter, sales in the US were resilient with a positive

like-for-like growth in B&M. The slightly unfavorable trend

comes from Canada where the normalization of traffic is slower due

to the low level of tourism from Asia and weak local demand. The

network is down by two POS.

In APAC, the growth is

progressively back in the region, with €71m of sales in Q1, +3% on

an organic basis vs 2022. The trend gradually improved in Mainland

China over the quarter with January and February still affected by

low traffic, before returning to growth in March. The region

benefits from a good performance in Hong-Kong, Singapore, Malaysia

and Macau and the integration of Australia and New-Zealand in our

own retail network. The average discount rate decreased by more

than four points with the normalization of the situation after the

Covid constraints. Finally, the network continued to expand with

five openings, particularly in China and Singapore.

CONCLUSION AND PERSPECTIVES

Thanks to the strong desirability of its brands,

the Group records a good performance in the first quarter.

Subject to the evolution of the macro-economic,

social, and geopolitical situation, SMCP confirms its financial

guidance for 2023.

OTHER

INFORMATIONS

At its meeting of March 23, 2023, the Board of

Directors decided to create a Sustainability committee, which will

be responsible for monitoring the consideration of social,

societal, and environmental responsibility issues when defining the

Group’s strategy and its implementation.

FINANCIAL CALENDAR

June 21st, 2023 – Annual shareholders

meeting

July 27th, 2023 – 2023 Half-Year Results

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 9:00 a.m. (Paris

time).

Related slides will

also be available on the website (www.smcp.com), in the Finance

section.

APPENDICES

Breakdown of DOS

|

Number of DOS |

Q1-22 |

2022 |

Q1-23 |

|

vs. 2022 |

vs.Q1 2022 |

| |

|

|

|

|

|

|

|

By region |

|

|

|

|

|

|

| France |

459 |

460 |

456 |

|

-4 |

-3 |

| EMEA |

395 |

395 |

391 |

|

-4 |

-4 |

| America |

165 |

166 |

164 |

|

-2 |

-1 |

| APAC |

251 |

259 |

305 |

|

+46 |

+54 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

541 |

551 |

569 |

|

+18 |

+28 |

| Maje |

451 |

457 |

476 |

|

+19 |

+25 |

| Claudie

Pierlot |

209 |

201 |

203 |

|

+2 |

-6 |

| Suite 341 |

3 |

2 |

- |

|

-2 |

-3 |

| Fursac |

66 |

69 |

68 |

|

-1 |

+2 |

|

Total DOS |

1,270 |

1,280 |

1 316 |

|

+36 |

+46 |

Breakdown of POS

|

Number of POS |

Q1-22 |

2022 |

Q1-23 |

|

vs. 2022 |

vs.Q1 2022 |

| |

|

|

|

|

|

|

|

By region |

|

|

|

|

|

|

| France |

460 |

461 |

457 |

|

-4 |

-3 |

| EMEA |

545 |

552 |

505 |

|

-47 |

-40 |

| America |

195 |

198 |

196 |

|

-2 |

+1 |

| APAC |

467 |

472 |

477 |

|

+5 |

+10 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

736 |

752 |

733 |

|

-19 |

-3 |

| Maje |

618 |

627 |

611 |

|

-16 |

-7 |

| Claudie

Pierlot |

244 |

233 |

223 |

|

-10 |

-21 |

| Suite 341 |

3 |

2 |

- |

|

-2 |

-3 |

| Fursac |

66 |

69 |

68 |

|

-1 |

+2 |

|

Total POS |

1,667 |

1,683 |

1,635 |

|

-48 |

-32 |

|

o/w Partners

POS |

397 |

403 |

319 |

|

-84 |

-78 |

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

Number of points of sale

(POS)

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly operated stores (DOS), including

free-standing stores, concessions in department stores,

affiliate-operated stores, outlets and online stores, and (ii)

partnered retail points of sale.

Organic sales growth

Organic sales growth is the total sales in a

given period compared to the same period in the previous year. It

is expressed as a percentage change between the two periods and is

presented at constant rates (sales for period N and period N-1 in

foreign currencies are converted at the average rate for year N-1)

and excluding the effects of changes in the scope of

consolidation.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year. Like-for-like points of sale for a given period

include all of the Group’s points of sale that were open at the

beginning of the previous period and exclude points of sale closed

during the period, including points of sale closed for renovation

for more than one month, as well as points of sale that changed

their activity (for example, Sandro points of sale changing from

Sandro Femme to Sandro Homme or to a mixed Sandro Femme and Sandro

Homme store). Like-for-like sales growth percentage is presented at

constant exchange rates.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros. In general, figures presented in

this press release are rounded to the nearest full unit. As a

result, the sum of rounded amounts may show non-material

differences with the total as reported. Note that ratios and

differences are calculated based on underlying amounts and not

based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties. These risks and

uncertainties include those discussed or identified under Chapter 3

“Risk factors and internal control” of the Company’s Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers - AMF) on 11 April 2023

and available on SMCP's website (www.smcp.com).This document has

not been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 46 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

| |

|

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

1 Claudie Pierlot and Fursac brands

- Press Release - SMCP - 2023 Q1

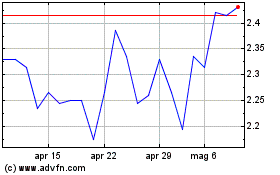

Grafico Azioni SMCP (EU:SMCP)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni SMCP (EU:SMCP)

Storico

Da Nov 2023 a Nov 2024